The U.S. dollar had been weakening against most major currencies since the start of the week.

A big reason why was due to expectations that the Fed might have reached “peak hawkishness” and would now start to become less aggressive in raising interest rates.

Today, it looks like the market realized this still might be wishful thinking.

What got the market questioning themselves was when the Reserve Bank of New Zealand (RBNZ), New Zealand’s central bank, raised interest rates earlier today by 50 basis points to 3.5%, a seven-year high.

According to RBNZ Governor Adrian Orr:

“The Committee agreed it remains appropriate to continue to tighten monetary conditions at pace to maintain price stability and contribute to maximum sustainable employment. Core consumer price inflation is too high and labour resources are scarce.”

They even admitted that they were thinking about raising rates by 75 basis points.

In other words, more aggressive interest rate hikes are to come!

As you’ll see, this caused the New Zealand dollar (NZD) to strengthen todayBut this hawkish rhetoric had the market wondering whether the Fed is thinking the same thing in terms of also maintaining its aggressive monetary policy stance, which also caused the USD to rise also.

Let’s review what else happened in the FX market today…

Currency Market Movers

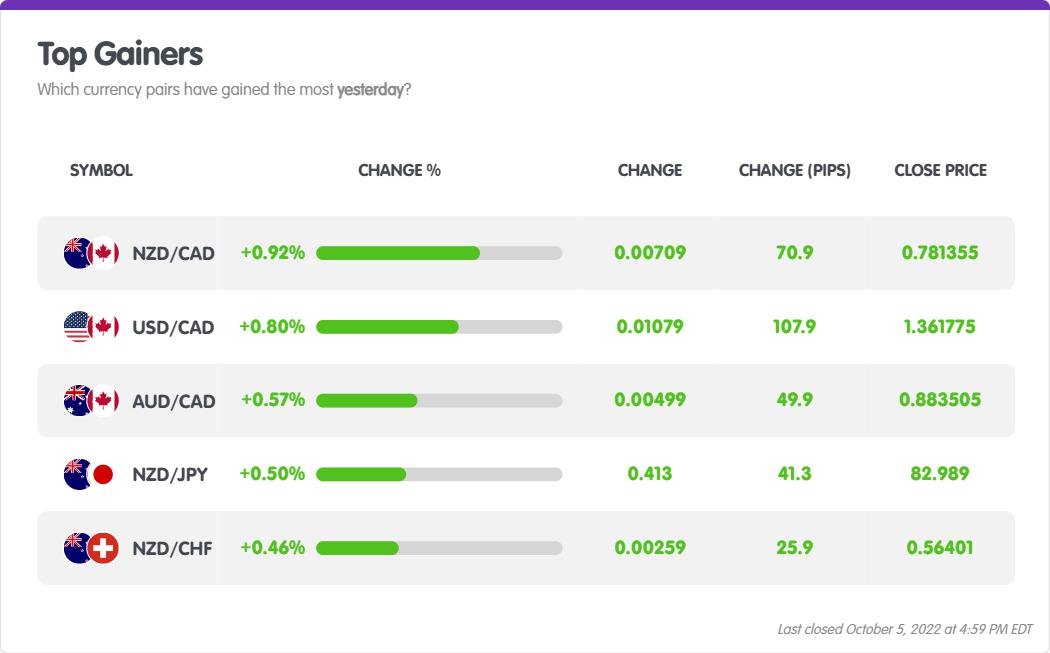

Which currency pairs gained the most today?

As shown by our FX Market Movers page, NZD/CAD was the leader of the pack, gaining 0.92% or 71 pips! 🏆

Looking at its price action (PA), with the price trading below both its 50 SMA and 200 SMA, NZD/CAD is clearly still in a downtrend.

Price has managed to find short-term support at around the 0.7720 area, but unless it can strongly break above 0.7860, it looks like the price is simply consolidating before falling further.

