NZD/USD - Walking Off The Highs As NZ Growth Stalls

Summary

- The New Zealand economy entered a phase of harder-won gains.

- The narrowing investment attractiveness gap between the US and China puts the New Zealand dollar under increased selling pressure.

- We expect NZD/USD to decline to the 0.68 level over the next two months.

Weakening Momentum in Economic Recovery in New Zealand

According to the ANZ New Zealand Business Outlook with preliminary results for March 2021, the New Zealand economy entered a phase of harder-won gains. Of particular concern is a slowdown in the construction industry, which drove the economic growth over the past six months.

Thus, the indicator of business confidence began to go down.

Source: Statistics New Zealand

Source: Statistics New Zealand

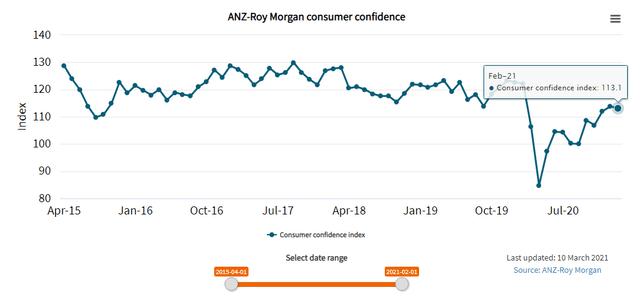

A similar trend demonstrates the index of activity outlook, declining for the second month in a row. Data on consumer confidence for March 2021 is not yet available, so we cannot talk about a steady downward trend.

Source: Statistics New Zealand

Source: Statistics New Zealand

The February 2021 ANZ-Roy Morgan NZ Consumer Confidence report noted a gradual decline in support for the economy from factors such as holiday savings, a catch-up from lockdown, the housing boom, and interest-free deals since early 2021.

China's demand for food, primarily dairy products, is growing amid limited stocks and rising shipping costs. Still, the latest ASB Commodities Weekly report indicates the risks of imminent market saturation and a decline in purchasing prices for dairy products:

At a certain point, there remains the risk that China will have built sufficient stockpiles and start to take its foot off the accelerator. The timing of such a move remains highly uncertain, and the reentry of other buyers into the market may help offset the price impact.

Source: Statistics New Zealand

Source: Statistics New Zealand

Since September 2020, prices for main New Zealand exports have increased, excluding livestock products. The growth of the price index for fruits (from 100 to 133) and dairy products (from 94 to 131) became especially noticeable. The forestry price index showed growth, which is in line with the average values for the last four years, from 91 to 106.

However, recent increases in export prices have given less support to the New Zealand economy. As noted in the February 2021 Monetary Policy Statement by RBNZ, "international prices for New Zealand's exports also supported export incomes, although the New Zealand dollar exchange rate has offset some of this support".

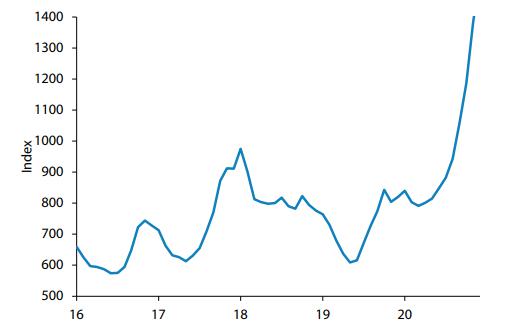

One of the factors that have a dual impact on the New Zealand economy is the ongoing logistical problems. Due to the closed borders, cargo container shipping remains the most significant transport mode used in the import-export trade. The container freight rate index between New Zealand and China has risen from 800 to 1400 since the start of the pandemic. On the one hand, such growth negatively affects New Zealand's international trade with its partners from the Asia-Pacific region; on the other hand, it supports the demand for its export at a high level.

Container Freight Rate Index - China to Australia/NZ Service

Source: ANZ Research

Source: ANZ Research

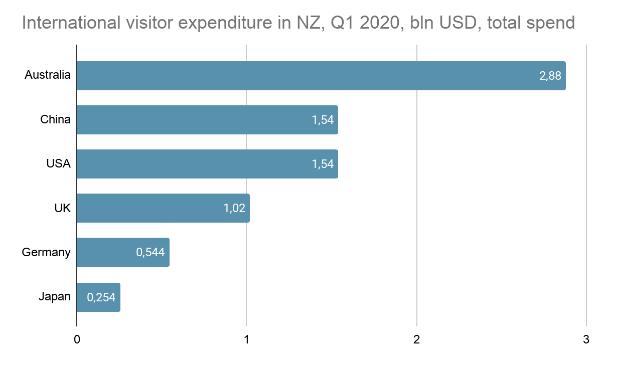

The closed borders also undermine the country's tourism industry. While travel restrictions with Australia, which brings the most significant revenues for the tourism sector in New Zealand, are to be lifted since late March 2021, the overall impact of this decision on the New Zealand currency is limited. Therefore, we do not expect it will have any immediate significance for NZD/USD.

