Gold Talking Points

The price of gold pares the advance following the update to the US Consumer Price Index (CPI) as the 10-Year US Treasury yield bounces back from a fresh monthly low (1.43%), and the Federal Reserve interest rate decision is likely to sway the near-term outlook for bullion as the central bank is slated to update the Summary of Economic Projections (SEP).

Fundamental Forecast for Gold: Neutral

The price of gold may face range bound conditions ahead of the Fed rate decision as the central bank appears to be on track to retain the current path for monetary policy, and it remains to be seen if the Federal Open Market Committee (FOMC) will adjust the forward guidance for monetary policy as the central bank braces for a transitory rise in inflation.

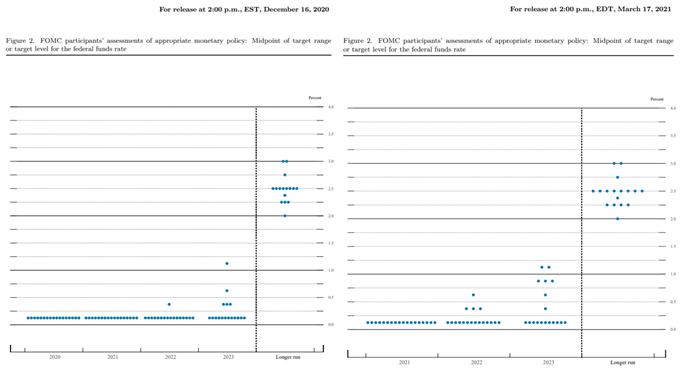

More of the same from the FOMC may prop up gold prices as the central bank plans to “increase its holdings of Treasury securities by at least $80 billion per month and agency mortgage-backed securities by at least $40 billion per month until substantial further progress had been made,” and the fresh projections from Chairman Jerome Powell and Co. may drag on longer-dated US yields if the interest rate dot-plot remains largely unchanged from the March meeting.

Source: FOMC

At the same time, another upward revision in the SEP may drag on the price of gold as it boosts speculation for a looming change in monetary policy, and a growing number of Fed officials may change their tone over the coming months as “a number of participants suggested that if the economy continued to make rapid progress toward the Committee's goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases.”

With that said, fresh projections from Fed officials may drag on gold prices if the central bank shows a greater willingness to switch gears, but more of the same from Chairman Powell and Co. may keep the price of bullion afloat as the FOMC relies on its emergency measures to achieve its policy targets.

--- Written by David Song, Currency Strategist

Follow me on Twitter at DavidJSong

Hot

No comment on record. Start new comment.