I am bullish on Goldman Sachs Group, Inc. (GS), as its strong growth potential, strong support from Wall Street analysts, and high upside potential relative to its consensus price target indicate that it could be a good time to add shares.

Goldman Sachs Group, Inc. is a multinational financial services and investment bank company that is based in New York City. Its services include securities, asset management, investment management, prime brokerage, securities underwriting, and investment banking.

Strengths

Goldman Sachs Groups is one of the biggest enterprises for investment banking, based on revenue. It is a primary dealer in U.S. Treasury securities and is an important market maker. Its major subsidiary is the Goldman Sachs Bank USA, a direct bank.

The company was ranked 62nd on the Fortune 500 list, based on total revenue.

Recent Results

Goldman Sachs posted revenue of $13.61 billion in the third quarter of 2021 ended September 30, 2021. Revenue was up 26% on a year-over-year basis from $10.78 billion and surpassed consensus estimates of $11.67 billion by a huge margin.

The company has surpassed consensus revenue estimates four times over the previous four quarters.

The company also posted quarterly earnings per share of $14.93, surpassing consensus estimates of $9.78 per share. The figure is in comparison to the $9.68 EPS generated in the third quarter of 2020.

The company attributed the strong revenue growth to its strength in financial advisory and underwriting, a solid equity financing net revenue, and FICC financing revenue.

During the third quarter, the firm also returned $700 million worth of common stock dividends and $1.7 billion worth of share repurchases to common shareholders.

Aside from this, the firm posted that its assets under management grew to $67 billion, including $49 billion worth of long-term net inflows, to $2.37 trillion at the end of the third quarter. Shares of Goldman Sachs jumped 3.8% after the announcement of its third quarter results.

Valuation Metrics

GS stock looks attractively priced at the moment, as its price to normalized earnings ratio is 9.17x, compared to its 5-year average of 10.27x.

Its dividend yield is 2.14%, compared to its 5-year average of 1.82%. On top of that, growth is expected to be solid over the next several years, with normalized earnings per share forecast to grow from $33.45 in 2020 to $39.66 in 2022. The dividend is also expected to grow rapidly, from $5 per share in 2020 to $8.49 in 2022.

Wall Street’s Take

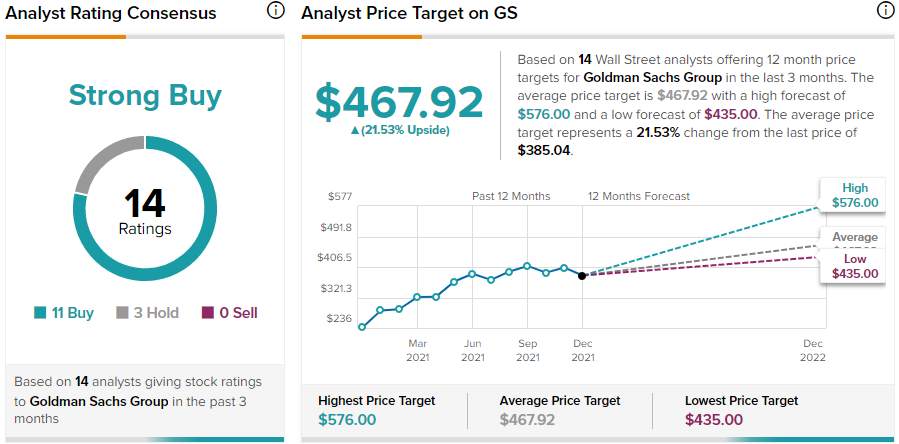

From Wall Street analysts, GS earns a Strong Buy analyst consensus based on 11 Buy ratings, 3 Hold ratings, and 0 Sell ratings in the past 3 months. Additionally, the average GS price target of $467.92 puts the upside potential at 21.53%.

Summary and Conclusions

Goldman Sachs is a leading player in the financial services industry, and as a result, enjoys significant brain and brand power competitive advantages.

On top of that, the stock looks attractively priced at the moment. Wall Street analysts agree, with an overwhelmingly bullish stance on the stock and a consensus price target that implies strong upside for the share price over the next year. Last, but not least, the growth outlook is strong over the next few years. As a result, it looks like now might be a good time to add shares.

Disclosure: At the time of publication, Samuel Smith did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates

© TipRanks. Copyright and all rights therein are retained by authors.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now