#NegativeOilPrice#

1.56k View

149 Discuss

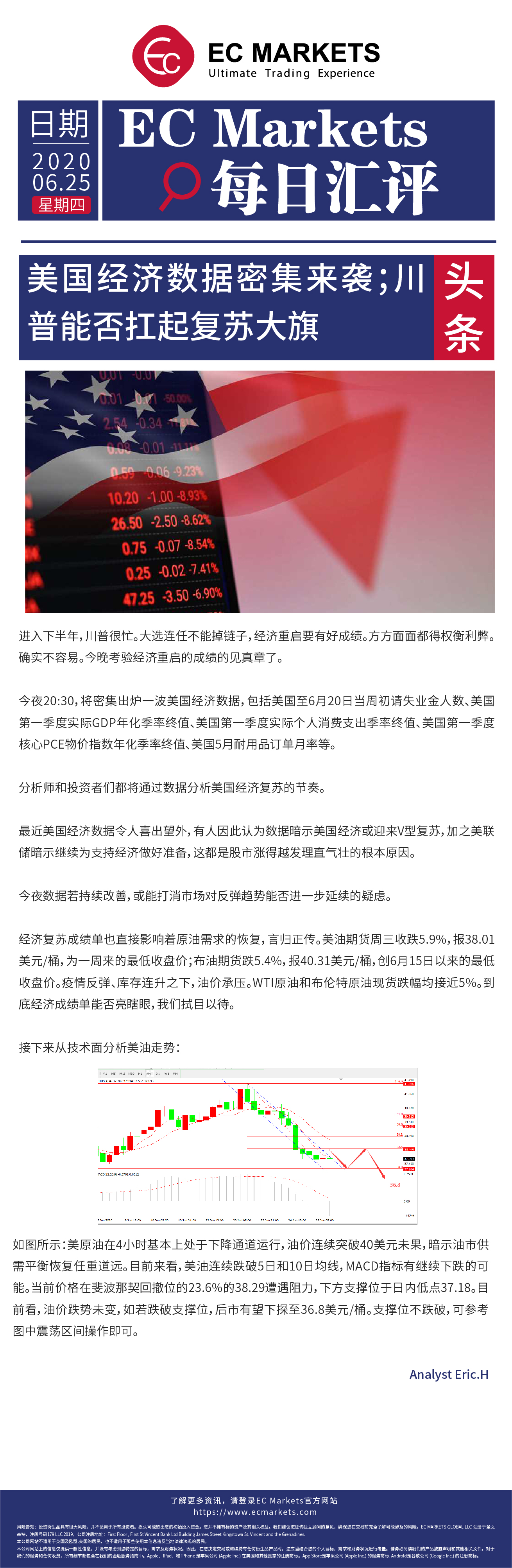

The American oil industry is facing a doomsday scenario.

The coronavirus pandemic has caused oil demand to drop so rapidly that the world is running out of room to store barrels. At the same time, Russia and Saudi Arabia flooded the world with excess supply.