While the euro (EUR) climbed back above parity with the U.S. dollar yesterday, it didn’t last long.

Today, selling pressure pushed the euro back below parity after the European Central Bank (ECB) interest rate decision.

In order to control the worst inflation in decades, the ECB hiked interest rates by 75 basis points (0.75%), the same amount as the Federal Reserve’s previous rate hike.

It was their rate hike in a row, after hiking rates by 50 basis points in July and 75 basis points in September.

Not familiar with interest rates? Read our lesson on Why Interest Rates Matters to Forex Traders.

According to the central bank’s statement, “Inflation remains far too high and will stay above the (2% inflation) target for an extended period.”

The ECB also confirmed that there are more rate hikes to come, and they expect to “raise interest rates further.”

But when asked to comment specifically on the magnitude and duration of future rate hikes, ECB President Christine Lagarde kept it pretty vague: “The destination for us is clear, the exact pace will be determined meeting by meeting.”

As seen on the price chart of EUR/USD, this answer didn’t seem to be the one that the euro bulls were looking for.

Another currency moved huge today…

Dogecoin!

Dogecoin (DOGE), the largest and most famous meme coin, rose over 13% today and reached a new monthly high of over $0.08.

This huge rally is associated with Elon Musk’s purchase of Twitter which is expected to be finalized tomorrow. In the past, he’s expressed interest in integrating the use of DOGE into Twitter.

And now that he’ll actually be the owner of Twitter, crypto traders are now betting on the hope that it’ll actually happen.

Elon has been a vocal supporter of DOGE and has disclosed he actually owns dogecoin, as well as bitcoin (BTC) and ether (ETH).

If you’re new to cryptocurrencies, check out our School of Crypto. Our online crypto course is made for beginners to help them learn how to navigate the crypto market.

Let’s review what else happened in the FX market today…

Currency Market Movers

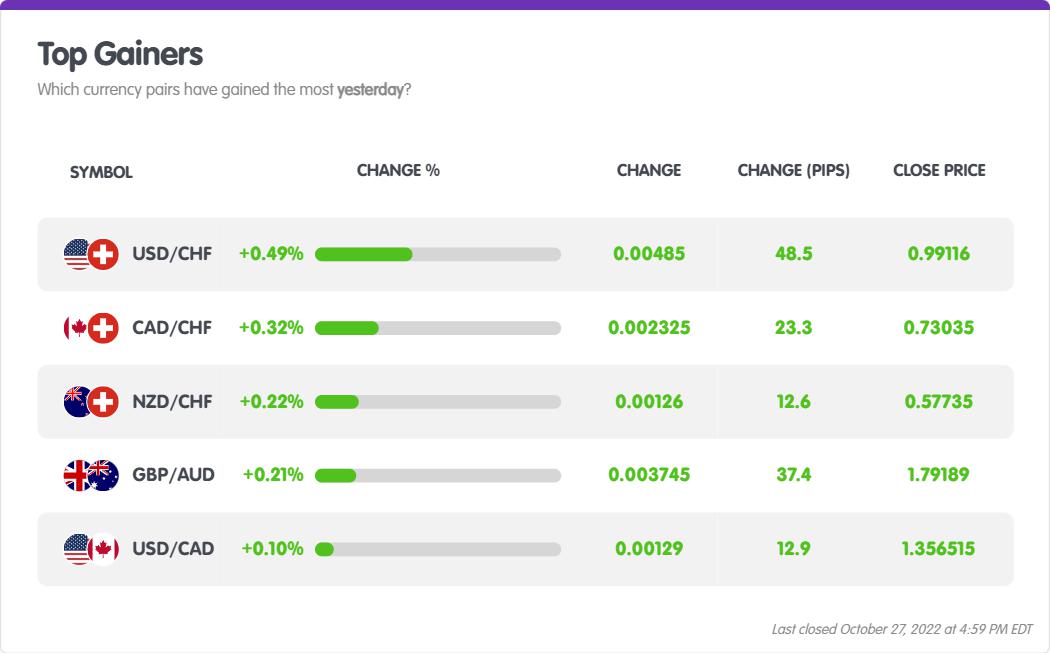

Which currency pairs gained the most today?

