galangsimanjuntak735

GBP/USD Analysis: Bulls struggle above 1.2500 amid coronavirus jitters, Brexit uncertainties

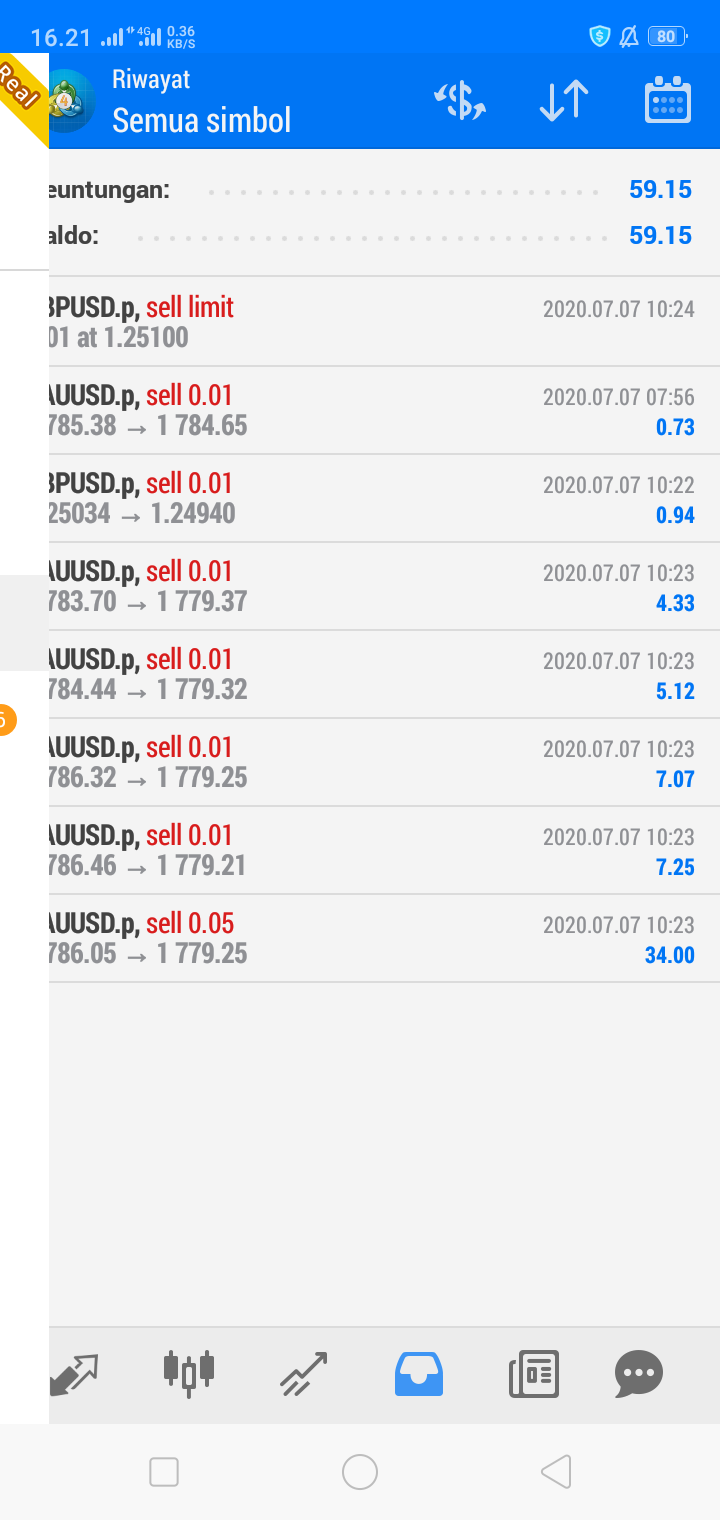

Sustained USD selling assisted GBP/USD to gain some traction on Monday.

The upbeat market mood continued undermining the safe-haven greenback.

Concerns over rising COVID-19 cases, Brexit uncertainties capped the upside.

