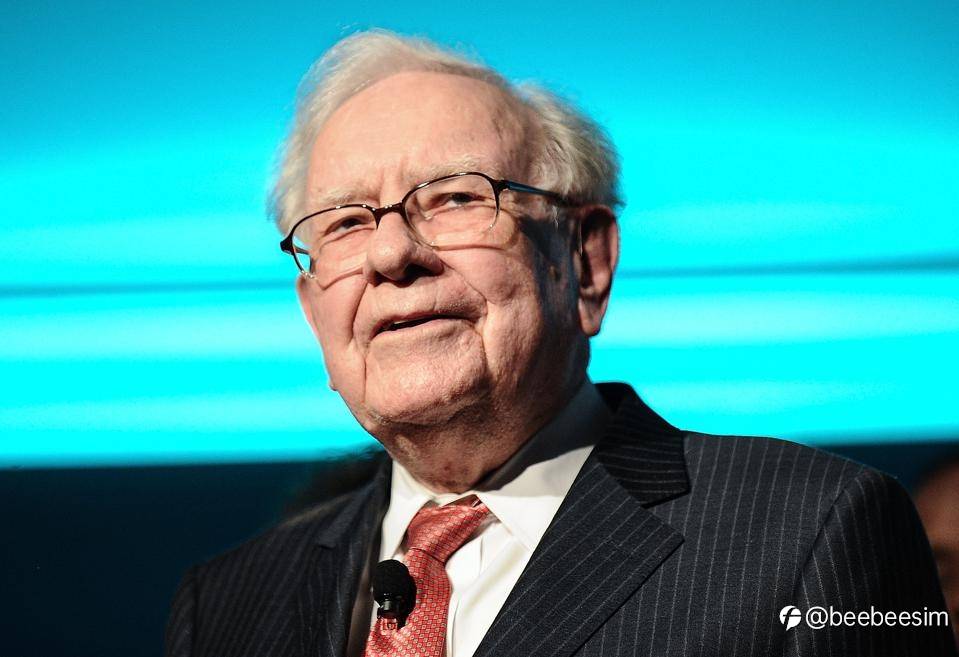

The Berkshire Hathaway Annual Meeting of Shareholders is a major event for many value investors and fans of Warren Buffett, and his business partner Charlie Munger. This year the event will again be live-streamed via Yahoo Finance at 1.30 pm Eastern Daylight Time on May 1, 2021 (note there’s some pre-meeting content that will start at 1 pm). As with 2020, 2021 will be a virtual meeting, though the company is optimistic that 2022’s event will be back in person.

What creates interest is not the Berkshire Hathaway BRK.B +1.7% annual meeting itself. That formal shareholder meeting is a dry 30-minute corporate event that’s essentially an add-on to the real show. The highlight is Buffett and Munger holding court and taking questions for three and a half hours.

A Broader Group

This year the group answering questions will expand. Charlie Munger missed last year’s meeting. He will be back this year with the meeting coming from Los Angeles, rather than Omaha. Continuing the theme of last year Greg Abel, who was present last year, and Ajit Jain, who wasn’t, will also answer questions on their domains. Abel focuses primarily on energy and other non-insurance operations. Jain focuses on insurance. Given the advanced age of Buffett and Munger, this enables Berkshire investors to become more comfortable with Berkshire’s succession planning.

However, if past years are any guide, the value won’t necessarily be in the deep analysis of Berkshire’s operations, but rather Buffett and Munger’s broader views on business and the economy.

Impressive Growth

2020 was a year when Berkshire’s value lagged the S&P 500, but over 1965-2020 the return of Berkshire’s assets has been 20% a year. That rate of growth, when compounded, has lead to incredible investment returns far in excess of a benchmark such as the S&P 500.

The Challenge Of Scale

This has also sowed the seeds of challenges for Berkshire as the company now has hundreds of billions of investments and employees around 350,000 people across its businesses. At that scale, much like turning an oil tanker rather than a speed boat, it becomes harder to beat the broader market. In fact, Berkshire is now among the largest companies in the S&P 500. However, Buffett and Munger remain one of the strongest investment partners of all time and they’ll share their insights on May 1.

Reprint from Forbes

Author: Simon Moore

Edited 30 Apr 2021, 17:14

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now