These funds hold the same stocks that the Oracle of Omaha does

Chairman Warren Buffett and vice chairman Charlie Munger will host Berkshire Hathaway's (BRK.B) annual shareholder meeting on Saturday, May 1, 2021.

For the second year in a row, the throngs of people who typically travel to Omaha, Nebraska for the festivities will have to settle for a virtual gathering. This year, though, the meeting will be held in Los Angeles. Buffett, Munger, and Berkshire vice chairmen Ajit Jain and Greg Abel will answer questions for several hours via livestream before the official meeting kicks off at 5 p.m. Eastern time.

We're once again marking the upcoming Berkshire Hathaway meeting with our annual look at "Funds That Buy Like Buffett"--mutual funds with the highest percentage of stocks in common with Berkshire's investment portfolio, as listed in Buffett's annual letter to shareholders. The letter is also part of Berkshire's annual report. Morningstar's Susan Dziubinski discussed the letter when it came out in February.

Berkshire Hathaway's top 15 stock holdings by market value, as of Dec. 31, 2020, were Apple (AAPL), Bank of America (BAC), Coca-Cola (KO), American Express (AXP), Verizon (VZ), Moody's (MCO), U.S. Bancorp (USB), BYD (BYDDY), Chevron (CVX), Charter Communications (CHTR), Bank of New York Mellon (BK), AbbVie (ABBV), General Motors (GM), Itochu (ITOCY), and Merck (MRK). The top four stocks were the same as the previous year's, but beyond that there has been a lot of turnover: Only four of the remaining 11 stocks were holdovers. Among other changes, three airlines that were among the top 15 last year are gone (presumably because of the changes wrought by the coronavirus), while the list now includes a Chinese stock (electric carmaker BYD) and a Japanese stock (industrial conglomerate Itochu).

