Market update: Stocks recover poise

“COVID remains a threat to the global economy. Initial evidence suggests the Omicron variant is more transmissible but results in less severe illness compared to previous variants,” – CBA.

-

USD (USDIndex 96.50) held onto gains as US stocks recovered all of Monday’s losses, as Yields also rose; USOil rose 3.7% breaking back over $70.00 and Gold once again pivots at $1788. Risk back on, & a weaker JPY & CHF. Asian markets also higher again. Huge spike in European wholesale power prices – OMICRON signs of market boredom? – Biden orders 500 million free at-home tests, UK & US cut contact isolation times from 7- to 5-days, Israel offers a 4th dose of the COVID-19 vaccination to people over 60.

-

Turkish Lira holds on to gains for now USDTRY at 12.60.

-

US Yields 10yr traded up to 1.487% and trades at 1.46% now.

-

Equities – USA500 +81 (+1.78%) at 4649 Dow +1.6%, Nasdaq +2.4% – USA500.F trades up at 4634. Nike +6.15% & Micron +10.54% after earnings beat. Other movers; TSLA +4.29% & CITRIX +13.63% as takeover target. PFE -3.39% & MRNA -2.98%.

-

USOil – rallied 3.7% peaking at $71.45, as sentiment lifts, low inventories and increasing demand.

-

Gold – once again rejected $1800 and pivots around the key 1788 level.

-

FX markets – EURUSD 1.1264, USDJPY rallies to 114.15, Cable recovers form 1.3200 to 1.3255 now.

Overnight – BOJ Minutes: “See need to keep monetary easing despite costs” (no surprise). UK Q3 GDP unexpectedly revised down to 1.1% q/q from 1.3% q/q reported initially. Business investment -2.5% vs. 0.4% and Current account deficit leapt to -£24.4b vs. -£15.8 expected and -£8.6b in previous quarter.

European Open – The March 10-year Bund future is up 16 ticks at 173.47, matching moves in Treasury futures. The long end outperformed and 30-year futures have been rallying overnight, as the risk on rally in stocks started to run out of steam overnight. DAX and FTSE 100 futures are still posting gains of 0.45 and 0.3% respectively, but US futures are fractionally lower, as virus developments and the outlook for US fiscal stimulus remains in focus. In Europe most governments seems to be shying away from imposing stricter lockdown measures this side of the Christmas holidays, but that may mean more stringent measures are needed thereafter.

Today – US GDP, Consumer Confidence, Existing Home Sales.

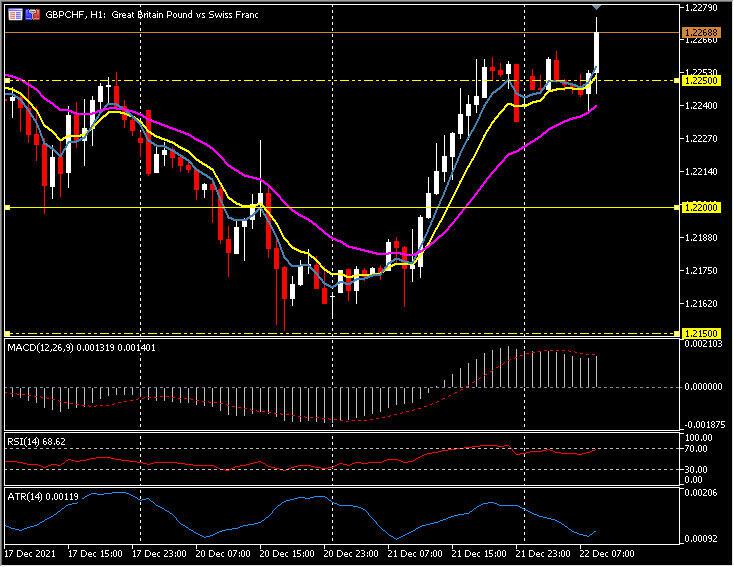

Biggest FX Mover (07:30 GMT) GBPCHF (+0.31%) Bounced from from test of 1.2150 lows Monday & Tuesday to 1.2270 now. MAs aligned higher, MACD signal line & histogram higher but stalling over 0 line since mid-Tuesday, RSI 68 & rising, H1 ATR 0.0012 Daily ATR 0.0087.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.