Not sure you noticed in the previous two examples in the previous lesson, but the A-Book broker did NOT make any money.

The examples were shown this way to keep the focus on how the broker offloaded its market risk.

So how do A-Book brokers make money?

Unlike a B-Book broker, an A-Book broker does NOT make money when its customers’ trades lose.

But an A-Book broker is not a charity. It’s a business and needs to generate revenue

Understanding how a broker generates revenue helps you understand their incentives. And focusing on the incentives will help you assess whether their interests align with yours.

Now that the risk transfer process has been explained, let’s add in more details and see how A-Book brokers actually make money.

How A-Book Brokers Make Money

When a broker acts as an “A-Book broker” if a customer clicks “Buy” for an asset (e.g. currency pair), it:

- immediately sells the asset to the customer, either at the same price that it receives from its LP (with a “commission”) or with a markup (with no commission). and then

- immediately buys the currency pair from the LP for its own account and records that transaction in its own trading book.

If your broker is not taking any risk on the trade, there are two primary ways for an A-Book broker to make money:

- Commission

- Spread Markup

Commission

In the previous examples, Elsa (the customer ) and the broker had the same entry and exit prices.

The way the broker can make money here is by charging Elsa a commission.

Commissions are normally charged according to the size of your trade. The way it’s expressed can vary between brokers.

It can be charged per lot, per million USD, or as a percentage of the trading volume.

For example, a broker may charge you $60 per $1M or $6 per standard lot.

Depending on the broker, discounted commissions may be offered based on your trading volume. The more you trade, the bigger the discount.

For example, if you trade over $100M volume per month, instead of paying $60 per $1M, you might receive a 33% discount, and your commission would be reduced to $40 per $1M.

Spread Markup

The other way an A-Book broker can make money is by applying a price markup or “marking up the spread”.

This is where a broker adds an extra amount to the pricing for its customers.

The broker makes money because the prices it trades with its liquidity providers (LPs) are better than the prices it trades with its customers.

The markup is the difference between the price shown to the clients and the price taken from the LPs.

This markup is similar to buying food at your grocery store.

The store pays “wholesale” prices and charges you a “retail” price. The difference between the two prices is the markup.

This is how the grocery store makes money in exchange for providing you a service (access to food).

Otherwise, it would make no profit and be out of business.

The same concept applies to the A-Book broker. In exchange for providing a service to its customers (ability to speculate on currency prices), it makes money by adding a price markup.

It pays “wholesale” prices from liquidity providers and charges you “retail” prices.

Essentially, an A-Book broker acts as a liquidity retailer.

Let’s look at an example to see how this works.

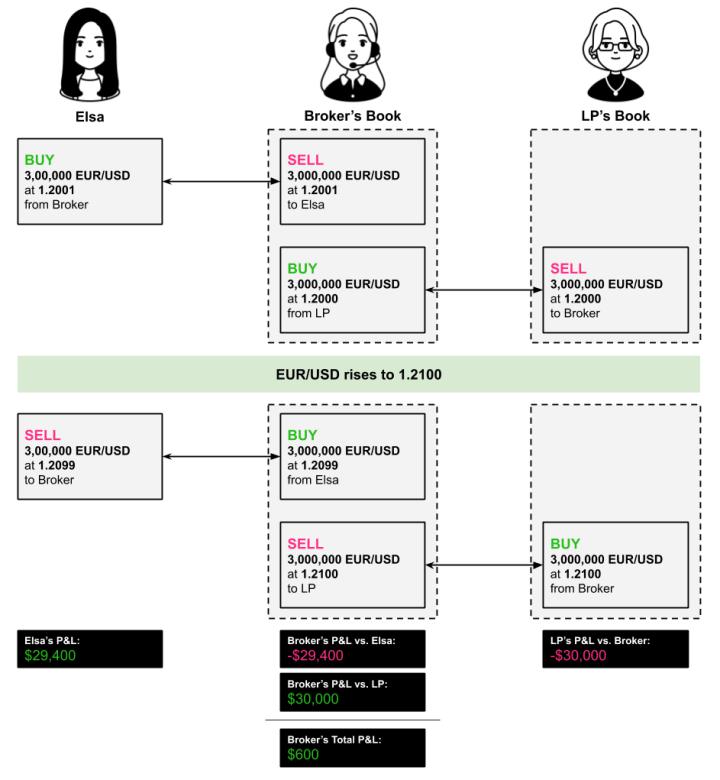

Price Markup Example: Buy EUR/USD

In this example, the broker adds a price markup of 0.0001 or 1 pip.

Elsa opens a long EUR/USD position at 1.2001.

