Gold: Waiting For YCC To Take Off

Summary

- Prices on almost everything is increasing fast everywhere.

- People are beginning to realize that fiat currencies are being devalued by all of the stimulus being created, so the fiat currencies are headed toward zero in value.

- Governments appear unconcerned about inflation and they want to leave interest rates where they are.

- If interest rates rise, they will probably let the short-end of the curve rise applying YCC on the long end.

Fundamentals

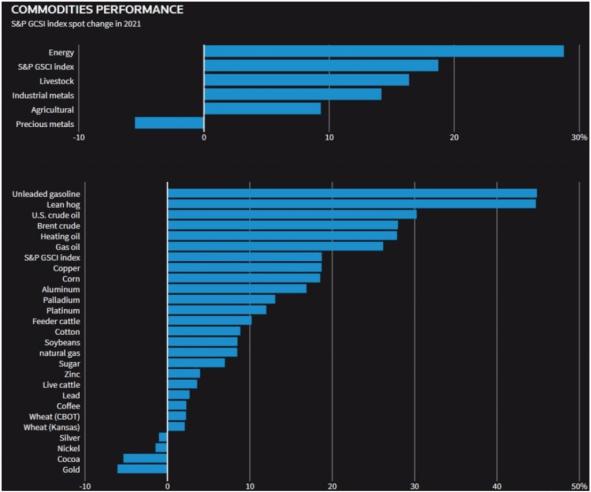

Real estate globally is rising fast. The amount of equity now in real estate is massive globally. Commercial real estate is suffering, but residential real estate is exploding worldwide. Prices on almost everything are increasing everywhere. People are waking up to the fact that we are entering a highly inflationary cycle, so they want real assets. People are beginning to realize that fiat currencies are being devalued by all of the stimulus being created, so the fiat currencies are headed toward zero in value.

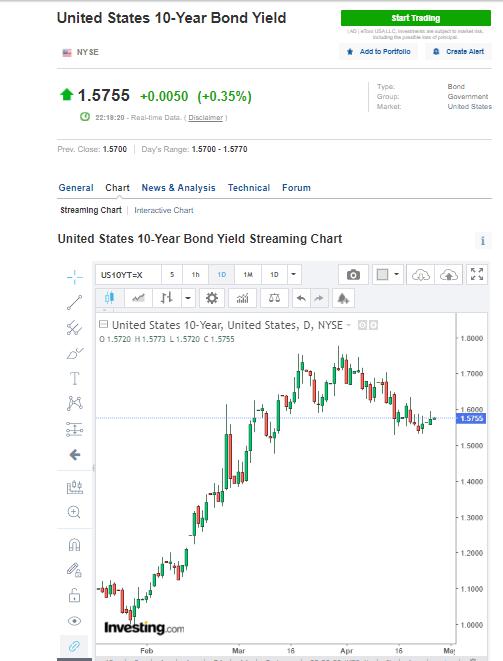

One way to reduce the debt burden on the global economy is to devalue the value of the currencies, which is clearly what appears to have been what governments around the world have decided to do. Interest rates are critical at this time. If interest rates rise significantly, or even a slight bit, debt defaults could ripple across the global economy. The 10-year Treasury note is rising and everyone is getting nervous already. Governments appear unconcerned about inflation and they want to leave interest rates where they are. If interest rates rise, they will probably let the short-end of the curve rise, since they need inflation to handle the debt - inflate our way out of this crisis.

However, the problem is that if long-term interest rates rise, then there is great danger of widespread debt defaults. Then the only alternative would be to cap the yield curve, so the 30-year bond rate would be capped. Governments appear to believe this rise in interest rates will be short term, even as soybeans hit $15.53, grains are up and crude oil is also up. Therefore, they seem to believe they can contain the long-term implications of the rise in short-term interest rates.

The velocity of money could increase significantly with governments pumping money into the economy and the world re-entering some form of a normal state after the pandemic. Art, stocks, collectibles, and many other sectors are going through the roof. The only place we have not seen is price inflation. We will see it, however. Grains and soybeans are way up in the futures markets, so food prices will soon rise significantly. The key question is how fast the demand will increase, which will then put even further pressure on supplies in the midst of ongoing supply chain problems caused by the pandemic. We already have a shortage of computer chips and various plastics, and such shortages are going to appear across the board. Silver and gold are facing shortages in the near future. If industrial demand for silver continues to increase, then there could be one of the most historic moves up in silver that anyone has ever seen. This is a unique situation and we could see unique increases in the price of silver.

The fundamentals for gold remain strong, with massive stimulus and the printing of fiat money, real hard assets, such as gold, will rise over the long term. The US dollar and other fiat currencies continue to fall in value compared to hard assets. If inflation increases, as there are already signs in the 10-year note that it is, gold should also increase in price, just as it did in the 1970s.

Courtesy: Bloomberg

Courtesy: Bloomberg

Gold

Gold has been going through a seven-month correction. The market appears to be completing a second Elliott wave. The first wave went from the low in March to the high in August of $2089, which was a second-wave corrective pattern. It then reverted and started what appears to be the start of the third leg. The third leg, according to Elliott wave theory, is double the first. The first wave we saw was $600 plus. If the low was at $1670 roughly, then the projection of a $1,000 leg to the upside, which would be at about $2670 or $2700 for gold.

Courtesy: TDAmeritrade

According to the VC PMI 360-day cycle, the average price is $1810. We are approaching that average price. Closing above $1810 will validate a breakout in the market. The initial target established in September 2020 is $2164.

Gold is at $1774, down about $3.90. We have been in a choppy market this morning. We activated a Variable Changing Price Momentum Indicator (VC PMI) bearish price momentum at about 3:30 am (PST). Gold came down to about $1770, which was a trend line support, and then went back up and found buyers at a higher high. Then it reverted again to the VC PMI average daily price of $1781. The weekly average price is about $1780. Therefore, this represents a strong level of resistance.

Courtesy: TDAmeritrade

Courtesy: TDAmeritrade

The VC PMI recommends that if the market is trading around the average price, there is a 50/50 chance that the market will go up or down. Therefore, we do not recommend buying when a market is trading around the average. Wait for the price to reach an extreme above or below the mean, which the VC PMI identifies for you.

The target is $1765. Right below that is a 50% Fibonacci retracement and a daily VC PMI Buy 1 level at $1761, a daily VC PMI Buy 2 at $1754, and the monthly VC PMI Buy 2 at $1754. They are in harmonic alignment. The weekly Buy 2 is at $1745.

On the upside, the average is $1780, the daily Sell 1 is $1786 and the Sell 2 is $1814. The extreme monthly sell level is at $1799 and the VC PMI weekly sell level is at $1796. Above that are the targets of $1808 and $1814 if the market meets and moves above the other levels. Once passed, the resistance levels become support. If you buy from Sell 1 or Sell 2, there is only a 5% or 10% chance of the market continuing to go up from there. They are where you want to sell short, which have a 90% (Sell 1) and 95% (Sell 2) chance of the market reverting to the mean from those sell levels.

Either gold will come down to $1765 or it will go up through $1780, which will be very bullish because there are multiple levels of resistance at or near that level. We did not come down to $1765, so if we take out $1780, it will make the price trend momentum bullish.

Reprinted from Seeking Alpha,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.