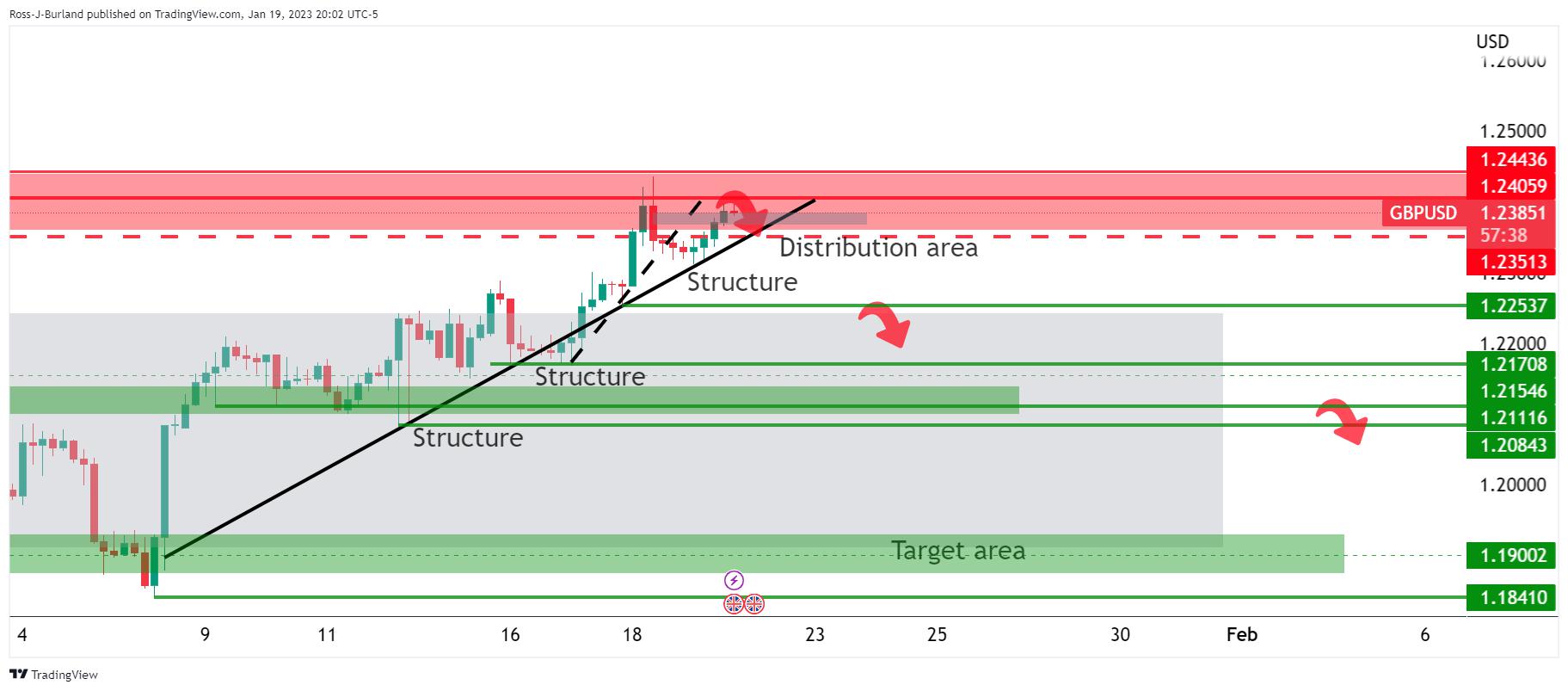

GBP/USD at a critical juncture on the charts, a test of 1.2400 eyed and 1.2250 below

- GBP/USD bulls are attempting to break 1.2400.

- On the 4-hourly time frame, the technical bias for GBP/USD remains bearish while below 1.2400.

GBP/USD is testing the 1.2400 area but the focus is on the downside while below it and 1.2350 is eyed in that respect, as illustrated below. Meanwhile, the pound remains supported on the basis that the United Kingdom's Consumer Price Index remains near 40-year highs. Additionally, the US Dollar is having a hard time with things lately.

Earlier in the week, UK CPI data showed yesterday that there was an increase in services inflation and accelerating food/drink prices which will be a cause for some concern for the Bank of England's policy-makers. Net short GBP speculators’ positions moved higher for the third consecutive week a couple of weeks ago with the UK political backdrop in a calmer air since the start of PM Sunak’s premiership.

Nevertheless, the weak economic outlook in the UK is feeding some talk that the BoE could be less hawkish on policy than previously expected and it may not take much to see the US dollar bounce back amid hawkish rhetoric from the Fed officials.

During the week, we heard from a chorus of speakers at the Fed, sounding the rate hike alarms and was sit not for weaker and disinflationary data, the greenback might have been firmer. In recent trade, st. Louis Federal Reserve's President James Bullard spoke for the second time this week and he said US interest rates have to rise further to ensure that inflationary pressures recede.

''We’re almost into a zone that we could call restrictive - we’re not quite there yet,” Bullard said Wednesday in an online Wall Street Journal interview. Officials want to ensure inflation will come down on a steady path to the 2% target. “We don’t want to waver on that,” he said.

As for the BoE, Governor Andrew Bailey argued at the start of the week that a shortage of workers in the labour market posed a “major risk to inflation coming down”.

''The implication is that the Bank of England could remain more hawkish on its policy decisions this year,'' analysts at Rabobank said. ''We expect another 50 bps rate hike in February and then three more 25 bps moves as the Bank struggles to slice the final few percentage points from services sector inflation, which will be most impacted by wage growth,'' the analysts at Rabobank argued.

GBP/USD technical analysis

On the 4-hourly time frame, the technical bias for GBP/USD remains bearish while below 1.2400. A break of the trendline could ignite a frenzy of offers to test 1.2250 support and if that gives, 1.2170 will be eyed.

Reprinted from FXStreet_id,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.