Preamble

In 2020, the global economy was hit by an unprecedented shock due to the coronavirus. Although we saw the positive news of the coronavirus vaccine announced near the end of the year, the second wave of the virus outbreak has crippled many hopes of the ending of the "epidemic" by the end of 2020. Whether the coronavirus can be effectively controlled and how soon can the global economy can recover remain a mystery today.

From a global perspective, due to the impact of the coronavirus, the gross domestic product (GDP) of most economies has shriveled substantially and some even regressed. According to the calculations by the team of Barnaby Martin, a European credit strategist at the Bank of America, 93% of the world's economies have shown a contraction in GDP this year, and 53% of the economies have shriveled marginally by more than 6%. Interestingly, the financial market is showing a completely opposite pattern full of vitality.

Among the 16 major stock indexes in the world, 12 stock indexes rose. The international spot gold price broke through the $2,000 mark for the first time and hit a record high.

Commodity futures and stock index futures performed exceptionally well. The non-U.S. currencies in the market gained gratifying gains against the U.S. dollar, and the digital currency has doubled. Bitcoin has exceeded $30,000, and China’s iron ore and other black products have also ushered in a wave of crazy gains.

So how did the huge contrast between economic fundamentals and financial markets arise? Simply said, the credit belongs to the major central banks given the consistent stimulus support. Central banks of multiple countries, especially the Fed’s endless supporting effort, have not only quelled the panic in the financial market but also attract funds aggressive admission, which led to a wild rise in the financial market.

2020 is undoubtedly a year of disaster for the global economy, which was also filled with stimuli and challenges for the financial markets. After a round of roller coaster rides which saw some take a handsome profit while others hit hard by the losses, this is in the past now. It is important to learn from your mistakes and move forward doing better to achieve long-term goals.

Summary of the report

1, Subjects

The subjects in this report are the real users in the FOLLOWME social trading community.

2, Data source

All data in this report (unless mentioned otherwise) are summarized and compiled by FOLLOWME Data Research Institute based on the actual transactions of the subjects.

3, Statistical cycle

The statistical time interval of this report is from Jan 1, 2020, to Dec 15, 2020.

4, Indicator description

Trading account: an account that has at least made one transaction in 2020;

Copy trade efficiency: the number of COPYTRADE transactions in every second;

Trading community users: traders, subscribers, independent traders (non-traders, the same below) are collectively referred to as trading community users;

Top 10 mainstream trading symbols: XAU/USD, EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD, GBP/JPY, WTI, USD/CHF, NZD/USD.

Special statement: Unless specified otherwise, all data units involved in this report are in U.S. dollars by default.

2020 Annual Trading Data

1, Total number of trading accounts

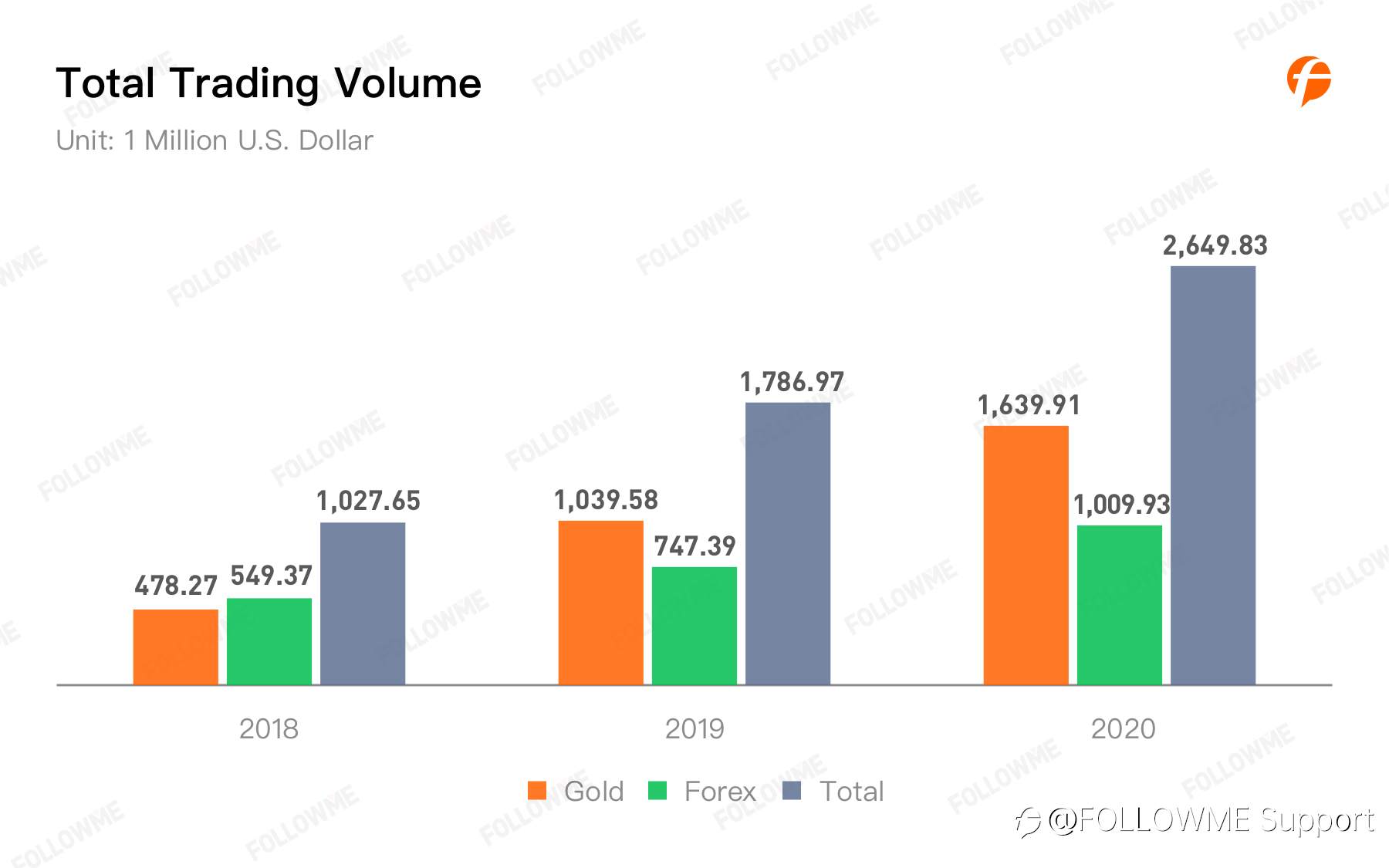

2, Total trading scale

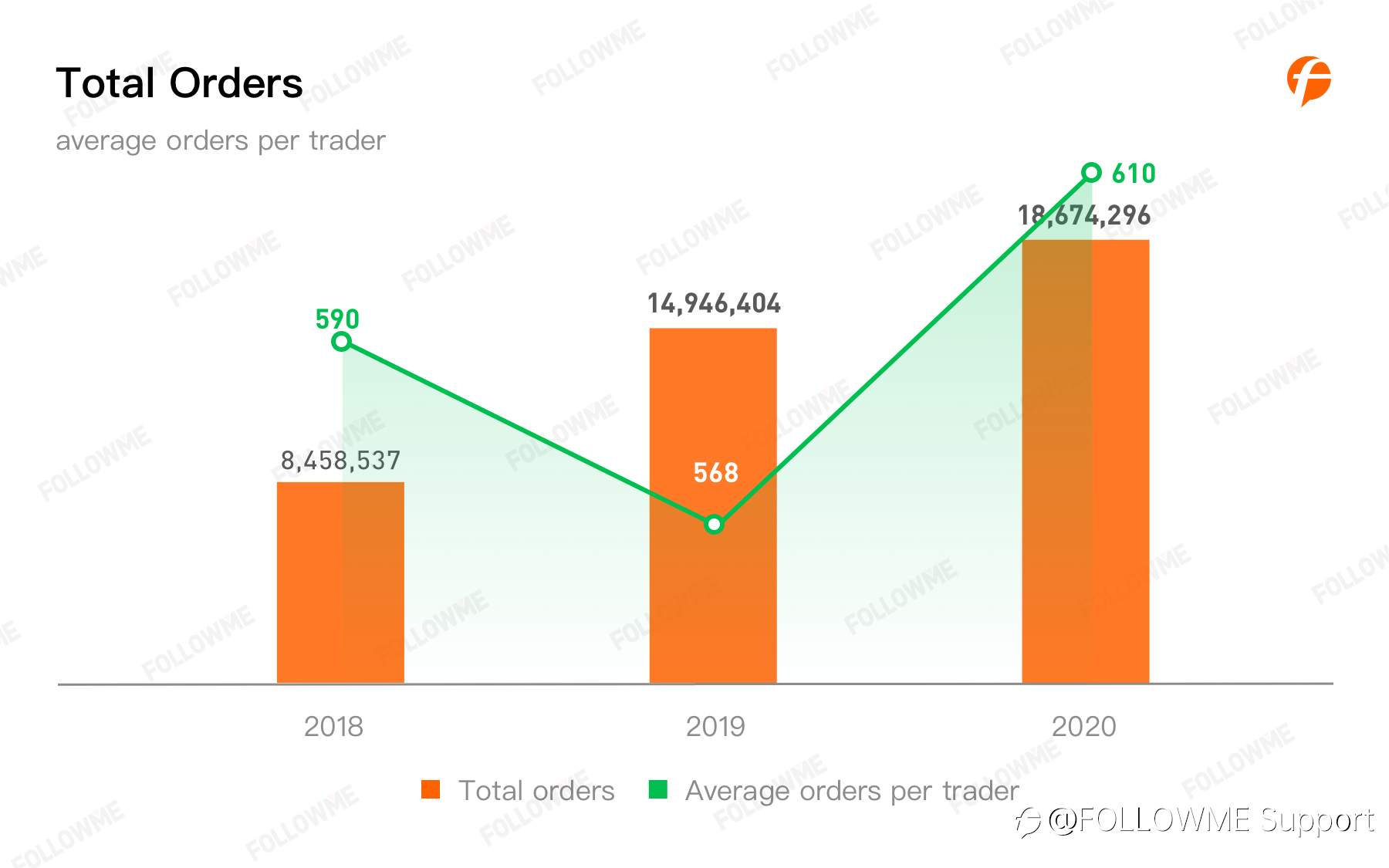

3, The total number of trading orders and the average amount of orders per trading account

As of December 15, 2020, FOLLOWME Trading Community has generated 18,674,296 transactions, with average daily transaction orders of 74,697 or one new order generated every 1.15 seconds.

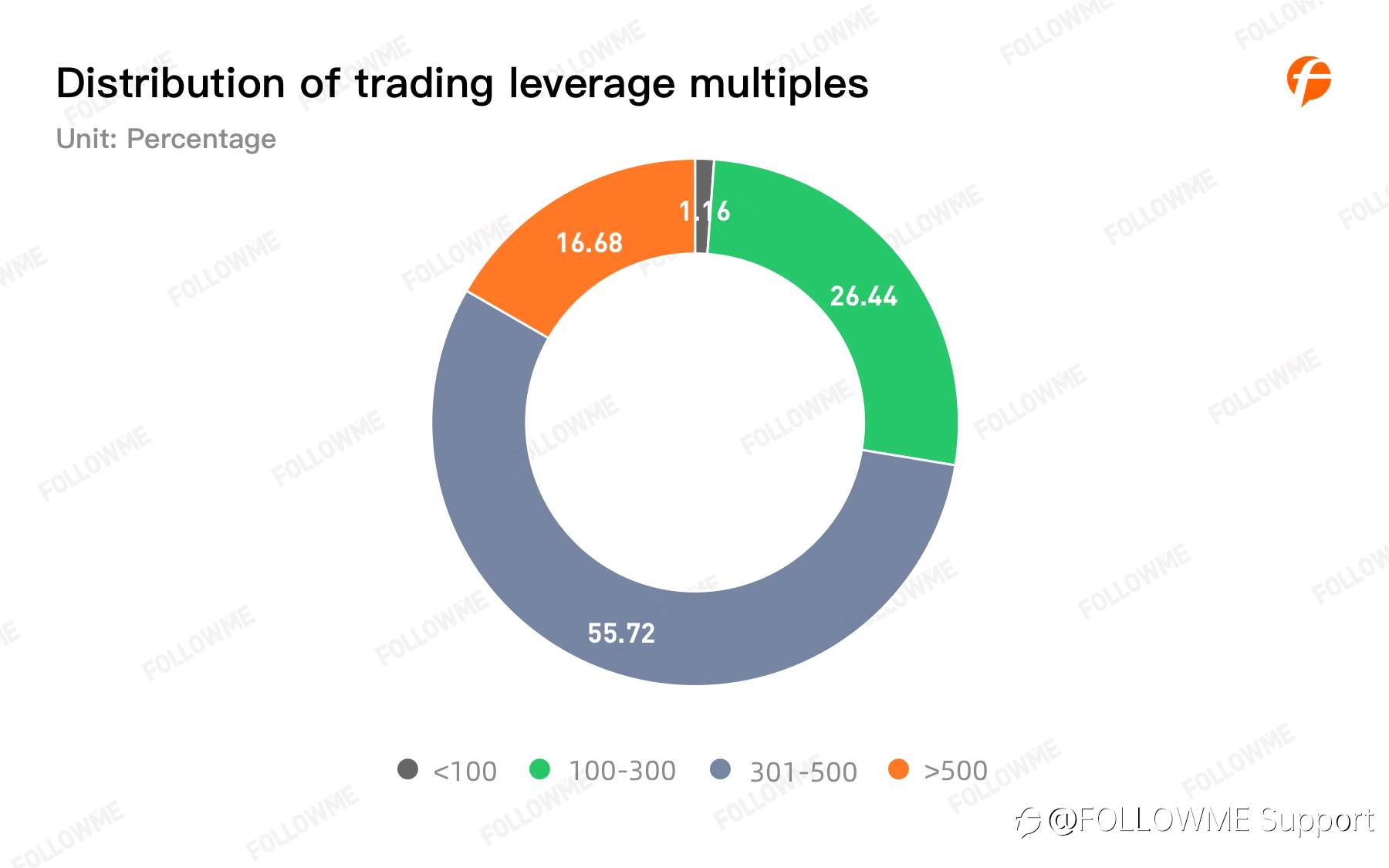

4, Distribution of trading leverage multiples

In recent years, the world's major regulatory agencies have begun to restrict the leverage ratio. In 2010, the United States implemented a 1:50 leverage ratio for major currency pairs and 1:20 for other currency pairs. In 2018, the British Financial Conduct Authority (FCA) announced a permanent reduction in the leverage of foreign exchange and contract for difference (CFD) products to 30 times Within. In 2021, the Australian Securities and Investments Commission (ASIC) will restrict traders to 30:1 for major currency pairs and 20:1 for minor currency pairs, gold and major stock market indexes.