Her position size is 3,000,000 units or 30 standard lots. This means a 1-pip move equals $300.

Notice how the broker buys lower from the LP than it sells to Elsa.

It bought EUR/USD at 1.2000 from the LP but sold EUR/USD to Elsa at 1.2001.

This is the 1-pip price markup in action.

When Elsa exits her trade, a price markup also occurs.

Notice how the broker sells higher to the LP than it buys from Elsa.

The LP is willing to buy EUR/USD at 1.2100, so the broker quotes Elsa 1.2099, to ensure it makes a profit on the transaction.

Scenario #1: EUR/USD Rises

As you can see, EUR/USD ended up rising.

Elsa ended up with a profit of 98 pips, which means her counterparty, the broker, ended up with an equivalent loss.

But…the broker was also in a separate trade with an LP.

In this trade, the broker ended up with a profit of 100 pips, which means its counterparty, the LP, ended up with a loss of 100 pips.

The profit made from its trade with the LP exceeds the loss incurred from its trade with Elsa (due to price markup), so the broker made an overall net profit of 2 pips or $600 ($300 x 2 pips).

Notice how when Elsa “won” here, the broker did not “lose”.

Because the broker had transferred the market risk to the LP, it avoided a loss when Elsa’s trade won.

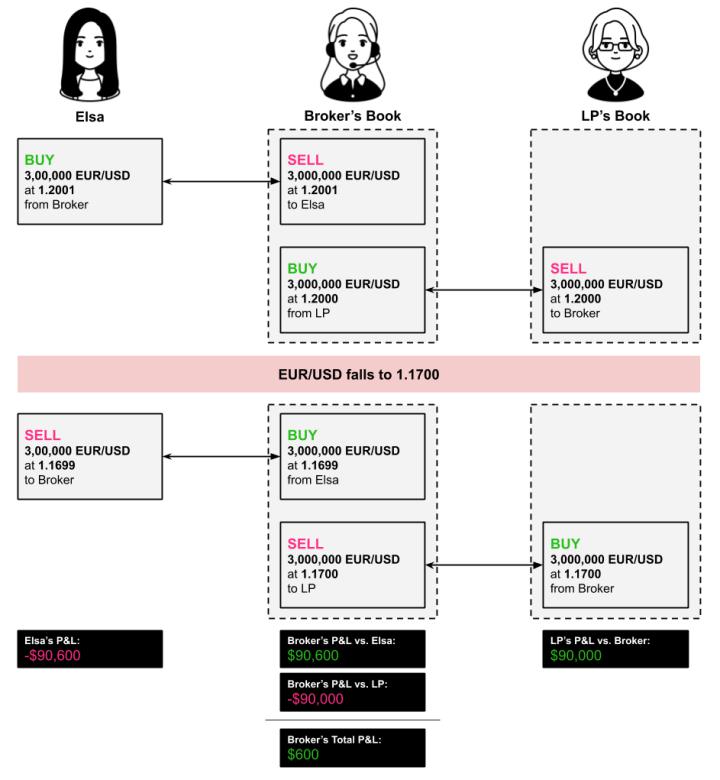

Scenario #2: EUR/USD Falls

Let’s see what happens if EUR/USD falls instead and Elsa ends up with a losing trade.

In this example, Elsa opens a long EUR/USD position at 1.2001.

Her position size is 3,000,000 units or 30 standard lots. This means a 1-pip move equals $300.

EUR/USD falls hard.

Elsa decides to cut her losses and exits at 1.699, ending up with a loss of 302 pips or $90,600 ($300 x 302 pips).

Since the broker is her counterparty, this means that the broker ended up with an equivalent gain.

But…the broker was also in a separate trade with an LP.

In this trade, the broker ended up with a loss of 300 pips, which means its counterparty, the LP, ended up with a gain of 300 pips.

The profit made from its trade with Elsa exceeds the loss incurred from its trade with the LP, so the broker still made an overall net profit of 2 pips or $600 ($300 x 2 pips).

Notice how the broker’s P&L ended up being the same regardless of whether EUR/USD went up or down.

Because the broker had transferred the market risk to the LP, it missed out on the 302 pips it would’ve gained if it had just internalized the risk.

But that’s the tradeoff for hedging.

When a trade is “A-Booked”, the advantage to a broker is that it’s no longer exposed to potential LOSSES due to price movements, but the disadvantage is that it’s also no longer exposed to potential GAINS due to price movements.

The broker’s revenue comes strictly from price markups.

As you’ve just learned, since an A-Book broker is not taking any risk on the trade, they make money by “marking up” the spread or charging a commission.

