Small Business Finances in Illinois during the COVID-19 Pandemic

For small businesses across the country, the onset of the pandemic was an unexpected adverse shock to normal business. The early days of the pandemic were marked by widespread reductions in operations or even temporary closures as businesses abided by the restrictions necessitated by the pandemic and consumers changed their behavior. As the pandemic continued, however, many small businesses adapted.

This brief focuses on the financial outcomes of small businesses in Illinois from March 2020 through February 2021. By analyzing a full year of outcomes during the pandemic, we offer insight into the financial health of small businesses after a protracted period of restrictions. In as much as the firms in this sample all faced the same state restrictions and recommendations, our results shed light on outcomes that are unlikely to be driven by differences in these policies.1 In addition, this perspective may be particularly relevant for state and local decision makers, who can interpret these findings in their geographic context.

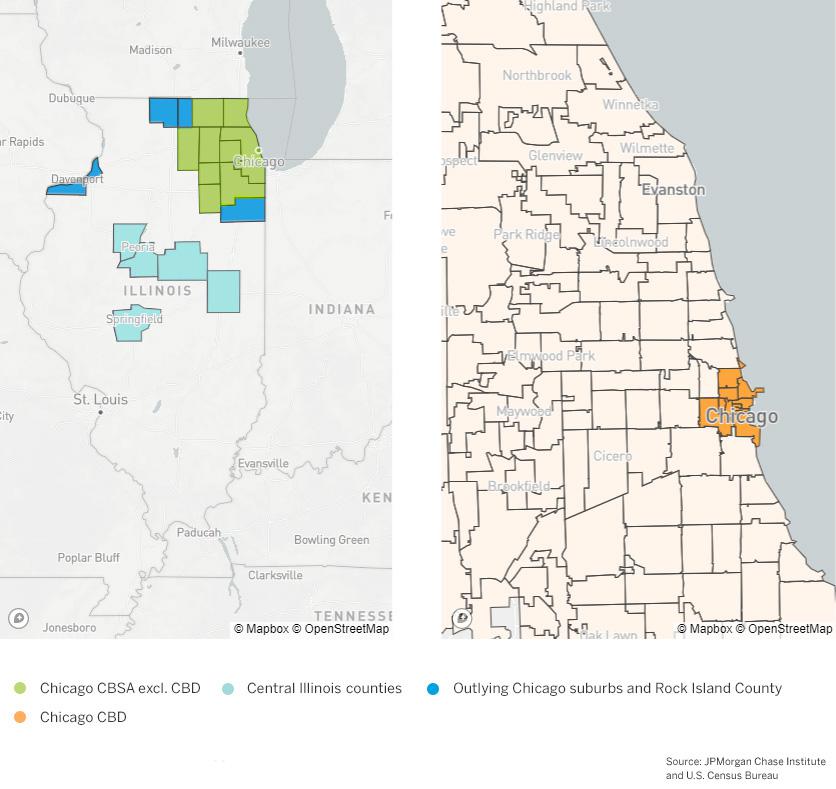

Our sample includes small businesses with Chase Business Banking deposit accounts that were operating in the year prior to March 2020. Our sample covers the relatively urban counties near Chicago, Davenport, and in central Illinois in which Chase has a retail branch footprint.2 Notably, small businesses tend to be relatively concentrated in metro areas. Figure 1 shows the locations where the firms in our sample are located. We combine the counties into several groups: the Chicago central business district (CBD), the Chicago CBSA3 excluding the central business district, outlying Chicago suburbs and Rock Island County, and central Illinois counties. Within the Chicago CBSA, we analyze small business finances at the ZIP code level by neighborhood characteristics derived from U.S. Census Bureau American Community Survey data, excluding the Chicago CBD centered around the Loop.

Figure 1: The sample of small businesses in Illinois covers urbanized counties.

We previously showed the revenue and expense growth trajectories of small businesses through September 2020 (Farrell et al. 2020). This analysis uses a full 12 months of financial data, which captures a cumulative view of small business finances during a period in which some may have closed temporarily and reopened, provides an estimate as to whether the recovery in later months was sufficient to offset the steep declines in the initial weeks, and addresses issues of seasonality that may be present for some businesses. In addition, COVID-19 vaccines became more widely available in Illinois in early 2021,4 so the 12 months ending in February 2021 is a year in which pandemic precautions were applicable to most.

We find that over the course of the year, small businesses adapted but their revenues have not fully recovered, although their cash balances are elevated relative to pre-pandemic levels. We found:

- Finding 1: Median expenses declined by a greater degree than median revenues during the COVID-19 pandemic. The largest declines were in Chicago’s central business district and in central Illinois.

- Finding 2: Small personal services firms were the most impacted and were especially hard hit in the Chicago CBSA.

- Finding 3: Firms located in lower-income and more racially diverse neighborhoods were less profitable during the pandemic.

As COVID-19 vaccination rates rise and restrictions are lifted, small businesses will continue to recuperate. Our analyses provides insight into the industries and locations which have been more severely impacted by the pandemic and may need support not only to recover from the past year’s losses but also to rebuild deliberately, allowing for future resilience as well as opportunities for growth.

Reprinted from JP Morgan,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.