Baybyface

Broker Interview | Tickmill

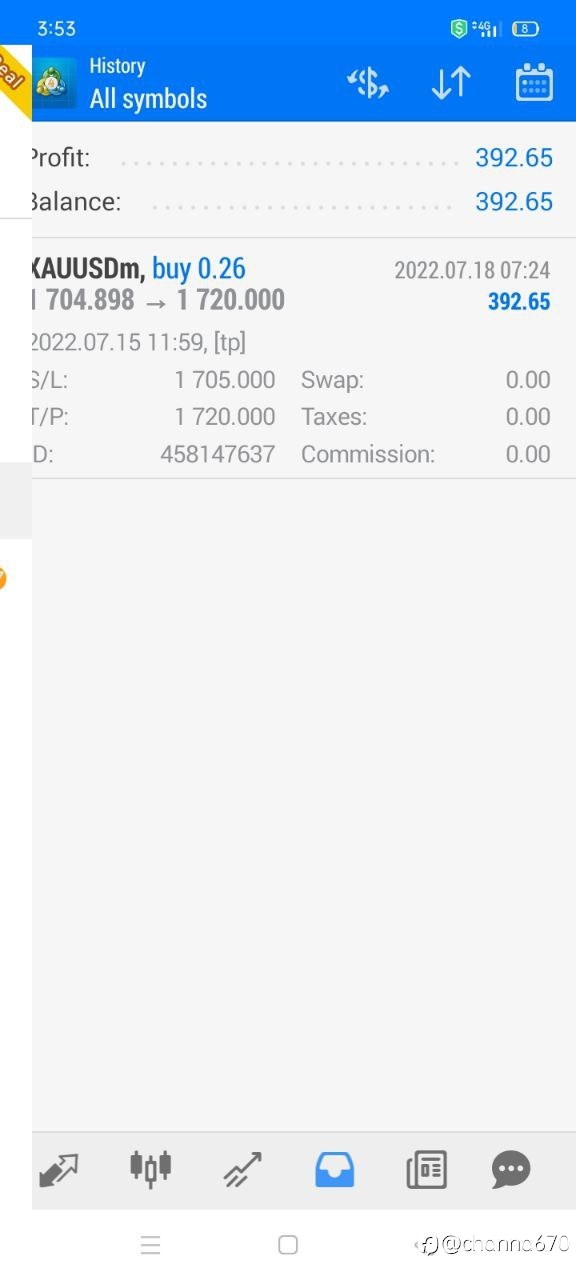

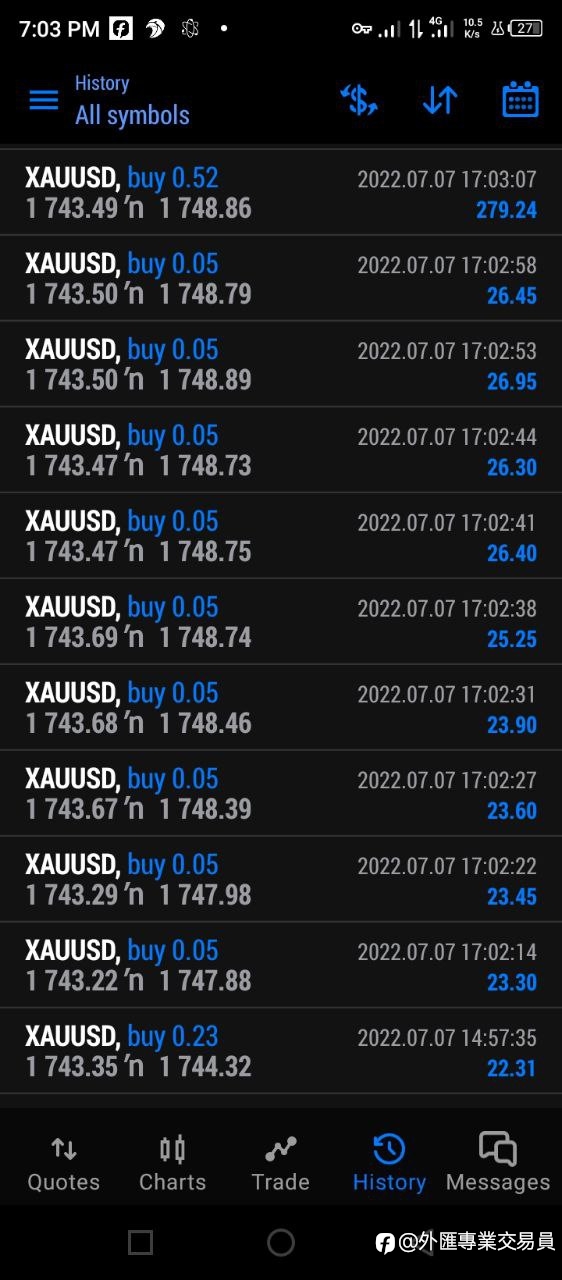

Tickmill, founded in 2014, Tickmill aims to provide an outstanding trading environment and trading services for retail and institutional customers around the world. The company offers CFDs in foreign exchange, stock indexes and crude oil, precious metals, bonds, and cryptocurrency products. Currentl

Bitcoin Rises. How Tech Earnings Could Threaten This Rally.

Crypto prices have rallied across the past week. Dreamstime Bitcoin and other digital assets were higher on Friday, but