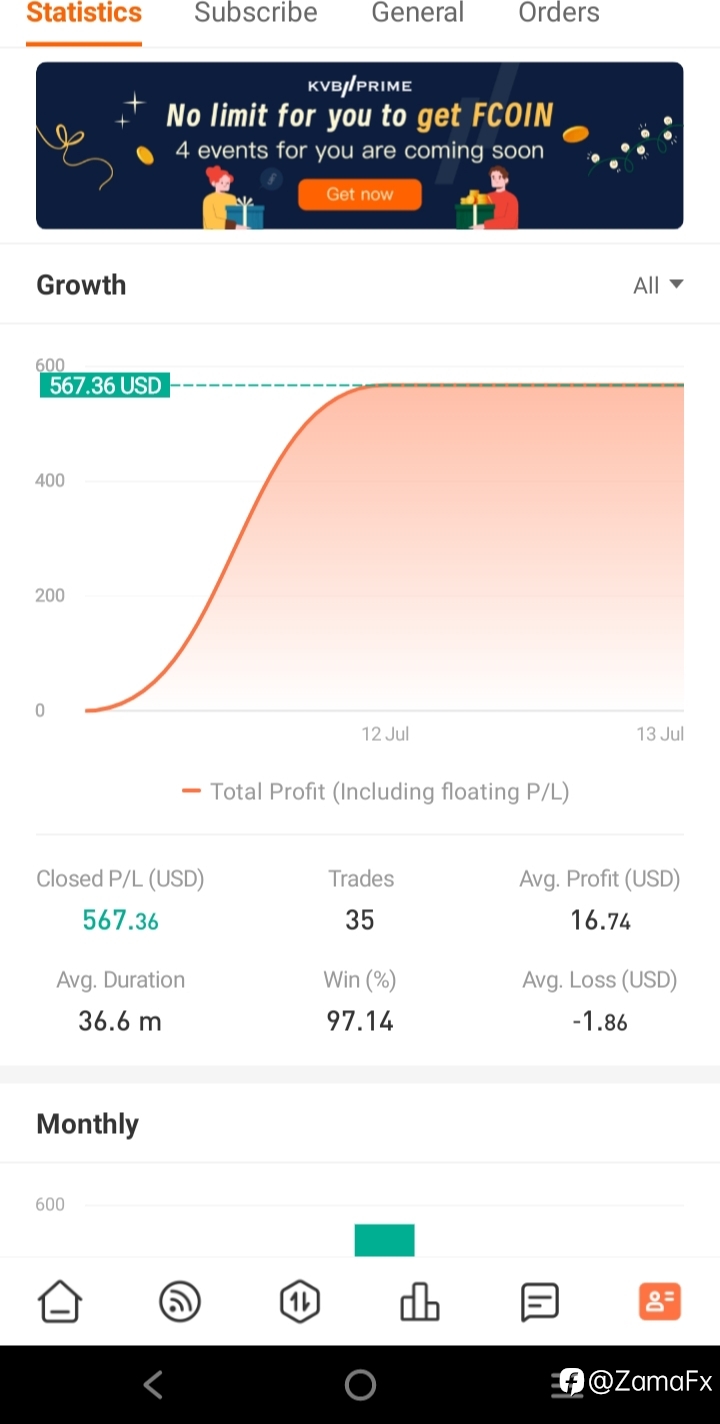

#GoldBreaks1670#

1.03k View

34 Discuss

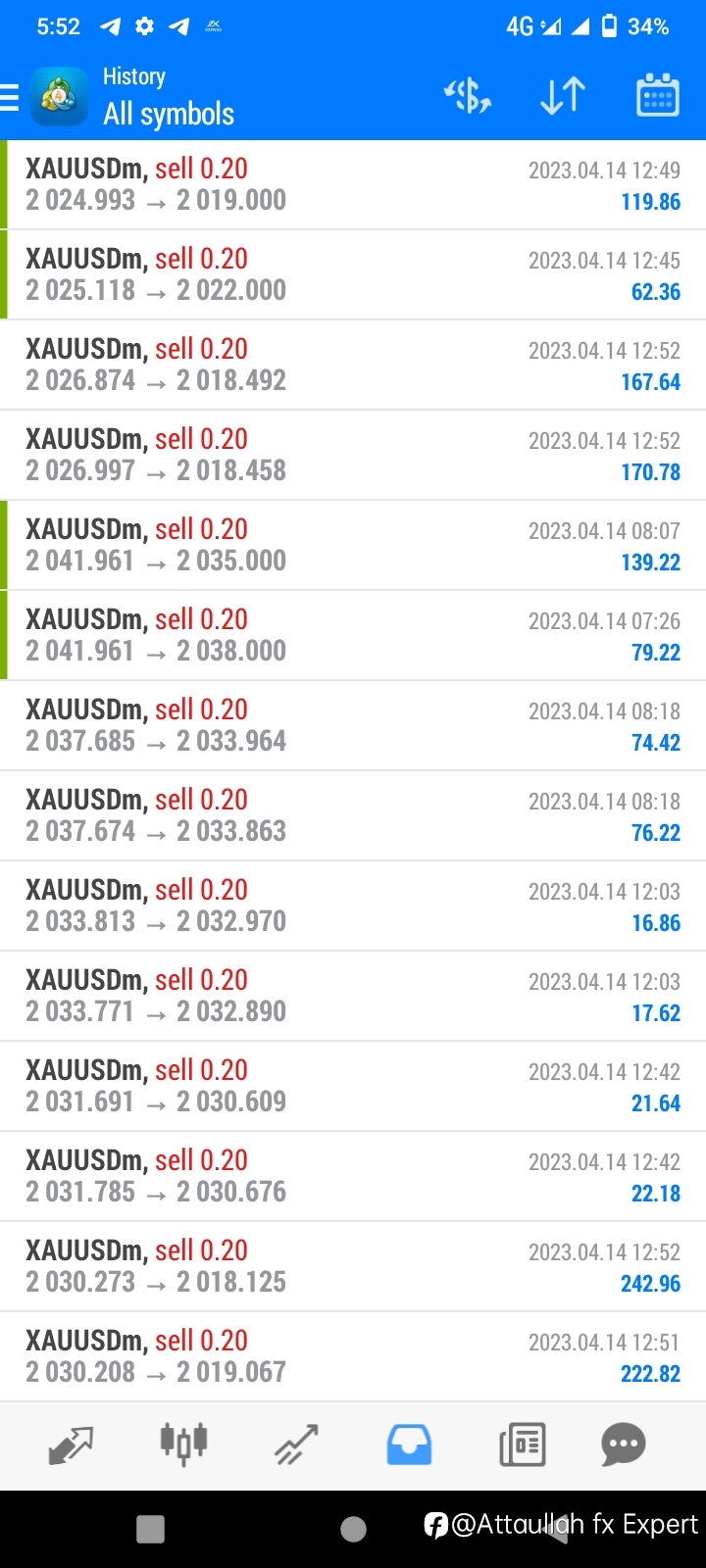

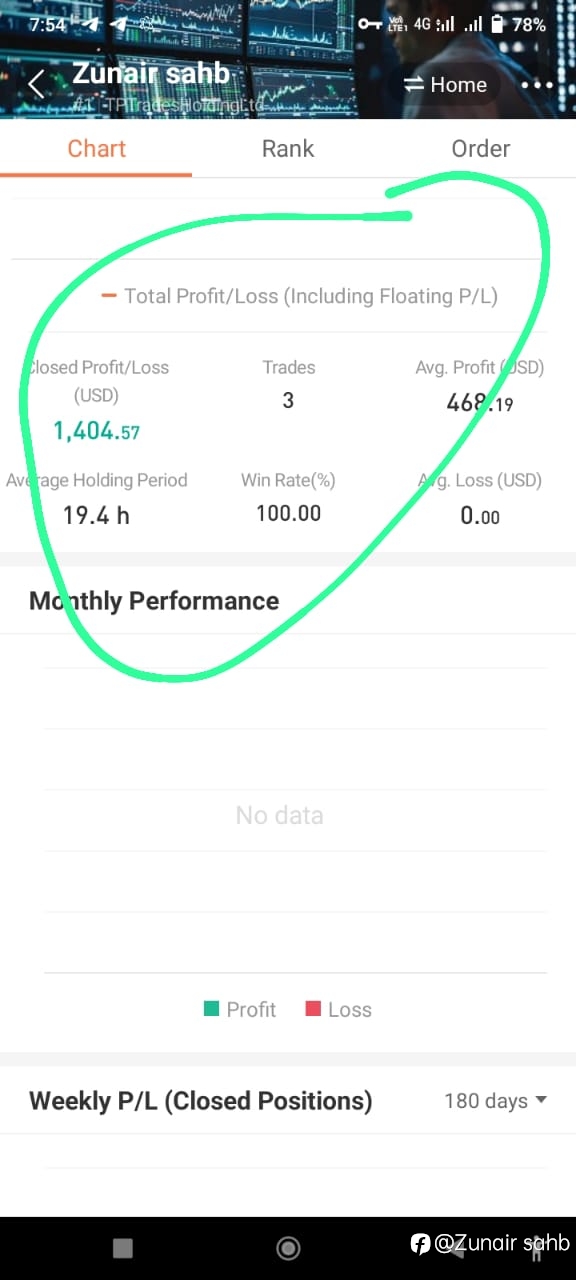

Boosted by the weakness of the stock market and the US dollar, the price of gold has returned to above 1670, currently hitting a new intraday high of 1676 and approaching a 7-year high of 1689. What will you do next? Still bearish and short?