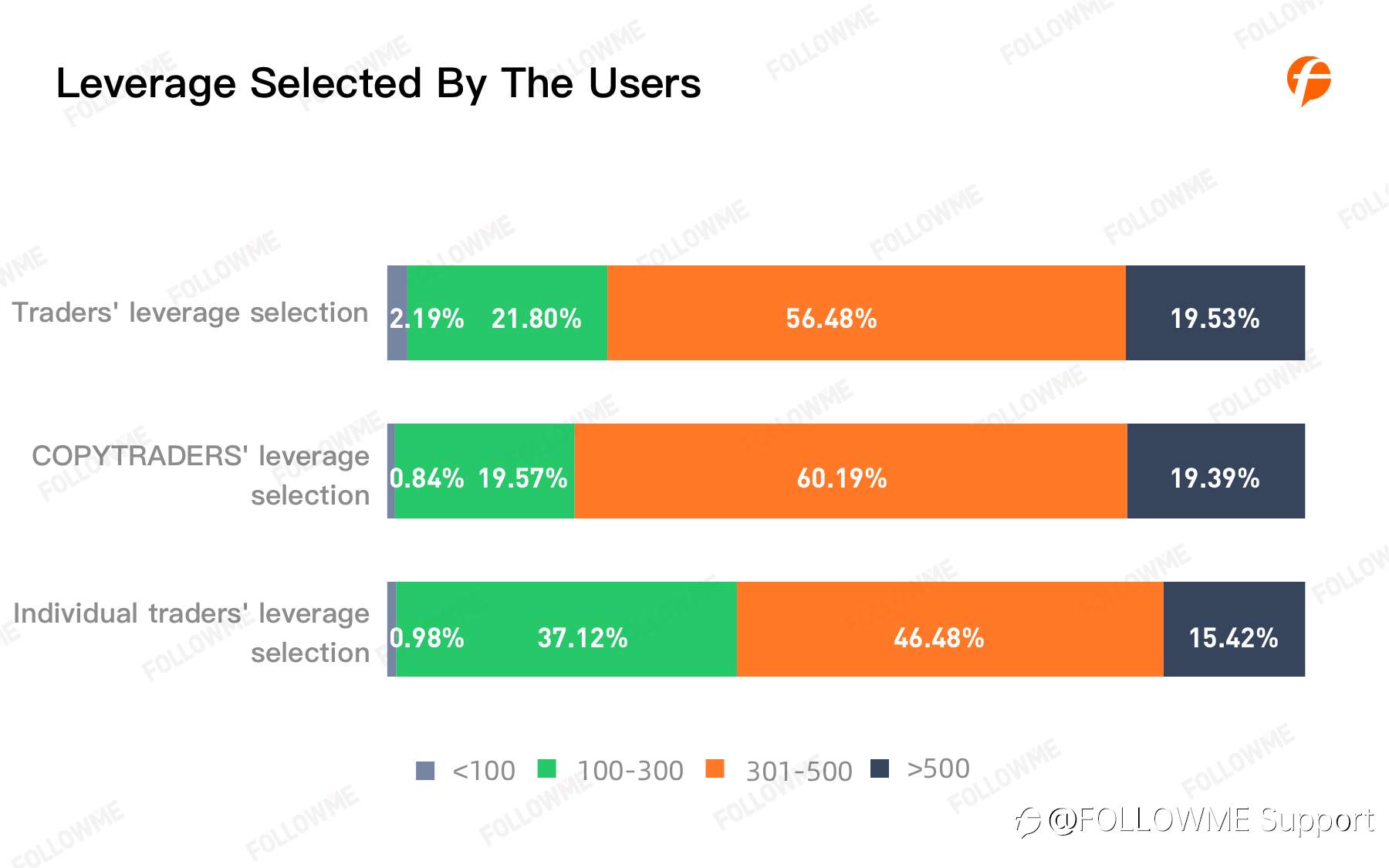

However, the statistical results show that the leverage multiples used by users in the FOLLOWME trading community are mainly concentrated 300-500 times. There is a contradiction between the low-leverage restrictions of the regulatory agencies and the high-leverage preferences of traders. Offshore supervision may become the choice of more traders in the future.

5 ,imTrader competition

In September 2017, FOLLOWME officially launched the "I am a Trader" professional league, which has been held for six consecutive seasons. In 2020, we officially changed its name to "imTrader".

Since the launch of the imTrader, participating accounts, funds, and the media influence have seen a qualitative leap. From season 1 to season 6, the participants grew from 270 to 1,632, and the participating funds registered a new high from $521,647 to $8,898,352. At the same time, the influential value went up from the initial 100,000 to 10 million.

On September 21, 2020, the imTrader Season 7 trading competition was officially launched. In this season, we saw the total participants further increased to 3,583, and the participating funds reached another new high at about $33,392,500. It is safe to say that this trading competition has paved its way into the trading industry and plays a critical event especially today.

Overview of Brokers

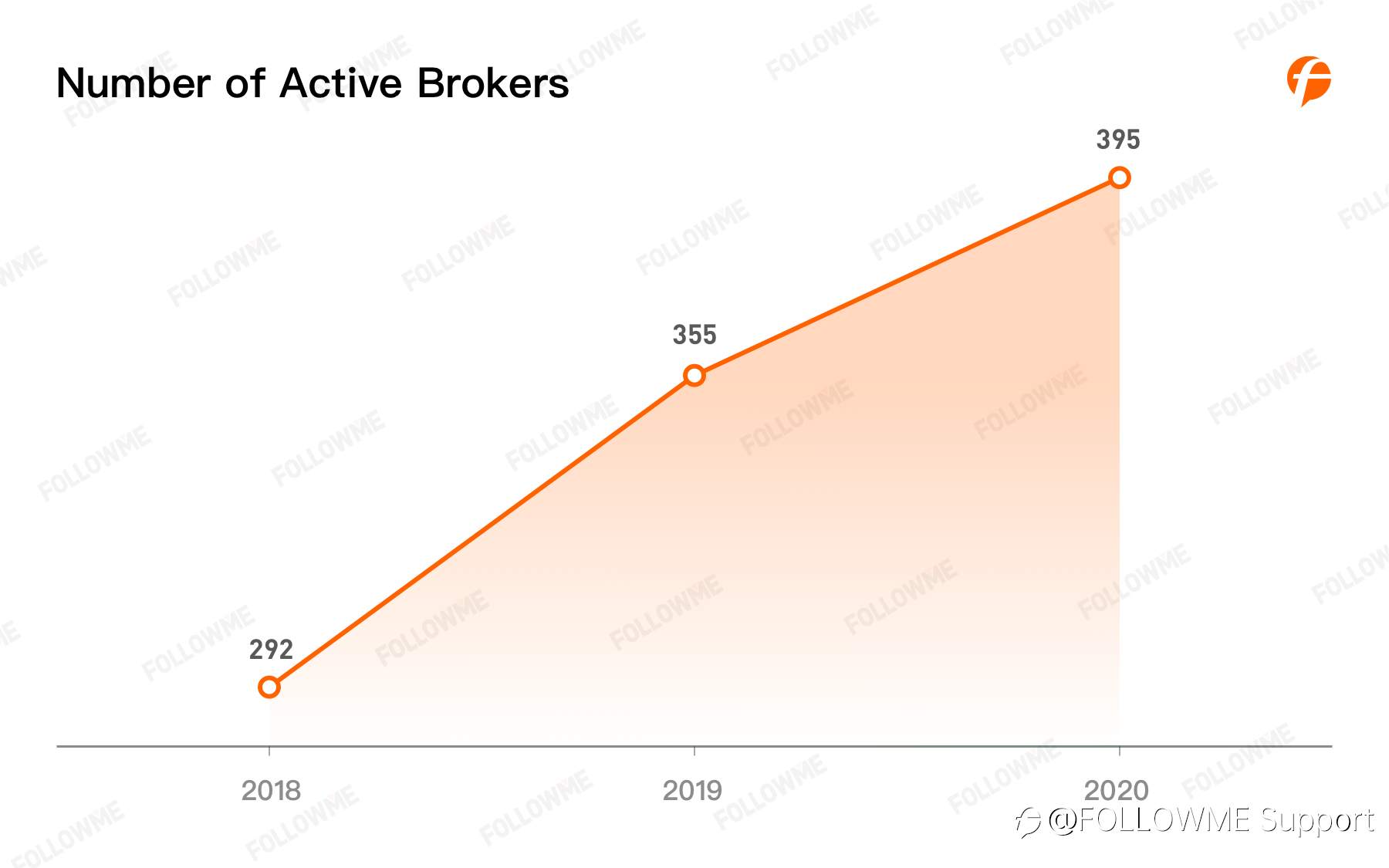

1, Number of Active Brokers

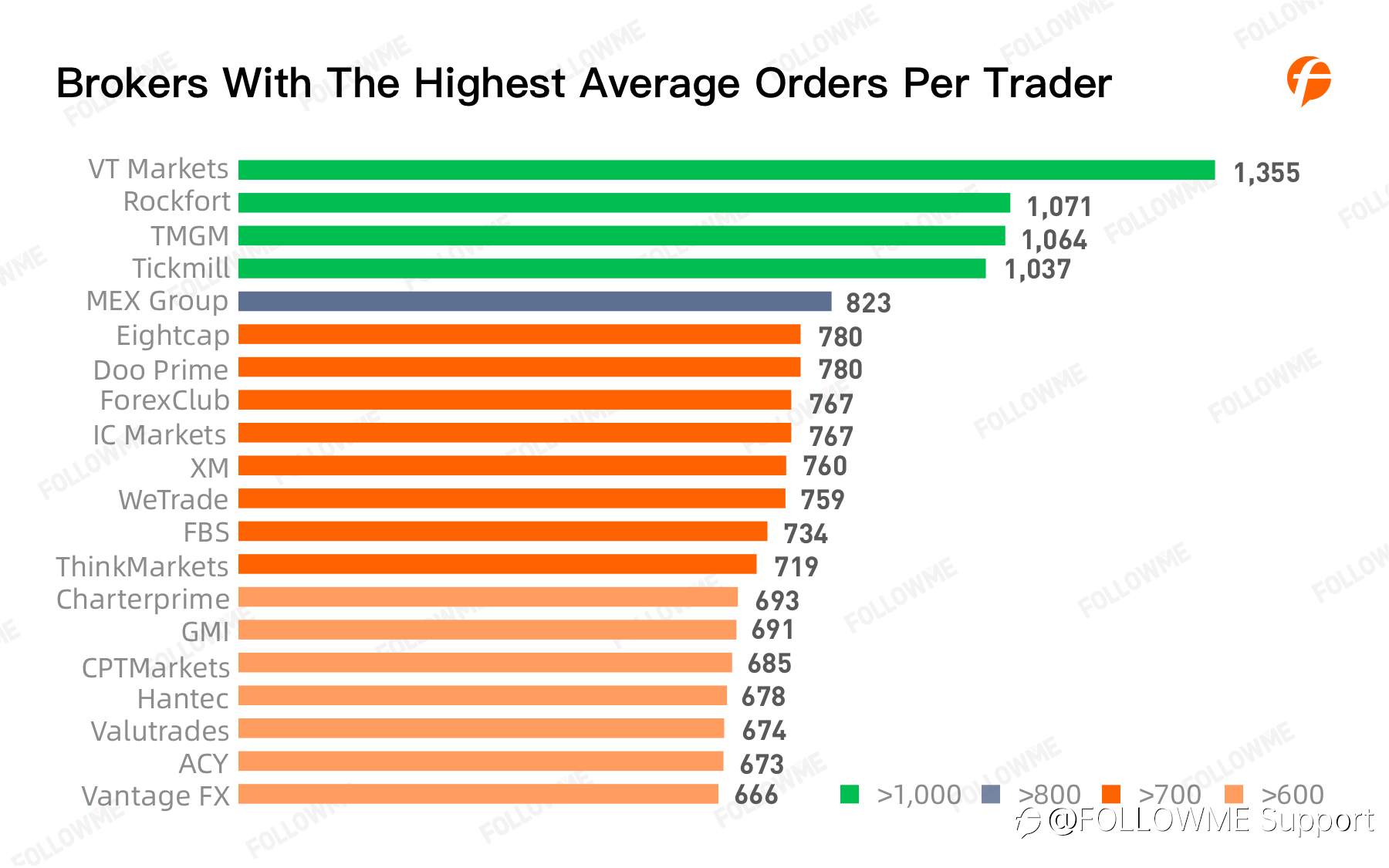

2, Top Brokers with the highest average amount of orders per account

3, Top Brokers with the most Trading Accounts’ Profitable Ratio

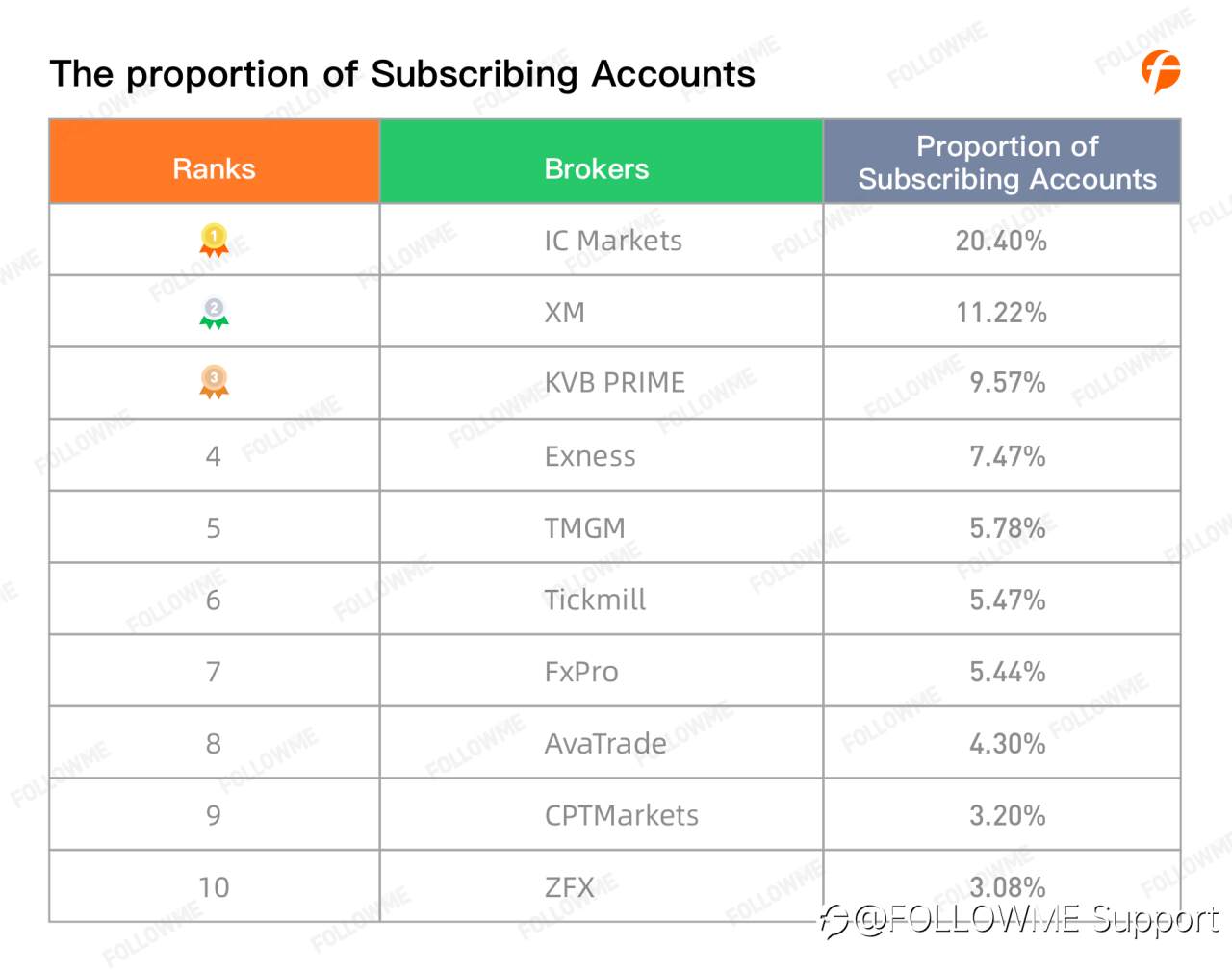

4, Proportion of Subscription Accounts

In 2020, FOLLOWME Trading Community has a total of 6,545 subscribing accounts. Among them, IC Markets has the upper hand of having the largest number of active trading users, and the proportion of subscribing accounts continues to snatch the first place, reaching 20.40%.