As shown by our FX Market Movers page, USD/CHF was the leader of the pack, gaining 0.49% or 48 pips. 🏆

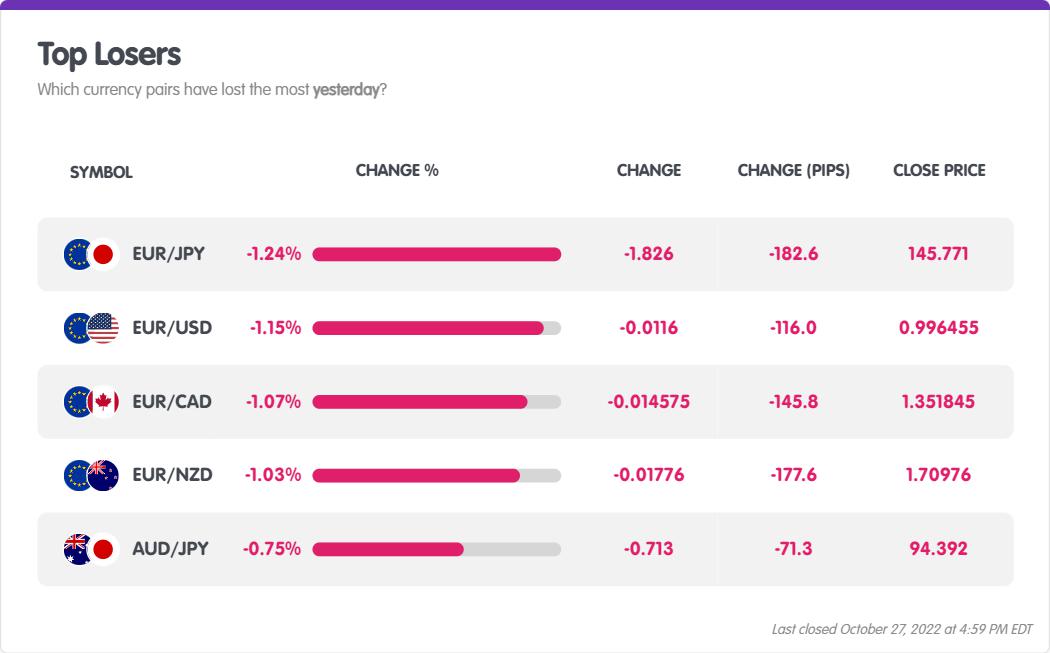

Which currency pairs lost the most today?

UER/JPY.was the biggest loser, falling 1.24% or over 182 pips! 😢

This currency pair continues to weaken so it looks like the intervention that I talked about seems to be working.

The Bank of Japan (BoJ) meets tomorrow so be prepared for some potential volatility.

Unlike other major central banks that have been aggressively hiking interest rates in an attempt to contain inflation, the BoJ is an outlier keeping its interest rate unchanged and sticking with its negative interest rate policy (NIRP) and yield curve control (YCC).

