Crony capitalism

We all know of the shortage of microchips that developed after the onset of the pandemic due to our inability to secure desired cargos from foreign suppliers and insufficient domestic production capacity to compensate. To the extent that we, collectively, recognize this dependence on foreign producers as potentially compromising our national security, it makes sense to take steps to encourage greater production here at home.

I had hoped that market forces, on their own, would solve this problem. When shortages arise, prices should rise, giving current and prospective suppliers the incentive to ramp up their production levels. It may take some time, but that’s the way free markets work. Depending on the supply response, ultimately, the prices might revert to their pre-shortage level; but it’s also possible that the post-shortage higher price may become the new market equilibrium.

In the current case of the microchip shortage, many have sought additional measures, calling for federal support to fund research and further incentivize onshore microchip production capacity. With that objective in mind, the House and Senate have both passed bills that are currently awaiting reconciliation. If passed, the federal allocation for this initiative would likely amount to somewhere between $250 billion and $400 billion over the next 10 years, with a specified allocation of $52 billion designated under the Chips Act that would directly benefit domestic chip producers.

Intel, the largest domestic producer of microchips, appears to be particularly visible in supporting the Chips Act, justifying its position, at least in part, from the assertion that foreign governments subsidize this production activity and in so doing incentivize producers to shift their production offshore. According to the Semiconductor Industry Association, while the US accounted for 37 percent of chip production in 1990, today, that figure has fallen to only 12 percent. The $52 billion ask is intended to level the playing field.

Let’s look at who’s asking — specifically Intel, the leading chip maker in the US. Here are some highlights: As of today, the share price of Intel is suffering with the rest of the market, with Intel trading near its 52-week low. Given the market, that’s not totally unexpected. More telling, however, are data relating to Intel’s earnings, in particular return on equity. This measure compares annualized reported income to the share price at the start of the year. The most recent Compustat Research report, which is widely available from most brokerage services, provides this return on equity statistics for the years from 2014 through 2021. Throughout that period, the best year was 2018, when Intel’s return on equity reached 28.2%; the worst was in 2017, at 13.9%. Over the entire seven years, the return on investment averaged 21.4%. Over that same period, the S&P500 annual total return averaged 15.39%. The best return of 31.49% came in 2019, and the worst in 2018 when this measure posted a loss of 4.38%.

The point of this comparison is simply to show that Intel has done well over these last 7 years, both absolutely and relative to general stock market performance. Investors appear to have earned generous returns. And management didn’t seem to be doing too badly either. The total compensation for CEO Patrick Gelsinger, for example, came to $16,541,804 in 2021. You might see this figure as representing a pretty substantial package, but not so fast. The year before, Gelsinger brought home over $42 million. 2021 was actually a pretty nasty comedown. In any case, these are the people looking for a handout from Uncle Sam.

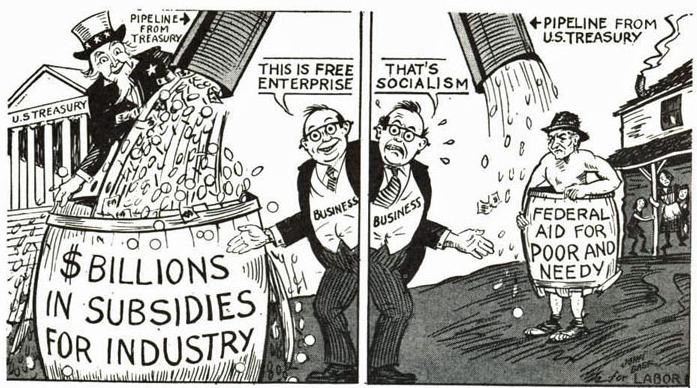

Why should this industry be seeking a federal handout? If there’s a need for capital, these firms can issue more stock or they can issue bonds. Instead, they seem to be asking for free money from the US government. Let’s understand, either an outright grant to a private company or a tax credit directly lines the pockets of the owners. Yes, spillover effects will foster some trickle-down benefits possibly to workers or customers, but the direct benefit would be to the owners. I simply think the money could be better spent, given the relative wealth of these prospective beneficiaries.

To be clear, the legislation awaiting reconciliation is considerably broader than the content of the Chips Act, and much of it is to my liking — particularly the allocations to research and government agencies including funding for a new National Semiconductor Technology Center that would work cooperatively with the Secretary of Defense, the Secretary of Energy, the National Science Foundation, and the Director of the National Institute of Standards and Technology. These allocations appear to be the kinds of provisions I favor, expecting them, in time, to expand the pool of talent available to support high-tech activities in a way that expressly addresses our national defense needs. The microchip shortage that we’re currently experiencing has no quick fix, as it takes several years to bring chip-making facilities to production ready, and funneling money to the corporate establishment, as we would do under the Chips Act, seems unlikely to change that reality. Such giveaways seem like a form of corporate welfare that we can do without.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.