This business model removes any potential conflicts of interest since the broker would earn the same amount of money regardless of whether its customers win or lose.

The broker makes money regardless of how the market moves.

Of course, this all assumes that the A-Book broker has the backend technology to act quickly and without errors when hedging customer orders.

How A-Book Brokers Make Money

Here is a simplified model of how an A-Book broker makes money:

Spread Markup Example

Let’s look at a simple example of how to calculate a spread markup.

On average, a raw institutional spread on EUR/USD is around 0.1 pip and this is paid by the A-Book broker.

There’s also an A-Book volume fee that needs to be added to the broker’s costs.

For EUR/USD, it’s around $2 USD per lot, and that equals 0.2 pip.

Let’s add these up:

0.1 pips + 0.2 pips = 0.3 pips

Since the average spread in the retail market for EUR/USD varies from 1 to 1.5 pip, and the A-Book broker’s institutional cost equals 0.3 pip, adding a 1 pip markup will set the final retail spread at 1.3 pips.

This equates to $13 USD per standard lot or $1.30 USD per mini lot or $0.13 per micro lot.

So for every standard lot, the broker will make $10.

| Liquidity Provider (Raw Spread) | Trading Platform’s A-Book Volume Fee | Broker’s Markup (pips) |

Retail Spread (pips) |

Retail Spread (USD) | Income on each lot (pips) | Income on each lot (USD) | |

| EUR/USD | 0.1 | 0.2 | 1 | 1.3 | $13 | 1 | $10 |

| A-Book Transaction Fee | 0.3 | ||||||

And for every mini lot, the broker will make $1.

| Liquidity Provider (Raw Spread) | Trading Platform’s A-Book Volume Fee | Broker’s Markup (pips) |

Retail Spread (pips) |

Retail Spread (USD) | Income on each lot (pips) | Income on each lot (USD) | |

| EUR/USD | 0.1 | 0.2 | 1 | 1.3 | $1.30 | 1 | $1 |

| A-Book Transaction Fee | 0.3 | ||||||

And for every micro lot, the broker will make $0.10!

| Liquidity Provider (Raw Spread) | Trading Platform’s A-Book Volume Fee | Broker’s Markup (pips) |

Retail Spread (pips) |

Retail Spread (USD) | Income on each lot (pips) | Income on each lot (USD) | |

| EUR/USD | 0.1 | 0.2 | 1 | 1.3 | $0.13 | 1 | $0.10 |

| A-Book Transaction Fee | 0.3 | ||||||

As you can see, an A-Book broker barely makes money offering mini lots, only making about $1 per mini lot (10,000 units).

But the money is even punier when offering micro lots, where the broker only makes 10 cents!

Now you can see how difficult it is to operate as strictly an A-Book broker if you have customers who trade small position sizes.

Here’s how the broker’s income would look like with the growing number of customers compared to a different amount of mini lots (10,000 units) traded.

The numbers below show the broker’s income after paying the institutional spread and transaction fees.

Monthly A-Book Revenue Example

Based on the numbers above, here’s what an A-Book would make per month if its customers traded mini lots.

| Number of Customers | Number of mini lots per month per customer | ||

| 5 | 10 | 30 | |

| 100 | $500 | $1,000 | $3,000 |

| 500 | $2,500 | $5,000 | $15,000 |

| 1,000 | $5,000 | $10,000 | $30,000 |

| 5,000 | $25,000 | $50,000 | $150,000 |

| 10,000 | $50,000 | $100,000 | $300,000 |

Yearly A-Book Revenue Example

Based on the numbers above, here’s what an A-Book would make after 12 months if its customers traded mini lots.

| Number of Customers | Number of mini lots per month per customer | ||

| 5 | 10 | 30 | |

| 100 | $5,000 | $12,000 | $30,000 |

| 500 | $30,000 | $60,000 | $150,000 |

| 1,000 | $60,000 | $120,000 | $360,000 |

| 5,000 | $300,000 | $600,000 | $1,500,000 |

| 10,000 | $600,000 | $1,200,000 | $3,600,000 |

As you can see, it’s hard for A-Book brokers to make money unless they have A LOT of customers who trade FREQUENTLY (preferably at large sizes).

A-Book brokers are motivated to have profitable traders because profitable traders tend to increase either their trading size and/or volume which means more revenue for the broker.

Advocates of A-Book brokers argue that the A-Book execution model is “better” for customers versus B-Book since the broker is not directly profiting from customers losing money on the trade. This means that a broker’s interests are more aligned with their customers.

But the A-Book execution model also comes with its own challenges…

Hot

No comment on record. Start new comment.