After a volatile start to the week on covid-19 fears, markets calmed down to a steady recovery by the end of the week.

The Canadian dollar was the top dog among the majors, not only rising with the recovery in risk, but also likely on rising oil prices as traders forecasts tightening supplies.

Notable News & Economic Updates:

- Dow sinks 2% on Monday as virus surge stifles recovery hopes

- OPEC+ agreed to boost oil production in August, demand improvements seen

- China’s banks keep rates flat, confirming policy stability

- U.S. yields slide on fears virus variant to hamper growth

- ECB pledges low rates for longer, warns about Delta variant

- The beta Covid variant is causing concerns in Europe. Should we be worried?

- Lagarde says ECB has learned from history, won’t tighten early

- Bubble burst: New Zealand suspends quarantine-free travel with Australia

- Oil edges up in weekly rebound on forecasts for tight supplies

- JP Morgan gives wealth management clients access to bitcoin, Ethereum funds

- European agency is 1st to approve Moderna jab for children

- Powell has broad support among top Biden aides for new Fed term

- ECB hawk says he’s uncomfortable with central bank’s new policy, but dissent shouldn’t be dramatized

- S&P 500, Nasdaq hit record highs on megacaps, earnings strength

- Covid cases are rising again in all 50 states across U.S. as delta variant tightens its grip

Intermarket Weekly Recap

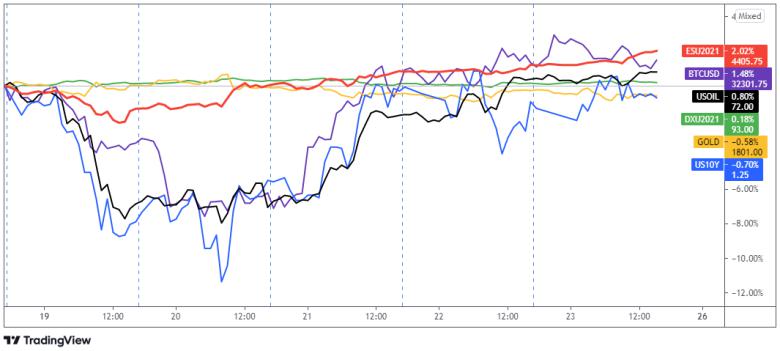

Risk aversion sentiment hit the markets at the start of the week as traders priced in fears that the recent rise in the covid-19 cases around the world would weaken the economic recovery. On the chart above, we can see the turn lower in risk assets (i.e., equities, oil, and bitcoin), as well as a fall in U.S. Treasury yields.

That sentiment lasted through Tuesday’s session, where a bottom in risk aversion sentiment seemed to quickly form, despite a lack of attributable news events or headlines. With no apparent catalysts for the shift in sentiment, that bottom was likely a “buy the dip” move by traders.

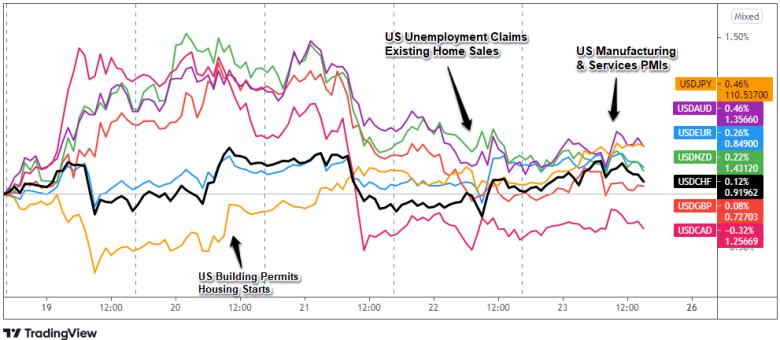

In the currency space, safe havens like the euro, yen, and Greenback benefited from the risk-off moves on Monday and Tuesday, and as expected in this environment, the comdolls were hard hit early on.

But as positive risk sentiment slowly recovered through the rest of the week, the comdolls eventually took the top spot among the majors, lead the Canadian dollar. The Loonie’s out performance was likely boosted by the swift recovery in oil prices as traders speculated that oil supplies would tighten.

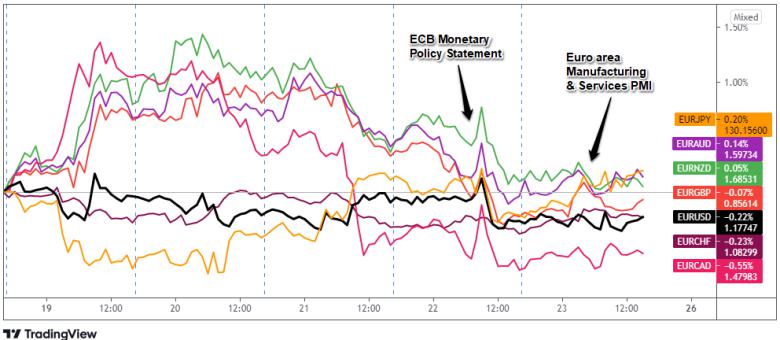

The euro had the most notable scheduled event of the week for currency traders with the latest monetary policy statement from the European Central Bank. This event came inline with the expectations that the ECB would remain accommodative, raised their inflation goal to 2%, and re-iterated that they’re not too eager to pull emergency support anytime soon. Euro volatility quickly pick up quickly on the event, ending with the euro lower on the session.

