RBI hikes repo rate by 40 basis points to 4.40% as it seeks to reign in inflation

Key Highlights

- US Federal Reserve raises rates by 50 basis points, biggest hike in two decades

- Bank of England raises the rate to 1% with warning of 10% inflation.

- India's April services growth at 5-month high amid mounting price pressures.

- US non-farm payrolls rise by 428K in April, versus a forecasted 391K gain.

The EU is willing to exempt some central European member states from its embargo on Russian oil

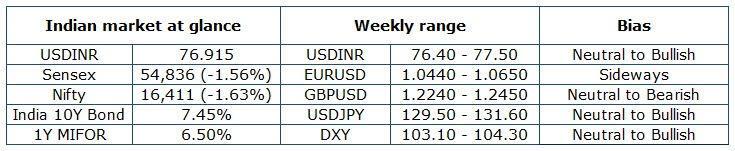

USDINR Weekly performance & outlook

The USDINR pair made a gap up opening at 76.49 and remained volatile during the week. The pair closed the last day of the trading session at 76.9150 levels. The dollar index continues to trade firm above 103 levels as the expectation of the 50 bps by the Fed in the FOMC meeting gave support to the dollar. The USDINR pair rose as rapid shifts towards higher interest rates by major central banks across the globe soured the outlook on emerging market assets, wreaking havoc on domestic equity and bond markets. The stronger dollar globally and elevated crude prices also dented the sentiment for the rupee. The pair is expected to trade with a neutral to bullish bias on the back of firm dollar amid Fed’s aggressive rate hike expectations to curb inflation. Elevated crude oil prices and overall global uncertainty is expected to keep the rupee under pressure. The anticipated IPO inflows may cap the major gains in the pair. Lately, RBI has been protecting the rupee levels which has led to the drop in the forex reserve. As per the latest data from RBI, the country's foreign exchange reserves slipped to USD 597.73 billion in the week ending 29th April from USD 617.65 billion in the week ending 25th March.

ECB sees a sequence of moves to lift rates into positive territory: Lane

EUR/USD:

The euro gained strength after much factored in the Federal Reserve rate hike as the dollar lost ground post FOMC meet. However, the EURUSD pair lost the gains as the dollar rebounded globally and in the wake of damaging data from the Eurozone and ongoing concerns over the Ukraine crisis. After bottoming out at the 1.0480 in the last trading session, the EURUSD pair managed to regain some buying interest and now reclaim the area further north of the 1.0500 barriers. Lending some support to the euro side was commentary from ECB’s Villeroy, who suggested that the bank’s policy rates could return to positive territory by the end of the year. The outlook still remains tilted towards the bearish, in response to dollar dynamics, geopolitical concerns, and the Fed-ECB divergence. German industrial production fell more than expected in March as pandemic restrictions and war in Ukraine disrupted supply chains, making it difficult to fill orders, official data showed. The pair is expected to trade with a sideways bias.

BoE chief defends cautious rate hiking cycle, sees unprecedented shock to people's income

GBP/USD:

The GBPUSD pair recovered modestly after having slumped to its weakest level in nearly two years below 1.2300 in the last trading session. The pair, however, is unlikely to stage a steady rebound in the near term after the Bank of England's dire recession warning on Thursday. Following its decision to hike the policy rate by 25 bps to 1%, the BoE noted that the UK economy could go into recession in 2022 with inflation rising above 10% amid surging energy prices. The bank also refrained from providing any details on the quantitative tightening plan, saying that they would unveil a plan at the August meeting. The BOE's gloomy outlook suggests that the policy divergence between the Fed, which is on track to hike its policy rate by 50 bps in the next couple of policy meetings, is likely to widen. Hence, the fundamental outlook is likely to continue to favor the dollar over the pound, limiting the GBPUSD's gains to technical corrections. The pair is expected to trade with a neutral to bearish bias.

Dollar near 20-year highs amid global markets rout

Dollar Index:

The dollar index pared gains after hitting a new 20-year high, as traders weighed a recent global market sell-off stoked by recession fears. The U.S. currency has stood tall on expectations the Federal Reserve will tighten monetary policy faster than peers to stem runaway inflation. The dollar index reached 104.09 on Friday, the highest since December 2002, before falling back to close at 103.68 levels. Data on Friday showed U.S. jobs increased more than expected in April. The next major U.S. economic focus will be consumer price inflation data on Wednesday. This is expected to show that price pressures rose at an annual pace of 8.1% in April, just below March's reading of 8.5%, according to the median estimate of economists polled by Reuters. The dollar index is expected to trade with a neutral to bullish bias on the back of a stronger dollar.