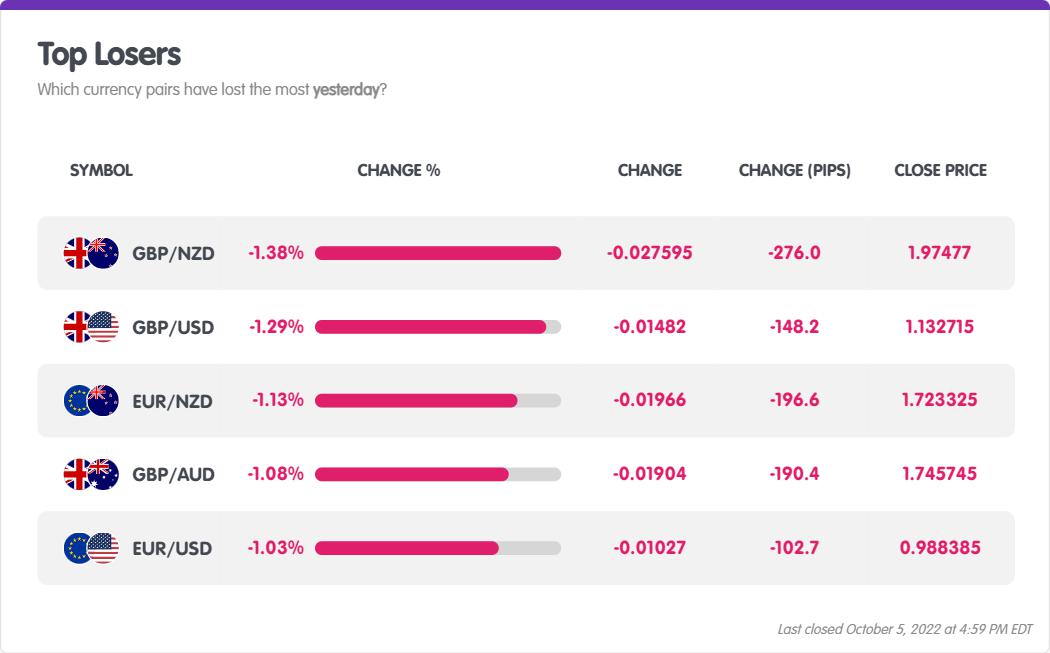

Which currency pairs lost the most today?

GBP/NZD was the biggest loser, falling 1.38% or 276 pips! 😢

Currency Strength

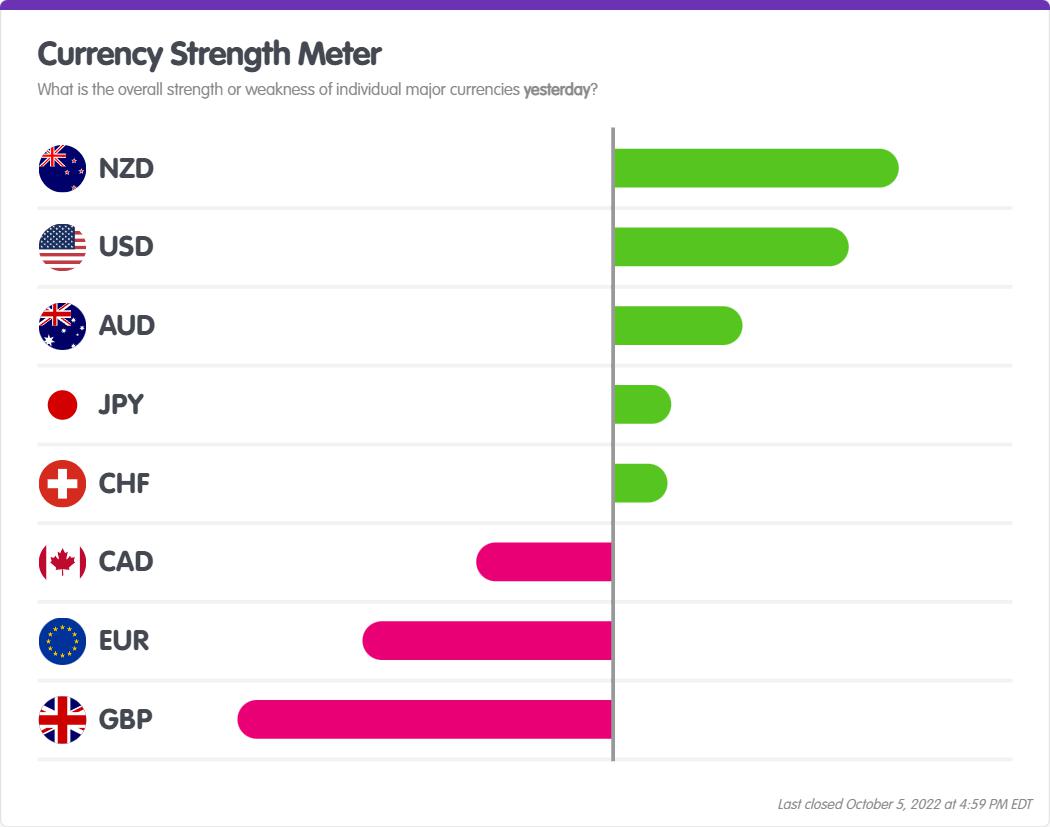

What was the overall strength or weakness of individual major currencies today?