Currency Strength

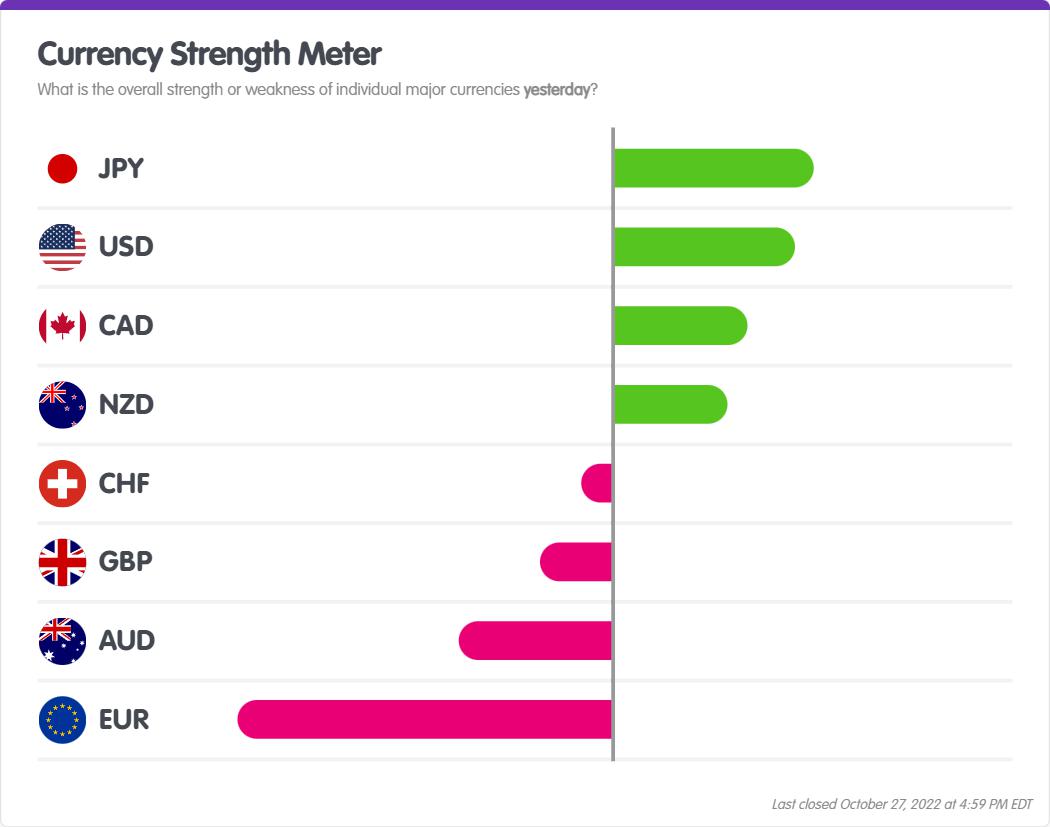

What was the overall strength or weakness of individual major currencies today?

Based on the Currency Strength Meter on MarketMilk™, JPY was the strongest currency. 💪

The euro (EUR)) was the weakest currency.

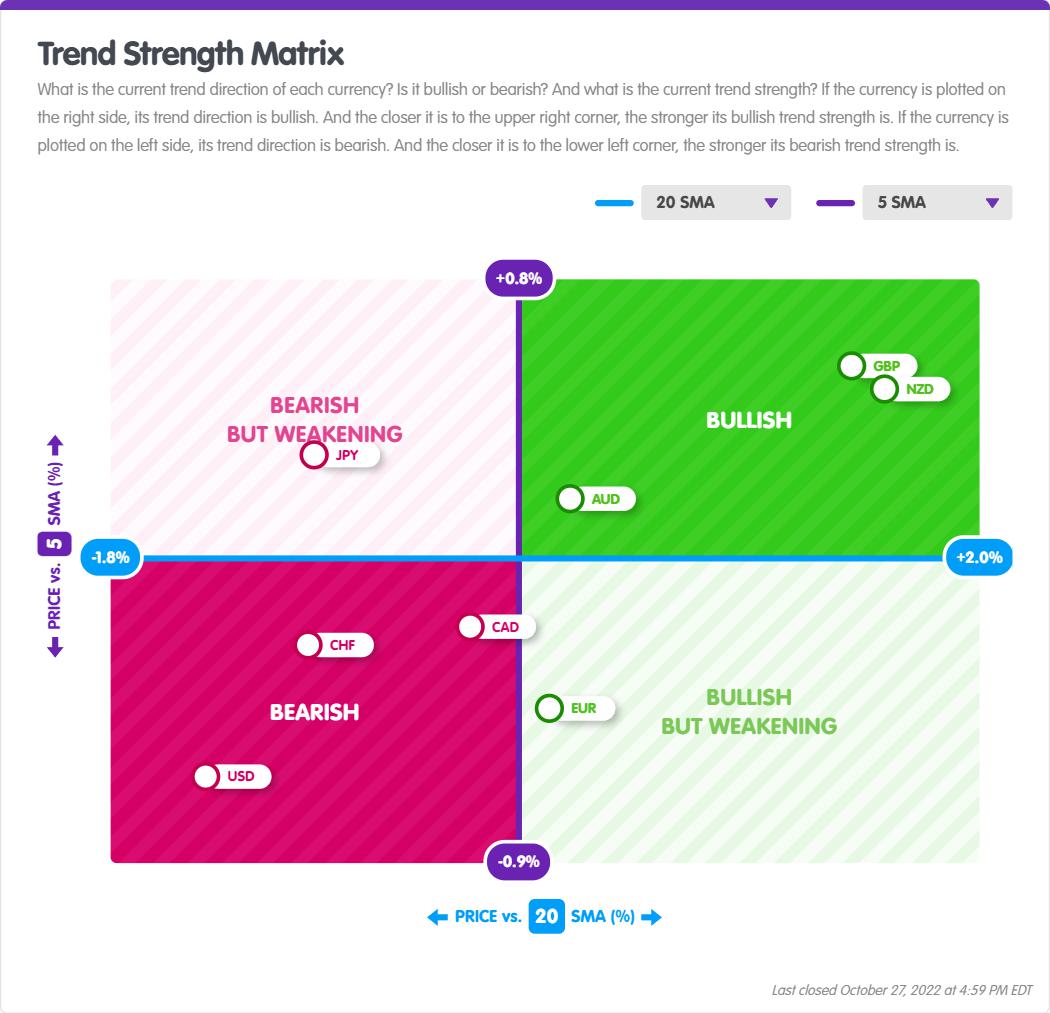

Currency Short-Term Trends

When it comes to short-term trend strength, the British pound (GBP) and New Zealand dollar (NZD) show the most bullish strength.

