© 2026 Followme

Liked

Forex and Cryptocurrency Forecast for January 19-23, 2026

The third trading week of 2026 opens with markets still pricing the balance between growth resilience, inflation trends, and the timing of the next policy steps from major central banks. Liquidity conditions may be thinner at the start of the week due to the US holiday on Monday, which can amplify i

Liked

Liked

If the “Broker” Lives on Telegram and a Cloned Website, It’s Not Investing, It’s a Funnel

I’ve only been trading for two months, but I’ve been studying scam patterns alongside risk management, and this story shows how scams are engineered like a system, not a one-off lie. The cloned foreign-company website is meant to make people drop their guard, and Telegram is used because

Liked

Liked

Profit by Following

335.48

USD

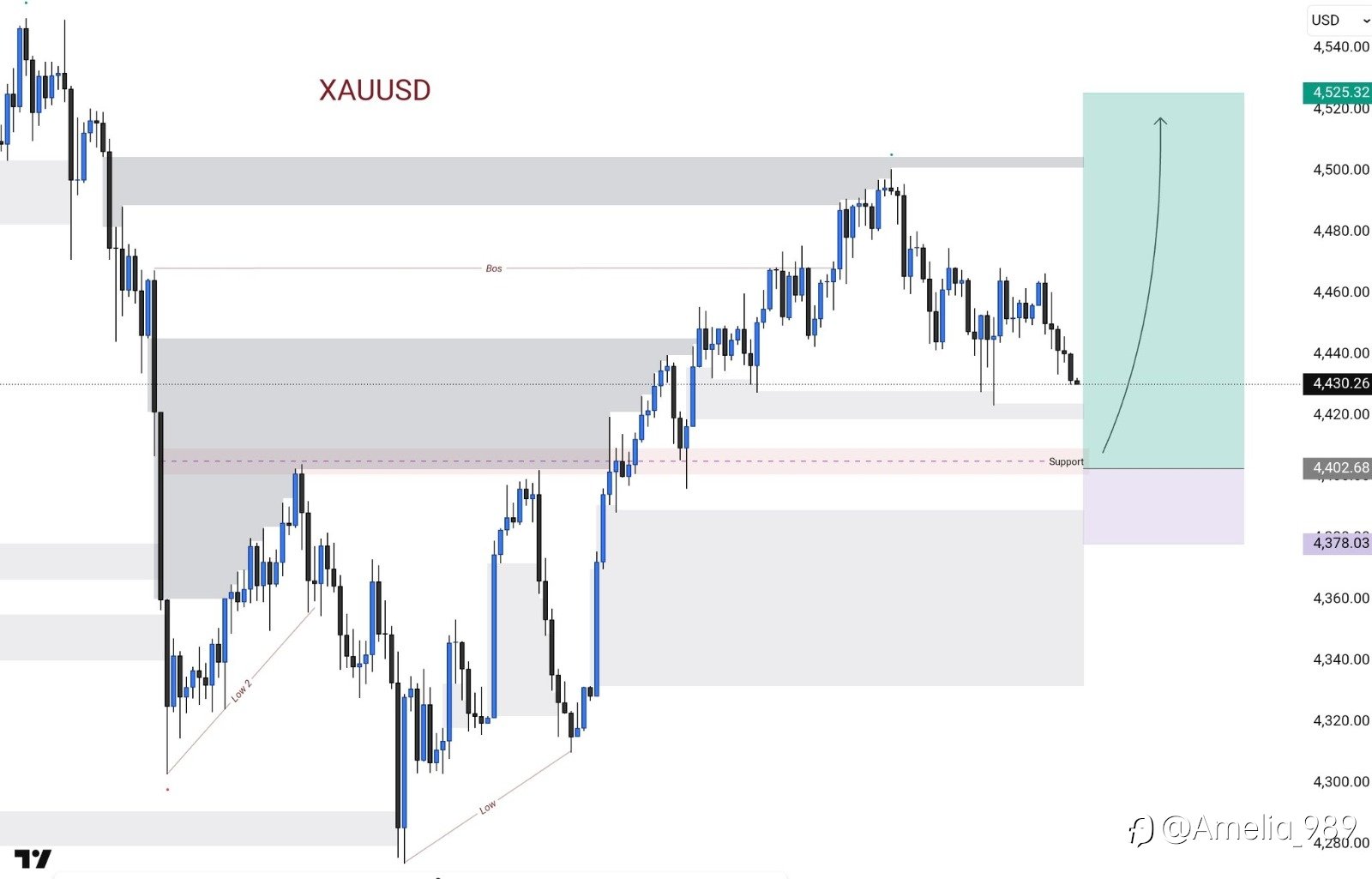

- Symbol XAU/USD

- Trading Account #2 951016732

- Broker KVB

- Open/Close Price 4,326.78/4,322.3

- Volume Sell 0.5 Flots

- Profit 224.00 USD

Liked

Liked

Liked

Liked

Liked

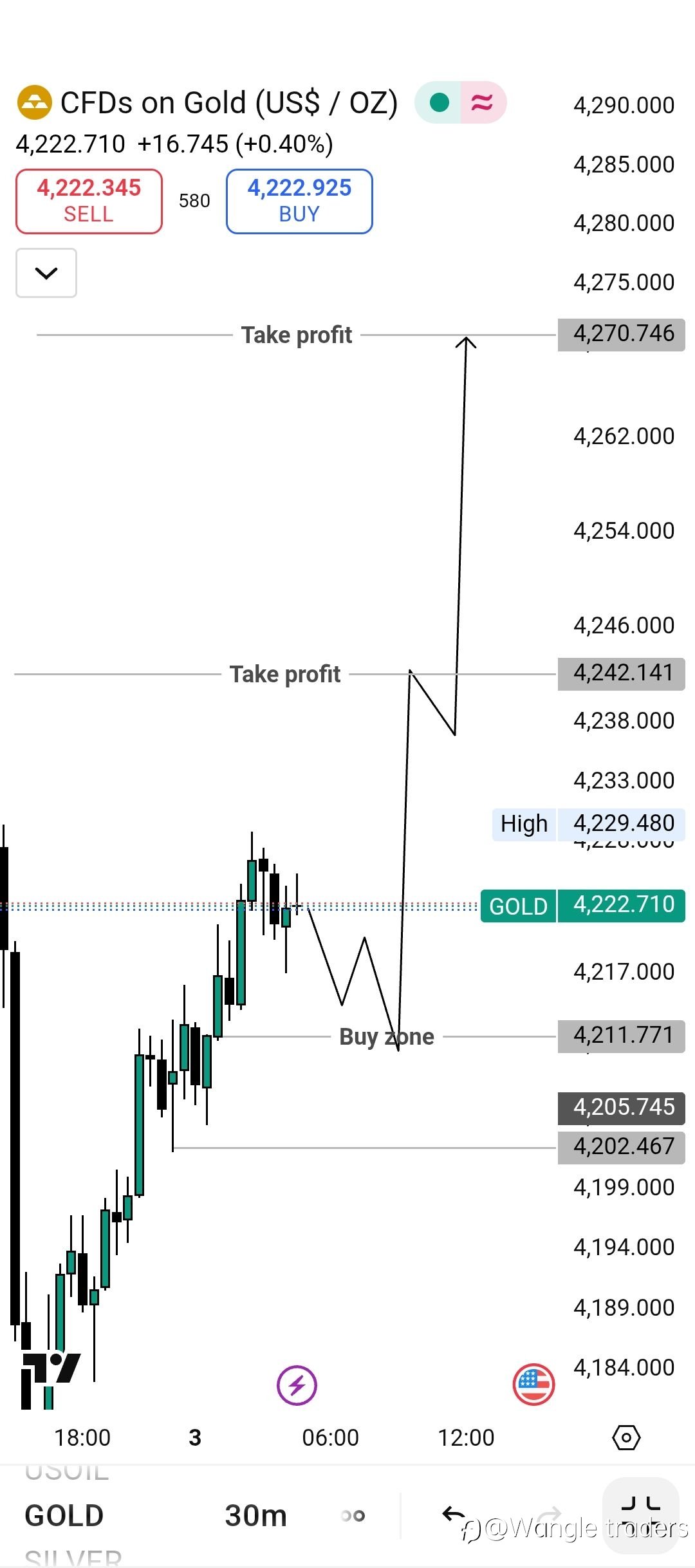

📢 GOLD TRADE UPDATE – TARGET HIT 🎯🔥

Another winning day for our community! Yesterday’s GOLD short signal smashed the target with perfect precision ✔️📉 We entered the market with a clear setup, followed the trend structure, and secured profits exactly as planned. Discipline strategy = consistent results. 💰 💡 Why Trade Alone? Join a

Liked

- MazharAli :are you in your sense dear your signal against your chart 📉