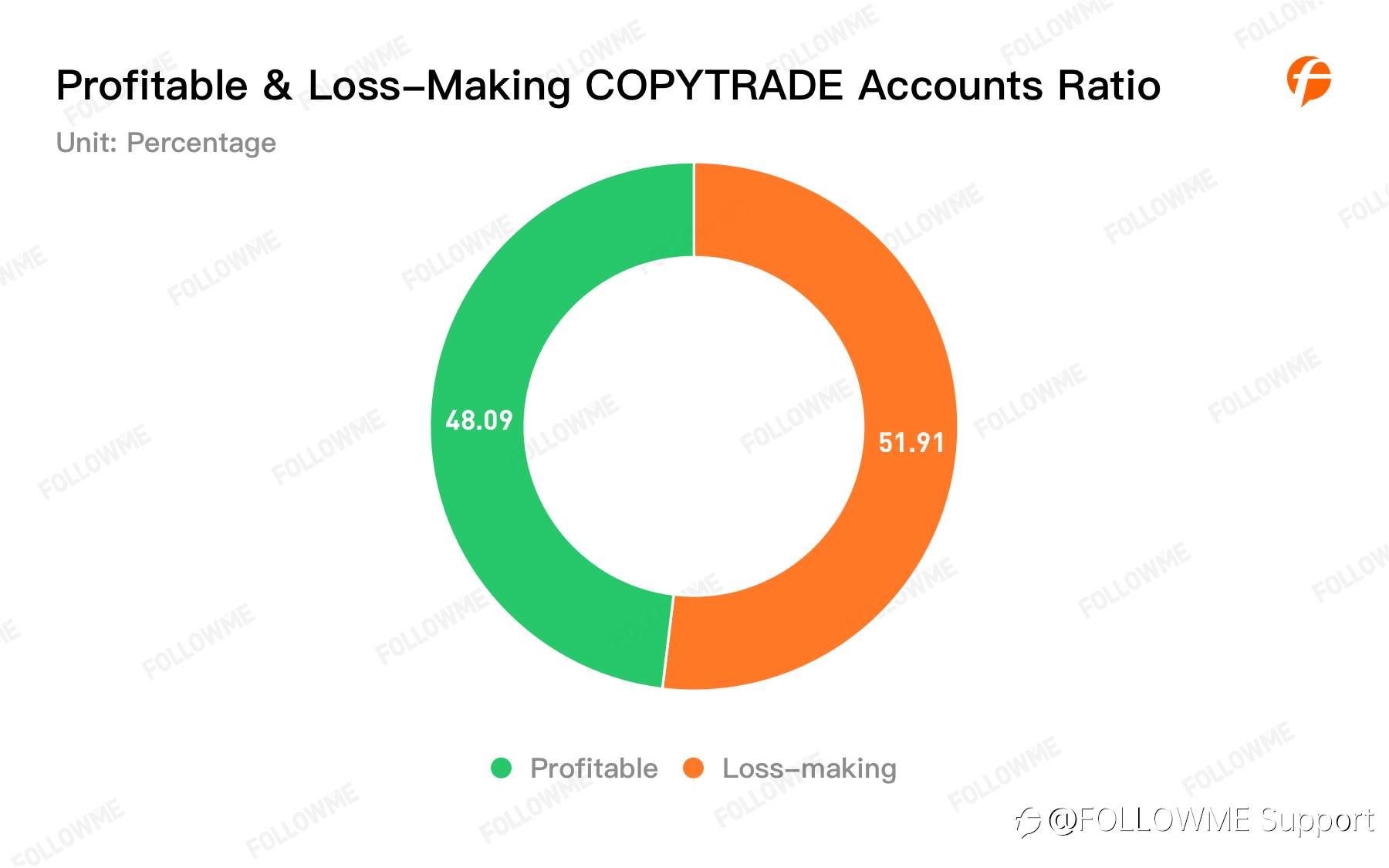

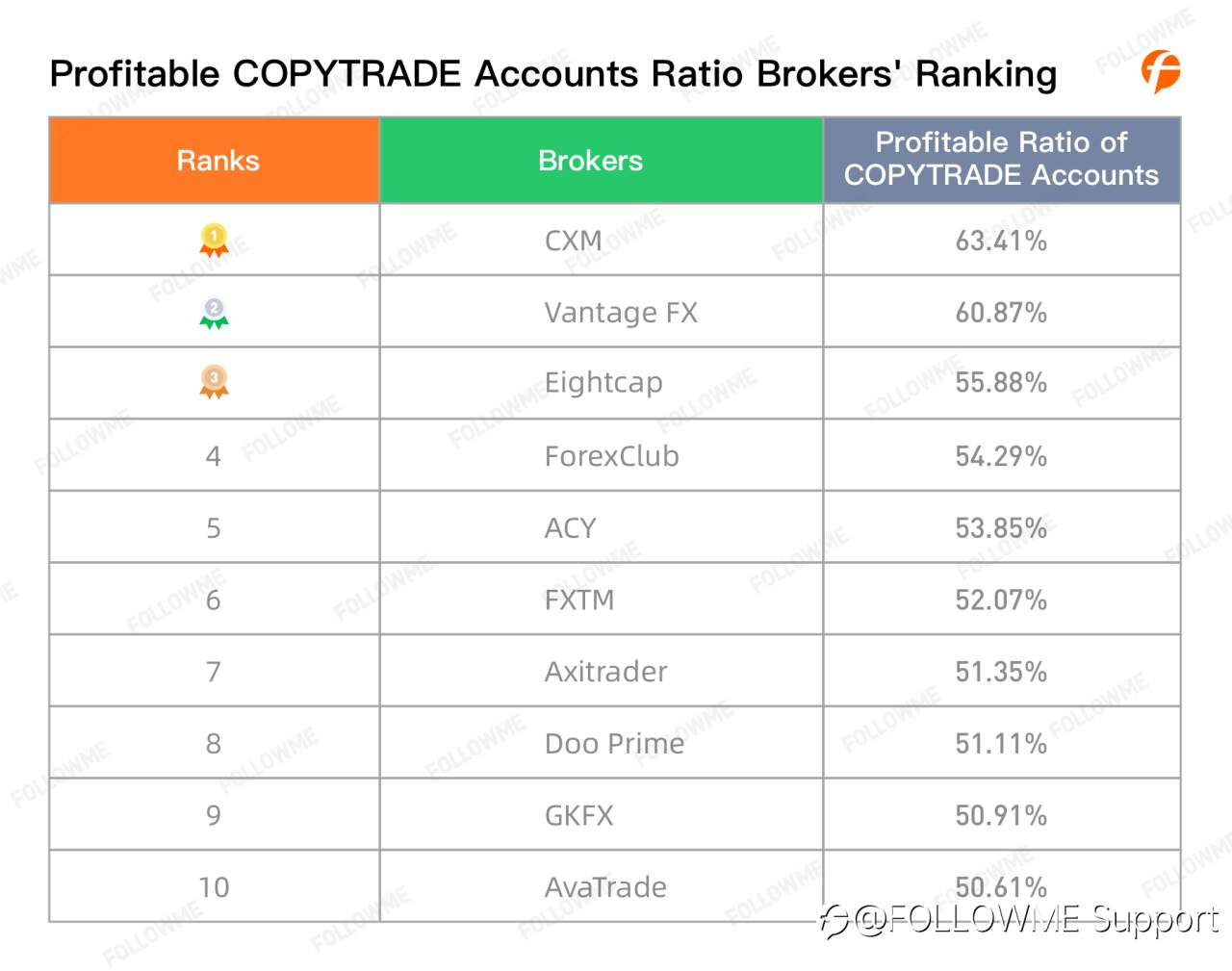

5, Profitable COPYTRADE Accounts Ratio

FOLLOWME Trading Community saw a 48.09% of COPYTRADE accounts made a profit, and the Top 10 Brokers with profitable COPYTRADE accounts had a higher ratio than the overall average.

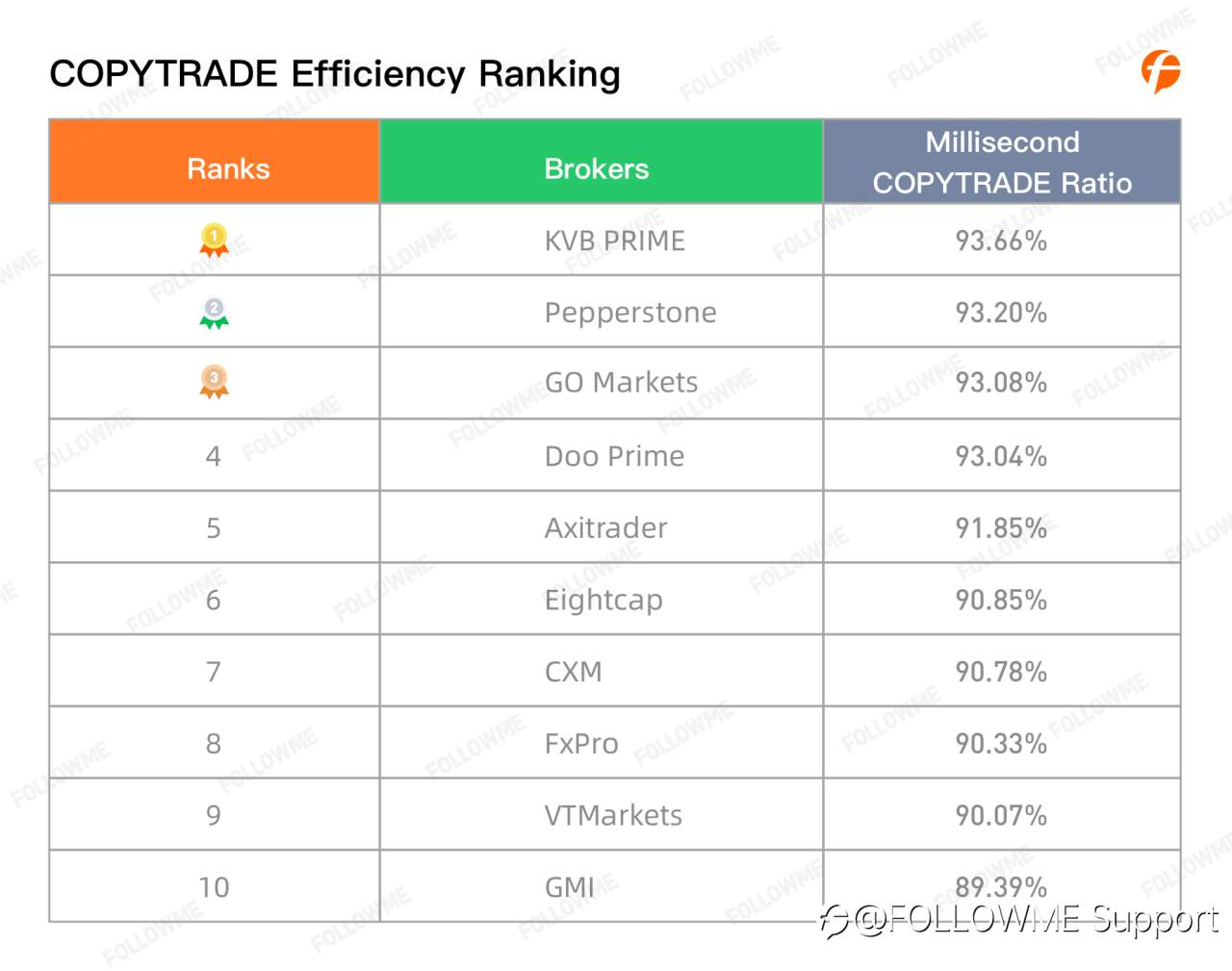

6, Rankings of COPYTRADE Efficiency

The total number of COPYTRADE orders in FOLLOWME Trading Community for the year of 2020 was 1,575,061, out of which, 1,259,029 COPYTRADE orders were opened and closed within a second, accounting for 79.94%. From the perspective of Brokers COPYTRADE orders efficiency, KVB PRIME is the best broker with a record of 93.66% transactions completed within a second.

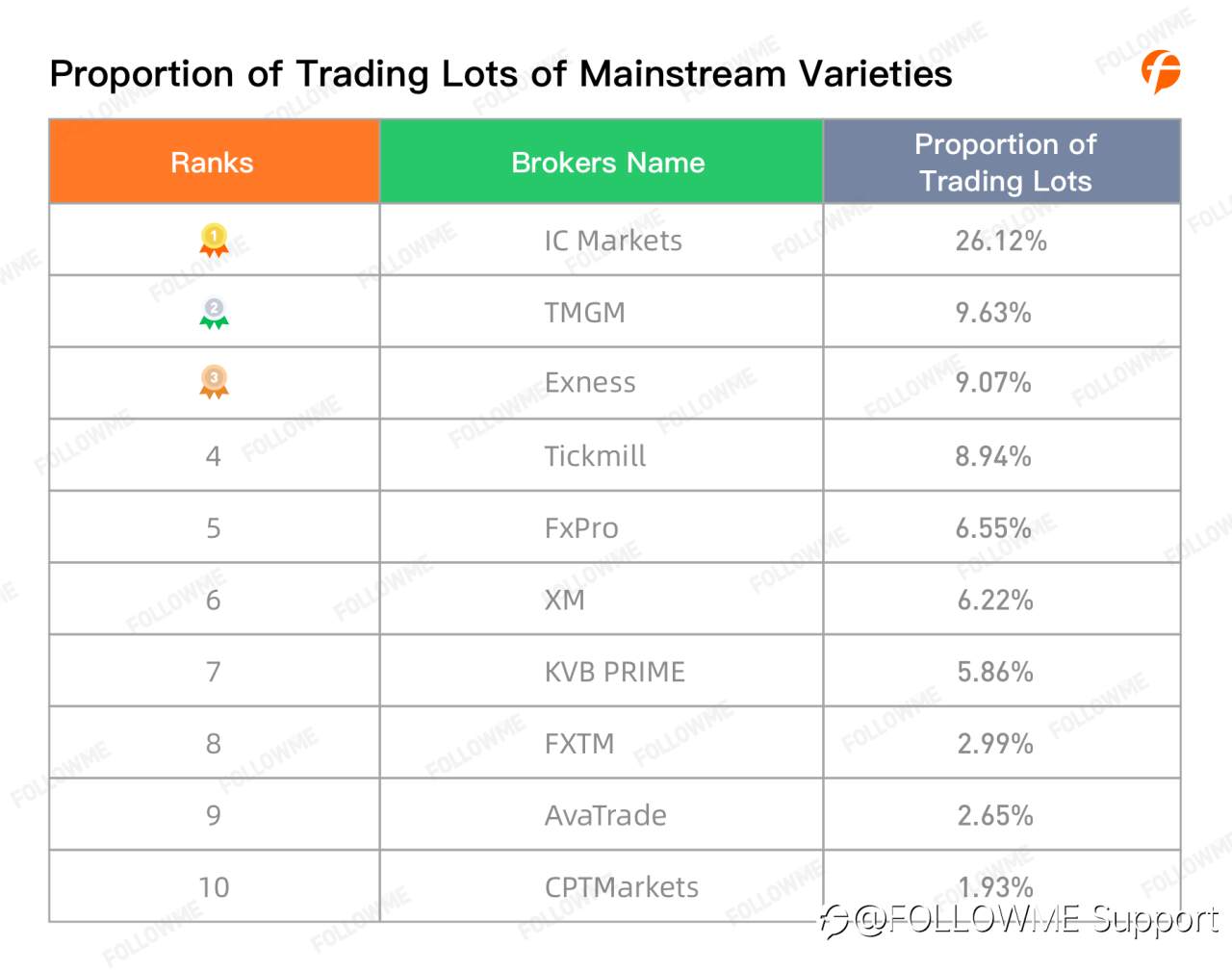

7, Proportion of trading lots of mainstream symbols

In 2020, the trading lots of the Top 10 mainstream trading symbols in FOLLOWME Trading Community accounted for 78.64% of the total trading lots. Among the brokers with the highest trading proportion of Top 10 mainstream trading symbols, IC Markets was far ahead the rest with a ratio of 26.12%.

