What to watch for from the RBA rate decision

The key focus heading into the RBA meeting is to what extent the RBA is concerned about slowing growth. In July’s meeting, the RBA hiked by 50 bps as expected and maintained its need to take ‘further steps’ to normalise monetary policy. However, the RBA was unsure how households would respond from here on in. In particular, the RBA noted concerns over inflation, rising interest rates, and falling house prices in some markets. See the previous article here. So, we know those areas will be in focus again. Let’s take a look at what we know from this last month’s data.

Inflation

On Wednesday, July 27, the inflation print was a miss. Headline inflation y/y came in at 6.1% vs 6.2% expected. Short-term interest rate markets now only a see 92% chance of a 50 bps hike (down from 100bps) and a 61% chance of a 75 bps rate hike (down from 72%) at next week’s meeting. So falling inflation pressure means some relief over the RBA’s concerns.

Employment

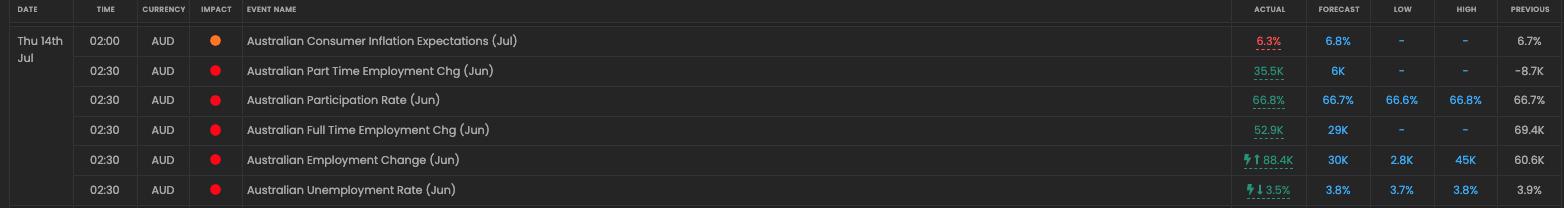

On July 14, employment surprised to the upside. Jobs grew at 88.4K vs 30k expected and 52.9K of those were full-time. The unemployment rate also fell below market’s minimum expectations to 3.5% which shows the jobs market is very robust right now.

So, there is not enough to obviously worry the RBA from either of these two prints on employment and inflation. Also, the recent data from China has been constructive, so there is an outside chance that the RBA does pull a similar trick to the ECB in front running rate hikes early. Aside from this speculation, the best opportunity would come from the RBA tilting more dovish and stressing global growth concerns as well as expectations for domestic markets to suffer more. The go-to pair for trading RBA rate decisions is the AUDNZD pair and the overhead resistance area on the daily can be used as a reference point.

Learn more about HYCM

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.