Fundamental Forecast for the US Dollar: Neutral

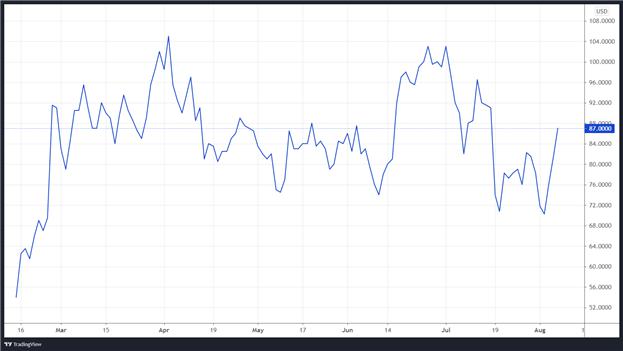

- The US Dollar (via the DXY Index) has rallied after the July US nonfarm payrolls report on the back of elevated US Treasury yields and a jump in Fed rate hike odds.

- Another hot inflation report is expected, and rates markets are starting to move in a manner suggesting that a more hawkish Fed could on the horizon; however, any upcoming change in policy will be limited to tapering asset purchases.

- According to the IG Client Sentiment Index, the US Dollar has a mixed bias heading into the second week of August.

US Dollar Back Up

The US Dollar (via the DXY Index) rallied after the July US nonfarm payrolls report on the back of elevated US Treasury yields and a jump in Fed rate hike odds. EUR/USD rates depreciated by -0.92% while USD/JPY rates added +0.47%. Even GBP/USD rates, which have been resilient of late, eased back by -0.28%. The question heading into the next week is simple: will the July US inflation report (CPI) help bolster the US Dollar’s rally?

Unlike around the June US inflation report (CPI), there is a greater chance that hot inflation readings spill into higher US Treasury yields – even though most Federal Reserve officials suggest that inflation is “largely transitory.” In a sense, this time is different: more evidence that high inflation is persisting could help US Treasury yields sustain their elevation, and thus, the US Dollar’s recent ascent.

US Economic Calendar Quiet then Loud

The progression towards the middle part of August will see a meaningful docket of event risk based out of the US. But the calendar is backloaded: neither Monday nor Tuesday will bring forth any truly important data releases; while Wednesday through Friday will contain all of the event risk.

- On Wednesday, August 11, the July US inflation report (CPI) will be released, with elevated inflation rates expected to persist. Also on Tuesday, the US federal government’s monthly budget statement for July is set for publication.

- On Thursday, August 12, weekly jobless claims figures are due, while the July US producer price index (PPI) – the cost of goods at ‘the factory gate’ – is due.

- On Friday, August 13, the preliminary August US Michigan consumer sentiment survey is expected. Within the report will be the latest update to consumer inflation expectations.

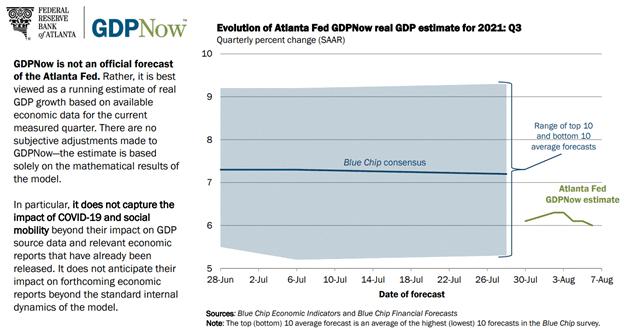

Atlanta Fed GDPNow 3Q’21 Growth Estimate (August 6, 2021) (Chart 1)

Based on the data received thus far about 3Q’21, the Atlanta Fed GDPNow growth forecast has been downgraded from +6.1% to +6% annualized. After the past week’s data, “a decrease in the nowcast of third-quarter real gross private domestic investment growth from +26.5% to +25.2% was partly offset by increases in the nowcasts of third-quarter real personal consumption expenditures growth and third-quarter real government spending growth from +3.8% and +2.8%, respectively, to +3.9% and +3.3%, respectively.”

The next update to the 3Q’21 Atlanta Fed GDPNow growth forecast is due on Tuesday, August 17.

For full US economic data forecasts, view the DailyFX economic calendar.

US Treasury Yield Curve (1-year to 30-years) (August 2019 to August 2021) (Chart 2)

Historically speaking, the combined impact of rising US Treasury yields alongside elevated Fed rate hike odds has produced a more favorable trading environment for the US Dollar.

Fed Still in the Spotlight

On the heels of back-to-back strong US labor market reports, the July US inflation report intensifies focus on the Federal Reserve’s narrative that price pressures are “largely transitory.” Another hot inflation report is expected, and rates markets are starting to move in a manner suggesting that a more hawkish Fed could on the horizon; however, any upcoming change in policy will be limited to tapering asset purchases.

We can measure whether a Fed rate hike is being priced-in using Eurodollar contracts by examining the difference in borrowing costs for commercial banks over a specific time horizon in the future. Chart 1 below showcases the difference in borrowing costs – the spread – for the August 2021 and December 2023 contracts, in order to gauge where interest rates are headed in the interim period between August 2021 and December 2023.

EURODOLLAR FUTURES CONTRACT SPREAD (AUGUST 2021-DECEMBER 2023): DAILY RATE CHART (February to August 2021) (CHART 3)

At their July high following the June US nonfarm payrolls report, there were 107-bps worth of rate hikes discounted by December 2023; at their low this week, there were just 69-bps discounted. Following the July US nonfarm payrolls report, there are now 87-bps priced-in. In other words, three full rate hikes are expected, and there is a 48% chance of four rate hikes by the end of 2023.

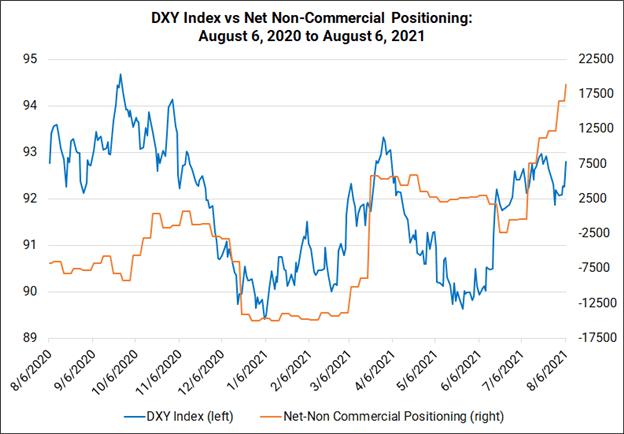

CFTC COT US Dollar Futures Positioning (August 2020 to August 2021) (Chart 4)

Finally, looking at positioning, according to the CFTC’s COT for the week ended August 3, speculators increased their net-long US Dollar positions to 18,880 contracts from 16,561 contracts. Net-long US Dollar positioning is now at its highest level since the second week of March 2020 (the apex of coronavirus pandemic concerns in financial markets).

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

Hot

No comment on record. Start new comment.