The GBP/USD pair built on Friday's intraday bounce of around 50 pips and gained

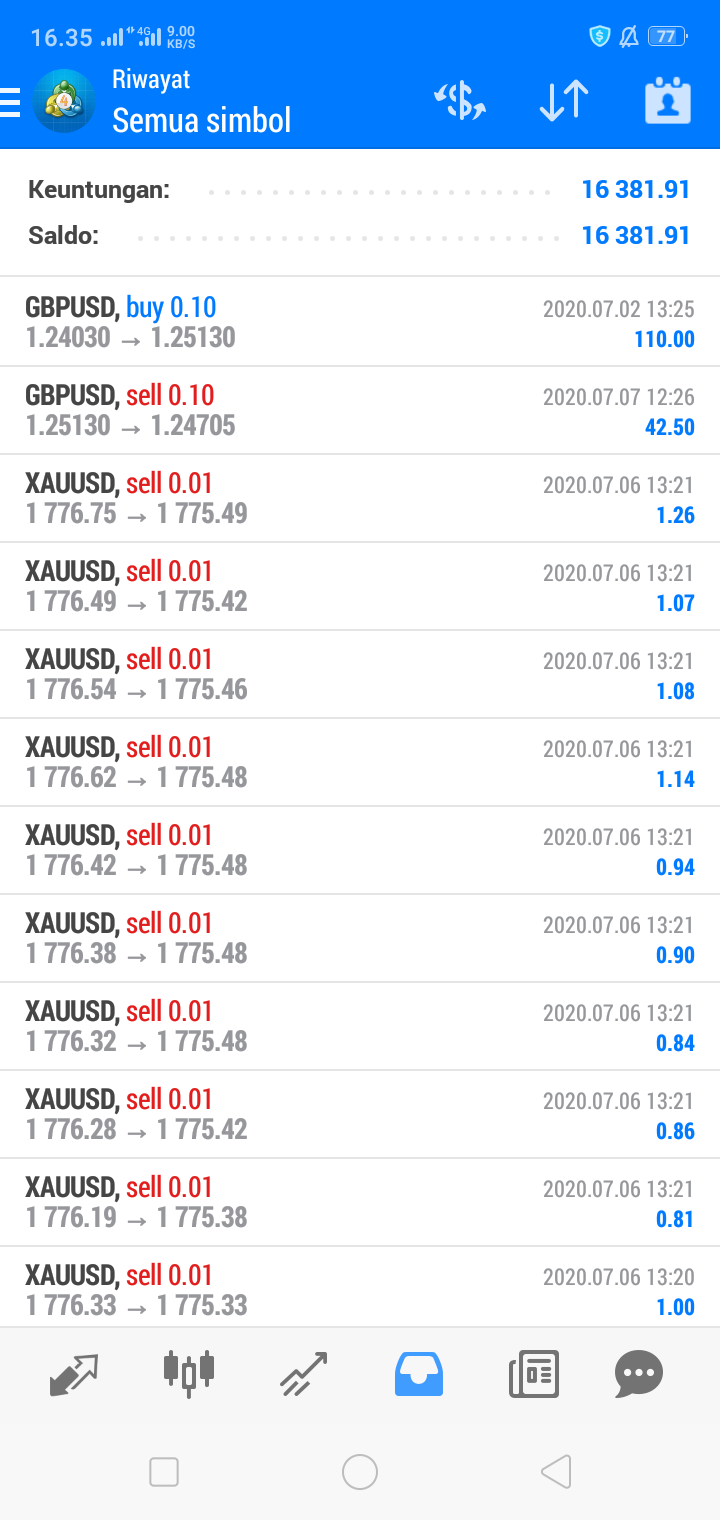

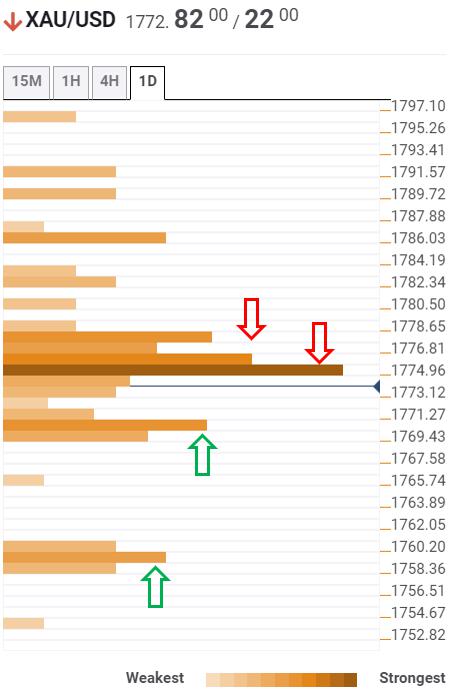

Gold Price Analysis: Acceptance above $1775 is critical for the XAU bulls – Confluence Detector

Gold kicked-off a fresh week on the defensive amid the upbeat market mood, although held onto the $1770 level. The stimulus expectations led rally on the global stocks could likely weigh on the safe-haven. Key technical levels to watch.

The Technical Confluences Indicator shows that the yellow metal

SPX500USD SPX FUTURES ELLIOTWAVE next 2-3 months DOWN

#SPX500USD#

The 3 wave structure of the BEAR MARKET RALLY since March lows is more clear on the Dow and sector ETFs - especially XLF . Elliot wave theory calls for going to March lows again. June 8 was the end of this bear market rally and we are now completing wave c of 2 of the larger C wave

GBP/USD: A move to 1.2580 is not favoured so far – UOB

Cable’s potential advance to the 1.2580 region in the short-term horizon seems to be losing momentum for the time being, suggested FX Strategists at UOB Group.

Key Quotes

24-hour view: “We highlighted last Friday “momentum has eased considerably and GBP has likely moved into a consolidation/correcti

GBP/USD Price Analysis: Again fails to keep 100-day SMA breakout

GBP/USD remains depressed after taking a U-turn from 1.2490.

Two-week-old resistance-turned support could restrict immediate downside.

Bulls will have to cross June 24 top to confirm further advances.

GBP/USD eases from 1.2490 to currently around 1.2465 during the initial hour of Tokyo open on Thur

Pull-up Update