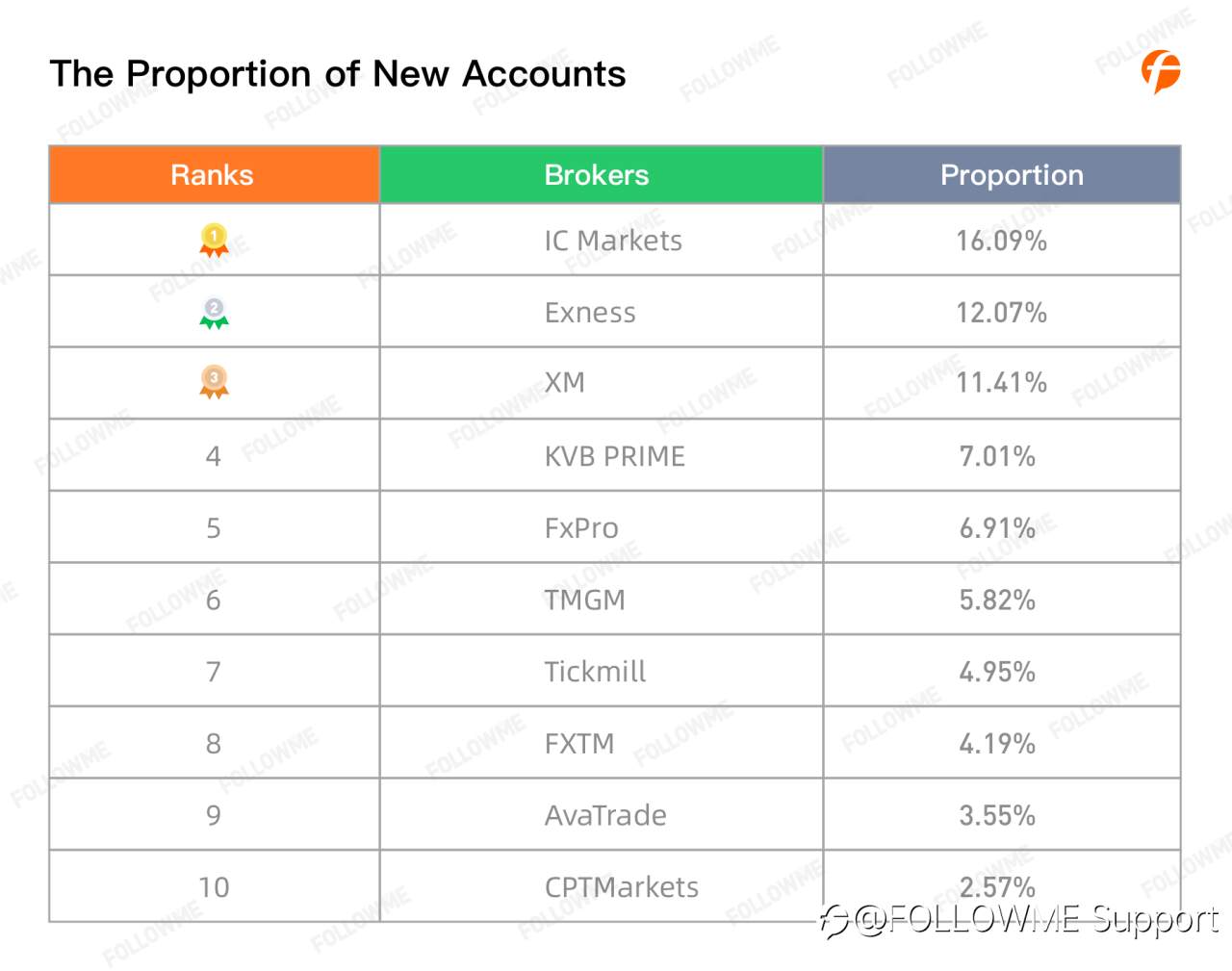

8, Proportion of New Accounts

Overview of Trading Users

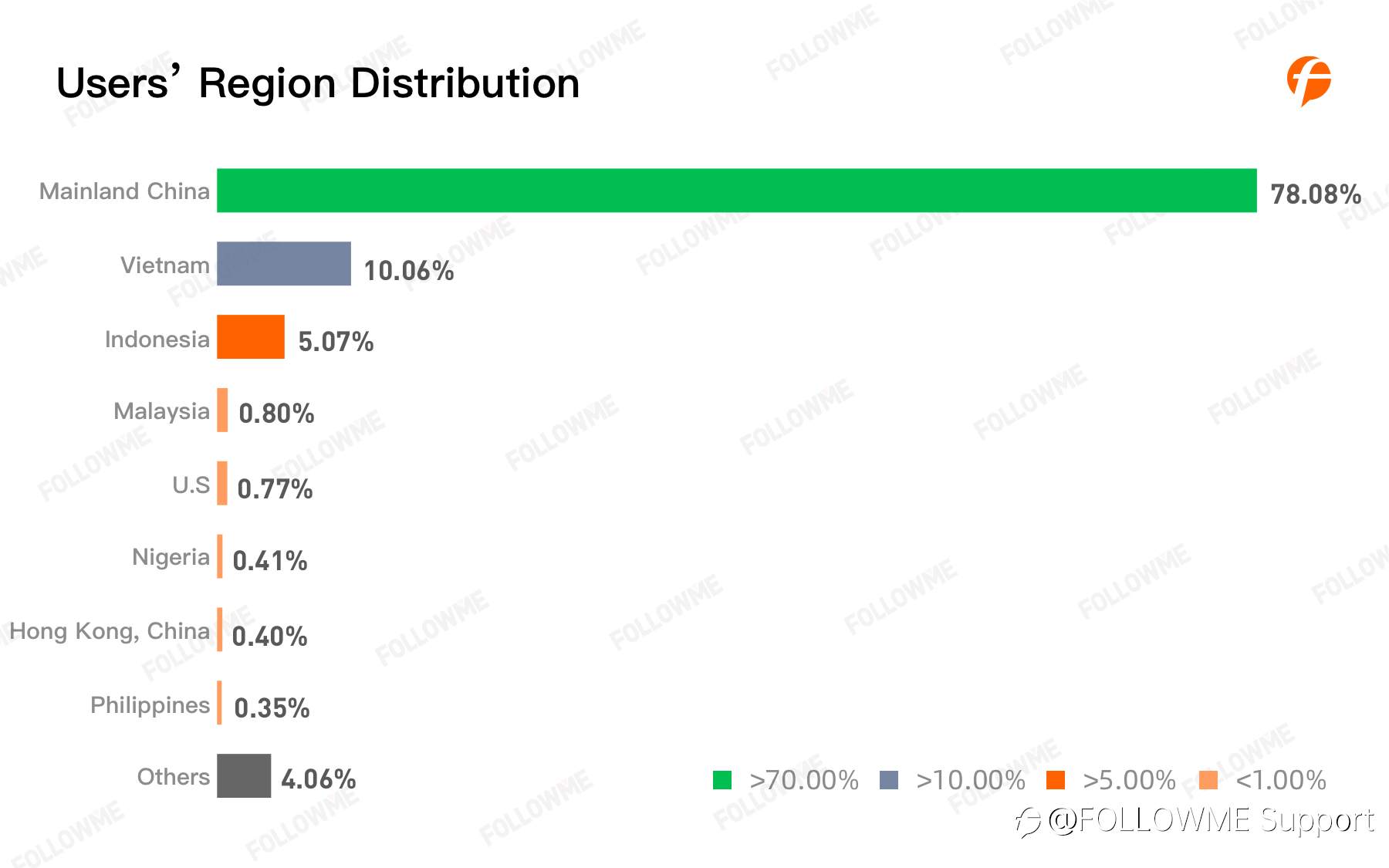

1, Users’ Region Distribution

Mainland China is the country with the most trading users in the FOLLOWME Trading Community, accounting for 78.08%, followed by Southeast Asian countries.

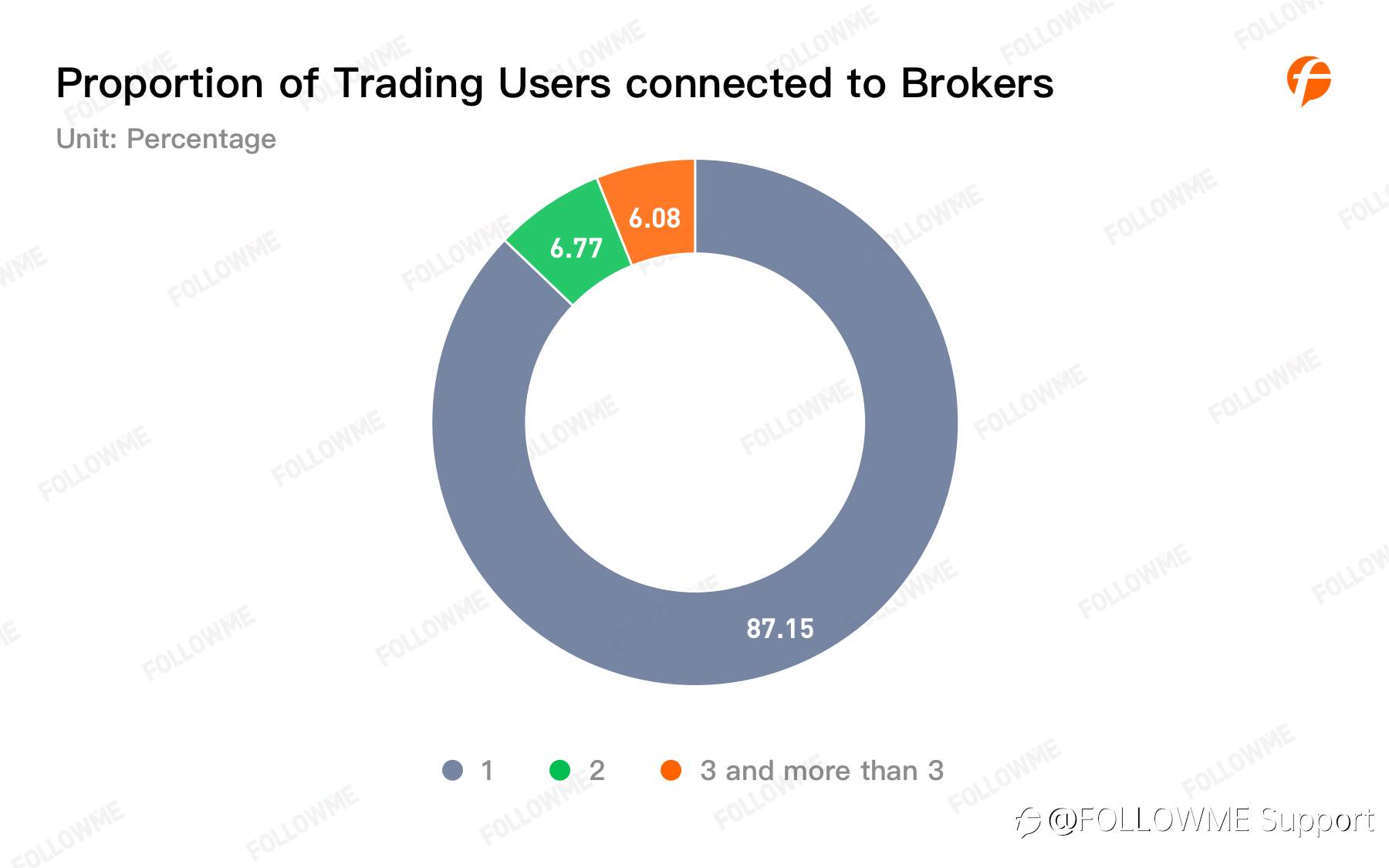

2, Proportion of Trading Users connected to Brokers

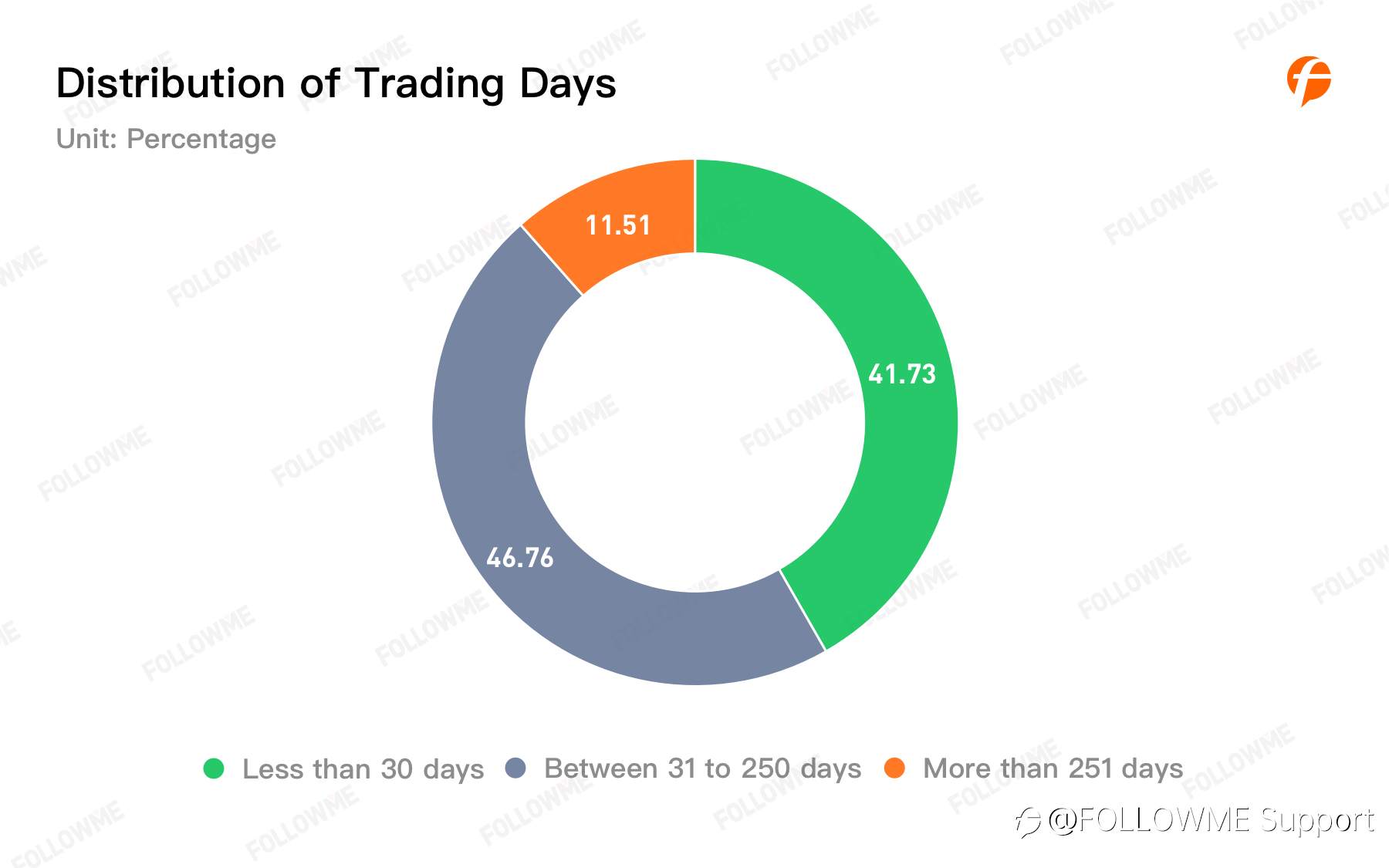

3, Distribution of Trading Days

The trading days across all users are not more than 250 days.