Based on the Currency Strength Meter on MarketMilk™, NZD was the strongest currency, while GBP was the weakest currency. 💪

British Prime Minister Liz Truss spoke at an annual conference and tried to reassure her fellow party members of her plan to transform the economy and the country.

And as she spoke, GBP fell. 😬

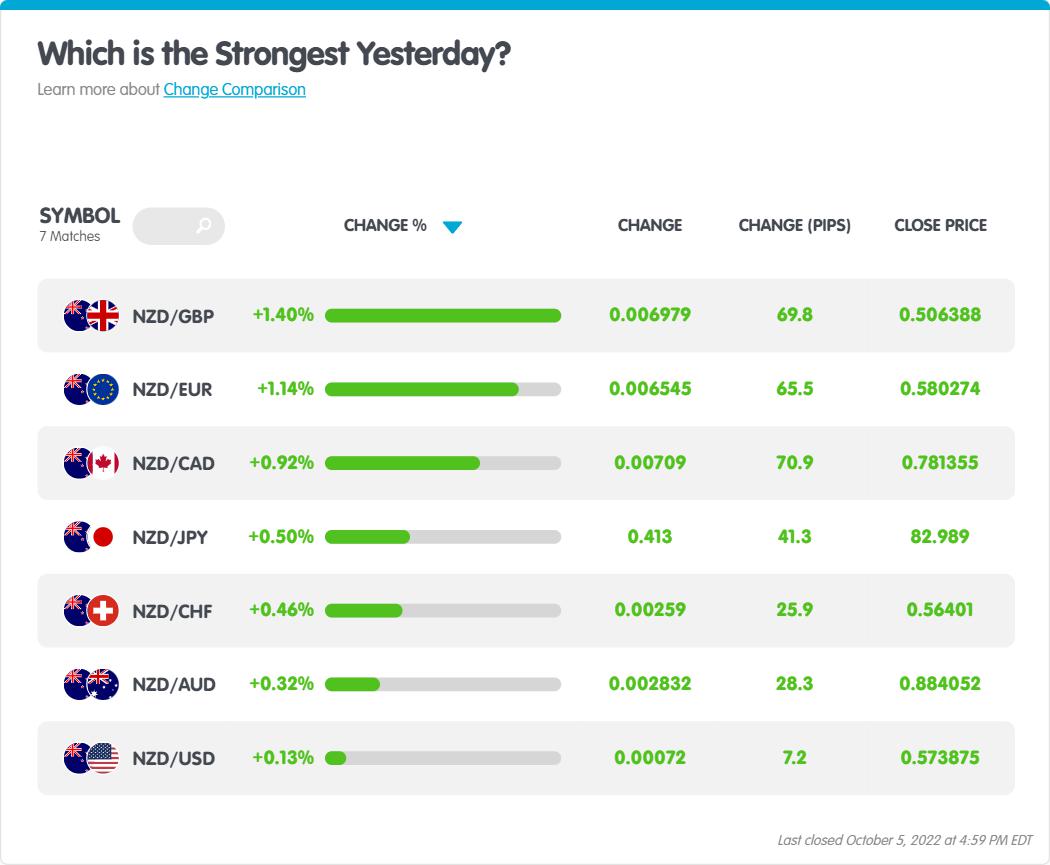

If we dive a little deeper and look at all the NZD pairs, we can clearly see that NZD was “green” against all currencies today.

Although NZD was by far, strongest today against GBP and EUR.