Source: MBIE

Source: MBIE

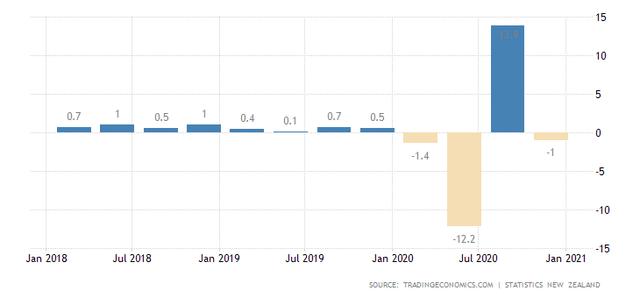

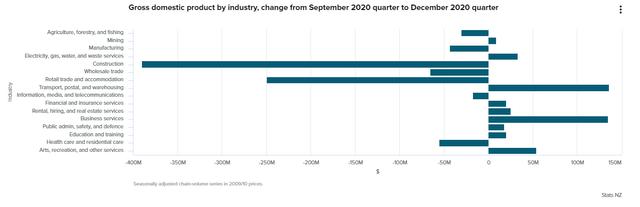

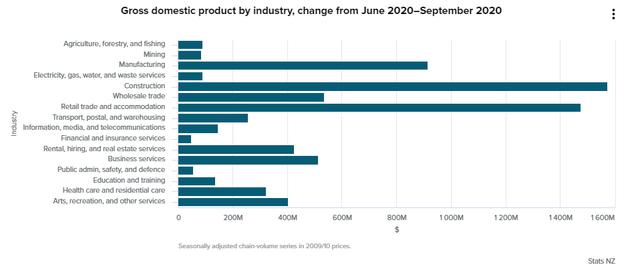

In recent news publications (Financial Times, Bloomberg), the likelihood of a double-dip recession in New Zealand - a decline in GDP for two consecutive quarters - has become more often mentioned. Indeed, after a pent-up-demand-driven overshoot in Q3 2020, in the fourth quarter, we again see a GDP contraction.

New Zealand Quarterly GDP Growth Rate

Source: TradingEconomics.com

Source: TradingEconomics.com

The Q4 2020 GDP breakdown shows that the construction industry and retail sales contributed the most to the GDP contraction.

Source: Statistics New Zealand

Source: Statistics New Zealand

This fact is especially significant since, in the previous quarter, these sectors were the main growth drivers of the New Zealand economy.

Source: Statistics New Zealand

Source: Statistics New Zealand

The recent ANZ Quarterly Economic Outlook also acknowledges the same factor that will limit further recovery and growth in New Zealand:

[...] until borders reopen, growth is going to be harder to achieve from here, as the industries that have done most of the heavy lifting to date bump into capacity constraints.

Narrowing Investment Attractiveness Gap between the US and China

The current attempt to put the US economy back on a sustainable growth trajectory, known as the American Rescue Plan, worth $1.9 trillion, may have a better chance of success. Recall that a year ago, a similar package of measures to stimulate the American economy, the CARES Act, worth $2.3 trillion, only allowed to avoid a deeper recession.

The adoption of the CARES Act has led to a decline in the US dollar. The impact of rising COVID-19 cases in this country and the delays in vaccine development in 2020 can be generally assessed as limited since, along with the periods of a risk-off trade, the pace of recovery in China and countries linked to its economy was more important. Now, with the vaccine available and quick vaccination progress in the US, following the adoption of the $1.9 trillion American Rescue Plan, traders are hoping for a rapid recovery in the US economy similar to China's V-shaped rebound in 2020.

Overall, for now, we see that a compared performance of the Chinese and US economies will have profound importance for the New Zealand dollar exchange rate, as the economy of New Zealand itself has come to the point of slowing recovery and the growing risks of a second recession.

