© 2026 Followme

Liked

Liked

Financial Market Recap – 22/01/2026

Forex Focus & Short-Term Outlook for Traders Today’s market showed lower tension compared with the previous session, as geopolitical risks “cooled off” following adjustments in U.S. policy/trade messaging. Market sentiment therefore stabilized, and safe-haven demand temporarily

Liked

Japan’s Yen Intervention Watch: Why the FX Market Is on High Alert

Global FX markets are closely monitoring Japan’s stance on the Japanese yen (JPY) as the currency trades near historically weak levels against the U.S. dollar. The possibility of official intervention has re entered market discussions, creating a high volatility environment parti

Liked

Liked

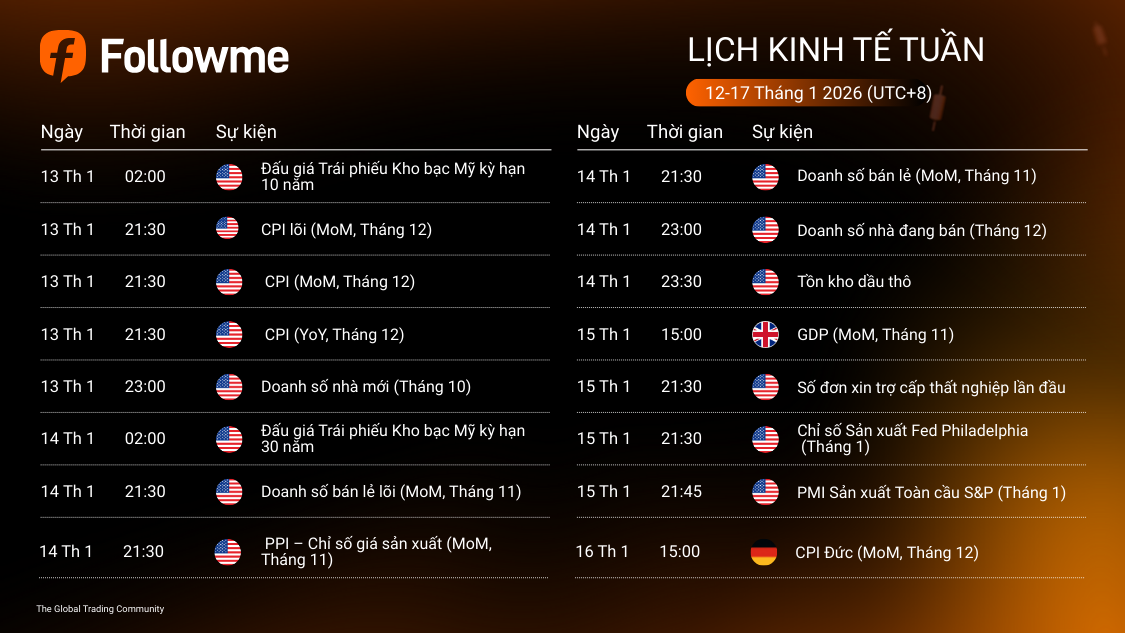

🌅 NordFX Morning Update - 14 January 2026 (Wed)

📉 US futures are slightly lower ahead of the US session: US100 and US500 are down about 0.15%, as traders position for a heavy headline and data day. 🧭 What markets are watching today ⚖️ A US Supreme Court ruling schedule that may include decisions tied to tariffs 📊 US Retail Sales and PPI - key

