Gold Price Forecast: XAU/USD bears keep $1752 in sight ahead of Fed – Confluence Detector

- Gold price retreats towards six-week lows, downside favored.

- USD holds weaker amid improved risk sentiment, yields firm up.

- Gold bears in driver's seat as focus shifts to FOMC.

Gold price is consolidating Monday’s rebound, as the bulls turn cautious heading into the two-day FOMC meeting that begins later this Tuesday. Expectations of Fed’s tapering plan remain alive and kicking tempering the mood around gold investors. Meanwhile, easing China's Evergrande scare has led to improvement in the risk sentiment, lifting the US Treasury yields at gold’s expense. However, gold buyers continue to find support from a broad-based US dollar retreat, thanks to the calm market tone.

Gold price halts its recovery mode after the bulls ran into stiff resistance near the $1767-$1768 region, as the six-week lows at $1742 continue to lure the sellers amid hawkish Fed’s expectations and a data-light US docket.

Read: Gold set to fall? Technicals to outweigh Evergrande risks

Gold Price: Key levels to watch

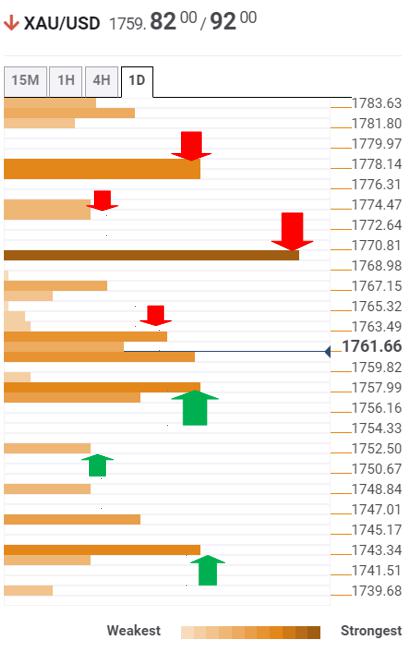

The Technical Confluences Detector shows that gold price struggles around a bunch of healthy resistance levels near $1762-$1763. That level is the convergence of the Fibonacci 23.6% one-day and Fibonacci 23.6% one-week.

Acceptance above the latter could challenge the range highs near $1768-$1770, which is the intersection of the Fibonacci 38.2% one-week and SMA100 one-hour.

Further up, the SMA5 one-day at $1774 will test the offers on the road to recovery.

The Fibonacci 61.8% one-month at $1778 would guard the further upside.

Alternatively, if the bulls fail to resist above $1760 support, then a drop towards the confluence of the Fibonacci 38.2% one-day and Bollinger Band one-hour lower at $1757 cannot be ruled out.

The Fibonacci 61.8% one-day at $1752 could emerge as minor support, below which the downside will open up towards $1742, the previous day’s low and the Fibonacci 38.2% one-month.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Reprinted from FXStreet_id,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.