© 2026 Followme

Liked

Liked

Liked

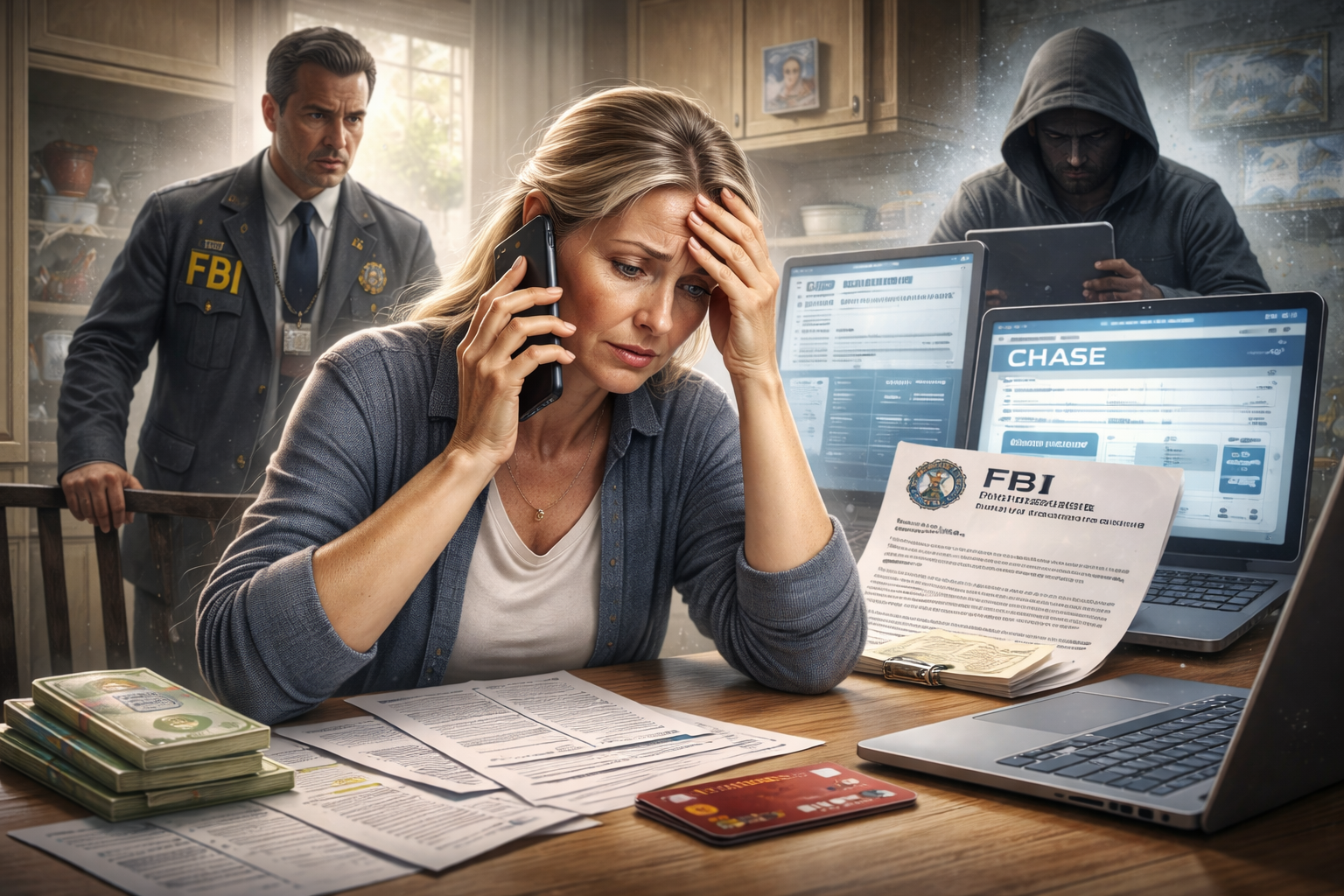

Impersonating the FBI is Not a Trading Strategy, It’s a Crime

As a retired professional trader, this Houston case highlights one of the darker aspects of financial manipulation that goes beyond just market moves — it exploits human trust. Scammers impersonating trusted institutions like banks and the FBI is an old trick but with new, sophis

