Hoover

Americans throw away millions of U.S. coins because american money is junk

Americans throw away millions of dollars in coins every year. That's because American money is junk. But that wasn’t always the case. In an article published by the Wall Street Journal, Reworld, a Pennsylvania waste management facility, claimed that Americans toss about $68 million worth of coins ev

Building a Personal Brand as a Young Entrepreneur: Saraf Furniture a national brand

Your personal brand becomes the rock-solid foundation upon which your entrepreneurial journey is built. Saraf Furniture was one of the first few furniture retailers to enter the organised sector through mobile applications. To keep up with the market, Raghunandan didn’t stop at the quality aspect bu

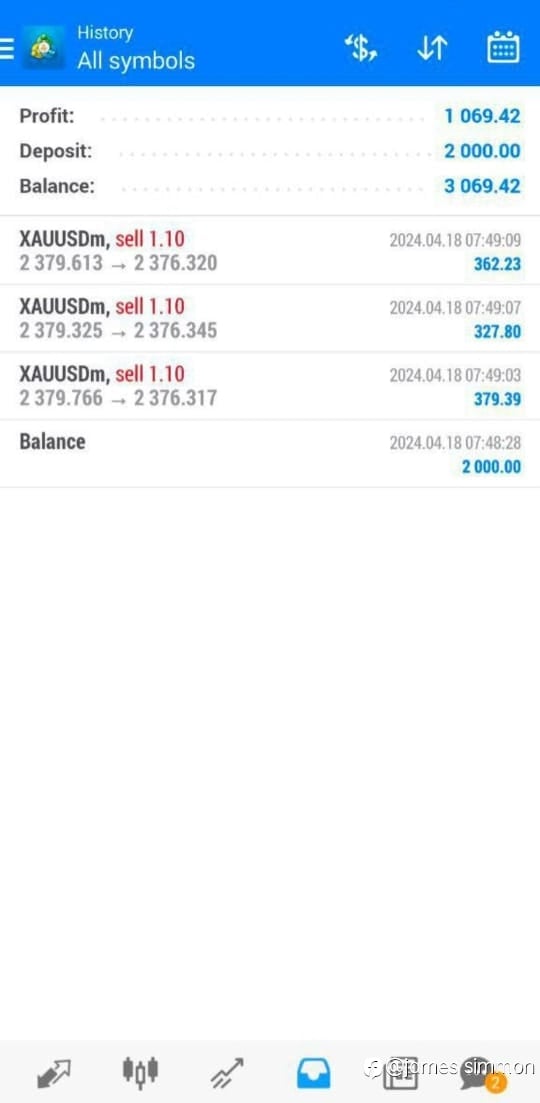

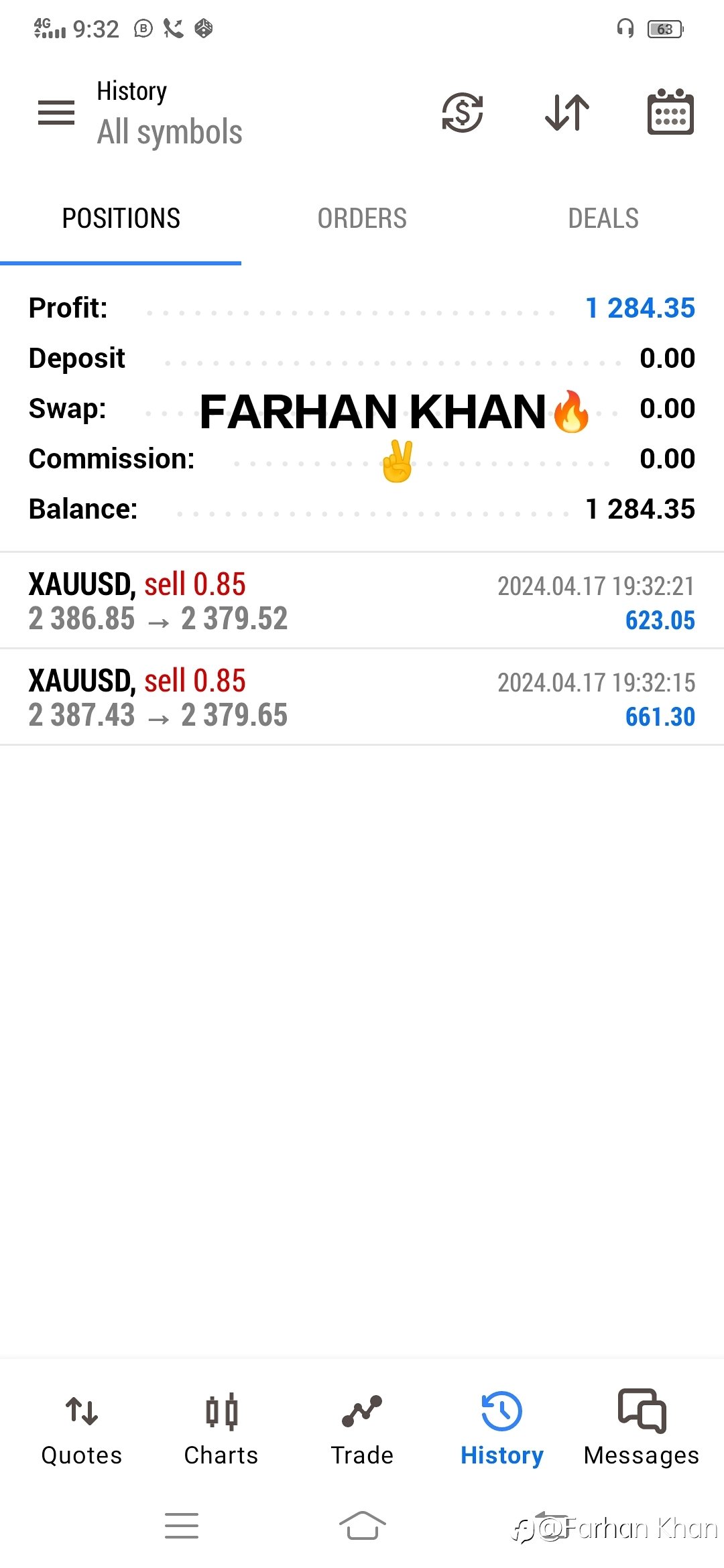

XAU/USD 18 April 2024 Intraday Analysis

#XAU/USD# H4 Analysis: -> Swing: Bullish. -> Internal: Bullish. Price remains contained within an internal range where we saw a reaction from H4 supply with price unable to close below strong internal low. Price reacted at H4 supply and subsequently reacted at H4 demand. Price is

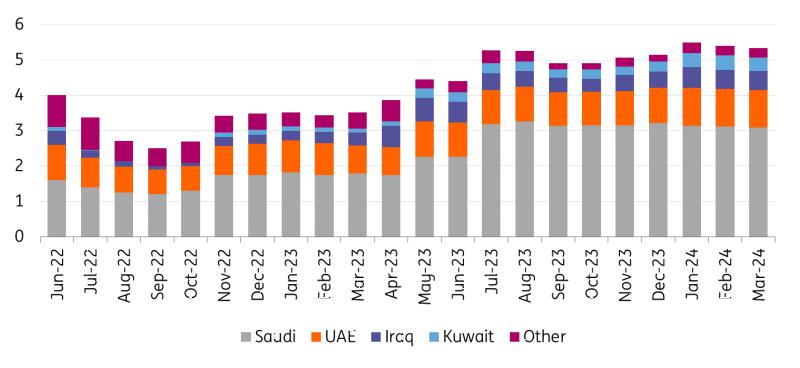

Middle East escalation boosts Oil supply risks

The oil market continues to be supported by ongoing tensions in the Middle East. The lack of price action following recent escalation has been surprising but suggests there already is a large risk premium priced into the market. Even so, there is still plenty of risk facing the market. The risk of d

