EUR/USD outlook: Euro may fall further on robust US jobs data

EUR/USD

The Euro edges higher in European trading on Friday, consolidating a sharp fall on Wed/Thu (2.04%).

Renewed risk aversion which dragged the euro lower, is likely to gain pace as markets expect a robust US jobs report that would give a fresh signal to the US central bank for further aggressive tightening.

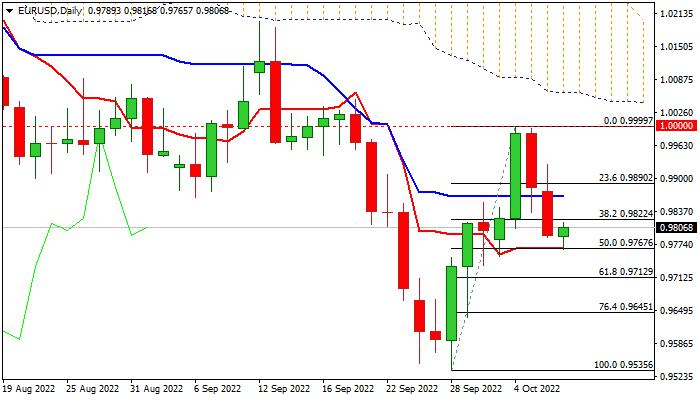

Bearish signals on daily chart from a double-top at parity level and a bull-trap above 0.9949 (Fibo 61.8% of 1.0197/0.9535) weigh on Euro along with weak daily studies, in addition to continuing pressure from a gap between the Fed/ECB interest rates.

Upticks should be ideally capped by broken Fibo 38.2% (0.9822), though near-term action is expected to remain biased lower while holding below daily Kijun-sen (0.9866).

Bearish continuation through temporary footstep at 0.9767 (50% of 0.9935/0.9999/daily Tenkan-sen) would expose targets at 0.9712 (Fibo 61.8% of 0.9935/0.9999 and 0.9645 (Fibo 76.4%) with stronger bearish acceleration on positive NFP surprise to risk retest of 20-year low at 0.9535.

Res: 0.9822; 0.9866; 0.9890; 0.9926.

Sup: 0.9767; 0.9712; 0.9645; 0.9585.

Interested in EUR/USD technicals? Check out the key levels

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.