Prior to the presentation, Ken had a general review on the global financial crises. The first one Ken can recall is 1997 Asian financial crisis, when he lost everything in stock market. In 1999 there was US bubble, with the biggest one in 2007, which caught everyone by surprise. Since then, everyone has been trying to predict crisis. Now we have the latest crisis caused by coronavirus, which is very serious due to the unprecedented amount of global debt. Here is chart of the global debt in $ trillion.

Ken’s presentation was divided into three parts: 1. Principle of global market; 2. High volatility prediction; 3. Psychology

1. Principle of global market

As the continuous progress of globalization, the world is unprecedentedly connected in all respects, among which financial market the most important one.

As you know stock market, forex, bond market is all connected. You can trade NASDAQ even you are in China, you can purchase Chinese stock even if you are in Europe. The global market is connected as a whole.

The global fund portfolio includes stock, treasury bond, commodity and forex. Recently, many traders have been keeping an eye on Tesla, Google, Apple in stock market; U.S. treasury bond, Japan treasury bond in treasury bond market, which is the biggest market in the world; oil, gold, Natgas in commodity market, which will get high returns with high leverage, and EUR/USD, GBP/USD in forex market for hedges.

2. High volatility prediction

Last week, everything in the portfolio is going down, even the safe-haven asset like gold because the whole market was in turmoil. Ken stressed that when three markets are going down while only one market is going up, DONOT enter that market or bet an upward trend, because investors need to increase the liquidity in their portfolio. Everything will go down because of that.

