© 2026 Followme

Liked

Crypto Crash: When Leverage Turns Dips Into Disasters

Partner Center When it comes to describing the crypto market selloff lately, “bloodbath” seems to be a mild way of putting it. Bitcoin dropped from around $94,000 to briefly touch $76,000 in just days, chalking up a nearly $10,000 nosedive in 24 hours at one point. Ethereum crashed below $3,000 to a

Liked

Liked

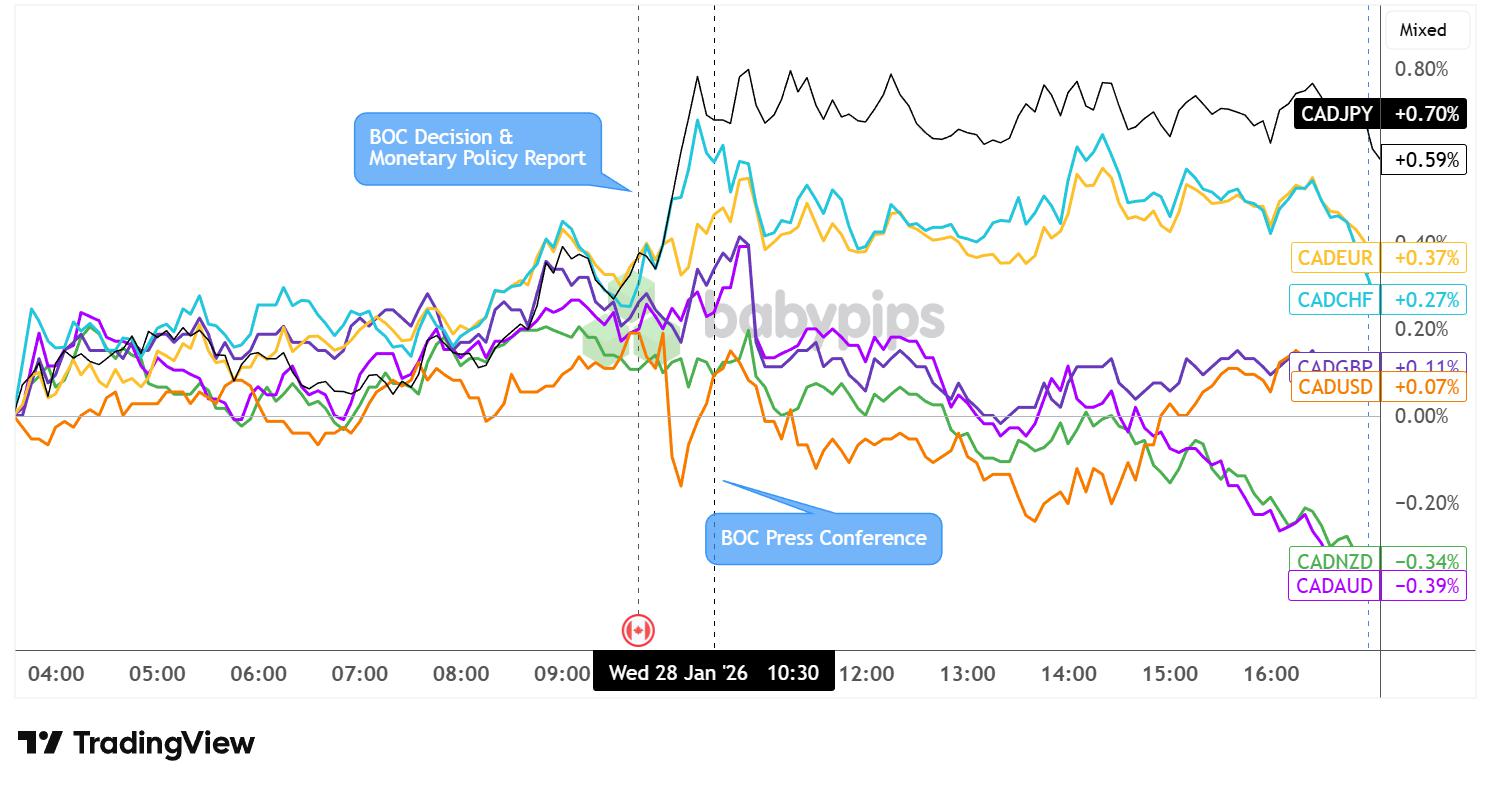

BOC Hold Decision Lifted CAD, But Gains Erased During Presser

Partner Center The Bank of Canada (BOC) kept its policy rate unchanged at 2.25% in their January decision as widely expected while acknowledging heightened uncertainty from U.S. trade restrictions. During the press conference, BOC Governor Tiff Macklem emphasized the bank remains content with curren

Liked

Streamline Office Communication with a Reliable Self-Inking Faxed Stamp

In any modern office, clear communication and proper document handling are essential. Even in a digital-first world, faxed documents still play an important role in legal, medical, finance, and small business environments. To keep paperwork organised and clearly marked, a dependable stamp can make a

Liked

Liked

Liked

Liked

Liked

Liked

Liked

Liked

📉 Gold 30-Minute Analysis – Market Under Strong Bearish Pressure

Gold continues to trade under selling pressure on the 30-minute timeframe as price action stays firmly below the key pivot zone of 4225, indicating dominance from the sellers. 🔻 Key Technical LevelsMain Target: 4143Pivot Level: 4225Resistance Levels: 4243 – 4257Immediate Support

- Followme :Weibo has obtained the basic prize in the Opinion Leader Program: 10 Points that can withdraw. Click to know more details about //soci...