It started a cryptocurrency investing opportunity that slid into George Kissi’s direct messages in late April.

It’s ending with a bitcoin loss of almost $20,000 that the self-declared “risk taker” from Dublin, Ohio calls “a total scam.”

“I don’t know why I fell for that, other than greed,” Kissi, 49, told MarketWatch. When you have your eye on the prize and want everything now, he said, “That’s when you get scammed.”

What happened to Kissi is a cautionary tale that’s becoming common and costly, according to regulators. Some people are luckier than others in avoiding scams, but Kissi made mistakes in his attempts to make money and learned a lot of lessons too.

Perhaps the most salient lesson in light of the current crypto crash: Losing a large chunk of your investments can be a stressful and emotionally taxing experience. As such, the promise of a big payday in such a volatile market can prove too tempting to resist.

Crypto con artists scammed Americans out of $1 billion since last year, with median reported losses of $2,600, according to the Federal Trade Commission. A common snare is the purported promise of “huge returns,” the agency said.

The question is how to stop it, as federal lawmakers come up with proposed bipartisan legislation aiming to put cryptocurrency under more government supervision.

But as crypto investments keep hemorrhaging value during the latest downturn in the market, the question is also whether market conditions will turn more investors into the targets of scammers preying on people trying to recoup loses.

“‘It’s difficult to predict exactly how the current bear market will impact illicit activity vulnerabilities across crypto investments.’”

— Kim Grauer, director of research at ChainalysisBy Wednesday, bitcoin

BTCUSD,

“It’s difficult to predict exactly how the current bear market will impact illicit activity vulnerabilities across crypto investments, especially given that an individual’s response to market strain can vary widely,” said Kim Grauer, director of research at Chainalysis, a cryptocurrency analytics firm working with government agencies, exchanges, financial institutions, and other clients.

For now, Grauer has not seen an increase of scamming across assets. “Anecdotally, we have heard that some people may lose money to scams because the high-risk stakes of these investment offerings are appealing,” Grauer said.

“Some people may invest in many investment opportunities with the expectation that most of them will fail, but a few might pay off. However, scammers also often target the most vulnerable, including the elderly,” he said.

Kissi has been day trading cryptocurrencies since 2017, and at the heart of his strategy is swapping coins to pocket returns. Kissi said he made $100,000 through his handiwork last year — as for this year, he’s holding his breath.

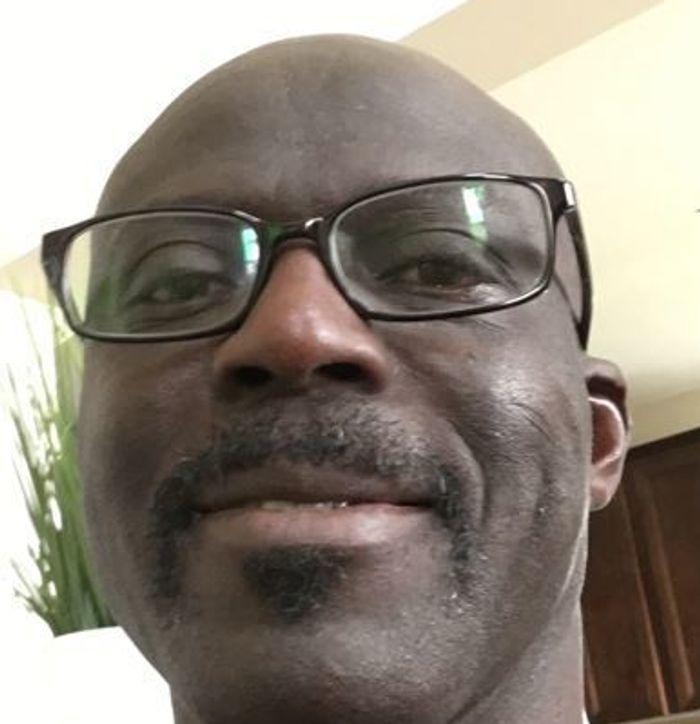

‘When you want all at once and want to be greedy, that’s when you get scammed,” said cryptocurrency investor and day trader George Kissi.

Courtesy George KissiKissi has seen the asset’s valleys, its peaks and its perils. It’s just turned him more bullish on crypto.

Months into the investing ride, he logged onto an exchange and learned that particular exchange was not allowed to operate in the United States. On that occasion, he lost around $1,000 in coin holdings dogecoin

DOGEUSD,

Other scams began with technical glitches Kissi encountered with some of his coins around a year ago. Kissi asked for help in a chat room and someone claiming to be of assistance got access to Kissi’s digital wallet and “just completely wiped me out.” (The lesson: Don’t give strangers in a chat room access to your wallet.)

Kissi does his own research, which includes listening in and participating in various online forums.

In late April, Kissi received a direct message to his Telegram account from a person he didn’t know. Kissi asked if they knew each other and the person replied, “So sorry, actually we share the same mutual group chat,” according to a screenshot reviewed by MarketWatch.

The person gave Kissi a heads up on an outfit. One email to this site requesting comment went through with no reply. Two follow up emails bounced back.

Wording on a cached version of the website — which is no longer operational — said the entity was a “U.K.-registered online digital-asset company.” It offered a “wide range of sustainable finances that integrates the most efficient Human-Centered Artificial intelligence to infuse cognitive fiat-cryptocurrency trading and financial services by analyzing millions of data points and execute trades at the optimal price.”

“‘There’s no in between with me.’”