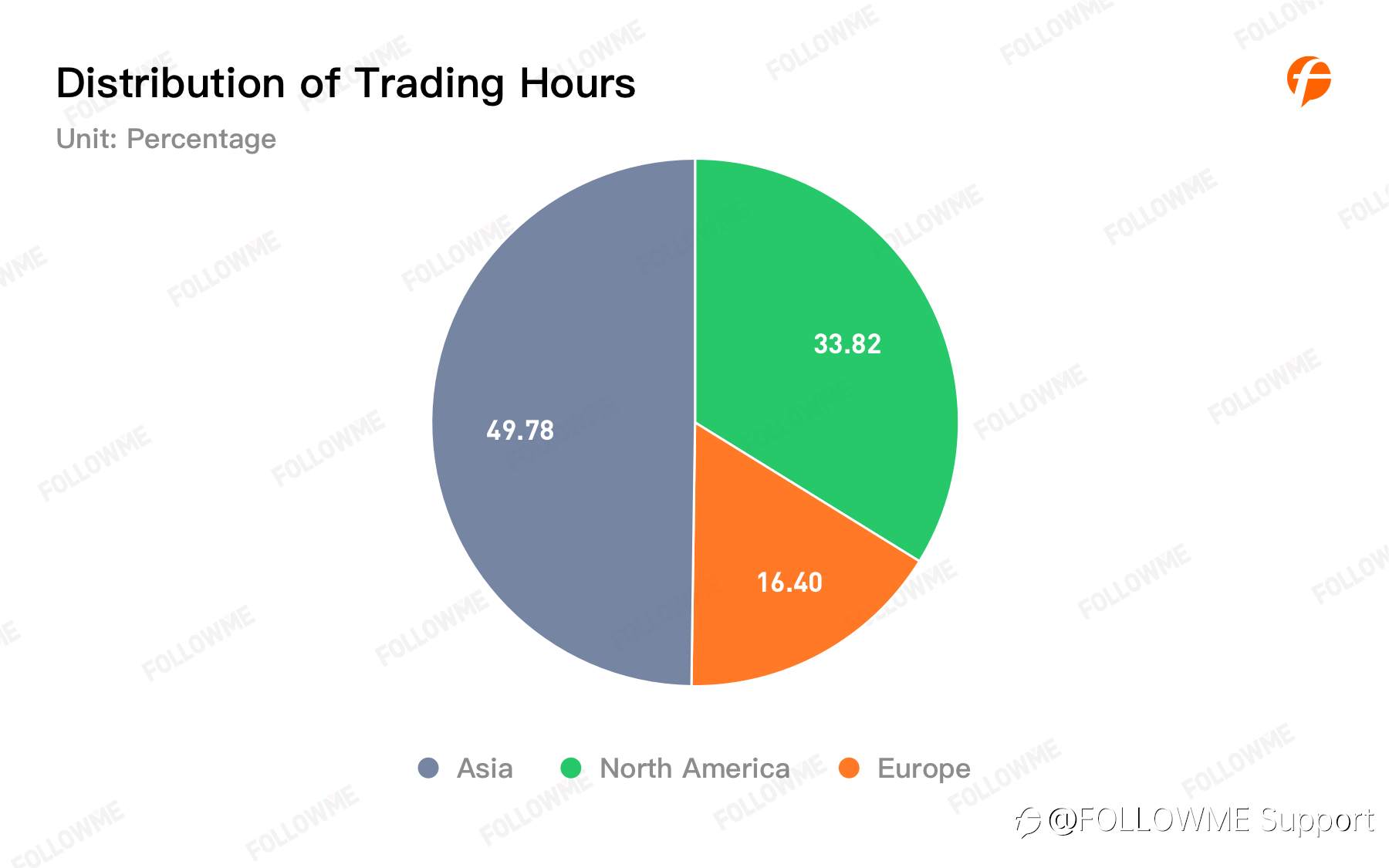

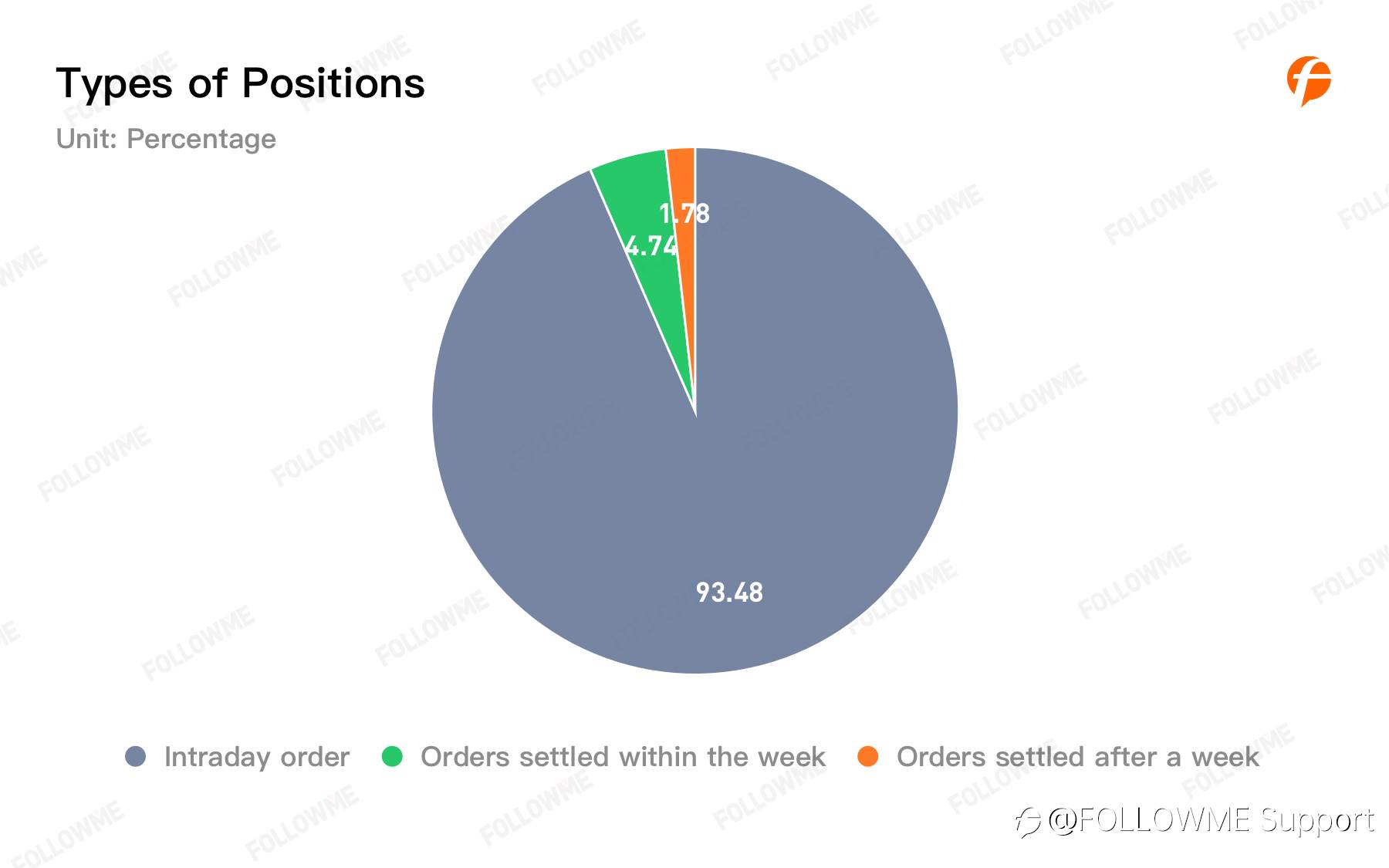

4, Distribution of Trading Hours and Types of Positions

In 2020, FOLLOWME Trading Community users mainly choose to trade during the Asian session. Intraday orders are still the most important type of positions, accounting for 93.48%.

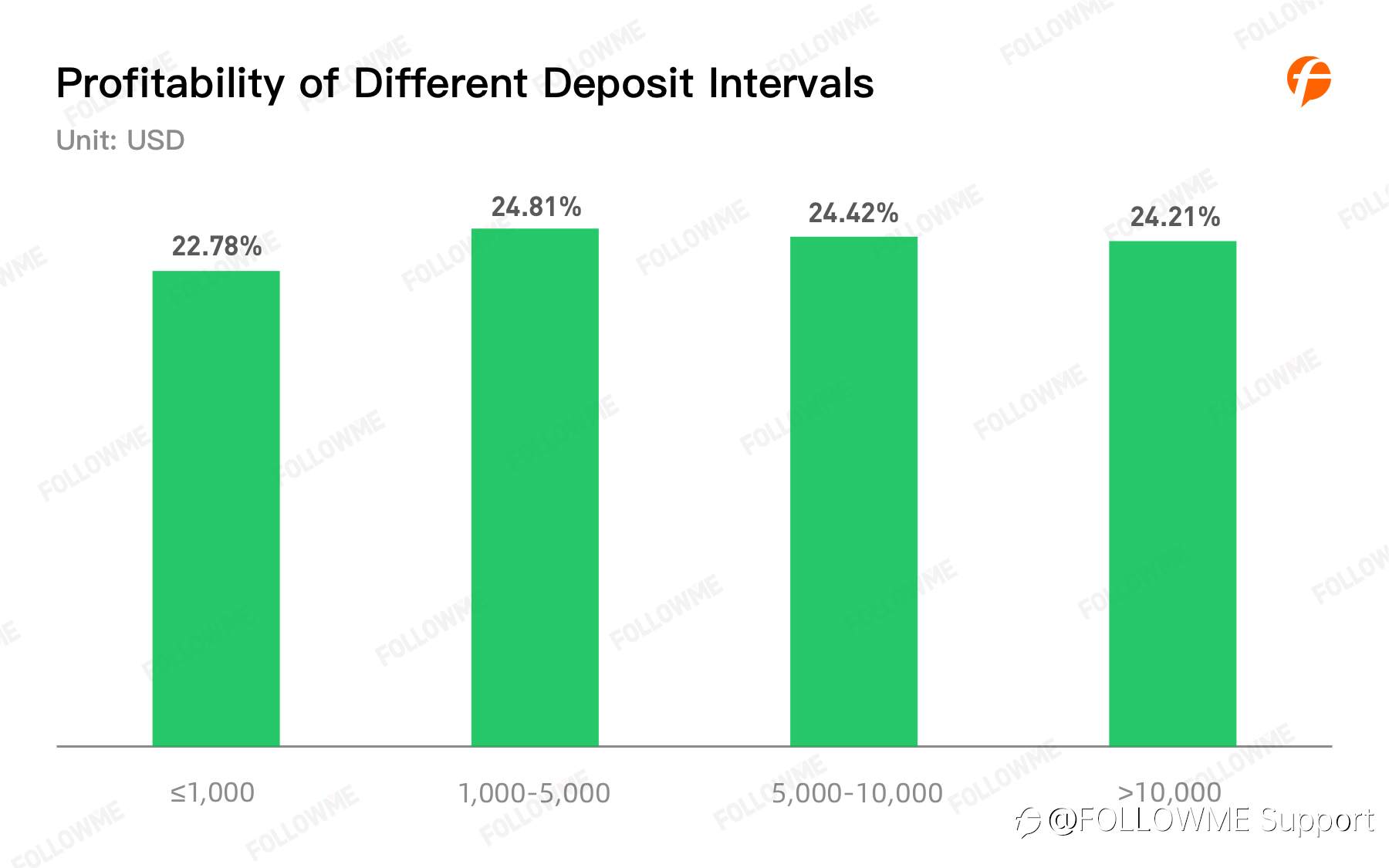

5, Profitability of Different Deposit Intervals

There is little difference in terms of the profitable accounts ratio across various deposit amounts which sits between 22% and 25%.

