© 2026 Followme

Liked

Liked

Profit by Following

2,672.42

USD

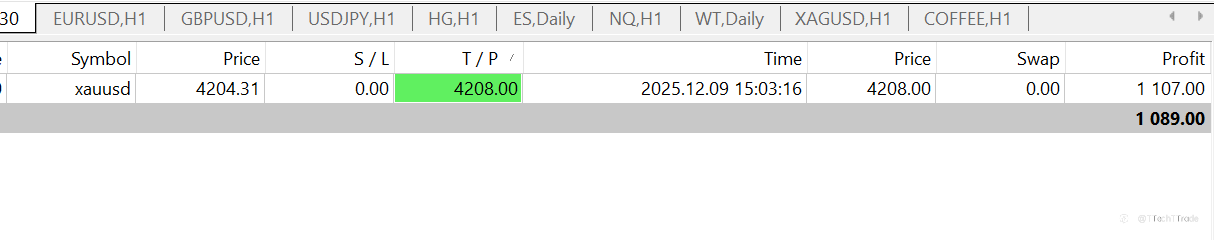

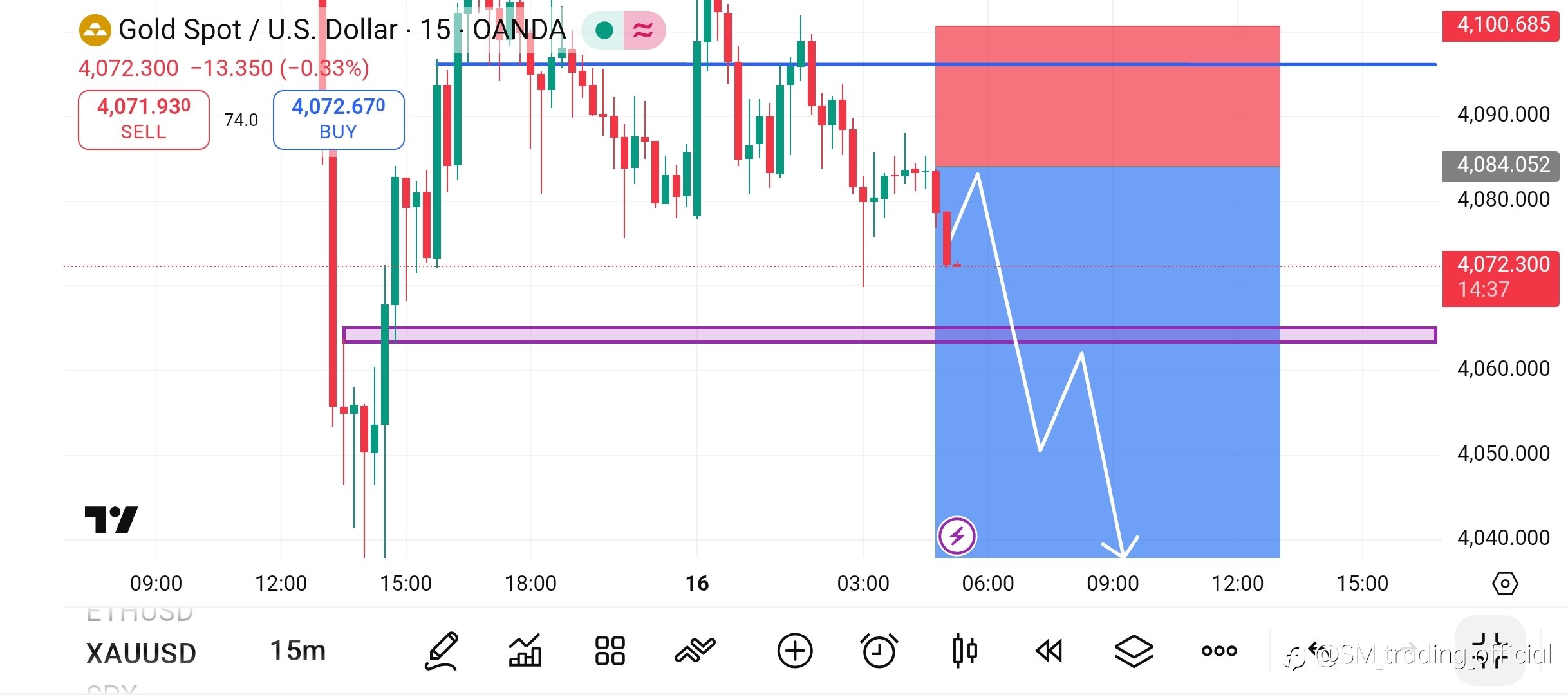

- Symbol XAU/USD

- Trading Account #2 951016732

- Broker KVB

- Open/Close Price 4,412.21/4,404.8

- Volume Sell 2 Flots

- Profit 1,482.00 USD

Liked

The Rise of Blockchain-Powered Gaming Experiences in Competitive Sports

The intersection of blockchain technology and competitive sports is reshaping how fans engage with games, teams, and digital ecosystems. What once revolved around passive viewership has evolved into an interactive experience driven by decentralization, transparency, and real-time participation. As b

Liked

What This Historic Move Means for the Future of Forex Trading

Looking ahead, the Bank of Japan’s rate hike could reshape parts of the Forex landscape. If Japan continues moving toward higher rates, it may reduce the dominance of certain carry trade strategies and encourage more balanced currency positioning. For Forex traders, this means paying closer at

Liked

Liked

Rooibos Tea: A Smooth, Caffeine-Free Herbal Infusion

Rooibos tea is a naturally caffeine-free herbal tea that delivers a smooth, flavorful, and soothing drinking experience. Known for its nutty flavor with subtle floral notes, hints of sweetness, and vanilla, this tea is gentle on the palate and non-astringent, making it ideal for enjoying any time of

Liked

JPY Weakness Persists as Market Watches BOJ’s Next Move

The Japanese yen continues to weaken against the U.S. dollar, driven by Japan’s ongoing ultra-loose monetary stance. Markets are increasingly focused on whether authorities will intervene or hint at policy adjustments to defend the yen. For now, USD/JPY maintains its upward tone, supported by

- Satellite d'Arusha :hello how are you my fan

Liked

- Different_Rain369 :you look more than the way I expect your handsome

Liked

TMUS Bullish Outlook: Wave ((4)) Low Holds, Eyes $300 Target

TMUS remains in an all-time bullish sequence. The recent dip appears to have found support in the blue box. The resultant bounce could advance to $300 thus, keeping the buyers in control. T-Mobile US (NASDAQ: TMUS) is a leading U.S. wireless carrier, known for its aggressive pricing and nation

Liked

Liked

Co-Creating a Smart Ecosystem: DAOX Empowers Developers and Creators

As digital finance ecosystems rapidly evolve, single-focus trading and governance models no longer meet the needs of diverse participants. DaoBit is building an open intelligent ecosystem where AI developers, content creators, and trading strategy providers can share rewards through DAOX, collective