It’s so exhausting & busy for the last two weeks with business trips traveling all around my lovely country, since we are not affected too much by the pandemic.

Try to get some time to write down the latest EURNZD trading ideas:

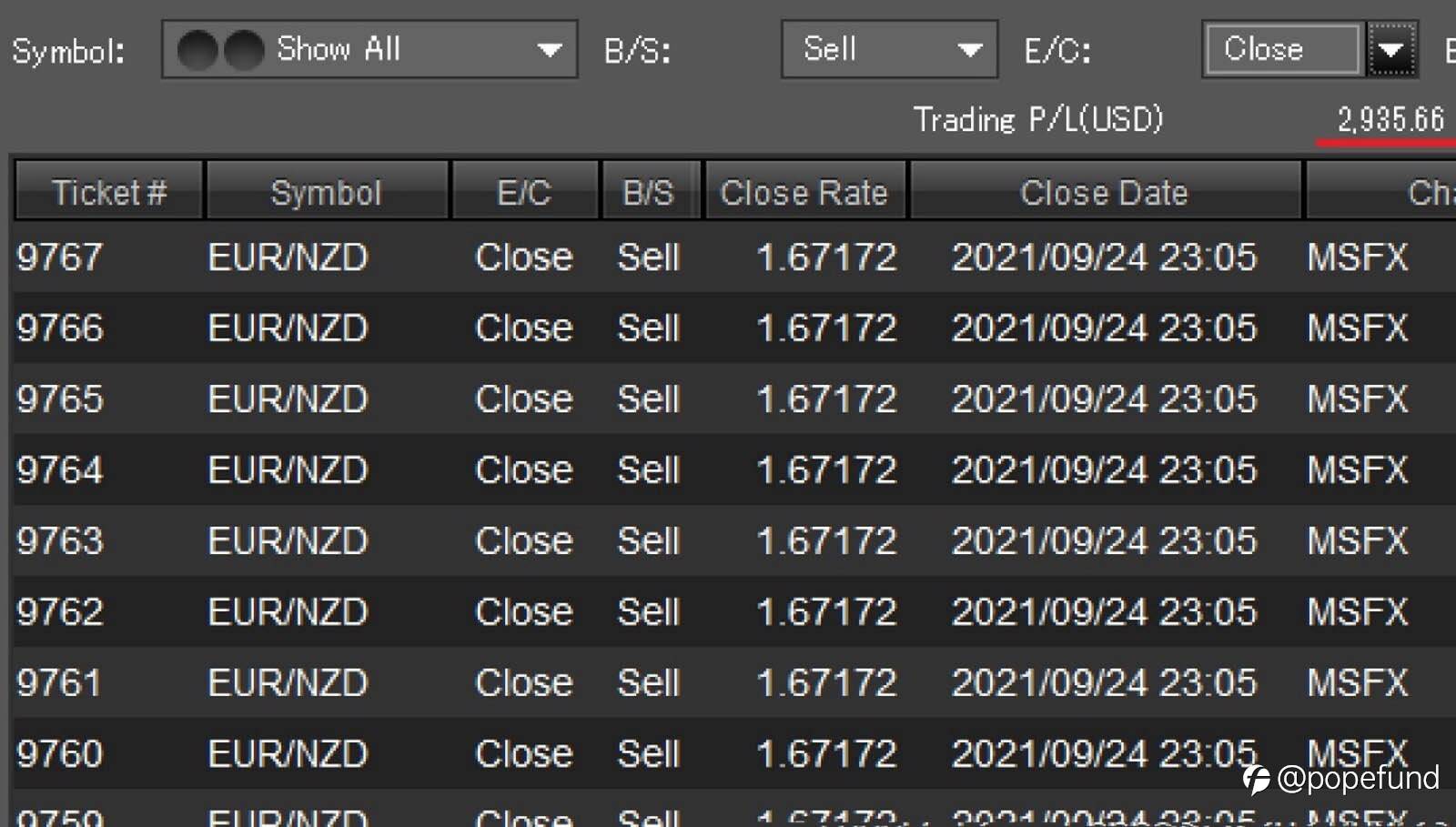

A.) Periods: Sep 1 – 24

B.) Position size: 8 lots approximately with 20x leverage

C.) Strategy: Buy low from 1.6640 to 1.6540 targeting 1.71s, however, the existing down trend is so strong, especially NZD has always been defending the 0.6980 level very successfully, finally had to give up the initial target. If you also take a look at AUDNZD, you will find that EURAUD is a much better option, that’s a overall/global view.

D.) Average holding period: 1.5 weeks

E.) Total profits: ~USD 3,000 (~NZD4300)

F.) Advice: Actually cross pairs of European currencies (EUR, GBP, CHF)vs commodity ones(AUD, NZD, CAD)are hard to trade due to their extremely high volatility, I suggest you to trade Yen pairs, that seems to be good choices with greater potential profits.

They were some kind of “buy & hold” strategies looking for a mid-term trend in daily frame, if had been done in a smaller one, say H1 – H4, range trading type, the total profits would have been much more.

Never mind, involved in a big project and hadn’t got enough time for trading.

Hints:

Stick to your own trading style and system, accept the fact that you yourself might make some mistakes occasionally, don’t change them frequently, when your start to change, you are starting to make a mistake.

Yet it’s good for you to adjust your trading plan to be in the same rhythm with the market.

Good luck and have a nice weekend.

Edited 26 Sep 2021, 13:35

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now