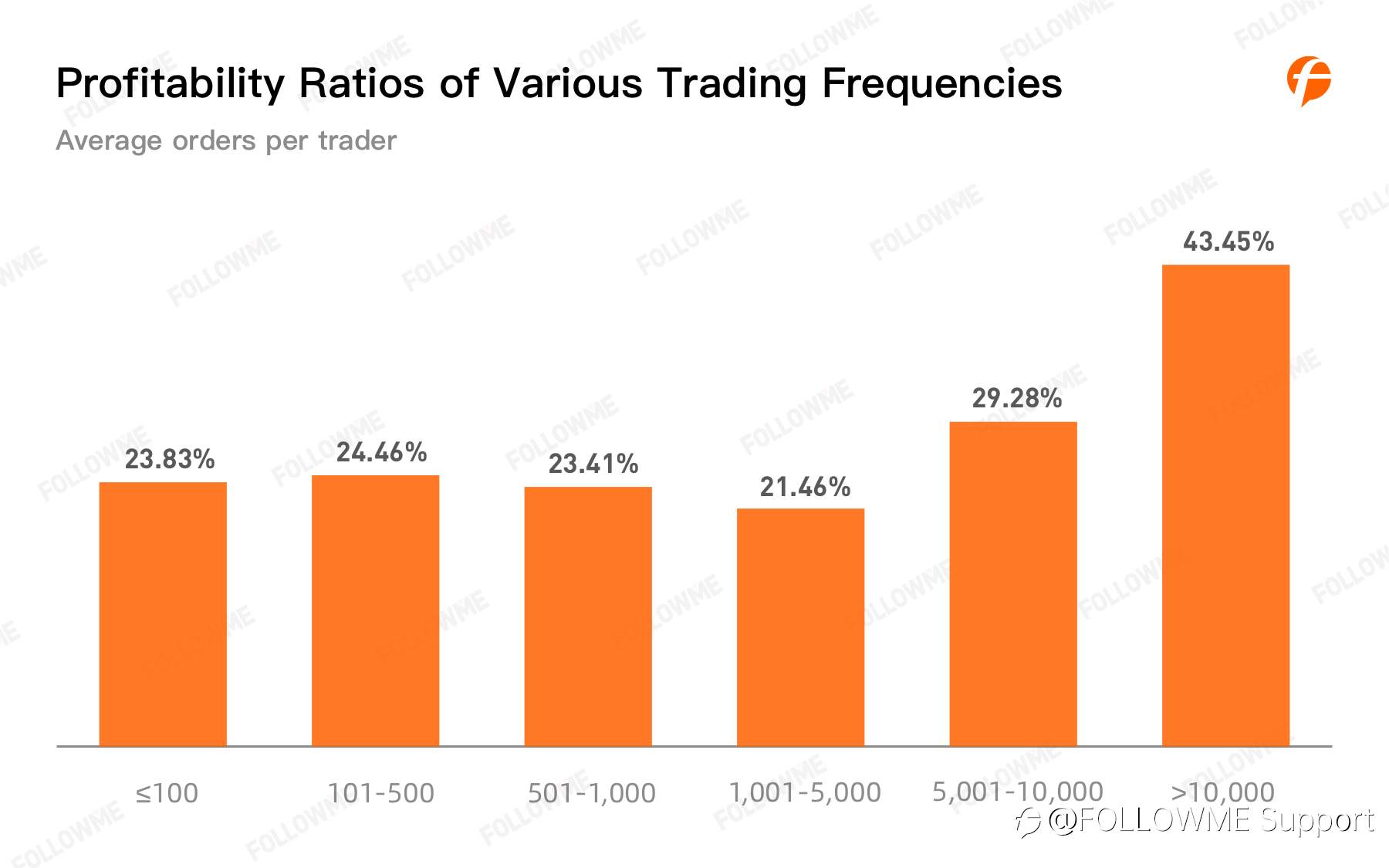

6, Profitability Ratio of Various Trading Frequencies

When the number of orders is less than 5,000, the probability ratios are almost identical. However, when the number of orders went up higher than 5,000, the probability ratios increased significantly. At the point when it went over 10,000, the probability ratio even reached 43.45%.

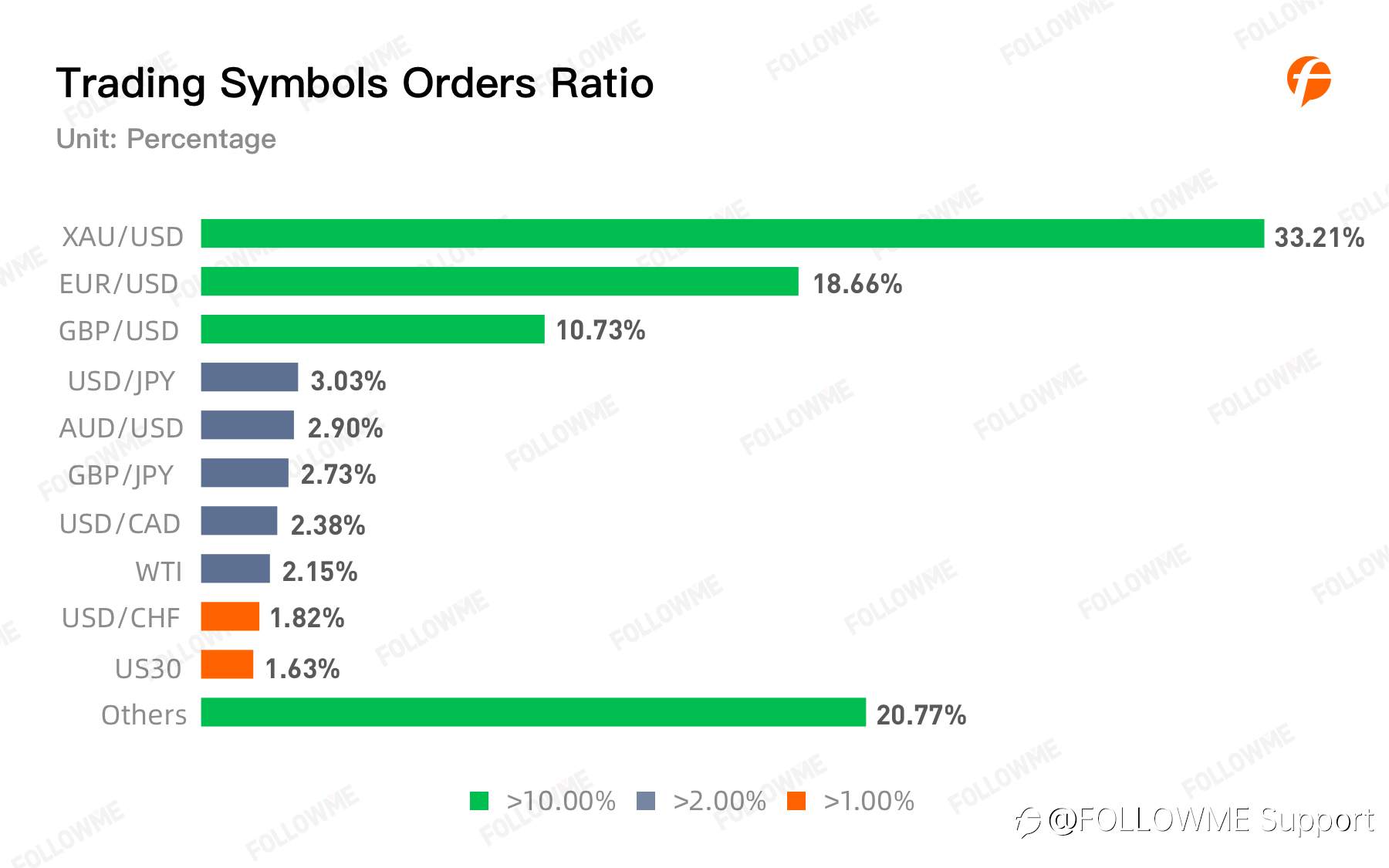

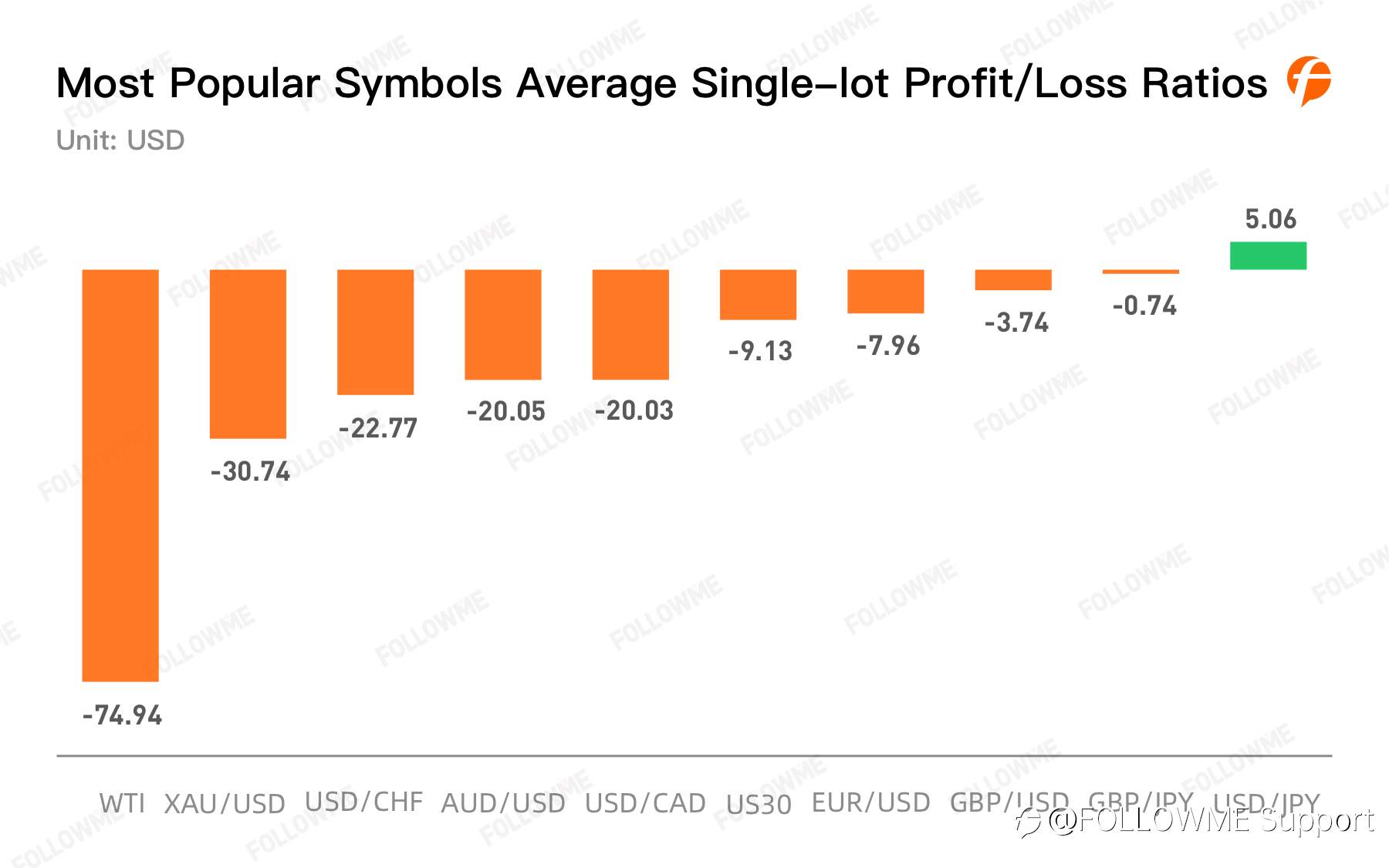

7, Profit/Loss Ratio of Popular Trading Symbols

The most-traded symbol on FOLLOWME last year belongs to XAU/USD, most likely due to the high volatility of the metal price itself.

Among the popular trading symbols, crude oil has the largest average single-lot loss amount, which reached $74.94, followed by gold, with an average single-lot loss amount of $30.74. Besides, USD/JPY is the only popular trading product with an average profit per lot.

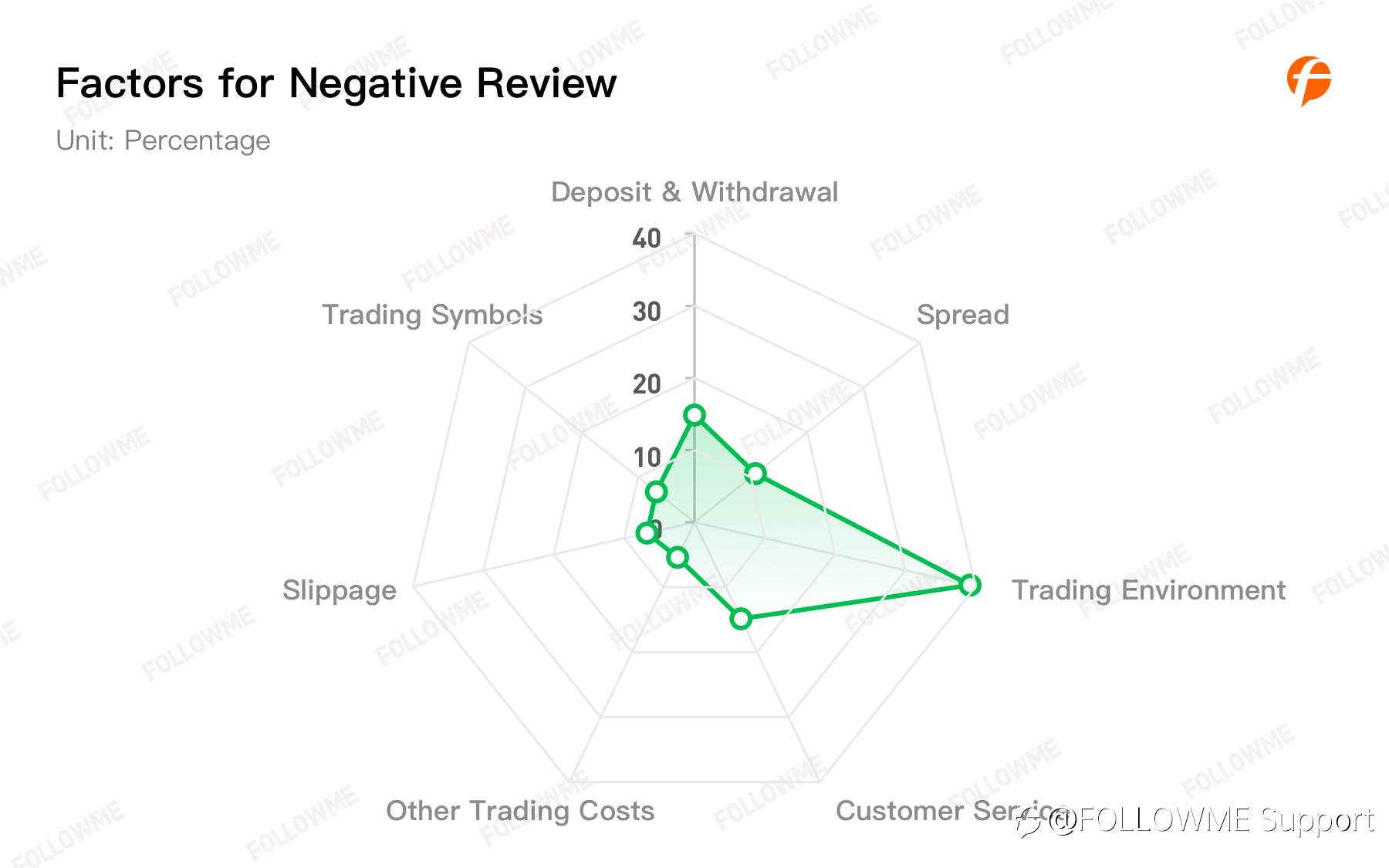

8, Important reference factors for traders to choose a platform

FOLLOWME Trading Community has conducted a questionnaire survey on 150 trading users and the results showed that our deposits and withdrawals system is the main contributor that leaves a positive impression. However, our trading environment has been voted as the main reason for the negative reviews provided by the group.

