What are trade patterns, and how to trade with them the best?

Have you ever wondered what trade patterns are and how best to trade them? Why are they an inevitable and crucial part of every professional trader’s career life nowadays? If you are an absolute beginner in Stock or Forex trading and, in general, this area of business, you must have heard many times how trading patterns are often used.

With them, more detailed technical analysis and, therefore, success in the market is possible. So, what is the secret behind trading patterns? And ultimately, why should every aspiring trader worldwide know its meaning and how to use it?

For those of you wondering, “what are trading patterns,” what are stock patterns and chart patterns?

What do trade patterns represent?

A trade pattern represents a particular trend in securities’ prices that traders have traded over a given period. Generally, trading patterns are viewed as inevitable aspects of technical analysis. For newbies, technical analysis is a specific method for determining the stock, bonds, and other securities’ value.

Usually, to observe the trading patterns and current market trends, technical analysis usually utilizes a macro approach. Trade patterns are usually identified in real-time. In many cases, they signal the entire market shift. The public mood makes this “psychological market” and its fluctuations.

Great indicators of the expanded market shift

Trade patterns are extremely beneficial indicators of the expanded market shift. They’re a crucial technical analysis tool and aspect of it. It’s advisable for traders always to get to know the history of their preferred trade pattern in order to understand the world and market conditions better every time a trading pattern happens.

There’s also a high level of connection regarding securities valuation and world or local events. During each economic cycle, traders could expect trade patterns to occur. Remember, the fundamental analysis represents another type of stock valuation formed on how the firm observes the history of a business and the business itself.

The pattern of trade in economics

In economics, the pattern of trade refers to the composition of imports and exports of one country and the volume of its trade that’s prone to fluctuations over some given period. Changes in trading patterns result from emerging economies’ impact, bilateral trading agreements, changes in exchange rates, etc.

How many types of trading patterns are there, and what are they?

In the stock market, for instance, trade patterns have five variations. These different types of patterns are the following ones:

Head and shoulders

The Head and shoulders pattern is a trade pattern that resembles the outline of both head and shoulders once they’re charted on a graph. In this pattern, the value of the securities rises at first. Afterward, they flatten out, and then they start to summit again.

Once the second peak happens, they return to the first peak’s level, flatten out, and, in the end, they manage to decline.

Triangle

The triangle is a trading pattern best described by an intense rise in peak, value and a decline to the original level.

Cup and Handle

The Cup and Handle pattern is in the “U” shape. It Includes a peak with a gradual downturn and an upturn right after it. The U shape is created once represented in a graph. The handle happens once the securities have reached their second peak after falling prices.

Ascending channels

Ascending channels represent a securities’ trading pattern in which a stock’s price significantly grows rationally during a certain period.

Descending channels

On the other hand, in Descending channels, we have a pattern in which traders easily trade securities at much more reasonable prices every following day for a certain time.

Stock chart patterns – get all the basics.

What are trade patterns, particularly stock chart patterns, as a crucial trading tool that traders need to use as an inevitable part of their technical analysis strategy? Regardless of your experience level, chart patterns always play a fundamental role in predicting market movements and trends.

They’re also commonly utilized by traders who are keen to analyze every single market, such as commodities, shares, forex, stock, and much more. Stock patterns represent lines and shapes that have been drawn onto price charts. The main goal of these charts is to assist traders in predicting future price actions like reversals and breakouts.

As mentioned earlier, stock chart patterns represent fundamental technical analysis tools that are crucial for using past price actions to guide probable forthcoming movements in the market. These patterns are, undoubtedly, the best trading assistants that ambitious traders could have.

What are essential stock patterns?

Among numerous stock patterns, the most essential is considered to be the following ones:

- Ascending triangle

- Descending triangle

- Pennant

- Symmetrical triangle

- Wedge

- Flag

- Double top

- Double bottom

- Rounding top or bottom

- Head and shoulders

- Cup and handle.