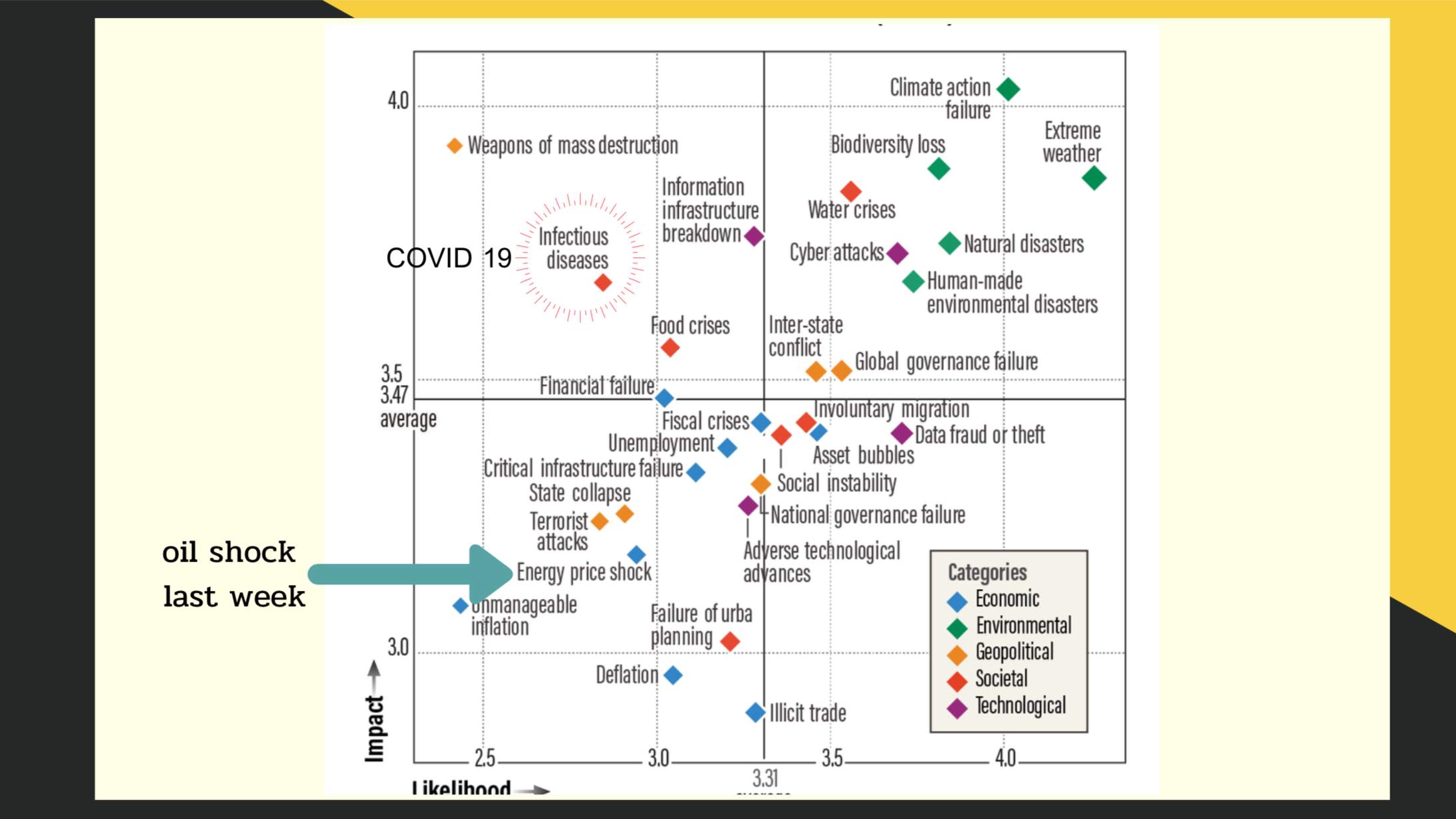

As shown in this chart, the horizontal axis represents likelihood while vertical represents impact. Ken was about to liquidate my portfolio when coronavirus broke out in China. Earlier this year, investors were busy preparing potential trade war between China and the U.S, and no one saw the spread of COVID-19 coming. Therefore, you don’t have to follow others’ opinion, because you are the one who manage your portfolio. Ken used to do nothing, wishing everything would become better again, but after learning from his experience, Ken thinks one should prepare for it.

3. Psychology

Ken considers three kinds of mentality important in the pre-volatility market where something unexpected happens. First is to reduce exposure, otherwise you will miss opportunity because you are likely to be short-sighted, gaining little profit but with high risks. If you don’t reduce your investment size, you might lose all of your money considering the difficulty to predict the market. The second is do not take risk. If you are wrong, the market might bounce and eat you out. Even if you are wrong at a time, the volatility is still very high. Thus, Ken suggests traders only trade 10% of your capital and keep the rest 90% in cash or safe assets, and only invest the 90% when the market is stable. This is what most of the rich investors do. For Ken, he invested 90% in property which he considered safe. Keep money in your hands, especially if you are a newbie, a beginner in forex trading.The third is be prepared for the ending for crisis situation or things get under control.