USD Pairs

- Fed official Kashkari: Many sectors still struggling with reopening

- U.S. homebuilder confidence falls to 11-month low in July

- U.S. housing starts rise in June, while building permits fall sharply

- U.S. mortgage applications decline in latest week as rates steadily rise -MBA

- U.S. weekly jobless claims totaled 419,000 for the week ended July 17, above the 350,000 estimate

- Republicans nix U.S. infrastructure debate, which could resume next week

- Existing homes rose 1.4% m/m in June; inventory increased from 2.5 month supply in May to 2.6 month supply in June

-

Flash U.S. Manufacturing PMI at 63.1 (62.1 in

June) - U.S. Treasury Secretary Yellen warns Congress on debt limit

GBP Pairs

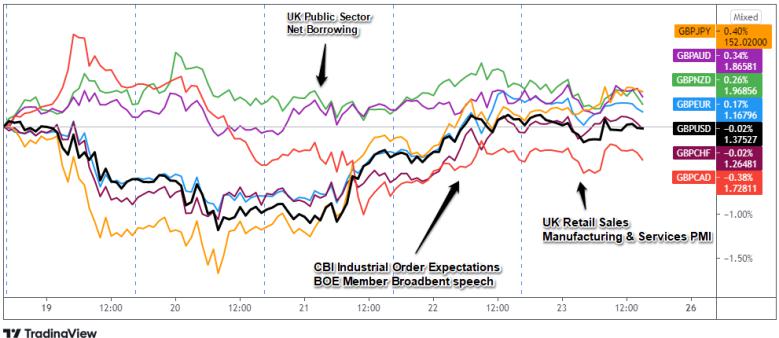

- BoE’s Haskel sees no need to curb stimulus in foreseeable future

- New BoE rate-setter Mann warns against early end to stimulus

- ‘Mini trade war’ imminent? EU rejects the UK’s attempts to overhaul the Brexit deal

- BoE’s Broadbent sees reasons for inflation tide to ebb

- U.K. GfK consumer confidence index up from -9 to -7

- U.K. retail sales up 0.5% vs. projected 0.2% dip on football season

- U.K. flash manufacturing PMI down from 63.9 to 60.4, services PMI down from 62.4 to 57.8

- Covid ‘pingdemic’ and Brexit mean food and gas shortages in parts of UK

EUR Pairs

- Germany’s Bundesbank sees faster growth barring virus comeback

- Germany Producer prices in June 2021: +8.5% on June 2020

- Euro area current account recorded €12B surplus in May 2021, down from €22B in previous month

- ECB set to tweak guidance to reflect its new 2% inflation target

- European Central Bank vows a ‘persistently accommodative’ stance in new guidance

- ECB pledges low rates for longer, warns about Delta variant

- ‘Mini trade war’ imminent? EU rejects the UK’s attempts to overhaul the Brexit deal

- In July 2021, the consumer confidence indicator edged down by 1.1 points m/m, in both the EU ( −5.6) & the euro area (-4.4)

- Flash Eurozone Manufacturing PMI at 62.6 (63.4 in June).

- ECB 2% goal must be 12 – 18 months away before hike, Villeroy says

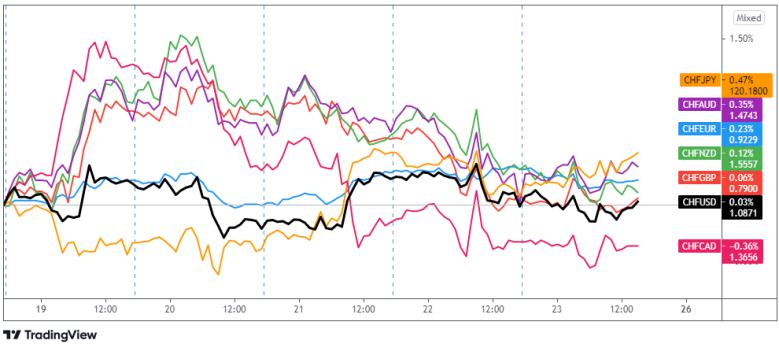

CHF Pairs

- No major news or catalysts from Switzerland this week. Price action was mainly influenced by broad risk sentiment as discussed earlier.

