Mavis

EUR/USD: Euro on defense mode but geopolitical risk could put the 1.0600 under challenge

The single European currency tries to react in the early trading hours of the new week and defend the level of 1,06 after Friday's sharp losses. Last week ended with significant losses for the European currency as hot inflation in the United States and heightened geopolitical concerns drove the US d

NZ dollar rises as RBNZ pauses

The New Zealand dollar has extended its gains on Wednesday and is higher for a third straight day. In the North American session, NZD/USD is trading at 0.6074, up 0.24%. RBNZ holds rates, says economy weak There was little drama from the Reserve Bank of New Zealand’s meeting on Wednesday, as the dec

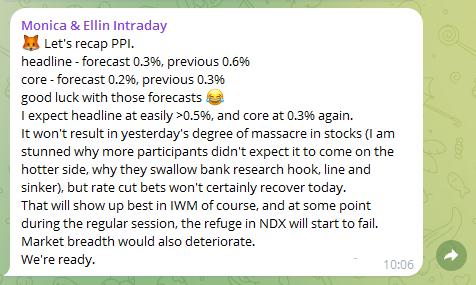

We’ll get some more views of central bankers today and they could spark some intraday movement

Markets The ECB laid the groundwork for a June rate cut yesterday and that was basically all there was to say about it. Lagarde revealed some wanted to cut rates already and reports afterwards wrote about a handful of officials that needed extra convincing to rally behind the decision to stand pat f

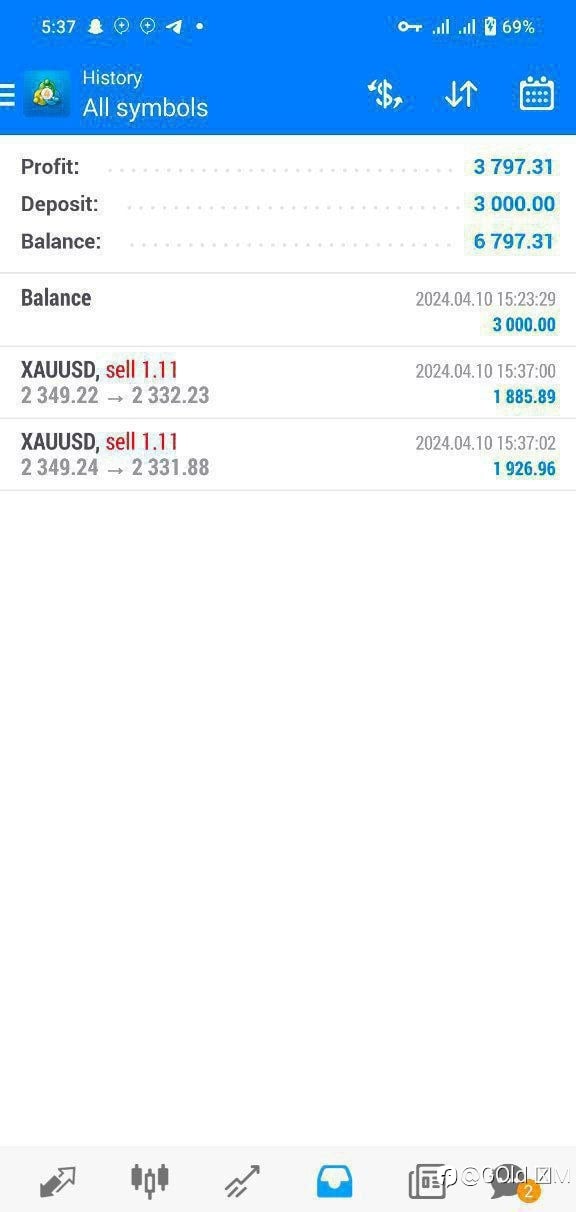

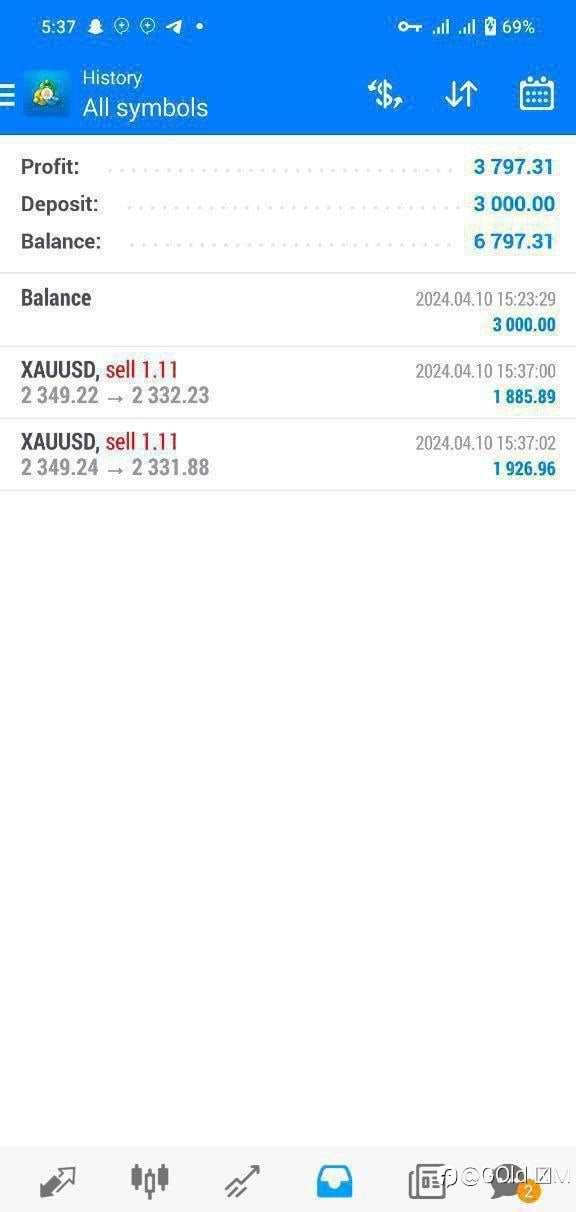

Hot CPI, it has led to dramatic rate cut timing expectations adjustment

S&P 500 didn‘t make even a little headfake on CPI as the figure was indeed too hot, 0.4% mom – ushering the long awaited correction. The magnitude of the surprise (really? It was so easy to see, and I made my macro estimates public well ahead of time, and freely) made for great intraday and new

Euro stabilizes ahead of ECB decision

The euro is steady on Thursday, after sliding over 1% on Wednesday following the hot US inflation report. In the European session, EUR/USD is trading at 1.0745, down 0.03%. ECB widely expected to hold rates The European Central Bank meets later today and is widely expected to hold the deposit rate a

AUD/USD Price Analysis: Finds temporary support near 0.6500

AUD/USD finds intermediate support neat 0.6500, more downside remains likely. The US Dollar strengthens as market push back Fed rate cut expectations for June. Australia’s consumer inflation expectations for next 12 months rose to 4.6%. The AUD/USD pair finds an interim support near the psychologica

Pull-up Update