Rates Spark: Contained contagion risk puts hikes back on the table

Contained contagion risk would allow the European Central Bank to resume its hawkish forward guidance. Things are more complicated for the Fed as hikes are seen as a key part of regional banks’ problems.

The path for higher Fed rates in the US gets more complicated

After a wobbly start, it seems markets have reacted positively to the measures taken over the weekend to shore up financial markets from further contagion. In the US, there is a growing consensus that regional banks’ vagaries will result in a degree of credit tightening for the economy but, were market conditions to remain calm until the Fed meeting concluding tomorrow, we would expect the Fed to still be in a position to hike 25bp. This is a big if, however, and the strength and speed of the market reaction to Silicon Valley Bank’s demise is an important warning that contagion risk is real. In that regard, potential plans to extend FDIC protection to deposits above $250,000, as reported by Bloomberg, would help prevent further runs.

One of the problems is that the Fed will struggle to escape the perception that further hikes would make regional banks’ funding position more difficult, and that cuts would help them. And this is without talking about the unrealised losses on their bond holdings. We fully expect the Fed to draw the distinction between monetary policy and financial stability but whether that distinction holds depends on the amount of stress the system is under. Above a certain level of stress, the system takes precedence, as the preventive extension of dollar swap lines with foreign central banks has shown.

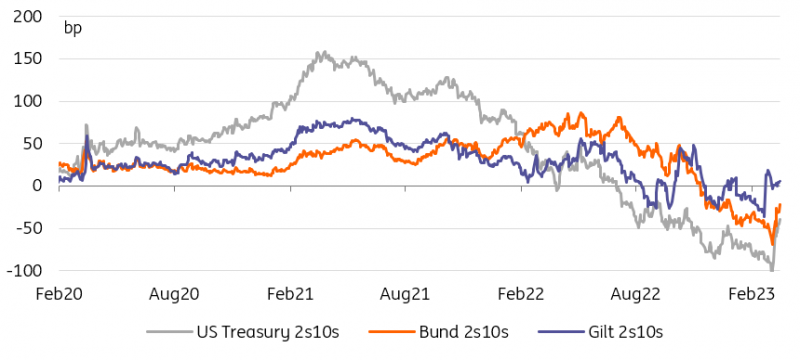

Less contagion risk would put hikes back into yield curves - and flatten them

Source: Refinitiv, ING

Systemic risk indicators at manageable levels vindicate ECB hikes

In the event, these lines were barely used, which is good news. This suggests that dollar funding conditions for foreign institutions in the jurisdictions covered by the agreement (the European Central Bank and Bank of England are key participants) are not challenging. We draw a similar conclusion looking at other indicators of wholesale money market funding for banks, for example the fact that FRA-OIS spreads did not make new highs after last week’s spike. Taken together, they suggest contagion risk is still at a manageable level, although this does not preclude an increase in funding and capital cost for banks, and so the economy.

If this remained the case, the perception would be that the ECB in particular will be emboldened to continue its hiking cycle. Many officials came out of the woodwork to reinforce President Christine Lagarde’s message that future decisions will depend on data, including the effect of banking stress on the economy. They could not help adding, and Lagarde added to the chorus that, absent market volatility, the ECB would have guided markets towards higher rates. In light of this message, a few more days of calm would in our view be enough for markets to price back ECB hikes into the curve. We continue to see euro rates as less liable to drop, and so think a further narrowing of USD-EUR rates differentials is in the cards.

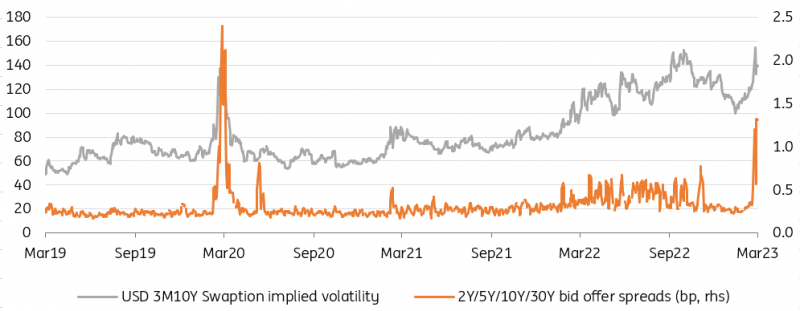

Doubts about the Fed's path have brought impaired trading conditions for Treasuries

Source: Refinitiv, ING

Read the full original analysis: Rates Spark: Contained contagion risk puts hikes back on the table

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.