Societe Generale

GLE,

If materialized, it will be the first time a major bank borrows from decentralized finance, or DeFi protocols, which refer to programs powered by cryptocurrencies and blockchains without reliance on intermediaries.

As DeFi protocols replace human middlemen with self-executing computer programs, they claim to be more efficient, faster and cheaper. Supporters also point to DeFi’s potential to benefit unbanked communities, as no government ID or social security number is required to use the platforms.

However, DeFi has also drawn concerns from regulators and some investors, as they worry that a loophole in the code may lead to investors losing assets, while no one would take responsibility.

DeFi platforms are often seen as competitors of banks. However, SocGen’s most recent experiment may herald some integration between the two worlds. Advocates envision a future where DeFi plays a major role in the EUR 2.9 trillion European covered bonds market and even the near $11 trillion U.S. corporate bond market.

“I truly see banks and the financial industry as a whole, as probably the best and the largest clients, potentially, of those decentralized protocols,” Jean-Marc Stenger, chief executive officer at the subsidiary Societe Generale – Forge (SG Forge), told MarketWatch in an interview.

The Maker protocol is a decentralized application that allows users to mint DAI, an algorithm-powered stablecoin pegged 1:1 to the U.S. dollars, by depositing collateral assets. As one of the earliest DeFi protocols that received mass adoption, Maker has $15 billion value locked on it as of Monday, Oct. 18.

Unlike most companies with centralized leadership, Maker is governed by a decentralized autonomous organization, or DAO, where a group of holders of the governance token MKR make decisions.

The future of bond refinancing?

SG Forge is raising up to 20 million DAI, which equals $20 million, with a tenor of six to nine months from MakerDAO, according to a proposal the firm posted on the MakerDAO forum on Sept. 30. Proceeds from the loan will be used to refinance some OFH bond tokens due 2025 held by Societe Generale, according to the post.

In 2020, Societe Generale SFH, a subsidiary of SocGen, issued security tokens called OFH tokens on the Ethereum blockchain, representing EUR 40 million zero coupon covered bonds due 2025 backed by home loans. The bond was given top AAA ratings by Moody’s and Fitch.

Security tokens are when securities such as equities, debt or derivatives, are issued on blockchains.

Compared with traditional securities, issuing security tokens would enable access to broader liquidity pools, according to Stenger. “When you issue such securities on a public blockchain, it’s a worldwide infrastructure,” Stenger said. “You can access them from anywhere in the world. It’s like the internet.”

“This first experimentation of a refinancing structure of security tokens through a DeFi protocol will allow us to shape the future for bond refinancing business activity,” SG Forge wrote in the post on the MakerDAO forum.

SG Forge plans to offer such refinancing solutions for security tokens to its clients starting next year, according to Stenger. The firm has been structuring debt instruments, including covered bonds, secured and unsecured notes and structured products in the form of security tokens, with the first one launched in 2019.

In the test case with MakerDAO, SocGen used OFH tokens to ease the process, as the bonds were issued by a SocGen entity and all held by SocGen since then. Also they bear zero coupon interest so the deal could “avoid asset servicing complexity.”

Why DeFi?

In traditional loan financing, debtors usually post collateral that far exceeds principal of the loan to mitigate risks for creditors, but if the collateral depreciates, adjusting its amount could take up to a week, Stenger noted.

However, an automated lending platform such as MakerDAO could shorten the time of collateral adjustment to less than an hour.

“The amount of over-collateral you need to post in front of these operations is massively decreased.” Stenger said. “So it results in much better financial terms for the asset manager that owns the security.”

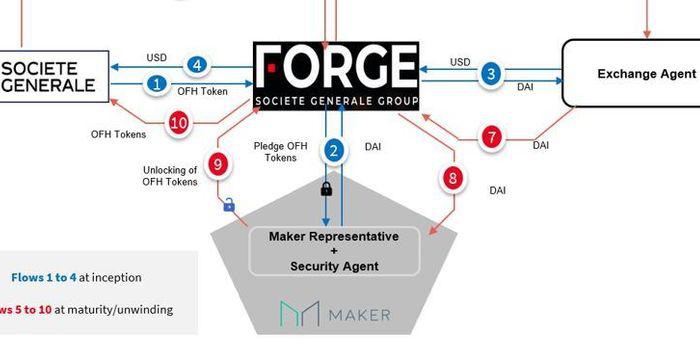

To raise the DAI loan, SG Forge would pledge all the EUR 40 million OFH bond tokens held by SocGen as collateral.

To complete the deal, SG forge will extend a loan in U.S. dollars to SocGen, which will then transfer the OFH tokens it holds to SG Forge. SG-Forge will borrow DAI from the Maker protocol and then exchange DAI to U.S. dollars with an exchange agent.

As MakerDAO isn’t a legal entity, the community will need to appoint a natural person or a legal entity to represent it, SG Forge noted in its proposal.

SG Forge proposed a deal structure to borrow from the Maker to refinance some OFH tokens

Societe GeneraleInteracting with a DAO

Even for SG Forge’s Stenger, who has more than 15 years of experience in traditional finance, interacting with a DAO is still a relatively new experience.

“We have been in touch with some members of this community to make sure we had the right understanding of how things should work and all the financial engineering and legal engineering we needed to organize this transaction in a way which is compliant,” Stenger said.

As SG Forge suggested a new form of collateral, it was required to submit a proposal for discussions and feedback. The MakerDAO community will later vote on the proposal, and if passed, the protocol’s risk, oracle, smart contracts, and optionally legal domain teams will assess the project.

Under SG Forge’s proposal, most people that participated in the conversation seem positive about it. (Participants in the forum aren’t necessarily holders of MKR.)

“Maker and SocGen-Forge are standing at the precipice of financial history. What a time to be alive,” user “PaperImperium” wrote.

“This MIP6 (proposal type) is a new landmark in DeFi and showing how DeFi and TradFi (traditional finance) are merging together to create Finance 2.0,” user “SebVentures” wrote. “This collateral should be seen as step 1 of what is next to come. Integrating all publicly traded bonds (that will be on Ethereum as we all know) and providing repo. Quite a huge market.”

Some expressed concerns about MakerDAO’s return. “No info about the stability fee, or any existing rate had been announced?” commented user “AXA.”

Stability fees are those users need to pay to “address the inherent risk in generating Dai(DAI) against collateral in Maker Vaults.” It resembles the concept of an interest rate in traditional loan financing.

A representative at SG Forge wrote in a follow-up post on Oct. 7 that the stability fees should be close to the refinancing rate of a covered bond, plus a liquidity premium. Other mortgage-backed covered bonds issued by SocGen SFH bear interest rates that range from 0.01% to 4%.

Some participants envisioned a future where all the mortgages backing European covered bonds are issued on the blockchain, where information is stored on the ledger and can be viewed publicly.

“While this is a very positive first step, let’s not forget that we should remain focused on a future where we tokenize all 350k mortgages in the pool for full on-chain transparency,” user “Jason” wrote.

“Jason” painted a picture where the issuer, credit ratings agencies, valuation firms, auditors, the Maker representative, and “any investors in the junior tranches” work together to measure the risks and price the loan.

“Such a structure will help solve some of the audit deficiencies that surfaced in 2008,” “Jason” wrote.

Read more: Major banks and other key financial institutions are working to tokenize assets ‘behind the scenes,’ says ‘Big Four’ firm EY

Hot

No comment on record. Start new comment.