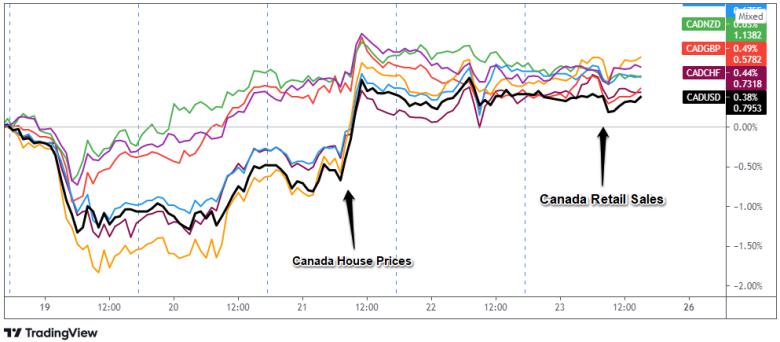

CAD Pairs

- Bank of Canada to make Kozicki Deputy Governor, expand Council

- Canadian retail sales fell by 2.1% in May amid COVID-19 lockdowns

- Cooler housing market won’t hurt Canada’s recovery, CIBC says

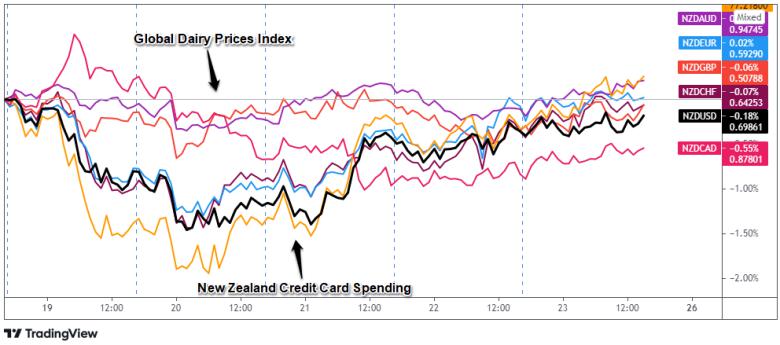

NZD Pairs

- Global Dairy Prices fall by -2.9% since Jul. 6

- New Zealand credit card spending up 6.3% after earlier 27.2% jump

- Bubble burst: New Zealand suspends quarantine-free travel with Australia

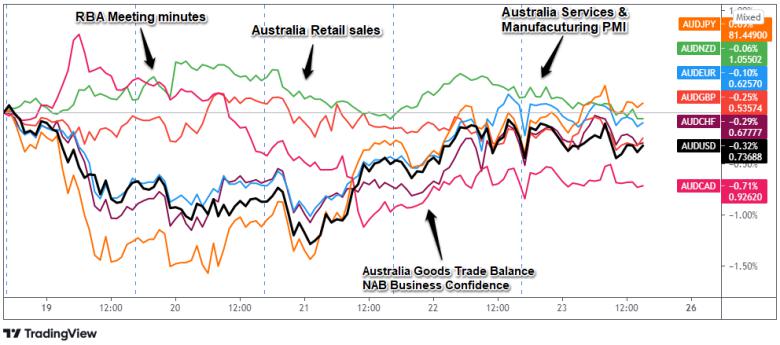

AUD Pairs

- Australia’s Victoria extends COVID-19 lockdown by seven days

- Australian central bank’s policy optimism tested by lockdowns

- Australian retail sales sank 1.8% vs. projected 0.7% drop

- Sydney COVID-19 new case count up 40% in past 24 hours

- NAB quarterly business survey: business conditions jump, confidence eased slightly in Q2 2021

- Sydney lockdown to extend past July

- Australia flash manufacturing PMI down from 58.6 to 56.8

- Australia flash services PMI slumped from 56.8 to 44.2

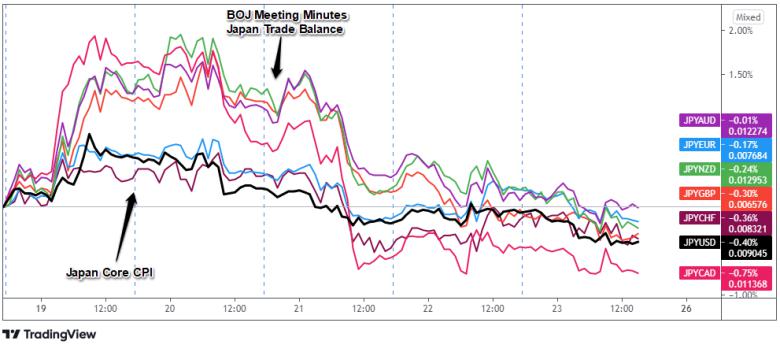

JPY Pairs

- Japan’s core inflation hits 15-month high on energy costs

- BOJ official Amamiya still hopeful for economic recovery on vaccinations

- Japan’s exports jump on solid U.S., China demand

Hot

No comment on record. Start new comment.