© 2026 Followme

Liked

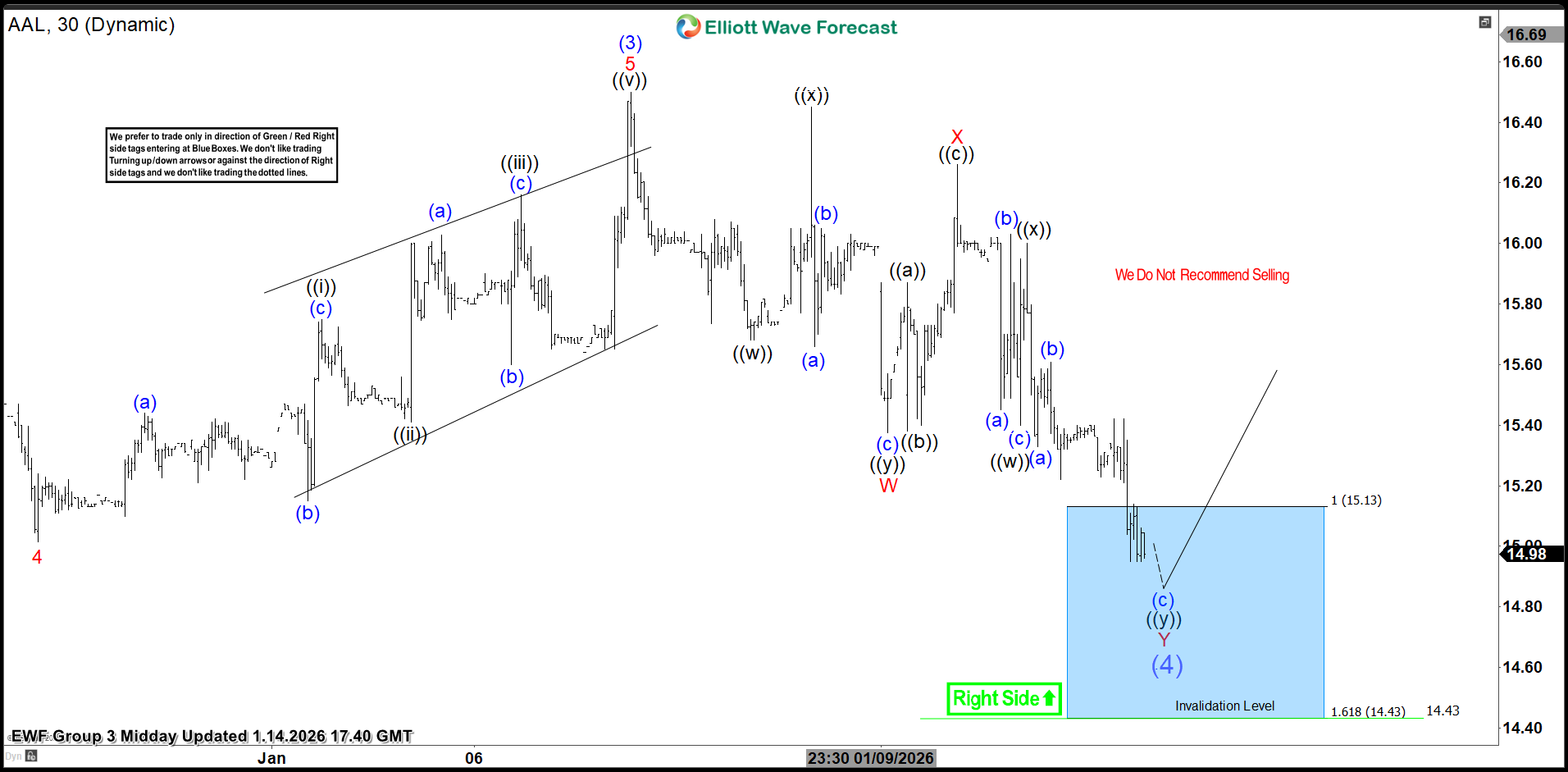

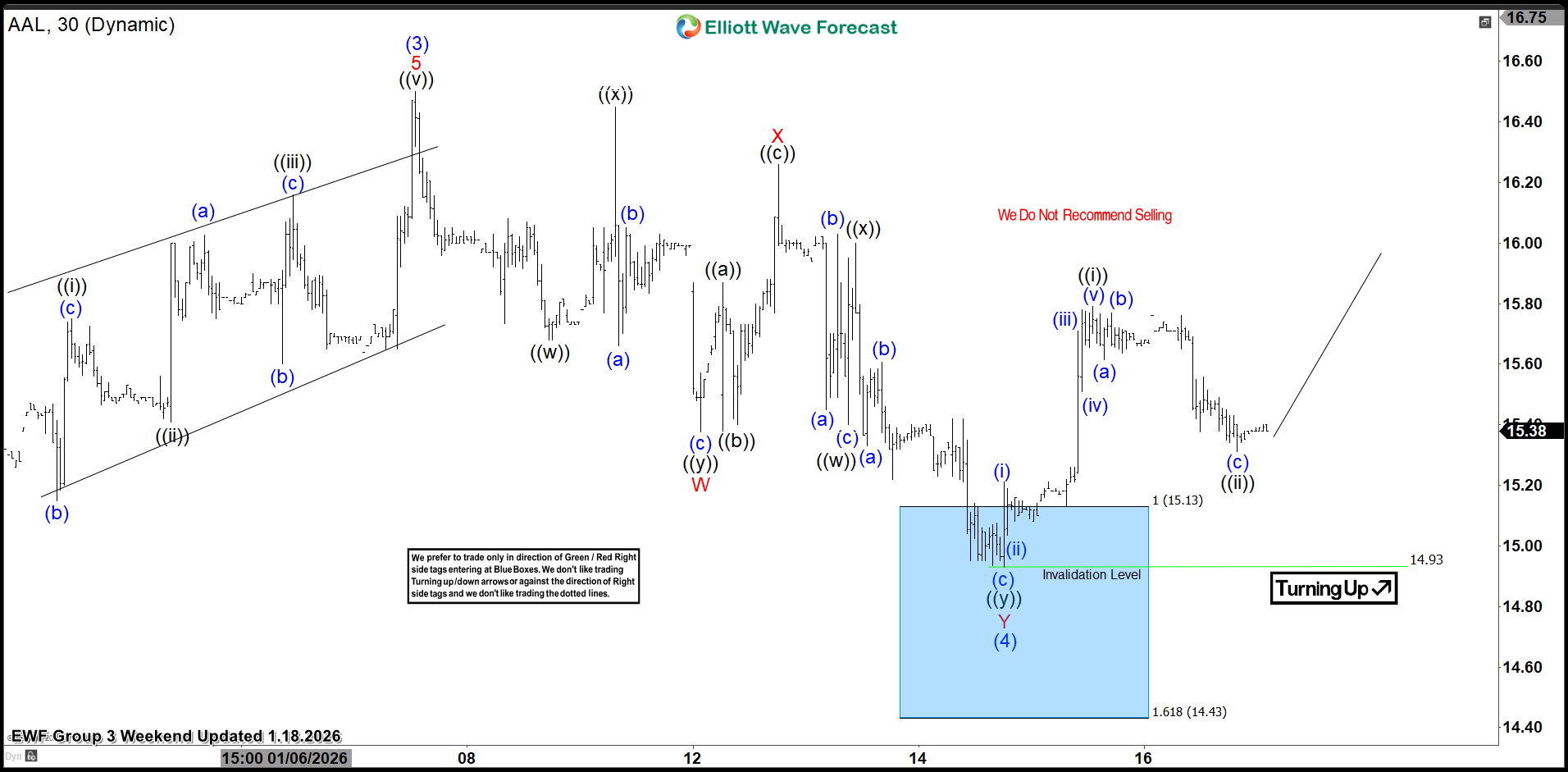

American Airlines (AAL): Buying the Stock at the Blue Box After an EW Double Three

Hello fellow traders, As our members know we have had many profitable trading setups recently. In this technical article, we are going to present another Elliott Wave trading setup we got in American Airlines (AAL) . The stock completed correction precisely at the Equal Legs zone, re

Liked

🌅 Morning Update | 12 January 2026

📈 Asian stock markets opened the week on a positive note. Hong Kong’s Hang Seng, China’s Shanghai Composite and Australia’s ASX 200 moved higher, supported by improved sentiment after Chinese trade data and the PBOC’s daily fixing. Japanese markets remain closed today due to a bank holiday. 📉 US s

Liked

Liked

Liked

Liked

Why Are Businesses Shifting to Cloud ERP Instead of Traditional ERP Systems?

In today’s fast-moving digital economy, businesses are under constant pressure to become more agile, cost-efficient, and data-driven. From startups and SMEs to large enterprises, organizations are rethinking how they manage finance, inventory, sales, HR, and customer relationships. This shift has le

Liked

Liked

What to Watch Next: Fed Signals, Gold Trends, and Forex Markets

Looking ahead, the path of gold prices will depend largely on how the Fed balances inflation control with economic growth. If inflation continues to cool and economic momentum slows, markets may expect rate cuts, which could support gold over the medium term. On the other hand, if inflation remains

Liked

Avoid Quant Trading Disappointment: The 3 Key Data Standards You’re Missing

For many quant traders, the frustration is all too familiar: a strategy that shines in backtests—boasting a Sharpe ratio of 2.8, with a steadily climbing profit curve—crashes and burns in live trading, racking up losses of 20% or more in just weeks. You audit code, swap platforms, and tweak logic, b