How can you easily spot chat patterns?

One of the main questions aside from “What are trade patterns” is how to spot them easily. Even though trade patterns aren’t so easily identified, especially when you’re an absolute beginner in trading, there are some tips that can help you do so.

For instance, with the proper usage of a legitimate tool that frequently updates to highlight technical trade set-ups, traders could easily spot numerous types of trade patterns. Particular platforms act, such as pattern recognition scanners, could be of the greatest help to all traders who desperately need identification of these chart patterns.

Some pattern recognition software collects data from more than 100 popular products. These software solutions are designed to alert traders once a valuable technical trading opportunity occurs.

What is the pattern exactly?

Generally speaking, patterns represent different formations developed by the formations developed by the security prices movements on a chart. Traders can identify by a line between common pierce points like highs or lows during a particular period.

Professional chartists look for a way to identify patterns as a crucial way to wait for the security’s price and future direction. They truly are a foundation of technical analysis that is crucial for any potential success in the market regarding trading.

How do trade patterns work?

Regarding security prices, it could happen anytime and at any point. Even though price patterns can be simple in hindsight, spotting them could be a great challenge. As we’ve mentioned above, there are numerous charts, where cup and handle, head and shoulders, and ascending/descending channels are among the most popular.

Two types of stock analysis

We’ve got two types of stock analysis:

- Fundamental analysis: It observes a particular business of a company. It leads research on price-to-book ratios, balance sheets, earnings projections, and much more. Besides that, this type of analysis is beneficial in determining what to buy.

- Technical analysis: In technical analysis, it’s the most common regarding pattern recognition if we exclude the performance. Uncovering pricing trends is when traders use these patterns. This analysis assists in determining when the right to buy is.

Professional investors usually use both studies because their combination is the best possible solution. Also, chart patterns are used by technical analysts to identify trend movements in the company’s stock price.

On what patterns are focused?

All patterns are focused on the following:

- Seconds

- Minutes

- Hours

- Hours

- Days

- Months

- Ticks

All of these are able to be applied to:

- Candlestick

- Bar

- Line charts

A trend line represents the most basic form of a chart pattern.

Two basic types of trade patterns

When asking yourself, “what are trade patterns,” it’s crucial to understand that there are also two basic types of trade patterns:

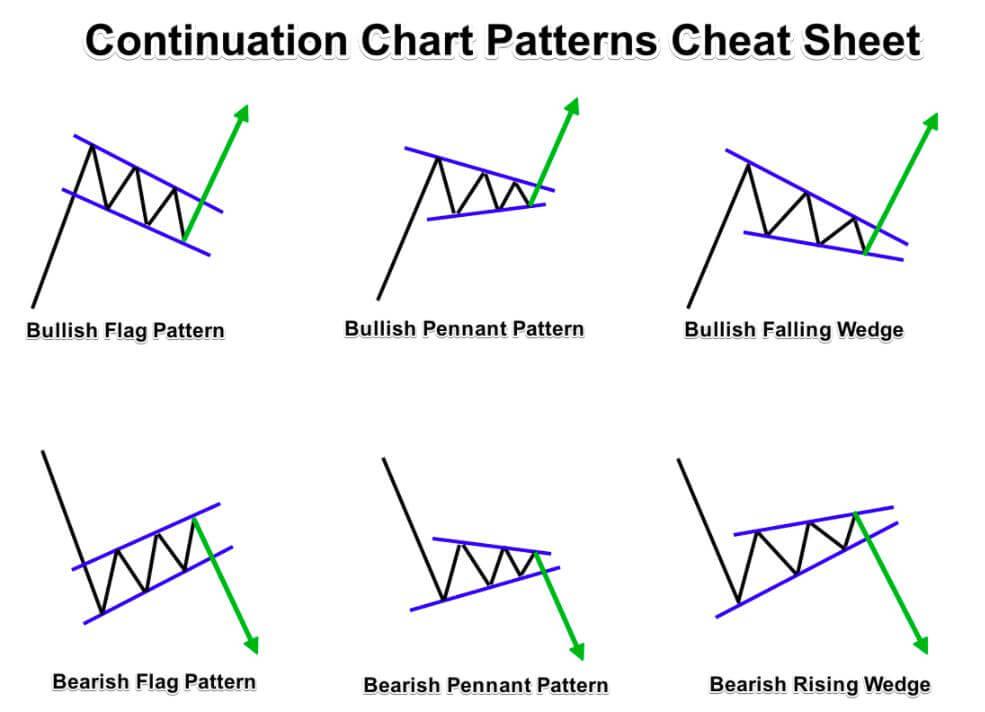

Continuation pattern

It identifies opportunities for traders who want to continue with the trend. The most usual continuation patterns are pennant patterns, symmetrical triangles, ascending and descending triangles, and flag patterns.

Retracements/temporary consolidation patterns are also common types of patterns where stock won’t continue with the trend.

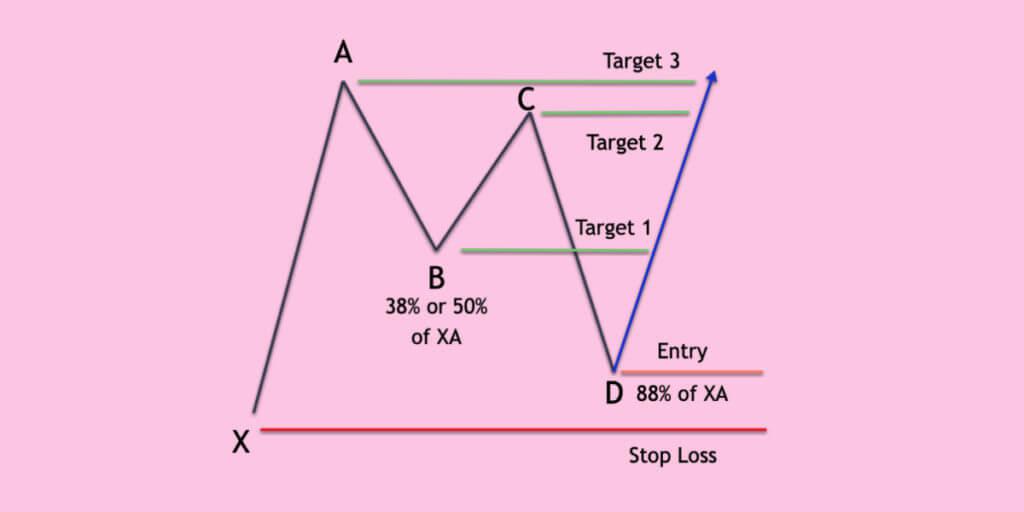

Reversal pattern

The reversal pattern is the opposite of the continuation pattern. It detects favorable opportunities to base a trade regarding the reversal of a trend. I.e., These types of patterns look unearthly once trends have ended.

Those who are seeking a reversal in a trend believe that a trend is good until it bends. Some of the most common reversal patterns represent triple tops and bottoms, head-and-shoulders, and double tops and bottoms.

KEY TAKEAWAYS

In this article, we have learned what trade patterns are. Here is what you need to remember:

- Trade patterns are a particular trend in securities’ prices that traders have traded over a given period.

- Trade patterns are extremely beneficial indicators of the expanded market shift.

- These patterns have five variations. These different types of trading patterns are triangle, cup and handle, head and shoulders, ascending patterns, and descending patterns.

- Stock chart patterns represent fundamental technical analysis tools that are crucial for using past price actions as a guide for probable forthcoming movements in the market.

- Generally speaking, patterns represent different formations developed by the formations developed by the security prices movements on a chart.

- Professional chartists look for a way to identify patterns as a crucial way to wait for the security’s price and future direction.

Hot

-THE END-