Tomorrow at 2:00 pm GMT the Bank of Canada (BOC) will publish its monetary policy decision for the month of June.

What are markets expecting? More importantly, how may major CAD pairs react?

Here are points you need to know:

What happened last time?

- BOC raised overnight rates by 50 basis points to 1.00% as expected

- “Quantitative Tightening” to start on April 25

- GDP forecasts revised lower for 2022 (from 4.0% to 3.5%) and 2023 (from 3.5% to 2.5%)

- Inflation estimates revised higher for 2022 (from 4.2% to 5.3%) and 2023 (from 2.3% to 2.8%)

As expected, Governor Macklem and his team raised BOC’s interest rates by 50 basis points in April.

They also took cues from the Fed and began shrinking its balance sheet by allowing maturing Canadian government bonds to go unreplaced. Macklem estimates that around 40% of the bonds in the balance sheet will mature in the next two years.What caught the markets’ attention was BOC announcing that “interest rates will need to rise further” after sharing that more than two-thirds of Canada’s CPI component is rising faster than 3%.

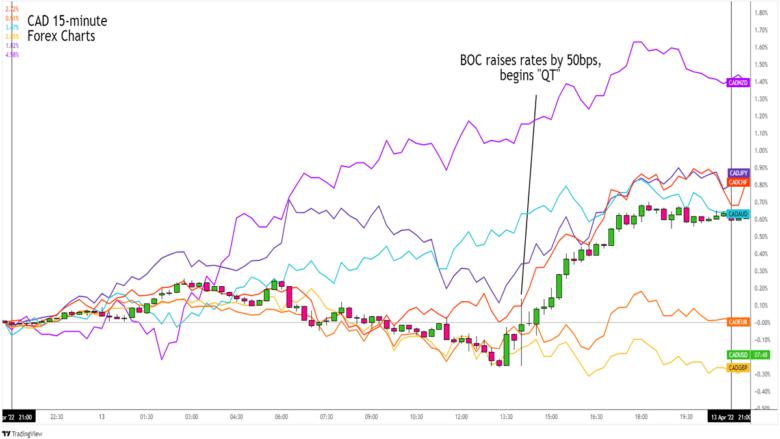

CAD 15-Minute Forex Charts

The lack of end in sight for BOC’s interest rate hikes helped push CAD higher against the safe-havens and its fellow comdolls. It also helped stem intraday downswings against European currencies like EUR and GBP.

What are traders expecting this time?

- BOC to raise overnight rates by another 50 bps to 1.50%

- Word on the impact of high interest rates on the economy

- Unless there’s renewed hawkishness, CAD’s reactions may be limited

BOC is widely expected to raise its interest rates by another 50 basis points to 1.50%. That’s the highest since January 2020!

But since the move is widely anticipated (read: priced in), CAD may not see as much volatility as it had in April.

Any hints from the presser may help. Back in April, Macklem was confident that “the economy can handle” higher rates. BOC won’t publish new growth and inflation estimates this time but talks of persistently high inflation would put further rate hikes on the table.Unless we see a 75-basis point hike or talks of even more rate hikes, then CAD could see a buy-the-rumor, sell-the-fact situation if not ignore the event in favor of bigger economic themes.

That doesn’t mean you shouldn’t trade CAD during the event though!

You can check out the major CAD pairs’ short and long-term trends to see if there are trend entry opportunities.

You can also compare CAD’s current performance against its major counterparts and compare them to their CAD’s average volatility in case there’s room for mean reversion plays.

Good luck and good trading this event!

Hot

No comment on record. Start new comment.