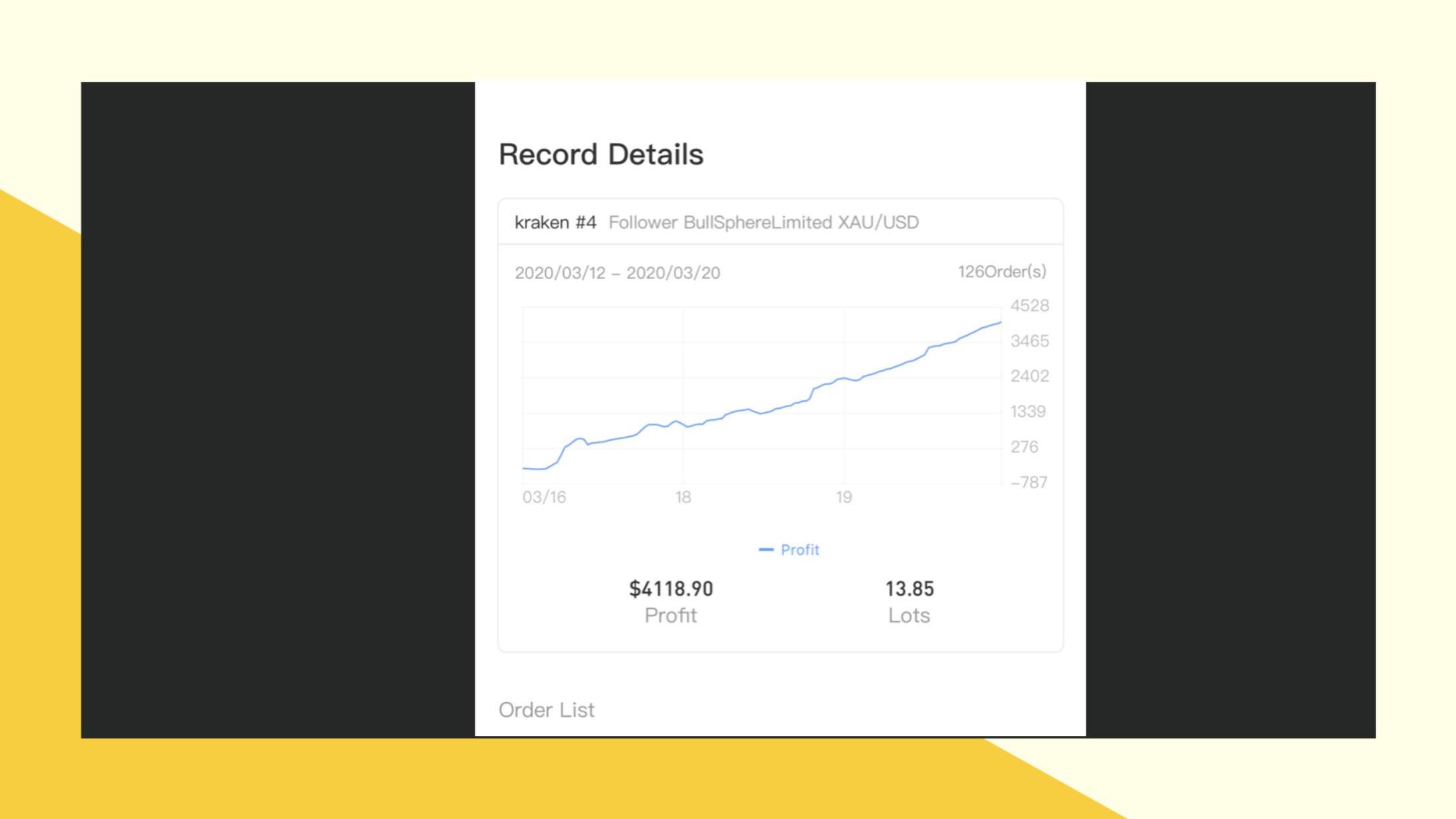

The below is one of Ken’s trading record details on Followme. Ken reduced exposure and gained progfit. Ken was glad that he profited instead of losing money in this volatile period, although he has a higher standard. Don’t panic, and don’t be too positive.

Q&A Section

1. Should I invest in bond or gold in this period of time?

Ken: I would recommend bond. You would need gold’s price to go up and profit, yet if it goes down, you would get nothing. However, if you invest in bond, you will still get interest rate every year despite the price ranging.

2. What kind of chart do you use for a long-term trading?

Ken: I look at fundamentals for long-term and use charts for short-term. I don’t think charts is helpful for long-term trading from my experience. I tried it before, and I lost money because of that. The charts can only tell you the history, but no the future. While the fundamentals will not be changed in a short period of time. For example, the birth rate in Europe or Japan is very low, thus affecting their GDP growth for a lack of workforce. This situation will not be changed in a short time.

3. What’s the correlation between stock market and forex market?

Ken: The two markets are interconnected. Investors in forex market is different from those in stock market. Banks play a key role in forex market and profit from the spread. When the market is in turmoil, they don’t lose anything because they have all the money in the bank.

4. How long do you think the impact of coronavirus will last?

Ken: I would suggest you keeping an eye on the countries that is greatly affected by the coronavirus. Now it’s in Europe of Italy, Germany, and France. If the situation gets worse, Euro will become weaker and weaker. I personally think this outbreak will be ended in 2 months, if not, 6 months max. I think the panicking sentiment majorly comes from social media, instead of the virus itself. However, we will be facing financial crisis then because of the global debt.

5. What suggestion do you have for other traders?

Ken: I almost lost everything in 2007 financial crisis because I have little experience. I was using only technical analysis instead of fundamentals to see the whole picture. I then learn to understand why banks are making certain policies and how the whole monetary system works, and I know which currencies are best to trade and which to avoid.

6. How do you think the trend will evolve?

Ken: As I said before, the global trend will not be changed in a short period of time. Just as when everyone says that US dollars has collapsed, dollars price is becoming stronger. Are people wrong? No, but the fundamentals in forex market is very complicated. US dollars is going up because Euro and Aussie are far more worse. The same logic can be applied to S&P increasing compared with other stock market. You shouldn’t abandon the less worse country and go to the worst country, should you?

Followme thanks Ken for his wonderful sharing on FolloWebinar. For any further question, you are welcome to inbox Ken @kraken for trading experience and knowledge. (Don’t ask for money. —Ken:)

This was a rather successfully FolloWebinar. Let’s look forward to the second webinar coming up very soon! Cheers!

(The complete video will be uploaded as soon as Followme team finishes editing!)

Edited 25 Mar 2020, 11:17

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now