Whattup, forex geeks! If you’ve peeked at your forex calendars, then you’ll know that the U.S. is set to print its CPI data tomorrow at 12:30 pm GMT.

Think you’re ready to trade the event?

Here are points you need to know first:

What the heck is a CPI report?

The consumer price index (CPI) report reflects the monthly change in the prices of goods and services purchased by consumers. The U.S. also publishes a “core” version, which removes volatile items such as food and energy prices.

Traders look at CPI because stabilizing prices is one of the Fed’s main #CentralBankGoals. That means it can change its policies if there are any significant trends that might affect economic growth.

What happened last time?

- Headline CPI (m/m): 0.8% vs. 0.2% expected, 0.6% in March

- Core CPI (m/m): 0.9% vs. 0.3% expected and previous

- Headline CPI (y/y): 4.2% vs. 3.6% expected, 2.6% in March

- Core CPI (y/y): 3.0% vs. 2.3% expected, 1.6% previous

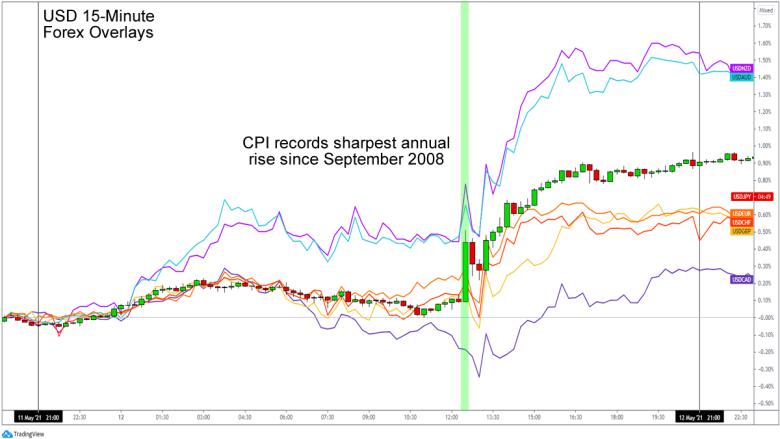

Consumer prices jumped by 0.8% from March and a whopping 4.2% from a year ago in April. That’s the fastest annualized increase since September 2008!

The base effect of comparing it to lockdown levels last year had contributed to the surge, of course, but semiconductor shortages, business re-openings, and other supply constraints have also boosted the prices of used cars (up 10%) and other key goods.

The markets and the Fed had expected price increases, but the surprisingly high numbers inspired talks of tapering for the Fed and boosted the dollar higher. USD popped up across the board and stayed near its intraday highs until the end of the day.

What are traders expecting this time?

- Headline CPI (m/m): 0.5% vs. 0.8% previous

- Core CPI (m/m): 0.6% vs. 0.9% previous

- Headline CPI (y/y): 4.7% vs. 4.2% previous

- Core CPI (y/y): 3.2% vs. 3.0% previous

Analysts see price increases slowing down from 0.8% to 0.5%, with core prices also easing from 0.9% to 0.6%.

But leading indicators support faster price increases:

Markit’s manufacturing PMI noted that supply chain disruptions and backlogs have led to the “fastest rises in input rises” on record and that manufacturers are passing it on “at an unprecedented rate.”

The services sector is also seeing unprecedented levels. Markit’s services PMI noted that “service providers raised their charges at an unprecedented pace” while ISM shared that “The last time the Prices Index was this elevated was when it registered 77.4 percent in July 2008.” Yipes!

How can you trade the event?

Traders will be looking for signs that price surges are as temporary as the Fed said they would be. Remember that the longer prices remain high, the more likely they are to be permanent.

If May’s price increases sharply surpass the market’s already high expectations, then we could see dollar demand jump as traders price in the increased pressure on the Fed to taper its asset purchases.

But if the numbers are more or less within expectations, then the markets can be tempted to favor riskier bets over the safe-haven dollar.

Hot

No comment on record. Start new comment.