Suzuki of Japan ready to take 'all measures' on FX

"We are closely watching the latest events," said Finance Minister Shunichi Suzuki on Tuesday in Tokyo before his departure for Washington to attend the annual International Monetary Fund events and meetings of finance ministers from the Group of Seven and Group of Twenty nations. "We stand ready to

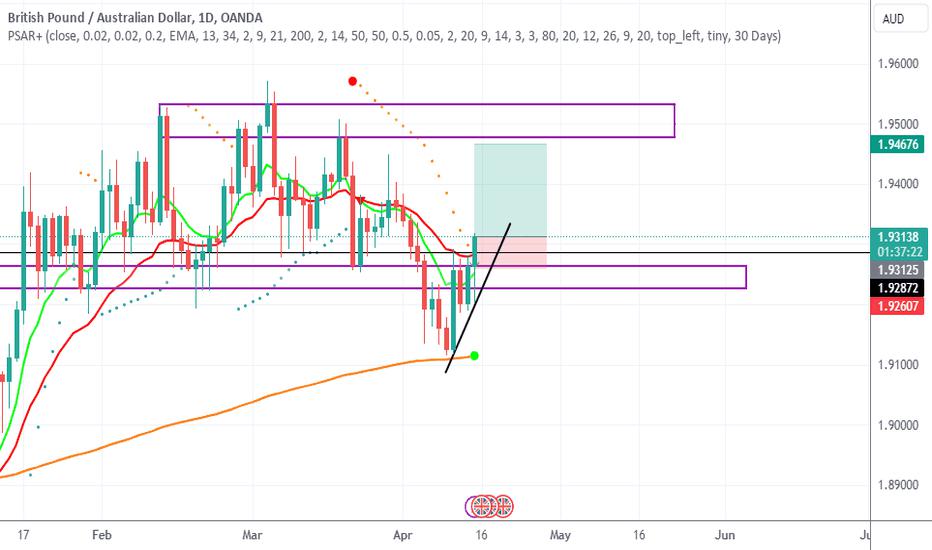

GBPAUD Long Trade

#GBP/AUD# 1. Breakout of Support 2. Breakout of 2 MA's 3. Price above 200 MA 4. Break about 200 MA on 4 Hr Chart 5. Currency Strenght Meter confirmation 6. Strong data for GBP Tomorrow as catalyst 7. Strong momentum bullish candle after with long wick taking stops from breakout traders

Forex Today: Focus remains on geopolitics and central banks divergence

The upside momentum in the Greenback remained unabated, extending the move to fresh yearly highs around 106.20 amidst rising yields in a week that appears to be dominated by increasing geopolitical tensions, particularly in the Middle East. Here is what you need to know on Tuesday, April 16: The Gre

Silver Price Analysis: XAG/USD sets for strong weekly gains on escalating geopolitical tensions

Silver price rallies to $29, boosted by safe-haven demand due to geopolitical tensions. A decline in US yields has reinforced demand for non-yielding assets. The US Dollar advances as speculation for Fed rate cuts wanes. Silver price (XAG/USD) looks set for a positive weekly close for the third time

EUR/USD tumbles to 1.0660 on firm ECB rate cut bets for June

EUR/USD slumps to 1.0660 as ECB rate cut bets for June strengthen. The US Dollar strengthens as the Fed is anticipated to start reducing interest rates later this year. Investors shift focus to the US Retail Sales data that will be published on Monday. The EUR/USD pair extends its downside to near f

Silver primed for surge as renewable energy and electric vehicles drive demand

Silver, a metal of many facets, has illuminated the path to technological advancements and ecological sustainability. Its inherent properties make it indispensable in industries that uphold the highest reliability, precision, and safety standards. Silver’s role becomes increasingly pivotal as the wo

Pull-up Update