© 2026 Followme

Liked

Liked

Profit by Following

167.6

USD

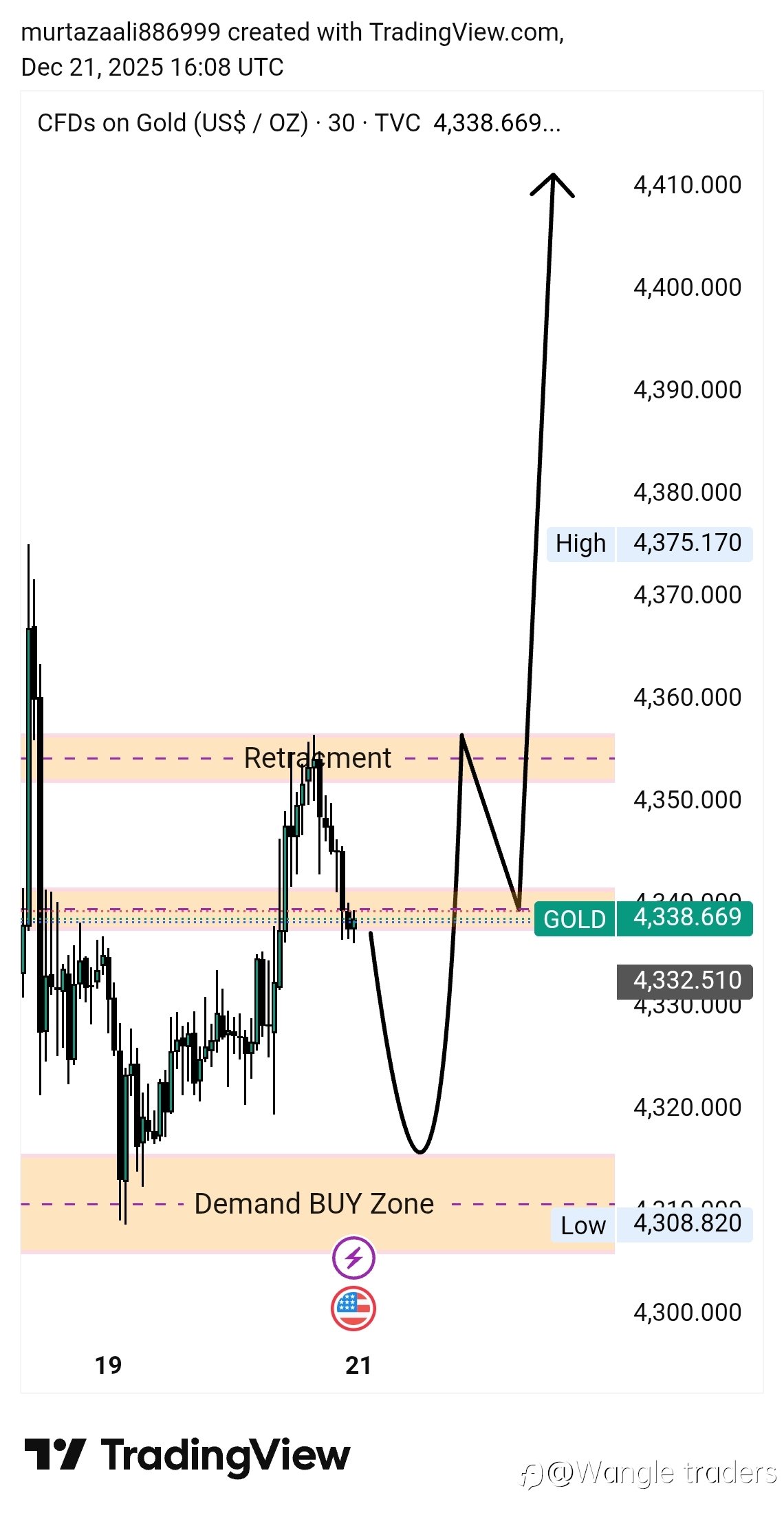

- Symbol XAU/USD

- Trading Account #2 951016732

- Broker KVB

- Open/Close Price 4,415.31/4,413.95

- Volume Sell 10 Flots

- Profit 1,360.00 USD

Liked

Profit by Following

1,330.39

USD

- Symbol XAU/USD

- Trading Account #2 951016732

- Broker KVB

- Open/Close Price 4,371.34/4,354.04

- Volume Sell 0.5 Flots

- Profit 865.00 USD

Liked

Liked

Liked

Low Liquidity, Wide Spreads, and Unexpected Price Swings

One of the biggest challenges during Christmas Eve trading is wider spreads. With fewer market makers and reduced trading volume, brokers often widen spreads to manage risk. This can increase trading costs and make short term trades less attractive. Another risk is unusual price swings, sometimes ca

- brandymass1126 :How are you doing now

Liked

Liked

Liked

Liked

Navigating a Risky Global Market — The Case for Integrated Asset Analysis

What the Wolfe Research framework highlights is a broader truth: in today’s connected financial world, asset classes don’t stand alone. Stocks, currencies, and bonds all influence each other. A problem in one corner can show up quickly somewhere else. For investors and traders, this mean

Liked

Liked

Myth vs. Reality: The Truth About Prop Firms

Partner Center Prop trading firms or funded trading companies have become increasingly popular among aspiring retail traders looking for capital, but they’re also surrounded by misconceptions and exaggerated claims. When you first hear about retail prop firms, it almost feels like you’ve stumbled on