Domestic and Global Equities

Domestic Equities:

Following the rout in the US markets, the Indian stock market fell sharply on Friday. As per the stock market experts, extremely fragile due to the entrenched inflation and the possibility of harsh measures by the central banks to tame the same, further other factors like geopolitical tensions, stagflation risk, and global economic growth slowdown have spooked Indian Investors and this led to a sharp fall in Sensex and Nifty this week. In India, the benchmark Sensex fell 1.56% to close the day at 54,836 while the Nifty declined 1.63% to settle at 16,411 in the last trading session. Among sectors, IT, metal, and realty indices fell 2-3%. Meanwhile, the domestic factors like earnings and macroeconomic data would further add to the choppiness and it’s prudent to limit positions and continue with a stock-specific trading approach. The Sensex fell by 3.90% while the Nifty corrected to the tune of 4.04% during the week.

Global Equities:

Global stock markets slid further as investors worried the Federal Reserve may not be able to curb inflation in the years ahead even as U.S. data showed decelerating wage growth in April. Trade was volatile on Wall Street. The Nasdaq and S&P 500 posted their fifth straight week of declines, and the Dow it's sixth. It was the longest losing streak for the S&P 500 since mid-2011 and for the Nasdaq since late 2012. Fed funds futures priced in a roughly 75% chance of a 75 basis-point interest rate hike at next month's Fed policy meeting even after Fed Chair Powell said the U.S. central bank was not considering such a move.

Domestic and Global Bonds:

Domestic Bonds:

The domestic bond market sell-off continued after the Reserve Bank of India shocked the markets with a 40bps repo hike and 50bps CRR hike. The elevated crude oil prices, higher US yield and FII outflows further kept the domestic bond yields under pressure this week. The government bond auction for Rs 32,000 crore, the first after the 40 basis point hike in the policy repo rate, sailed through on Friday as the Reserve Bank of India accepted the bids. Bond dealers said the yield had moved up before the repo rate hike. The acceptance of bids indicates the RBI is not alarmed at the rising yields. Meanwhile, the bond yield on the 10-year benchmark hardened by five basis points to 7.45% at the close of trading.

Global Bonds:

Treasury yields rose as market participants digested a volatile week in markets. The yield on the benchmark 10-year Treasury note rose 9 bps to close at 3.14% in the last trading session. It hit 3.144% at one point from the previous close, its highest level since 2018. This came after the Federal Reserve announced a 50 bps interest rate hike. The yields dipped initially following the decision on Wednesday, with stock markets seeing a relief rally after Fed Chair Powell said a more aggressive 75 bps hike was not on the cards. However, later in the week, there was heavy selling in both the markets, as investors remained concerned that a slowdown in economic growth could be a consequence of the Federal Reserve’s hawkish tightening of monetary policy.

Monthly FPI Net Investments:

Foreign portfolio investors have been net sellers of domestic equities for the eighth straight month in May. Weak global markets, unabated foreign fund outflows, and firm crude oil prices played spoilsport for equities as well as the debt market. The net outflow in the May month from equity and debt combined stood at INR -6,745 crores. Demand for the US dollar is expected to remain strong globally which may take US dollar Index above 105 levels in the near term. If this happens, then FIIs may continue to remain on the net seller’s side putting more pressure on the Indian market.

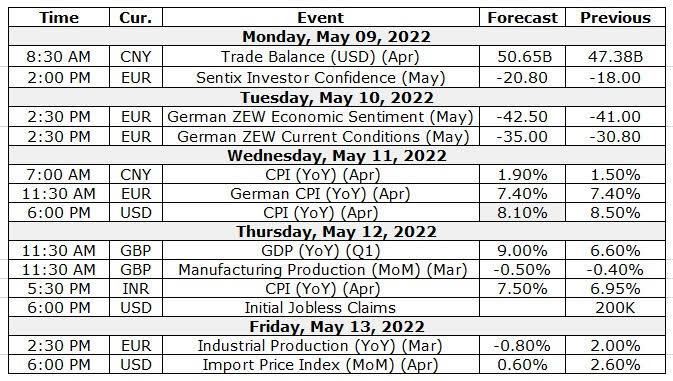

Macro-economic calendar

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.