Study on Traders and Subscribers

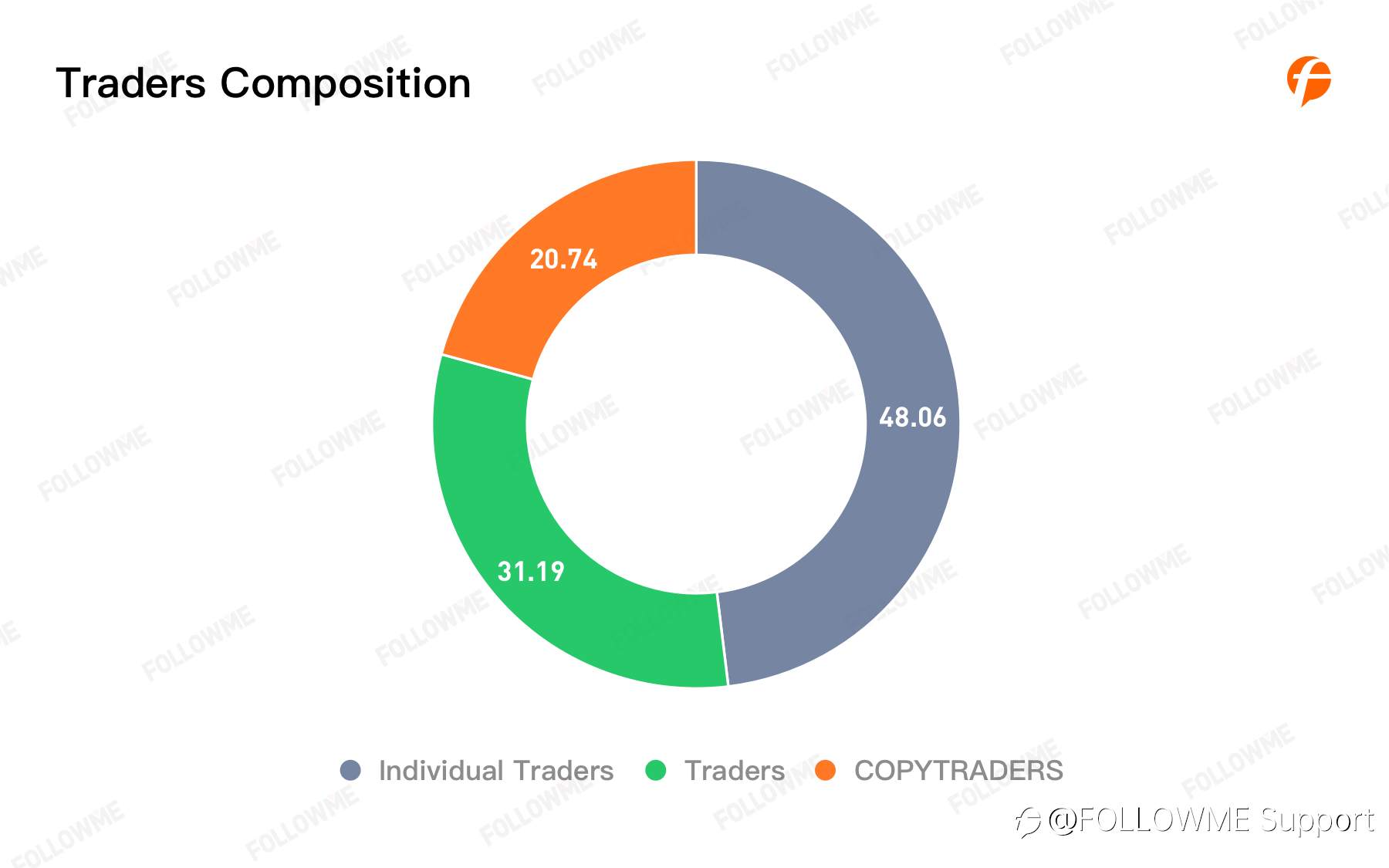

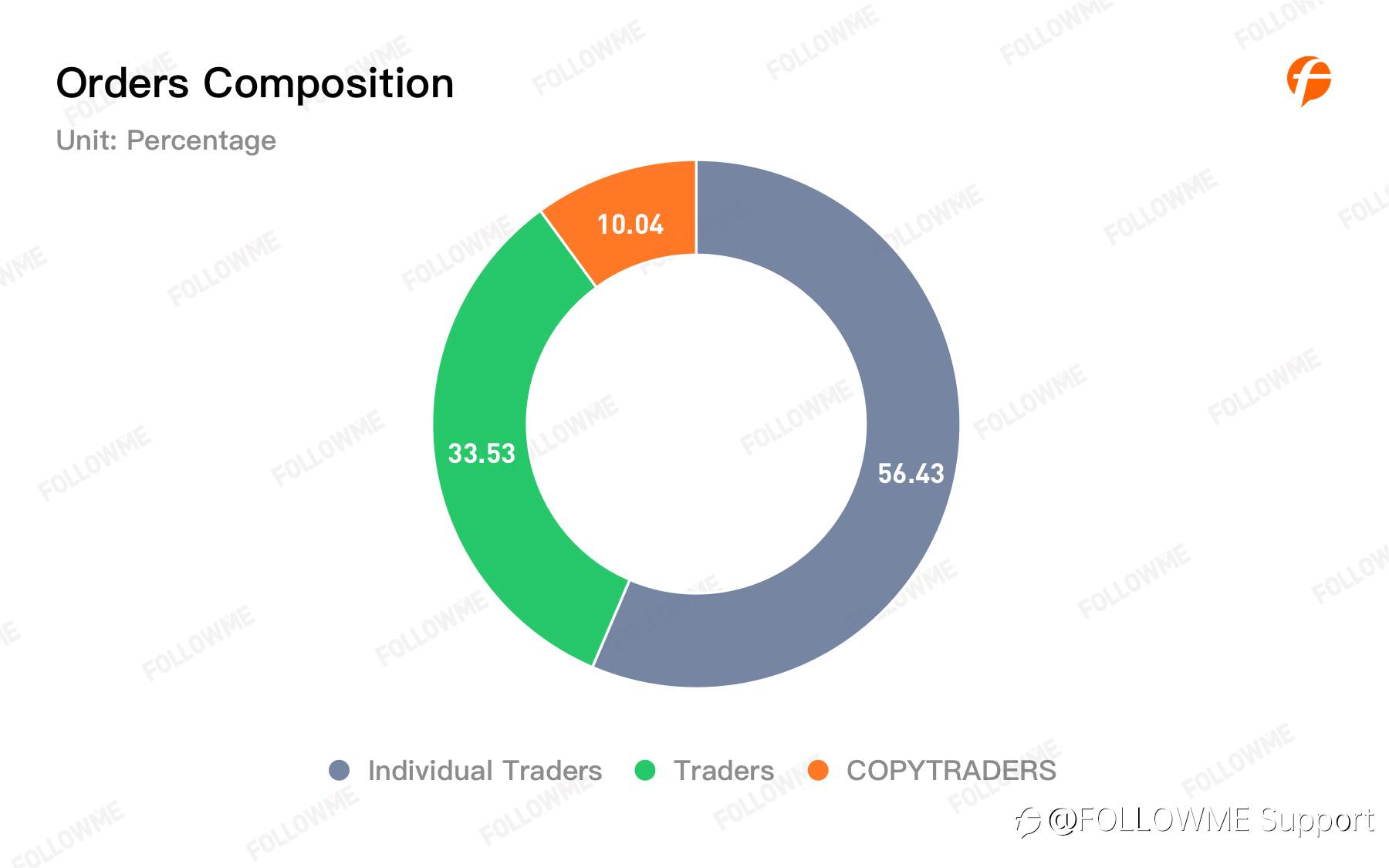

1, Traders and Orders Composition

Out of the number of orders traded on FOLLOWME, the number of individual traders’ orders accounted for the highest proportion, at 56.43%, which exceeded the sum of orders of Traders (Signal Providers) and COPYTRADERS.

2, Leverage selections by users

Compared with individual traders, Traders are more inclined towards selecting high leverage. The number of Traders who choose 500 times leverage or more reached 19.53%, reflecting their appetite for a higher risk-reward ratio. Meanwhile, the ratio of COPYTRADERS who chose 500 times is very close to that of Traders, at 19.39%.

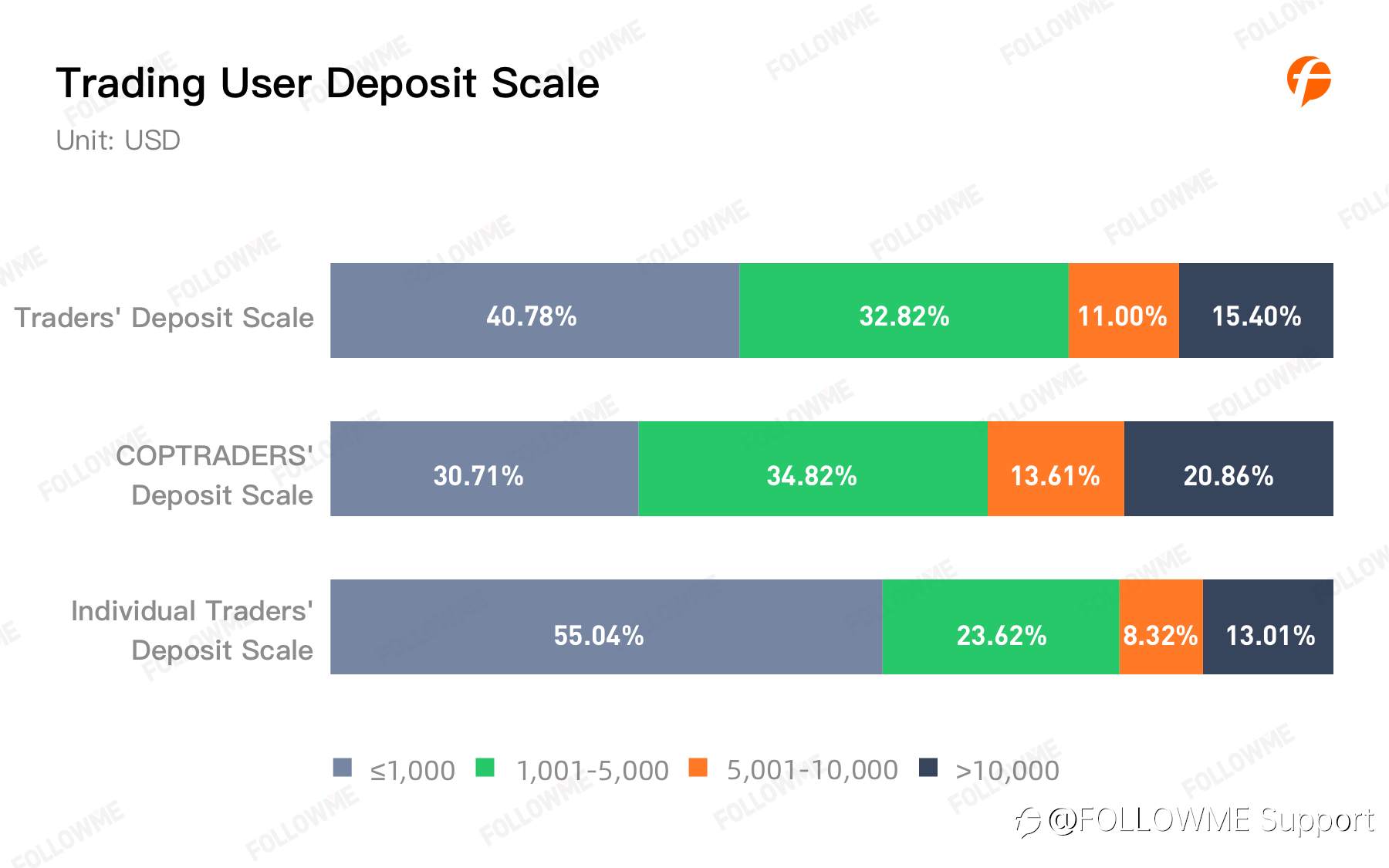

3, Trading Users’ Deposit Scale

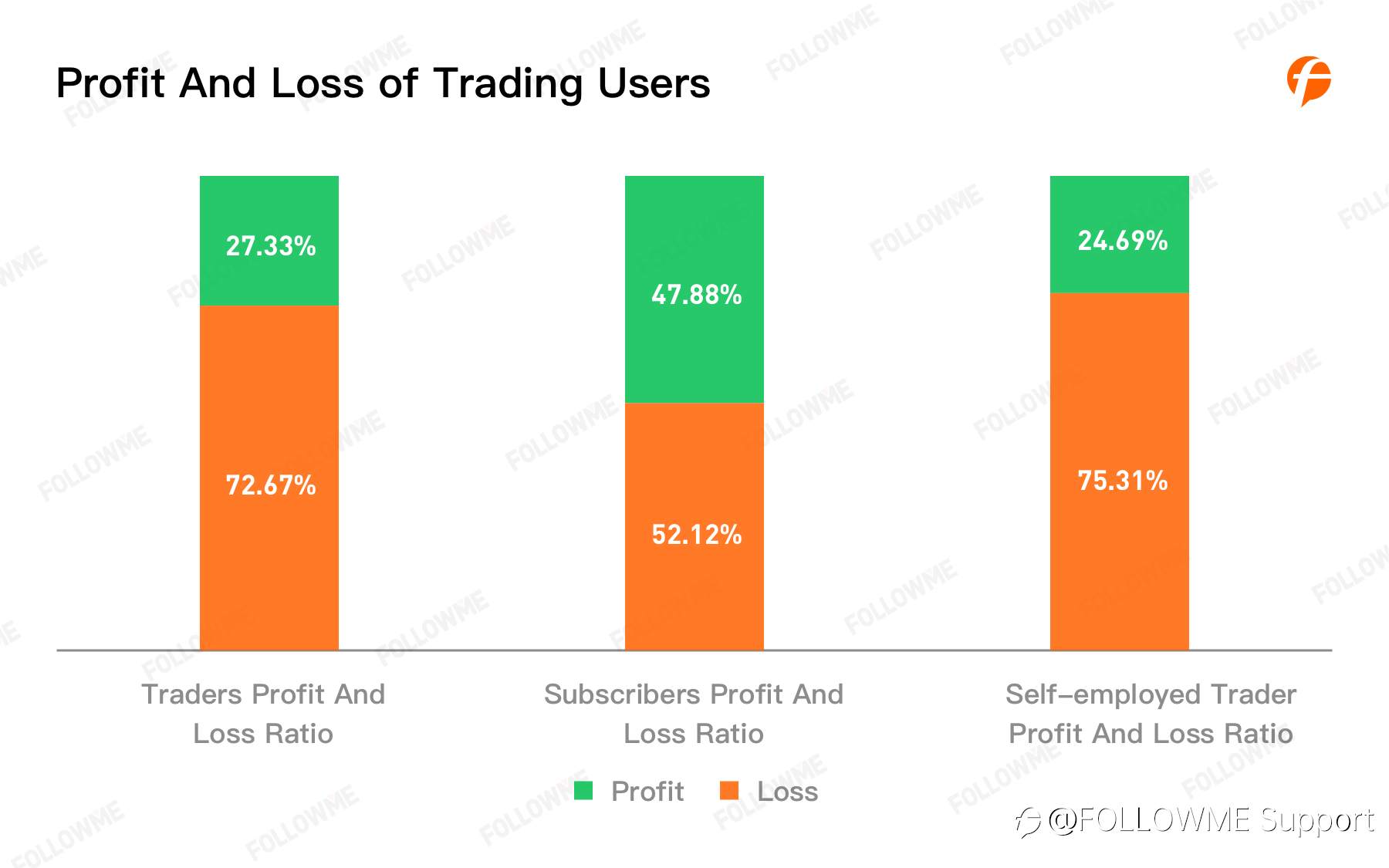

The proportion of COPYTRADERS' profit is much higher than that of Traders and self-employed traders, at 47.88%.