The U.S. dollar (USD), Canadian dollar (CAD), and Swiss franc (CHF) are the most bearish trend strength.

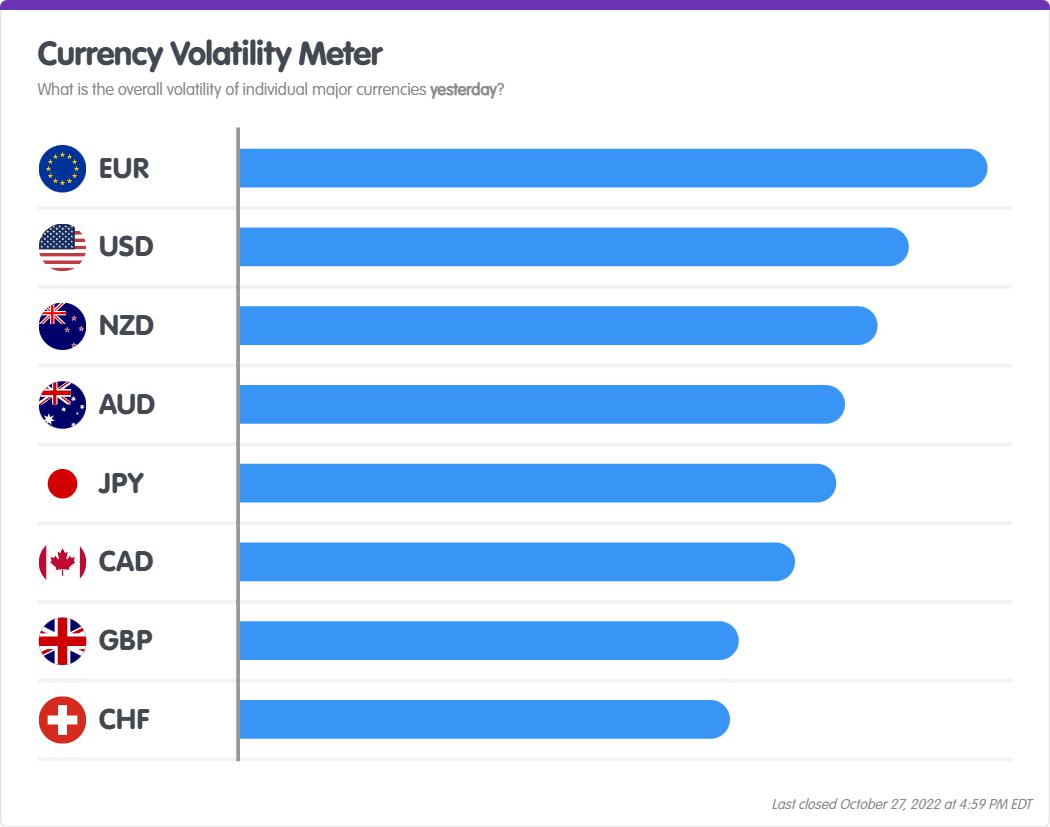

Currency Volatility

Which currency was the most volatile today?

Based on our Currency Volatility Meter, it’s the euro (EUR).