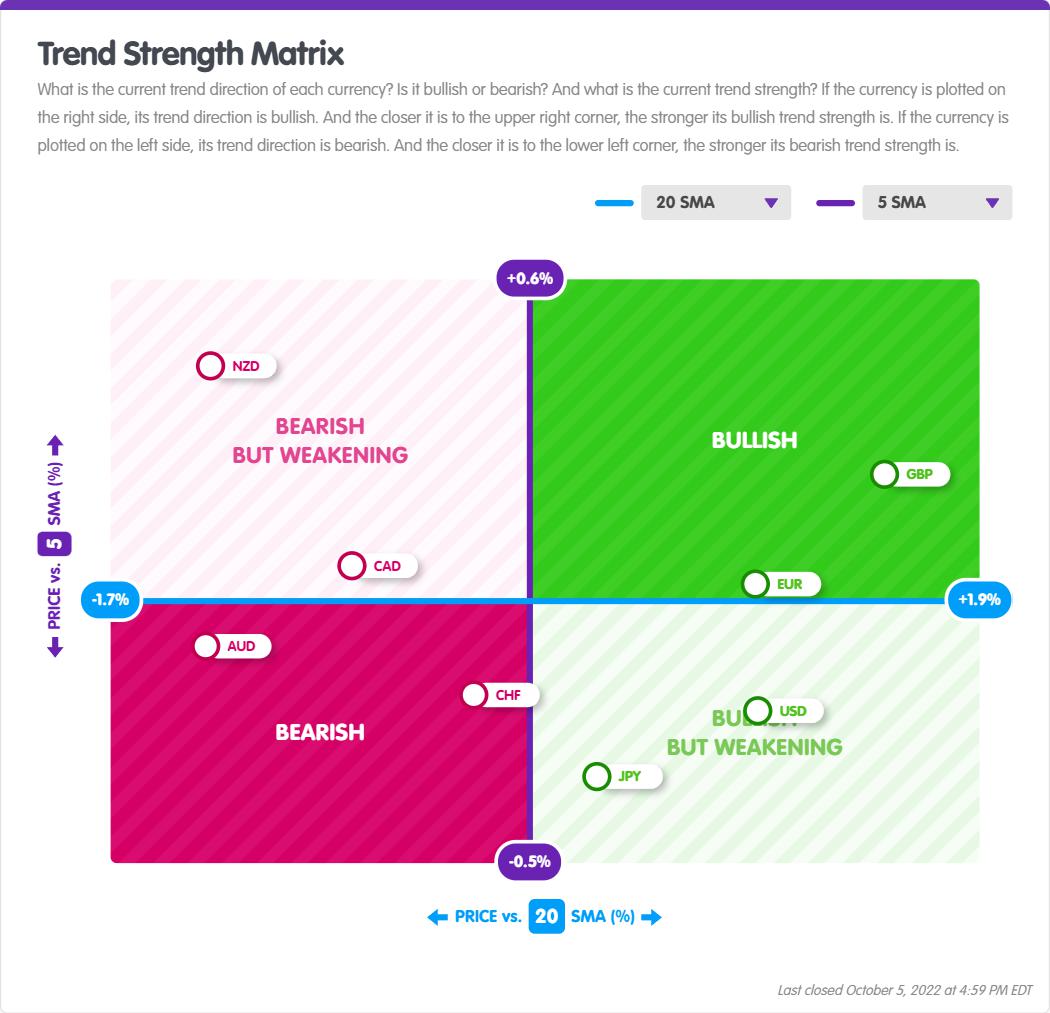

Currency Short-Term Trends

When it comes to short-term trend strength, the British pound (GBP) continues to show the most bullish strength, along with the euro (EUR)

The Aussie dollar (AUD) and Swiss franc (CHF) show the most bearish strength.