Liked

Liked

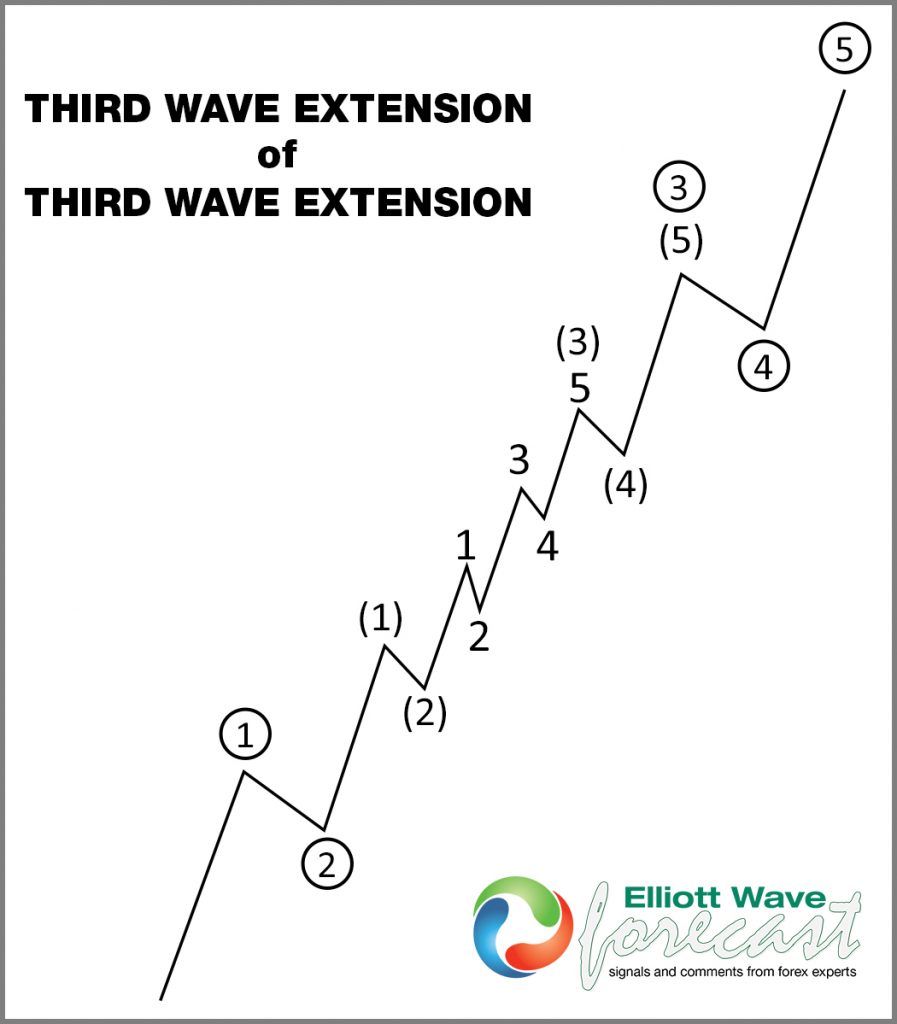

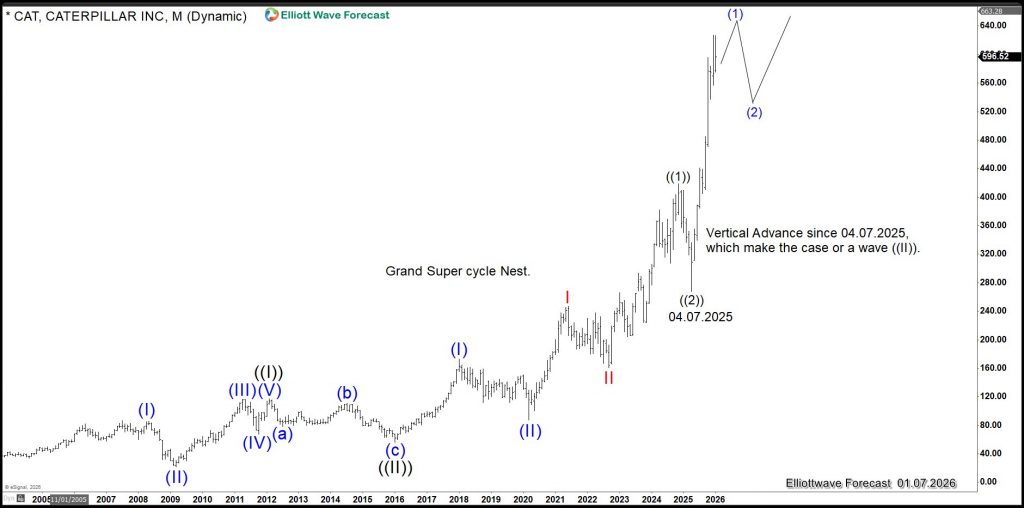

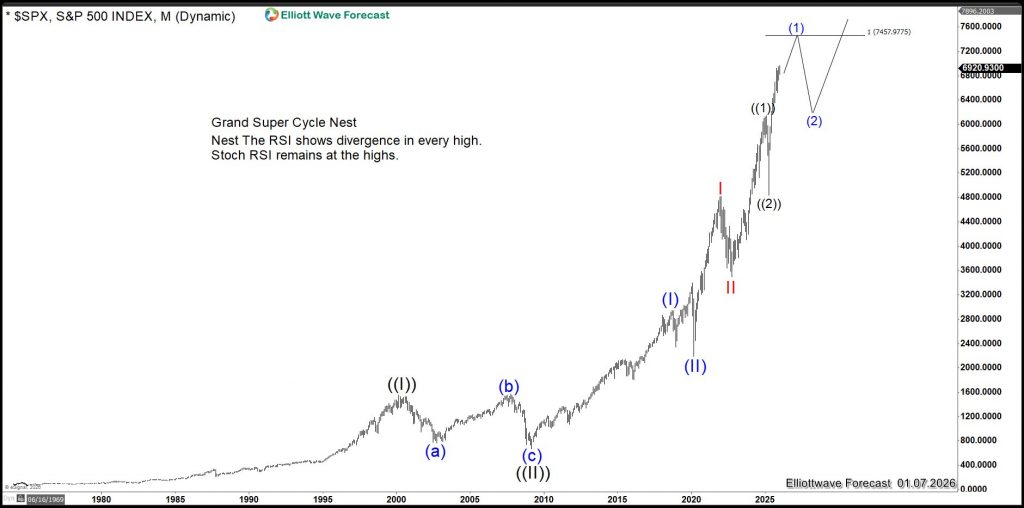

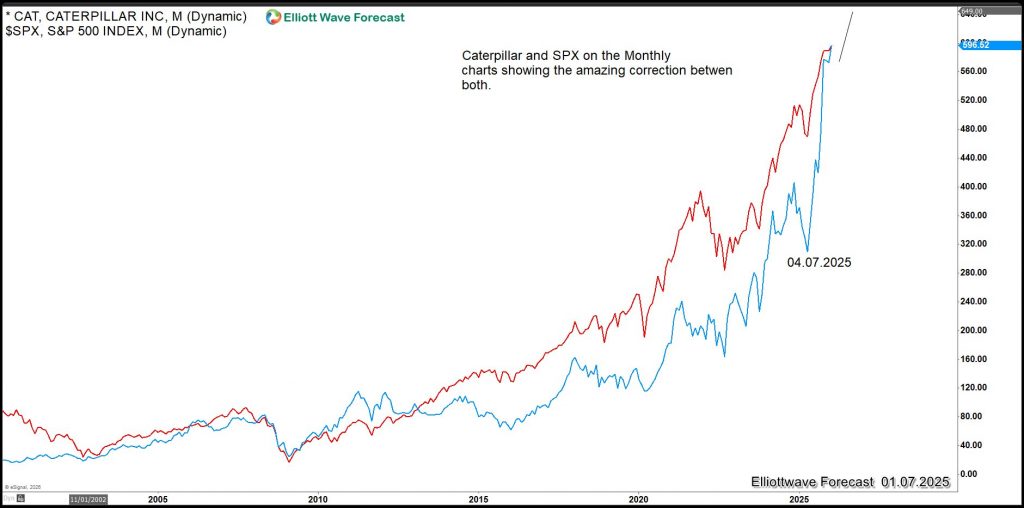

Caterpillar (CAT) Confirms Structural Nesting in the S&P 500 (SPX) With Targets at 10,000

As a bellwether industrial stock, Caterpillar often reflects the underlying strength of the economy and signals long-term market positioning. Its price behavior tends to lead broader market trends, offering insight into structural phases rather than short-term fluctuations. Viewed through this lens,

Liked

Liked

How Gold Helps Forex Traders Read Risk Sentiment

Gold is one of the clearest indicators of risk sentiment in global markets. When investors feel uncertain about growth, inflation, or financial stability, gold demand often increases. When markets feel confident and risk appetite improves, gold usually loses some appeal. This behavior is important f

Liked

Liked

Profit by Following

986.67

USD

- Symbol XAU/USD

- Trading Account #1 8081309

- Broker Windsor Brokers

- Open/Close Price 4,205.01/4,293.85

- Volume Buy 0.1 Flots

- Profit 888.40 USD

Liked

Crypto Doesn’t Create Scams, It Just Makes Bad Actors Faster and Harder to Catch

Crypto Doesn’t Create Scams, It Just Makes Bad Actors Faster and Harder to Catch As someone who has been in the markets long enough to see scams evolve from cold calls to crypto wallets, this India case is a textbook example of how old fraud wears new tech. Stock tips, FX schemes, fake