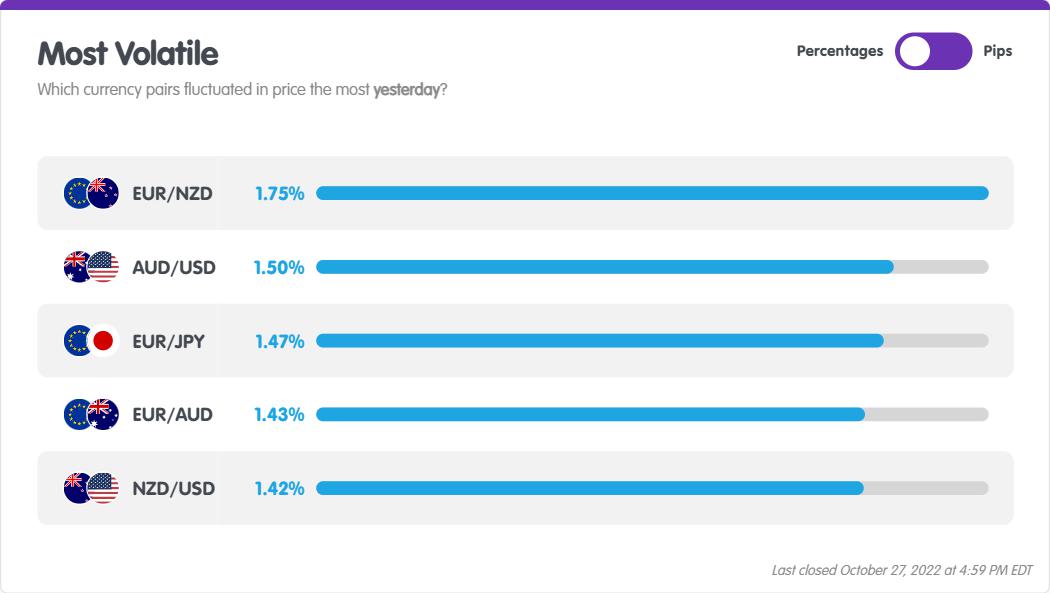

Which currency pair was the most volatile today?

Given that the USD was the most volatile currency, it has to be a USD pair. But which one?

EUR/NZD. From its high to low, it moved over 1.75% or over 297 pips!

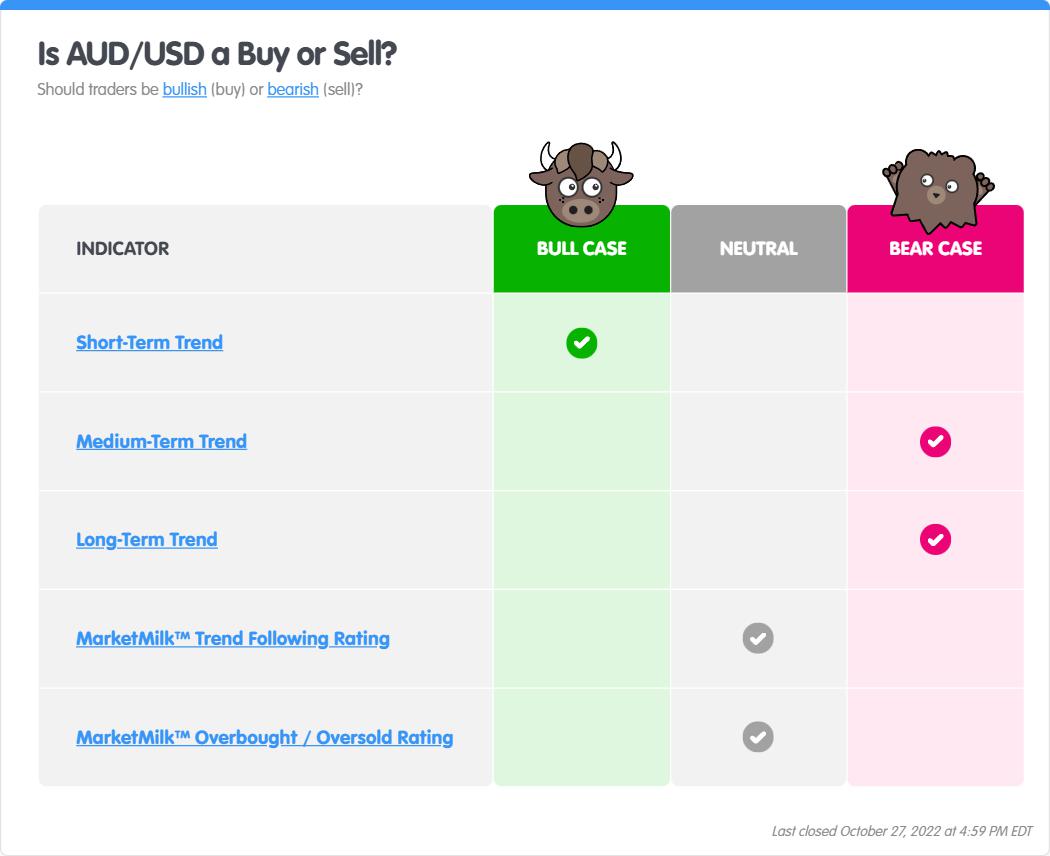

Are you bullish or bearish on AUD/USD?

Is AUD/USD a buy or sell?

Here’s what MarketMilk™ indicators say…

Hot

No comment on record. Start new comment.