— George Kissi, a Dublin, Ohio-based crypto investorFor $10,050 paid in Bitcoin, the return could be 19% in six days, according to screenshots Kissi provided. “Let’s give it a shot, because nothing ventured, nothing gained,” he figured, adding that double-digit gains are not unheard in this market. (The lesson: There is no such thing as guaranteed returns, and beware of sites that make such attractive promises.)

Kissi doesn’t flinch from risk. He was once a broker selling life and health insurance — industries built on the idea of odds, risks and rewards, Kissi notes. When it comes to investing, Kissi says he’s either all in, or he’s out. “There’s no in between with me.”

Even more so, Kissi emphasized he parted with crypto holdings he could afford to see vanish. “Always invest what you can afford to lose,” he said.

So Kissi made the bitcoin payment, gave it couple days and then sought a withdrawal. But Kissi’s returns appeared to be expanding so much, he was required to pay a higher fee, the site emailed him.

Even though Kissi suspected something was amiss, he made a last, desperate attempt to hold onto the belief that he had not just thrown his money away.supplied another $4,250 in mid-May. (The lesson: Don’t click on random links given to you by strangers on the internet.)

Over the next several days, Kissi began submitting complaints to authorities, including the Federal Trade Commission and the Ohio Attorney General’s office. Nevertheless, Kissi tried one more time to withdraw what he sunk in and paid another $5,050 in bitcoin in early June.

Why? Even Kissi’s friends told him not to do it, he recalled. “There was still a little part of me that said, ‘Maybe,’” Kissi said. Also, a scam might still at least pay out to one victim as it tried to operate by pulling in another, he said.

“Once you have bought into a con, much like a toxic relationship it can be difficult to extricate yourself from it.”

The FTC report on crypto scams echo Kissi’s experience. When victims “really try to cash out, they’re told to send more crypto for (fake) fees, and they don’t get any of their money back,” FTC researchers said.

(The lesson: Once you have bought into a con and made a decision to trust a source, much like a toxic relationship it can be difficult to extricate yourself from it.)

Kissi is resigned to never seeing the coins or his investment again. But he’s unapologetic about his decisions — particularly at a time when he hears from friends and relatives who complain about the losses in their 401(k) accounts. “There’s no safe haven anywhere,” Kissi said.

Of course, the key difference is 401(k) losses are paper losses, and history has shown — as it did in 2020 — that those losses are recoverable given time. Crypto, as a relatively new phenomenon, is more unpredictable. And losses to scam artists and rogue sites are, more often than not, gone forever.

Just 8% of people deemed cryptocurrency the best long-term investment, according to a Gallup poll last month. But the people who do see crypto as the best long term investment skew younger; 13% of people age 18-49 said it was the best investment, tying the percentage of people in the demographic who thought stocks and mutual funds were the best investment.

The S&P 500

SPX,

An FTC spokeswoman said she could not comment on individual complaints. But she added, “The internet facilitates scammers operating anonymously from anywhere in the world,” she said.

“Unlike with traditional forms of payment, such as credit or debit cards, cryptocurrency payments don’t typically come with any protections that can help consumers in the event of fraud,” she said. “We will continue to use our authority to warn consumers about cryptocurrency scams before they happen and to stop cryptocurrency fraud when it occurs.”

“It’s hard to predict the likelihood that any one individual would get their money back from a scam,” said Grauer, at Chainalysis. Still, she added, “law enforcement agencies are seeing more and more success in seizing cryptocurrency that has been used for illicit purposes.”

Cryptocurrencies may need more regulations and investor protections. Kissi obviously agrees. But there are rules, and then there’s risk tolerance — and extra laws can’t address an investor’s gung-ho mindset. Kissi said he can stomach his losses, even those made to scams, but the real worry is the scores of people who don’t fully appreciate the risks.

As for crypto investments? “Anything is possible for better and for worse, and I think that does attract a certain type of risk taker,” said Columbia Business School professor Omid Malekan, author of books including “The Story of the Blockchain: A Beginner’s Guide to the Technology That Nobody Understands.”

Malekan thinks good things will come for crypto in the future, but people could stand to lose a lot of money while the young asset matures. “Where the industry should be more thoughtful is communicating the risk and the volatility,” he said.

Months ago Matt Damon’s Crypto.com commercial told millions of Super Bowl viewers that “fortune favors the brave.” Now it’s being skewered for how much money’s been lost in crypto holdings ever since.

Meanwhile, Kissi is undeterred. He is involved in an arbitrage platform to turn profits — that’s the plan, anyway — on varying prices, but he also has $5,000 in bitcoin tied up in various trades. There’s also a roughly $50,000 investment in lesser-known coins that has fallen to $2,500 — at least, that was the value the last time Kissi was willing to take a look.

He advises people to do their due diligence. But as the recent plunge in cryptocurrency has shown, he adds, “Sometimes your due diligence is not enough.”

“All these loses, all of these experiences, they just strengthened my belief in the fact that a lot of money can be made in this space,” he said.

But whether or not you encounter scammers along the way, as the latest crash in the crypto market has shown, the opposite is also true.

Related:

‘I missed the bus on Bitcoin, but now feel like my time has come. I have another 25 years of a boring 9-to-5 job.’ Is the crypto crash an opportunity to buy low?

Opinion: What Ben Bernanke and other bitcoin skeptics get wrong about crypto — even after this latest crash

Tough times in the bitcoin mines. Pressure from the miners set to keep weighing, says analyst

Hot

No comment on record. Start new comment.