Candriam Luxembourg S.C.A. Purchases 28,279 Shares of MGM Resorts International (NYSE:MGM)

Candriam Luxembourg S.C.A. increased its position in MGM Resorts International (NYSE:MGM) by 117.7% in the 3rd quarter, according to its most recent 13F filing with the SEC. The firm owned 52,309 shares of the company’s stock after buying an additional 28,279 shares during the period. Candriam Luxembourg S.C.A.’s holdings in MGM Resorts International were worth $2,257,000 at the end of the most recent quarter.

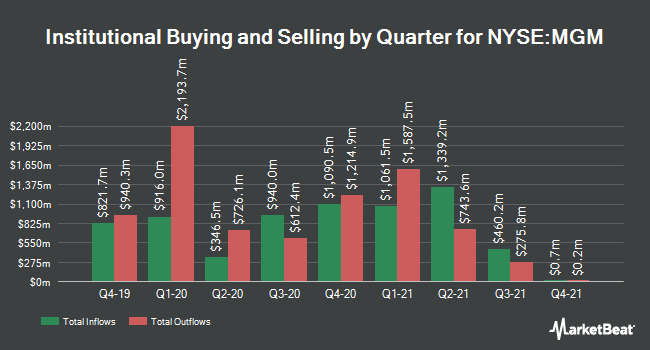

A number of other institutional investors have also recently modified their holdings of MGM. Weiss Multi Strategy Advisers LLC purchased a new stake in MGM Resorts International in the 2nd quarter worth $3,529,000. Price T Rowe Associates Inc. MD lifted its stake in MGM Resorts International by 89.9% in the 2nd quarter. Price T Rowe Associates Inc. MD now owns 18,797,538 shares of the company’s stock worth $801,715,000 after purchasing an additional 8,896,662 shares in the last quarter. TD Asset Management Inc. lifted its stake in MGM Resorts International by 0.8% in the 3rd quarter. TD Asset Management Inc. now owns 596,298 shares of the company’s stock worth $25,730,000 after purchasing an additional 4,532 shares in the last quarter. Senvest Management LLC lifted its stake in MGM Resorts International by 24.7% in the 2nd quarter. Senvest Management LLC now owns 2,935,641 shares of the company’s stock worth $125,205,000 after purchasing an additional 581,600 shares in the last quarter. Finally, Clearbridge Investments LLC lifted its stake in MGM Resorts International by 2.8% in the 2nd quarter. Clearbridge Investments LLC now owns 1,154,263 shares of the company’s stock worth $49,229,000 after purchasing an additional 31,407 shares in the last quarter. 63.42% of the stock is owned by institutional investors.

MGM Resorts International stock opened at $44.80 on Thursday. The company has a debt-to-equity ratio of 1.00, a current ratio of 1.96 and a quick ratio of 1.93. MGM Resorts International has a 1-year low of $27.81 and a 1-year high of $51.17. The firm has a market capitalization of $21.01 billion, a P/E ratio of 34.46 and a beta of 2.39. The company’s 50-day moving average is $43.83 and its 200 day moving average is $42.93.

MGM Resorts International (NYSE:MGM) last posted its quarterly earnings data on Wednesday, November 3rd. The company reported $0.03 earnings per share for the quarter, topping the Zacks’ consensus estimate of ($0.04) by $0.07. MGM Resorts International had a net margin of 8.33% and a negative return on equity of 6.80%. The company had revenue of $2.71 billion for the quarter, compared to analyst estimates of $2.41 billion. During the same period in the prior year, the company posted ($1.08) EPS. Research analysts anticipate that MGM Resorts International will post -0.75 earnings per share for the current fiscal year.

The business also recently announced a quarterly dividend, which was paid on Wednesday, December 15th. Shareholders of record on Friday, December 10th were paid a $0.0025 dividend. The ex-dividend date of this dividend was Thursday, December 9th. This represents a $0.01 dividend on an annualized basis and a yield of 0.02%. MGM Resorts International’s dividend payout ratio is currently 0.77%.

In other MGM Resorts International news, CEO William Hornbuckle sold 60,000 shares of the firm’s stock in a transaction on Monday, January 3rd. The stock was sold at an average price of $44.97, for a total transaction of $2,698,200.00. The transaction was disclosed in a filing with the SEC, which can be accessed through this hyperlink. Also, COO Corey Ian Sanders sold 40,000 shares of MGM Resorts International stock in a transaction on Monday, January 3rd. The shares were sold at an average price of $45.01, for a total value of $1,800,400.00. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 116,200 shares of company stock worth $5,311,864. Corporate insiders own 5.09% of the company’s stock.

Several analysts have commented on the stock. Stifel Nicolaus boosted their price target on shares of MGM Resorts International from $45.00 to $54.00 and gave the stock a “hold” rating in a research note on Thursday, November 4th. They noted that the move was a valuation call. Credit Suisse Group boosted their price target on shares of MGM Resorts International from $68.00 to $74.00 and gave the stock an “outperform” rating in a research note on Thursday, January 6th. They noted that the move was a valuation call. TheStreet upgraded shares of MGM Resorts International from a “c” rating to a “b-” rating in a research note on Wednesday, November 3rd. Susquehanna Bancshares cut shares of MGM Resorts International to a “negative” rating and upped their target price for the company from $10.00 to $36.00 in a research report on Friday, October 1st. Finally, Wells Fargo & Company upped their target price on shares of MGM Resorts International from $55.00 to $62.00 and gave the company an “overweight” rating in a research report on Thursday, November 4th. They noted that the move was a valuation call. One equities research analyst has rated the stock with a sell rating, six have assigned a hold rating and eight have given a buy rating to the stock. Based on data from MarketBeat.com, the stock currently has an average rating of “Hold” and an average target price of $49.18.

About MGM Resorts International

MGM Resorts International is a holding company, which engages in the ownership and operations of casino resorts. The firm’s casino resorts offer gaming, hotel, convention, dining, entertainment, retail, and other resort amenities. It operates through the following business segments: Las Vegas Strip Resorts, Regional Operations and MGM China.

© tickerreport. Copyright and all rights therein are retained by authors.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.