RBA: Hawkish hold as inflationary pressures rise

The RBA has recognised that it may need to be less ‘patient’ over increasing interest rates due to rising inflationary pressures in Australia. One of the strange things from the RBA has been the fact that even before this last meeting it projected inflation to be within their 2-3% band for the next 2 years. In this last meeting, it appears willing to concede that these inflationary pressures may become more ingrained.

Inflation transitory?

The RBA identifies the main drivers for inflation as supply-side problems and Russia’s actions in Ukraine combined with strong demand as economies recover. However, the RBA remains uncertain whether these factors will resolve and how quickly or slowly that could be. This is the key to its uncertainty over whether inflation is transitory or more longer term. However, labour data is the RBA’s key to knowing whether to act or not.

The labour factor

The one area in which the RBA really wants to see increases before hiking rates is the labour market. The RBA recognises that wage growth has picked up, but still sees it as still around the relatively low rates that were around before the pandemic. The next wage price index print comes in around the middle of May. If wage prices grow to 3% y/y that would essentially be seen as the green light to hike rates for the RBA. It is the only piece of the jigsaw that the RBA wants to see falling into place.

The takeaway

One of the best pairs to trade the interest rate differentials between the RBA and the RBNZ is the AUDNZD currency pair. There is a very simple trendline that can be used to define risk. Stay above the trendline and stay with the trade. Get below and you can get out.

The seasonals

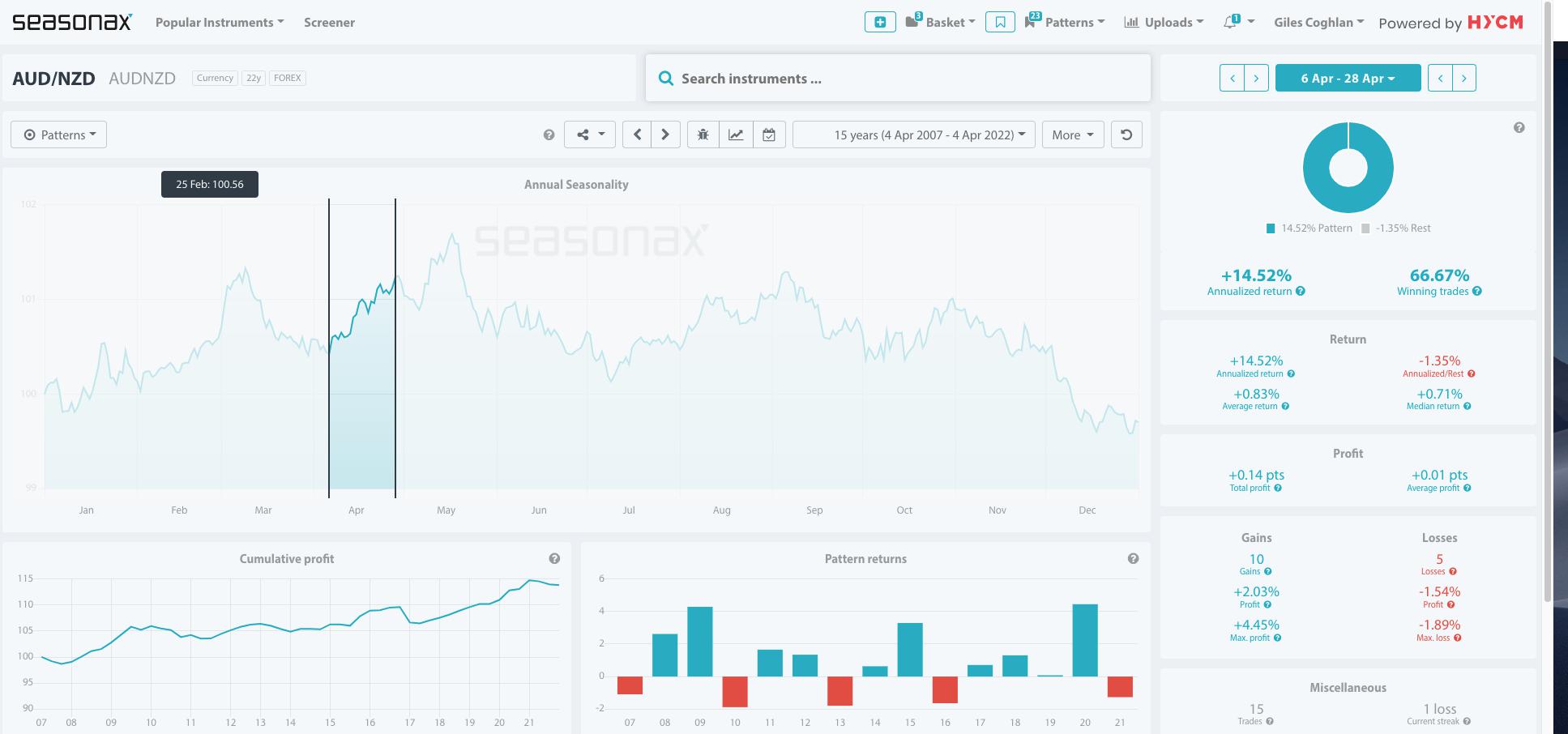

Seasonally you can see that the AUDNZD pair tends to see gains around this time of the year and this is worth bearing in mind.

The risks to this outlook revolve around any further shifts in RBA/RBNZ policy as well as any growth shocks coming from China.

Learn more about HYCM

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.