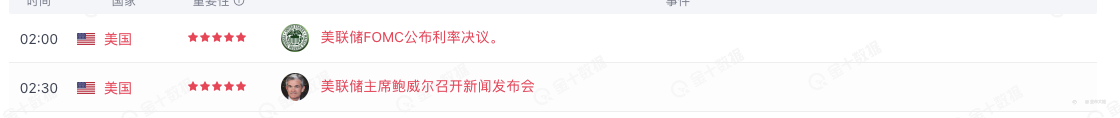

我一直跟大家说,金融市场的趋势,主要看的是资本的流向,说人话就是热钱往哪流,或者说政策希望钱往哪流。显然这波美股的下跌,在前期美联储多位官员已经公开表示抛售手中的股票了,紧跟着就是即将到来的本周四凌晨2点是美国的利率决议,之后是鲍威尔主持下的议息会议。在会议之前市场如此表现,还不清楚美联储本次要干嘛么?缩减购债才是真正诱发市场下跌的主要原因。正是由于前4个月里美联储鹰派论调的讨论,加上8月底全球央行年会上,鲍威尔提出要在年底之前开始缩减购债,9月公布出8月的失业率继续下降,一切都在为本次会议做暗示,做铺垫。因此在议息会议上提出缩减购债,市场的惊讶程度也不会太过于恐慌,从而做到平稳的过渡,资本只是提前嗅到了这些味道,所以接下来美国一旦确认了10月开始缩减购债,美国股市还要有一波较强的下行,届时不要感到意外,一切的巧合最终都会指向一个方向,那就是美国要开始收紧政策了。

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

-THE END-