action in the stock market was set to shake up sentiment for risk-sensitive assets, threatening to sweep the legs out from under the recent crypto rally. The price of Bitcoin has g

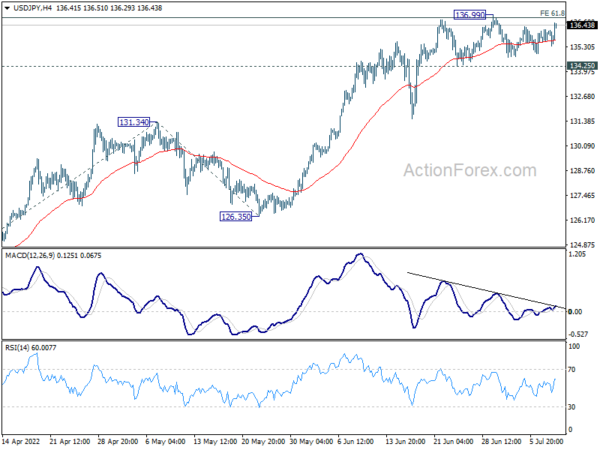

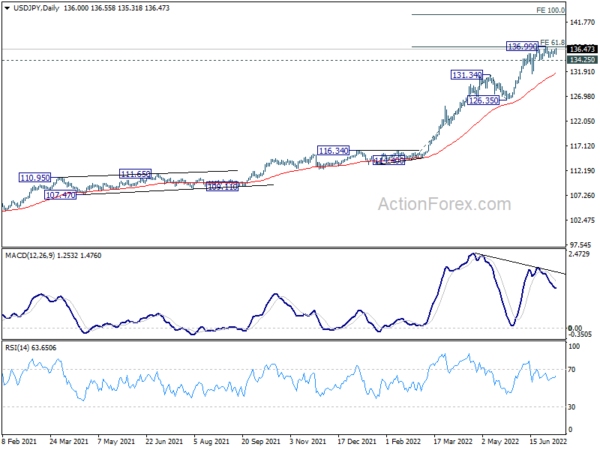

Dollar Rising Again on Strong NFP Data

#OPINIONLEADER# Dollar rises in early US session after stronger than expected non-farm payroll data. It’s also supported by extended rebound in 10-year yield, which reclaims 3%. Euro also follows German yield higher. On the other hand, Canadian Dollar turns softer after poor employmen

Pull-up Update