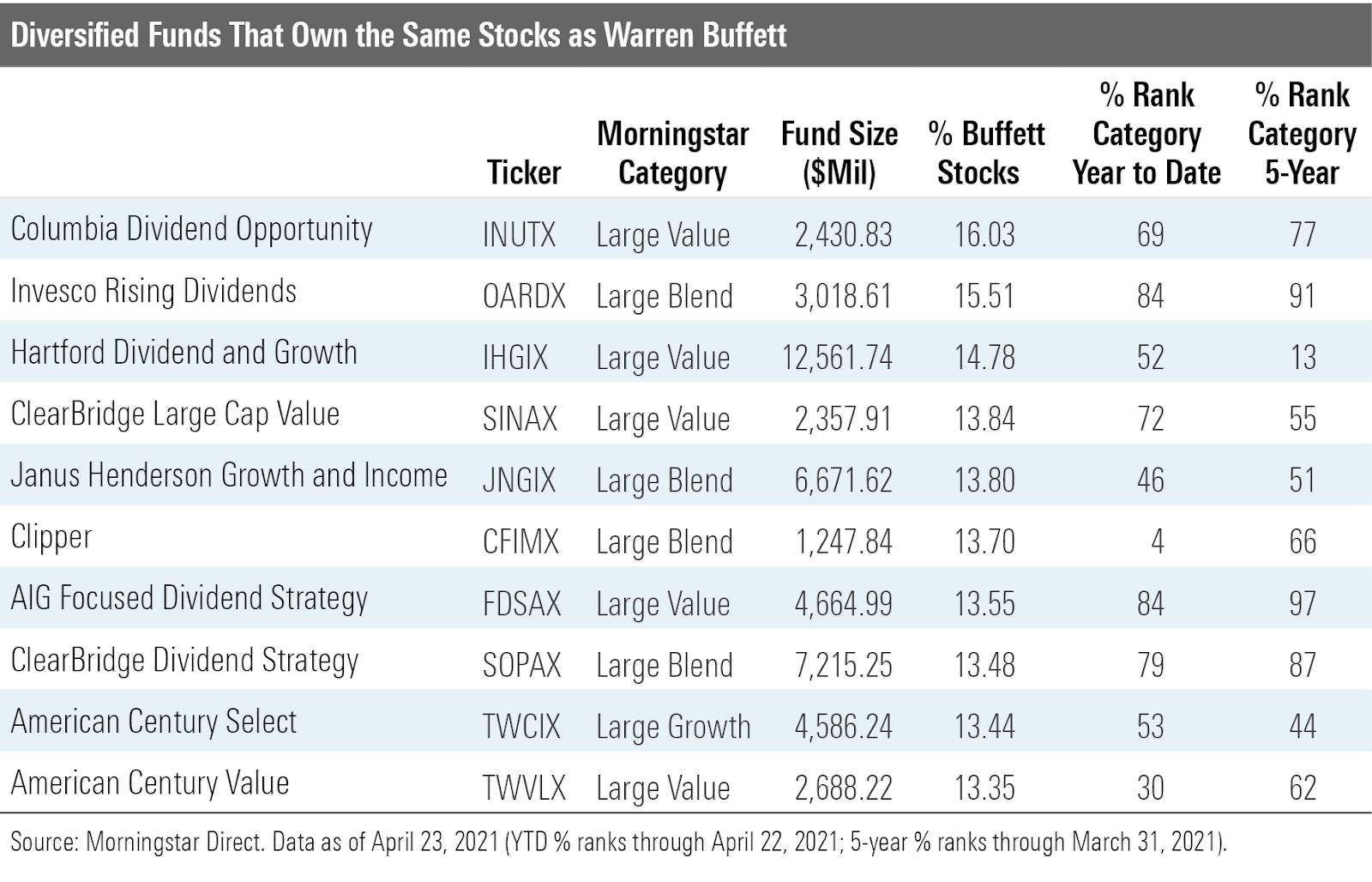

The table below shows the open-end mutual funds with the largest combined weightings in those 15 "Buffett stocks" as of their most recent portfolio. We left out funds with under $1 billion in assets, those not covered by Morningstar analysts, and sector funds such as banking and financial-services funds. With those constraints, the following table shows the 10 funds with the most Buffett-like taste in stocks. We show each fund's Morningstar Category, size, and percentile rank in its category for the year to date (through April 22, 2021) and for the trailing five years (through March 31, 2021).

None of these funds were on last year's list, but Clipper (CFIMX) is managed by Chris Davis and Danton Goei of Davis Selected Advisers, whose Selected American Shares (SLASX) and Davis New York Venture (NYVTX) made the list last year. Davis is a longtime Buffett fan whose investing approach often favors the big financial stocks and other blue chips that Buffett likes. Berkshire Hathaway was this fund's top holding on Dec. 31, 2020, with "Buffett stocks" Bank of New York Mellon, American Express, and U.S. Bancorp among the top 15. The fund had a tough time in 2020 but has bounced back nicely so far this year, ranking near the large-blend category's top for the year to date through April 22. The fund earns a Morningstar Analyst Rating of Bronze despite its frequent struggles the past few years.

One notable feature of this list is the prominence of dividend-focused funds, including the three funds with the biggest stakes in Buffett stocks: Columbia Dividend Opportunity (INUTX), Invesco Rising Dividends (OARDX), and Hartford Dividend and Growth (IHGIX). That's a change from last year, when only one fund with "dividend" in its name (Fidelity Dividend Growth (FDGFX)) made the top 10. Buffett has always liked the types of companies that pay healthy dividends, especially big banks like Bank of America. But in 2020 Berkshire sold several stocks that pay no dividends or very low dividends (notably the three airline stocks and Visa (V)) and added several stocks with high yields (Verizon, Chevron, AbbVie, and Merck). All four of those new high-yielding stocks are among the top 10 holdings of Columbia Dividend Opportunity, and Verizon and Chevron are prominent holdings of the other two funds. All three of these funds earn Neutral ratings.

Two of the Bronze-rated funds on this list are ClearBridge offerings, though different people run them with distinct strategies. ClearBridge Large Cap Value (SINAX) is a fairly straightforward value fund. Managers Robert Feitler and Dmitry Khaykin look for high-quality companies trading at reasonable valuations, without worrying too much about dividend yield. That's a very Buffettesque approach to investing, so it's no surprise that Berkshire Hathaway is in the portfolio, or that longtime Buffett favorite Bank of America is the top holding. Four of the six Buffett stocks in the fund's most recent portfolio are financials, with Charter Communications and Chevron as the only exceptions.

ClearBridge Dividend Strategy (SOPAX) also has a quality bias, but as its name implies, the managers focus on companies where dividends are a key part of the asset-allocation strategy. Thus, the fund does not hold Berkshire Hathaway (which famously does not pay a dividend), and while Bank of America is in the portfolio, it's much less prominent than in ClearBridge Large Cap Value, and the higher-yielding Merck and Coca-Cola are larger positions. This fund also held six Buffett stocks in its most recent portfolio, but only two of them were financials, while three were high-yielding Merck, Coca-Cola, and Verizon. These are both pretty good funds having a high overlap with Berkshire's investment portfolio, but the significant differences between the portfolios show that there's more than one way to buy like Buffett.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now