#GoldHit7yearHighAgain#

1.51k View

34 Discuss

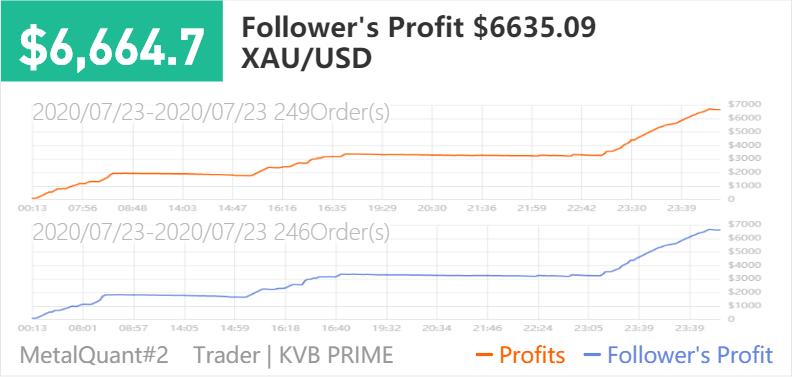

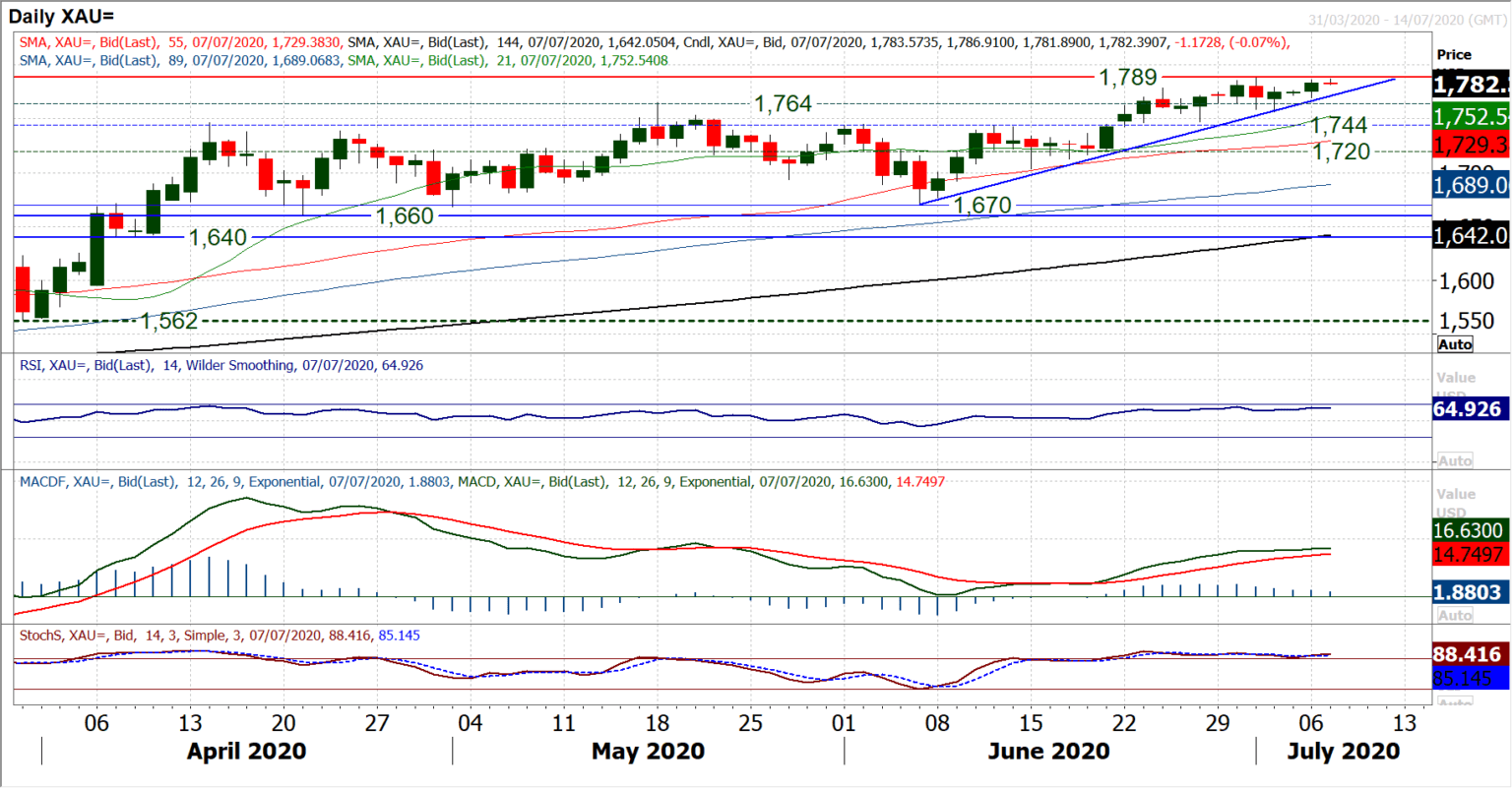

Boosted by the weakness of the US dollar, the price of gold this week hit another 7-year high, reaching the level of 1725 US dollars per ounce, an increase of nearly 10% this month. This week, we can focus on the US initial jobless claims and real estate data. If the data is not good, the price of gold is expected to strengthen further.