4, Profit and loss of trading users

For the year 2020, the ratio of COPYTRADERS’ profiting is much higher than the Traders and individual traders at 47.88% as shown below.

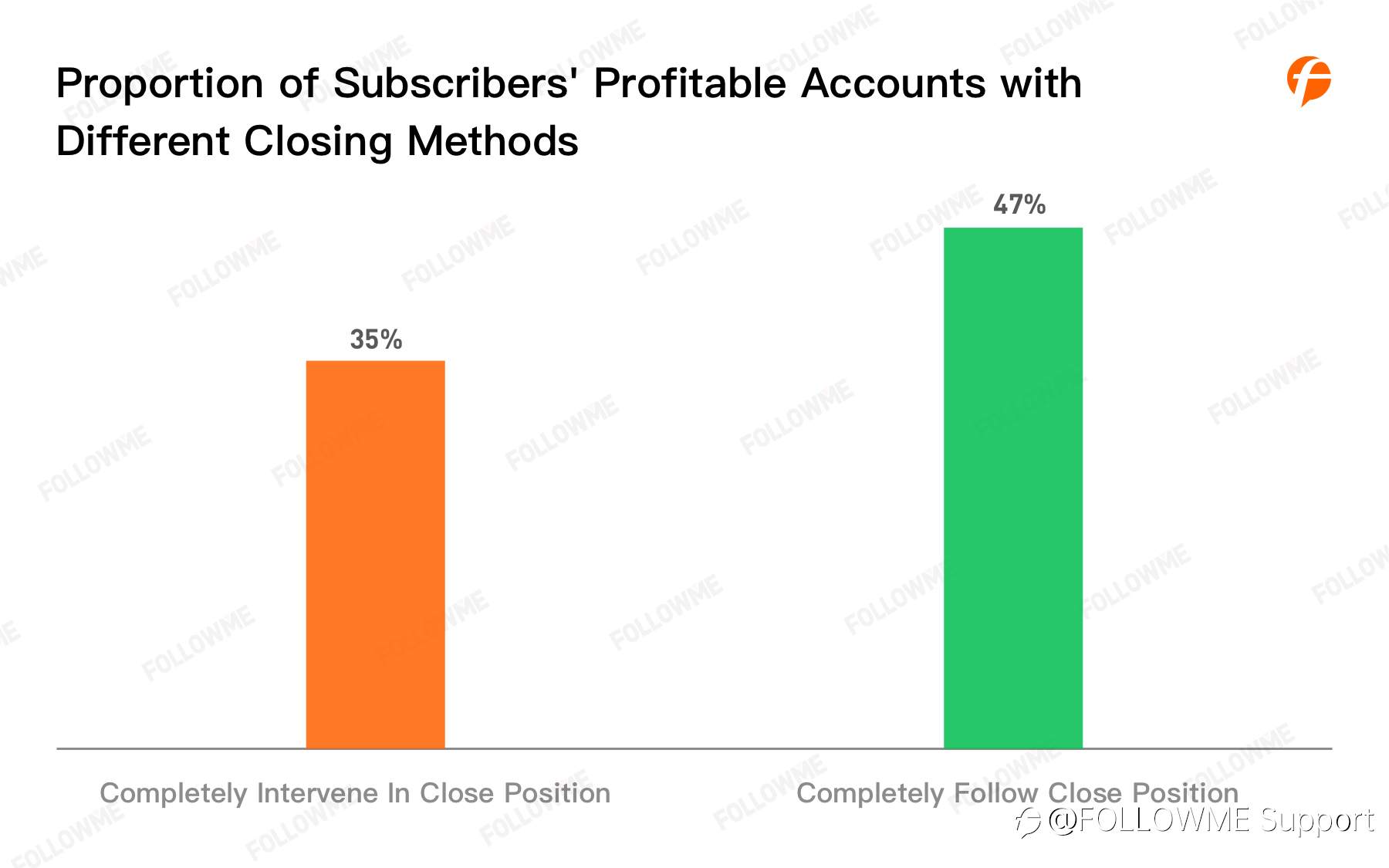

5, Follow closed position and intervene in the closed position

The proportion of complete intervene in close position accounts is 12% lower than the proportion of completely follow close position accounts.

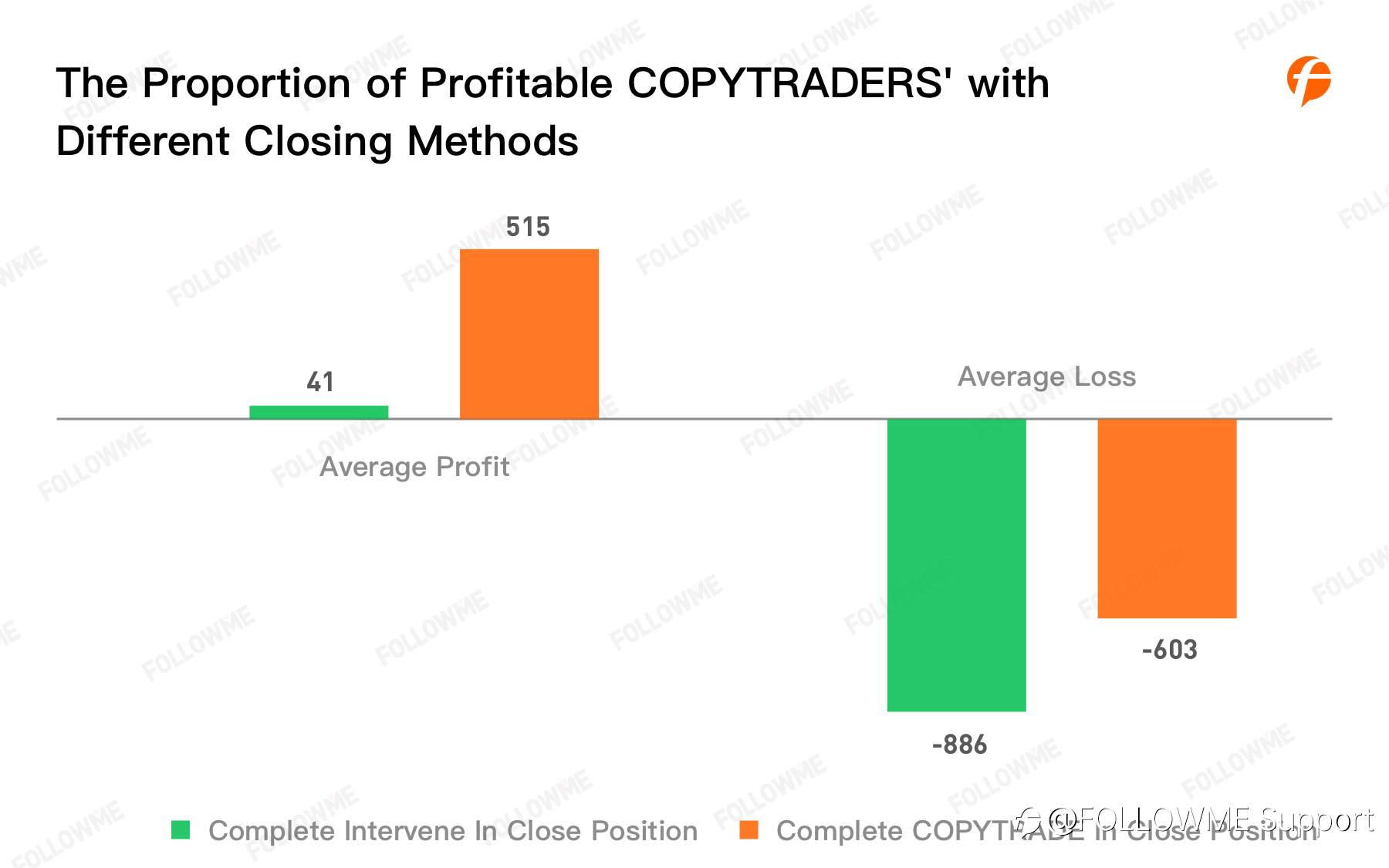

In addition, by adopting the method of completely intervening to close a position, the average profit is much lower than that of a completely following position, but the average loss is higher than that of a completely following position.

It can be seen that blindly taking full intervention to close a position will not only make you leave the market due to timidity when you can pursue higher returns but also choose to carry orders and cause losses when you are facing risks.

Appendix

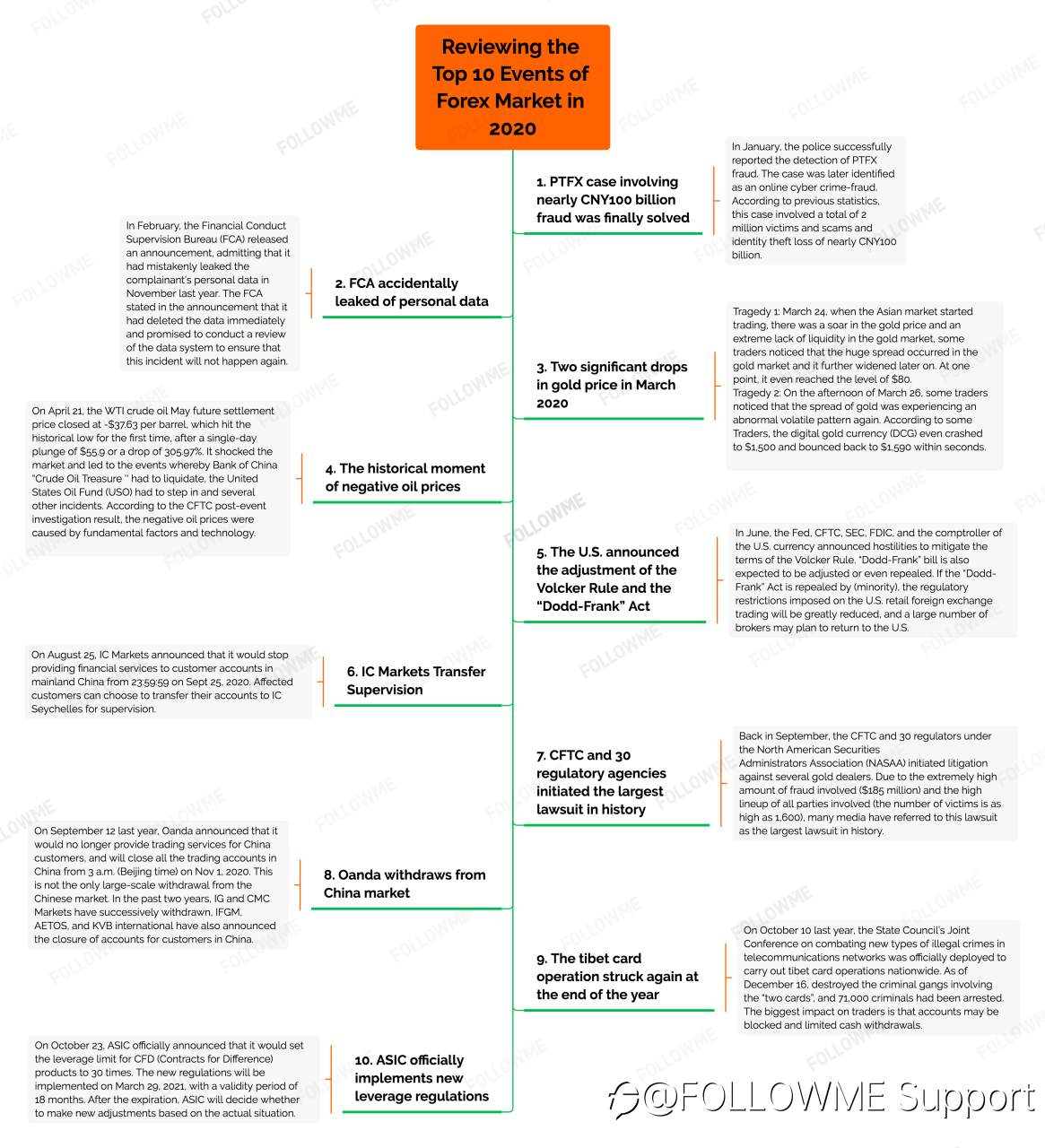

(Review of 2020 Top 10 Events in the Forex Industry)

FOLLOWME Trading Community Advantage

FOLLOWME Trading Community Platform’s follow trading system - COPYTRADE supports cross-Brokers deal trade. Users can connect to the community as long as they have an MT4 account. Currently, FOLLOWME supports the connection of more than 3,000 Forex Brokers.

Users on FOLLOWME Trading Community Platform can either choose to become a COPYTRADER or a Trader.

COPYTRADERS can choose to subscribe to their preferred trading Signals and even customize their subscribing method in order to enjoy automated trading services and earn a profit. Traders can sign up as a Signal Provider in the community to earn subscription fees. To set up a paid subscription account, the trader’s account must fulfill a specific operating time frame, company size, possesses a regulatory qualification, and has high popularity among users.

FOLLOWME Trading Community platform has set up servers in multiple regions and countries to ensure that community users with stable account connection and low latency trading services. Even when the market fluctuates wildly such as during the non-farm payroll data release, it can still ensure the efficiency to react to market events faster than the competition to increase the profitability trades.

The community has multiple protection mechanisms to ensure the safety of personal funds and handling any exceptions order.

The first mechanism: net worth protection. Net worth protection allows subscribers to set an appropriate net worth protection value. Once it reaches the protection value, it will stop following the order and close all orders to prevent further loss. Users can be noticed immediately by SMS, email, etc when an order is closed.

The second mechanism: exception monitoring. COPYTRADE will 24/7 monitor the account connection status and follower status. If the abnormal connection issue status occurs, COPYTRADE will immediately try to reconnect. If it fails to open a position for copied trade, COPYTRADE will attempt to reopen the position.

If failed to close a copied trade, COPYTRADE will attempt to close the trade, until it is successfully closed. Nonetheless, the risk control center will also ensure the safety and stability of copy trade to the greatest extent possible. Furthermore, where there is an unstable situation on the copy trade, the user will receive notifications such as text messages, emails, etc in a short time frame.

The Chart section conducts a multi-angle and Omni-directional analysis of the account trading data, forming multi-dimensional charts and statistical indicators, allowing you to view the situation of the trading account more comprehensively and in detail.

The scoring section considers the trader’s risk control ability, stability and profitability, and other three indicators as consideration factors on the premise of considering all the trading data and information of the trader to ensure the objectivity and scientificity of the scoring.

The subscription module mainly displays the number of traders' subscriptions, the total amount of follow-up funds, and the changes in subscriber income. The order section can view the information of each transaction order of the trader.

In the third quarter, the trading interface of FOLLOWME version 5.0 has undergone a new revision, where subscribers can see the data on trader account more clearly. The basic information of the signal includes information such as the trader’s nickname, account number, medal, score, number of subscriptions, rate of return, max drawdown, and subscription fee. The trader account layout page consists of four-parts, namely charts, ratings, subscriptions and orders.

Vision: To become the most active trading community in the world.

Mission: Make transactions more transparent and easier through the community.

Idea: Customer first, technology for social good.

Edited 01 Feb 2021, 18:30

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now