The stock market is in a state of confusion – Now what?

Outlook: We have a hodgepodge of data scatted around the world this week anda ton of it–the RBNZ policy decision, Canadian CPI, Germany PPI and ZEW. Econoday reports UK consumer inflation will be the biggie (forecast up 0.4% to 9.8%) bur we also get payrolls and average earnings. In the US, we get Fed minutes, housing starts and industrial production tomorrow and retail sales on Wednesday. The interesting thing about retail sales is the forecast for a flat reading. Today brings the Empire State manufacturing survey and TICS.

If you care about history, this is the 51st anniversary of Pres Nixon ending the dollar’s gold backing and thus the “end” of Bretton Woods, although so much of what was established there remains with us today.

The news from China has the potential to roil markets. If US retail sales are stalling, China is the most affected exporter. Rate cuts can’t offset that. Meanwhile, the zero Covid policy has caused lockdowns and continues to threaten production in various places. Western pundits are universally critical. Bloomberg points out “Gold reacted to the slowdown by dropping as much as 1.1%, after four straight weeks of gains.” A week or so ago, the WSJ had pointed to weak gold as a function of falling Chinese demand. You’d think it would be rising demand if the mortgage payment strike is such a big deal.

We had a rare and rapid flip-flop in sentiment last week, from inflation panic and expectations of 75 bp in September to tame-ish inflation data that had sentiment switching to “only” a 50 bp hike in September. As expected, though, Fed comments poured cold water on the 50 bp idea with affirmations that it will take several more tame readings to justify a policy reconsideration (Richmond Fed Barkin). According to Bloomberg, that expectation had dipped to 47 bp last week and is about 60 bp today.

This leaves the stock market in a state of confusion. To the extent the big gain–the S&P retraced about 50% of its earlier losses–can be laid at the door of those seeing the Fed as fundamentally dovish–now what? Assuming the August data comes in tame, too, as now forecast, do we not get an ongoing rally? That’s the view of JP Morgan Chase, which sees the rally persisting to year-end.

But as Bloomberg reports, “Morgan Stanley strategists said in a note Monday that the sharp rally since June is just a pause in the bear market, predicting that share prices will slide in the second half of the year as profits weaken, interest rates keep rising and the economy slows.”

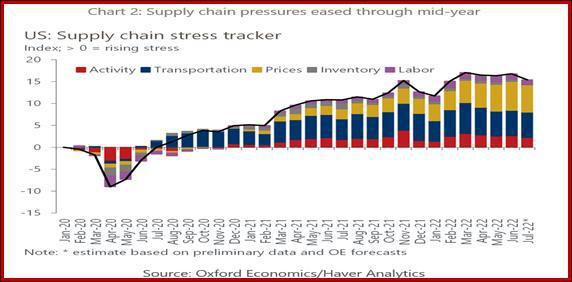

Oxford Economics expects upcoming data to be favorable: while rents are not coming down and housing prices are sticky, “… the process should begin shortly as plunging demand for homes will filter through to lower prices and eventually ease congestion in the apartment market, reining in rental costs. Meanwhile, easing price pressures on a broader scale should continue over the coming months, as supply snarls are untangling; delivery times are shortening, freight charges are dropping like a stone and price spikes caused by pent-up demand for services, particularly for vacationers, are retreating; hotels, air fares and rental car prices all fell significantly in July.”

Of all the inflation charts coming like bullets, here is one we like:

The implication is clear–more equity rallies. Unless oil and gas prices return to an upward trajectory. But don’t discount some flip-flopping in other risk sentiment contributors. Earlier this year when China had locked down Shanghai and other big cities, the outlook for Chinese growth was dire and risk aversion rose. Then we had a couple of surprisingly okay months and fear receded. If risk aversion is back, we might assume the classic beneficiaries are back, too–the yen, Swissie and dollar. The pro-growth currencies (CAD, AUD and NZD) lose their luster, which is indeed what we see this morning.

Then there is the hot-war thing. This is still luke-warm because nobody imagines China will invade Taiwan over Nancy Pelosi, so the US sent another delegation. Sabre-rattling is going on by both sides now.

Finally, the WSJ points out that the US labor force is contracting and is ”about 600,000 smaller than in early 2020, when Covid-19 triggered a deep but short recession. It is several million smaller if you adjust for the increase in population. After approaching pre-pandemic levels earlier this year, the number of workers has fallen since March by 400,000.” Nobody understand it but the implication is clear–rather than wage increases being zapped by the Fed, companies that want to stay in business must offer wage increases to keep the labor force going. This sets the Fed dead against a “natural” or organic price development. We need to stay tuned.

For all these reasons and probably a few more, the tide has turned to favor the dollar again. We were not expecting it until pullback Tuesday but never mind–and it could be a humdinger if incoming data shows the US persisting in a decent recovery. This will put added interest in the Empire State and Philly Fed reports.

Tidbit: House inflation is dire. On Friday the National Association of Realtors Housing-affordability index fell to 98.5 in June, the lowest level since June 1989. Sales themselves have fallen for 5 straight months in part on the affordability issue–including rising prices and rising mortgage rates. As the WSJ reports, “Existing-home prices have jumped 46% nationally in the past three years… and Mortgage rates have climbed since the start of the year, rising to 5.22% this week from 3.1% at the end of 2021.” Slowly falling prices now are offset somewhat by a shortage of new homes that started after the 2007-09 recession. Zillow says prices will not go back to 2019 levels, but we say consider the self-interest of the source.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.