mordor

US Dollar eases after earlier safe-haven inflow from Middle East turmoil

The US Dollar eases a touch despite safe-haven support on early Friday trading. Tensions in the Middle East flared up again with reports of Israel attacking an Iranian military base. The US Dollar Index holds above 106.00, though pressure is mounting for a break below it. The US Dollar Index (DXY),

Forex Today: US Dollar pulls away from multi-month highs ahead of mid-tier data

Here is what you need to know on Thursday, April 18: The US Dollar (USD) stays under modest selling pressure in the early European session on Thursday. The US economic calendar will offer weekly Initial Jobless Claims, Philadelphia Fed Manufacturing Survey for April and Existing Home Sales data for

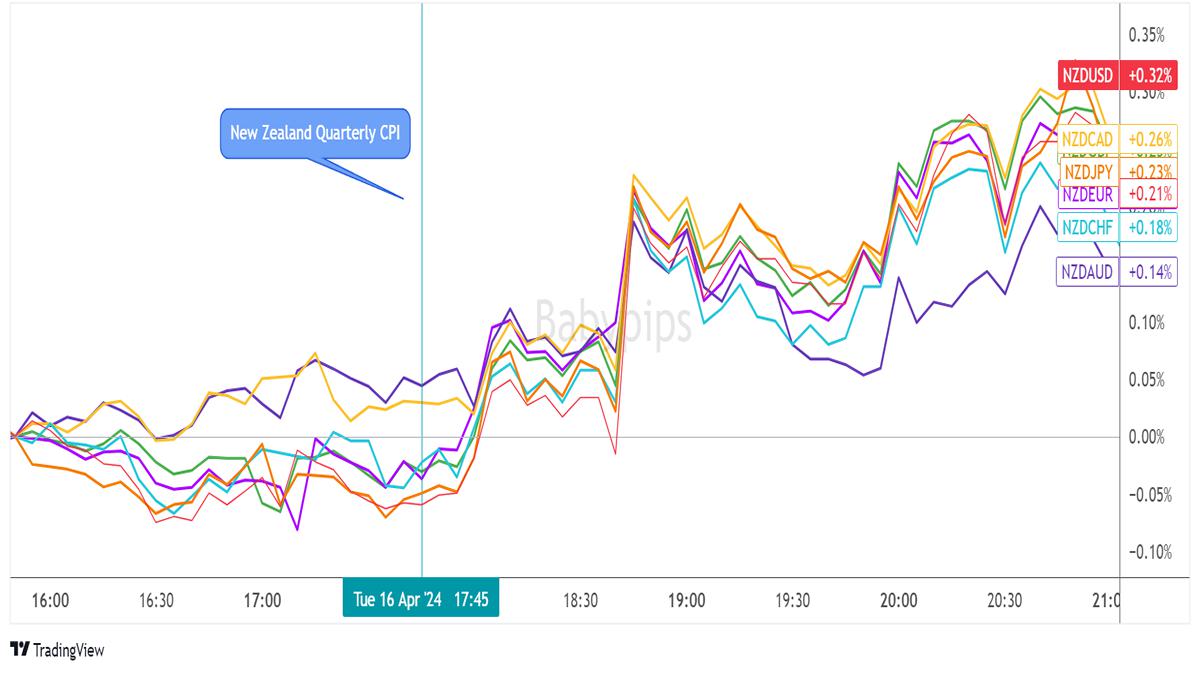

New Zealand’s Quarterly CPI Still Reflected Sticky Inflation

Partner Center Find a Broker New Zealand just printed its Q1 2024 CPI figures, with the headline reading coming in line with expectations of a 0.6% quarterly uptick. Not only was the actual result stronger than the previous period’s 0.5% increase in price levels, but underlying components also refle

When will Gold & Silver miners start believing in their product?

Miners spend billions of dollars every year pulling precious metals out of the ground. They toil mightily for years on end to produce these stores of value – but then they turn right around and sell all their gold and silver immediately in exchange for fiat currencies. If you stop to really think ab

China Q1 GDP data could suggest 2024 growth target of 5% is very ambitious – TD Securities

TD Securities analysts preview the upcoming data releases from China. Authorities may step up more fiscal action soon "We expect China industrial production and retail sales to miss to the downside in March despite the seemingly upbeat March PMIs. We pencil in a 5.1% y/y growth in industrial product

US DJIA Technical: Major US banks’ Q1 earnings in the focus over adverse macro factors

Three major US banks; JPMorgan Chase, Citigroup, and Wells Fargo will report their Q1 2024 earnings results today. JPMorgan Chase is ranked 13th in terms of component weightage in the DJIA. Analysts’ Q1 earnings estimates for these three US banks have been lowered which increases the possibility of

Forex Today: Fedspeak in the limelight amidst September rate cut bets

The risk complex regained some poise amidst a mild corrective decline in the US Dollar and rising speculation of a Fed rate cut in September. In the meantime, the ECB left rates unchanged as expected and opened the door to a rate cut in June. Here is what you need to know on Friday, April 12: The US

Pull-up Update