Liked

Liked

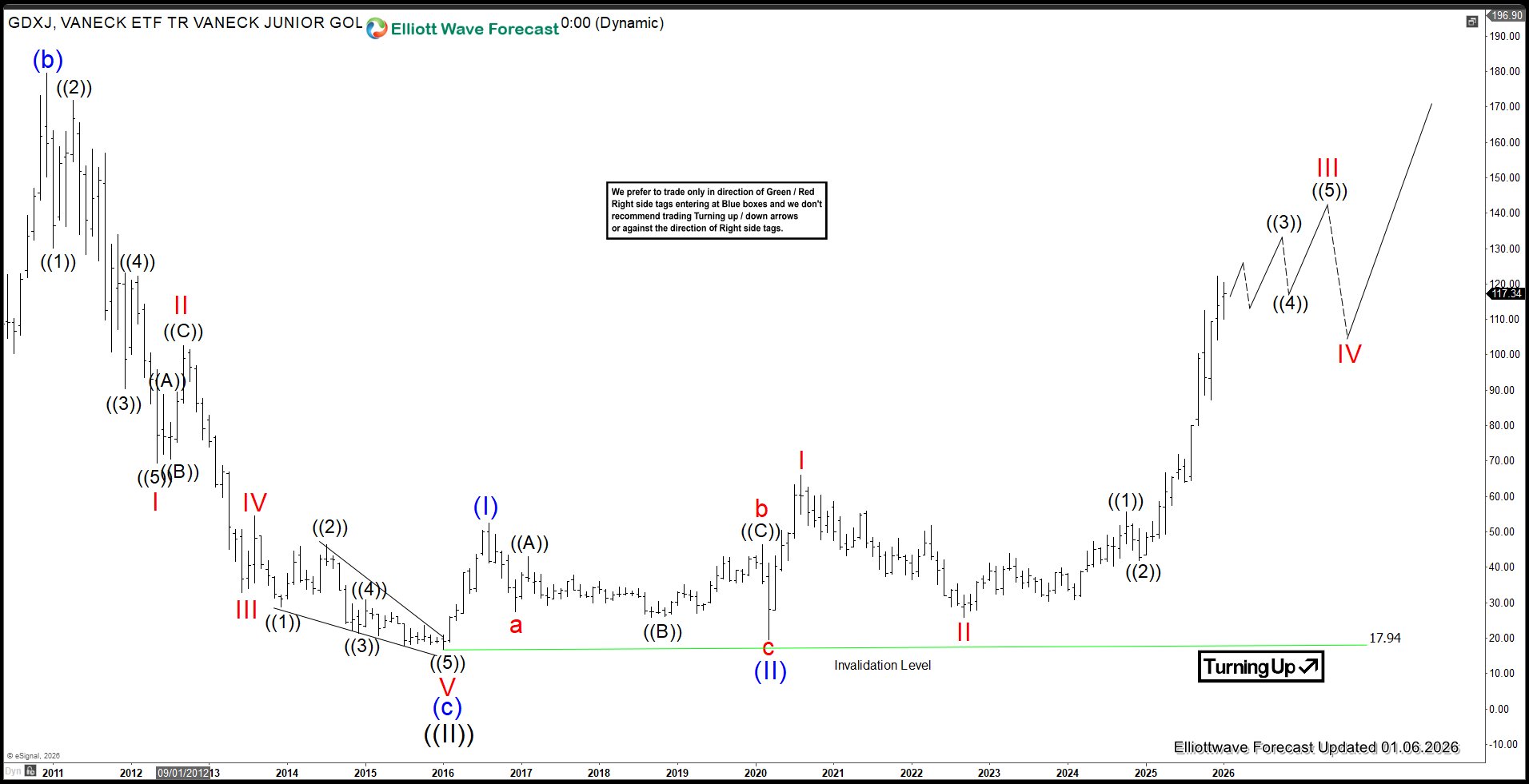

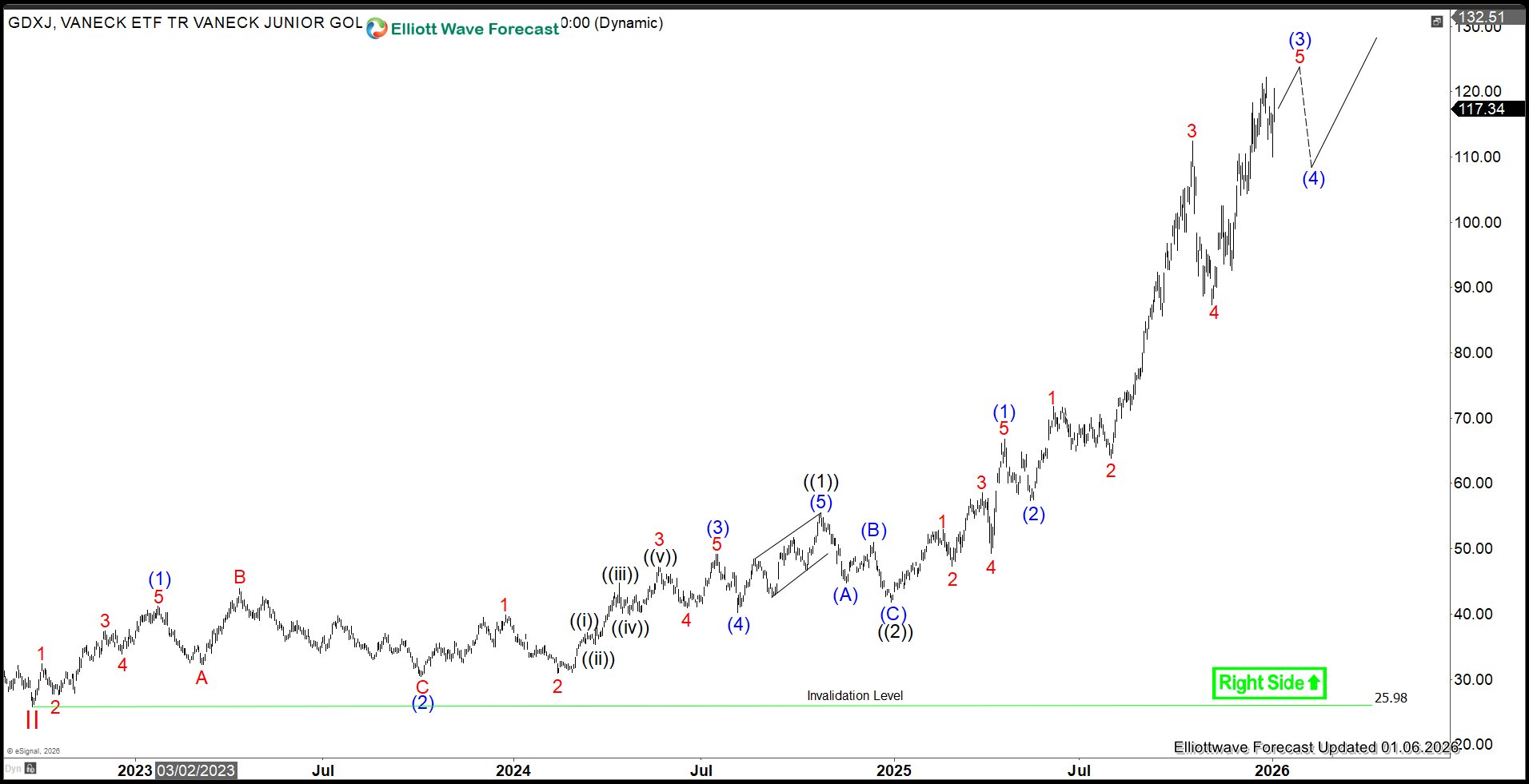

GDXJ – Gold Miners Junior: Impulse Rally in Motion

The VanEck Junior Gold Miners ETF (GDXJ) is an exchange-traded fund that provides exposure to small- and mid-cap companies primarily engaged in gold and silver mining worldwide. In this article, we will explore the long term Elliott Wave technical path of the ETF. GDXJ Monthly Elliott Wave View

Liked

Liked

Bitcoin Pullback Explained: Why This Dip Looks Like Consolidation, Not Collapse

Bitcoin’s recent dip has sparked familiar headlines — “BTC drops,” “Momentum fades,” “Is the bull run over?” — but the real story is far more nuanced. Over the last 24 hours, Bitcoin slipped roughly 1% to around $86,900. On the surface, that looks like weakness. Underneath, however, the market is sh

Liked