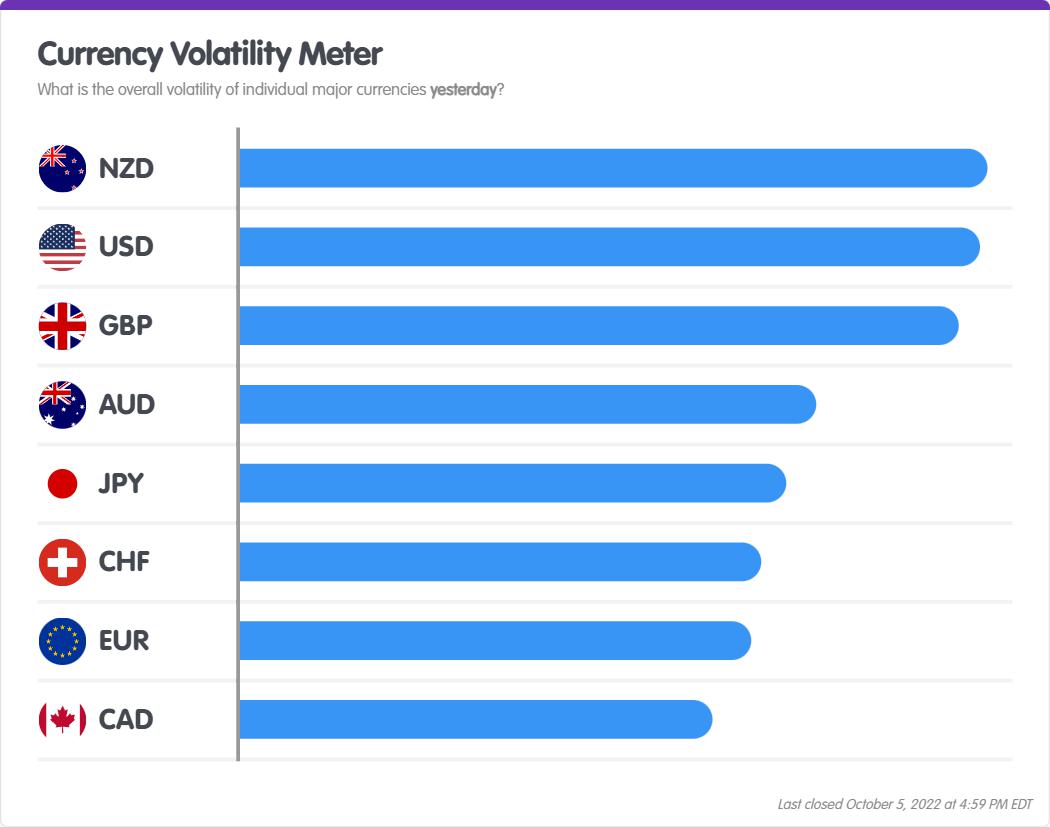

Currency Volatility

Which currency was the most volatile today?

Based on our Currency Volatility Meter, it’s the New Zealand dollar (AUD). Although the U.S. dollar was pretty volatile as well.

Given the announcement from the RBNZ earlier today, this should come as no surprise.

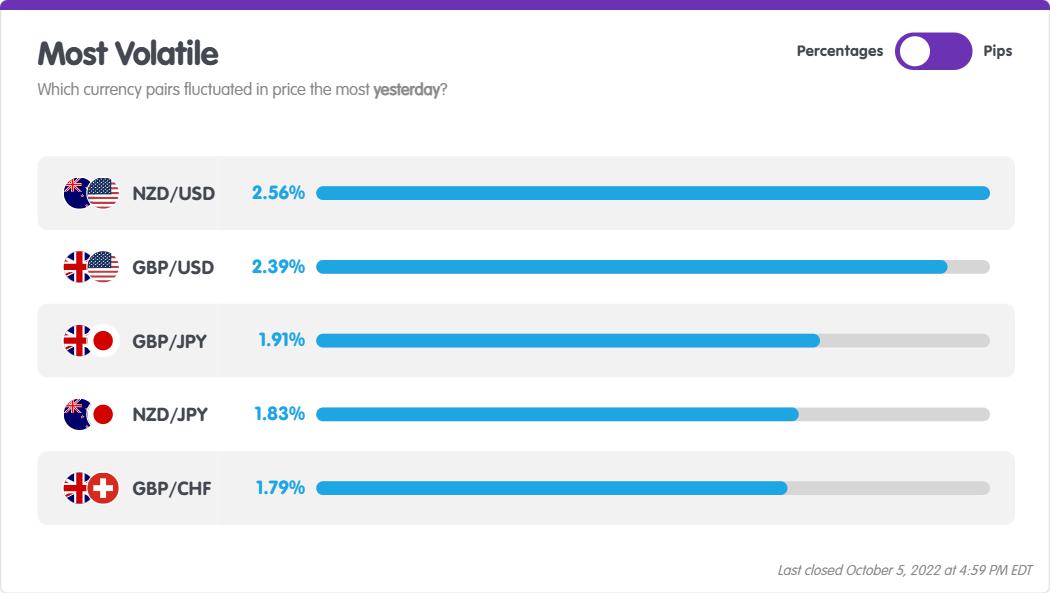

Which currency pair was the most volatile today?

Given NZD was the most volatile currency, it has to be an NZD pair. But which one?

NZD/USD. It moved over 2.56% or 144 pips.

Hot

No comment on record. Start new comment.