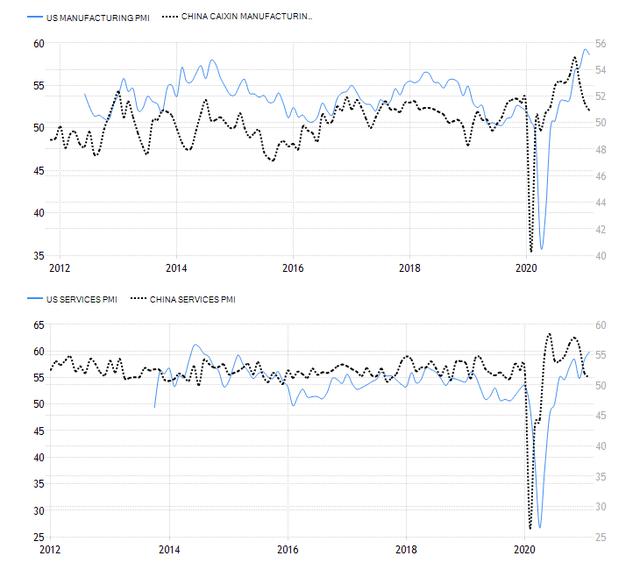

If we compare the leading indicators of the US and Chinese economies, the Manufacturing and Services PMIs, we will see an evident slowdown in China. They are still above the 50% threshold but showing a downward trend. The latest IHS Markit report for China points this out directly: "To sum up, the momentum of the manufacturing recovery further weakened".

The United States and China Manufacturing and Services PMIs

Source: TradingEconomics.com

Source: TradingEconomics.com

Note: PMI data for the US is on the left axis; PMI data for China is on the right axis.

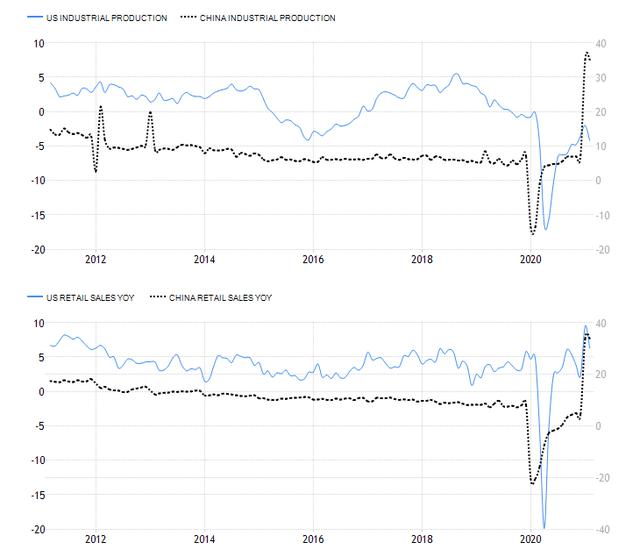

On the other hand, comparing coincident indicators, the volumes of industrial production and retail sales in the US and China, we see their explosive growth in February in the Chinese economy (industrial production up by 35.1%, retail sales up by 33.8% y-o-y).

Source: TradingEconomics.com

Note: Industrial production and retail sales data for the US are on the left axis; industrial production and retail sales data for China are on the right axis.

Another important indicator for the Chinese economy - the index of new export orders - is still under pressure. Overall, given the likely inflow of new orders from the United States following the adoption of a new economic stimulus package in March this year, we positively assess its growth prospects later in the second quarter of 2021. However, now this indicator does not reflect a significant acceleration in the growth of the Chinese economy:

Overseas demand continued to drag down overall demand as the measure for new export orders remained deep in negative territory for the second consecutive month. Surveyed manufacturers highlighted fallout from domestic flare-ups of Covid-19 in the winter as well as the overseas pandemic.

- Source: IHS Markit

Source: IHS Markit

Source: IHS Markit

What is more important is that the gap between the growth rates of the Chinese and US economies is likely to narrow. Therefore, the commodity-linked New Zealand dollar may face increased selling pressure.

Technical Outlook and Impacts

NZD/CAD and NZD/USD, 1W, as of March 21, 2021

Source: TradingView.com

The movement of NZD/USD in 2020 resembled the square root sign, when, after an initial flight to safety, the New Zealand dollar sharply recovered its positions and exceeded the pre-crisis level versus the US dollar. If we look at the NZD/CAD exchange rate, which usually highly correlates with NZD/USD and moves slightly ahead of it under similar economic conditions in the United States and Canada, we will see that this pair has already formed a clear local high around 0.92-0.93 and now is moving down. Similarly, NZD/USD topped in the 0.73-0.74 area before starting to retreat to 0.71-0.72. We expect this pair may decline to at least a 0.68 level, where the former resistance lies, over the next two months.

If the US economy fails to generate strong growth despite the newly adopted stimulus, we suppose there is a risk of a less significant correction in NZD/USD and a resumption of its ascending trend.

Reprinted from Seeking Alpha,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.