The Post-Pandemic Global Recovery As A Tailwind For The South African Rand

Summary

- Despite a subdued macro stand, the rand continues to strengthen against the US dollar and euro.

- The main factors behind its appreciation are the growing prices for mineral commodities, the recovery of world trade, coupled with China's continued economic expansion.

- We assume the rand will demonstrate a more solid rise against the euro backed by a slower economic recovery in the euro area than in the US and China.

- During H1 2021, we expect the EUR/ZAR pair to decline at least to 17.00.

Mixed Signals from Developed Economies

Speaking about the South African rand, we should emphasize that four main factors influence the exchange rate of this currency: the economic situation in the United States and SA's other major trading partners, commodity prices, the macroeconomic situation within the country, and its relative performance in the EM block.

The new stimulus package in the US will most likely lead to a fall in the dollar. Still, it can also lead to an increase in the investment attractiveness of the US economy. So, these two trends - a weakening dollar and growing investment attractiveness of the US economy - could produce mixed signals for the rand.

However, considering other factors, such as the post-Covid recovery of the global economy, accompanied by higher commodity prices, as well as the likely increase in demand for exports from South Africa from its main trading partners - China, the US, and the EU, we can conclude that positive factors should support the rand in the near term.

Indeed, according to OECD estimates, the US GDP growth in 2021 could reach 6.5%. The IMF forecasts a 5.1% increase in 2021. The Fed gives an average estimate of 4.2%, with the central tendency ranging from 3.7% to 5.0%. Forecasts for China range from 7.8% according to the OECD to 8.1% according to the IMF. At the same time, the Chinese authorities themselves point to a more modest figure above 6.0%. Based on a wide range of estimates of the US and Chinese GDP growth, some experts point to the possibility of higher growth rates in the US than in China. If this scenario occurs, investors may reassess the prospects for emerging markets and turn their attention towards developed countries, with a subsequent increase in the dollar. The China and US GDP growth data for the first quarter of this year will be available on April 15 and 27, 2021, respectively (according to FXStreet.com).

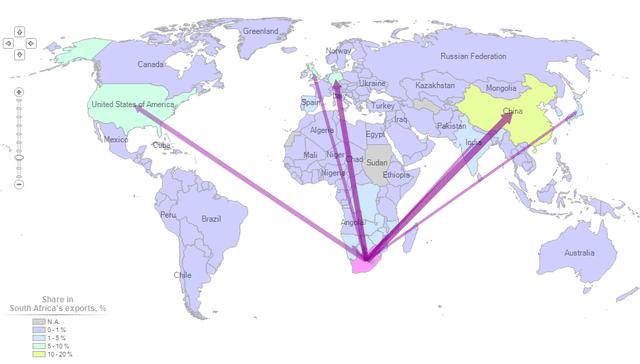

The economic growth rates in China, the EU, and the United States are significant for the rand because they are the main export markets for South Africa. The share of other countries is sufficiently low. This dependence makes the rand sensitive to changes in the economic situation in these three economies. Although the data provided on the map is for 2019, there have been no dramatic changes in the export markets for South Africa since then.

List of Importing Markets for a Product Exported by South Africa in 2019

Source: Trademap.org

Source: Trademap.org

While traders overwhelmingly agree that the US and Chinese economies should demonstrate a solid rebound in 2021, their views on the EU economy are less optimistic. The OECD predicts annual GDP growth in the eurozone at 3.9%, the IMF - at 4.2%.

Nevertheless, considering lower GDP growth rates in the EU, we should pay special attention to the rand performance in pair with the euro. Here we can ignore the probability of a sharp increase in the investment attractiveness of the European economy. In the absence of similar stimulus packages, the eurozone should become a less favorable investment destination when compared with emerging markets.

Favorable Commodity Prices

The South African Rand is a commodity currency, as commonly viewed. While many experts talk about the gradual diversification of South African exports and the declining dependence of the rand on commodity prices, it is still a commodity currency.

The correlation between the Bloomberg Industrial Metals Sub-Index and the rand has weakened to 0.2, from a peak of 0.7 in February. The inverse relationship with U.S. Treasury yields is much stronger, at almost 0.6, the most in four years, according to data compiled by Bloomberg.

- Source: Bloomberg

Indeed, since the beginning of 2020, we see an inverse correlation between the yield on 10-year US Treasuries and the USD/ZAR (EUR/ZAR) rate.

The Correlation between USD/ZAR (EUR/ZAR) and 10-Year US Treasury Bonds

Source: TradingView.com

Source: TradingView.com

However, in the absence of a stable statistical correlation between the rand exchange rate and other indices over a long period, we cannot confirm that the inverse relationship with the US bond yields will continue in the coming months. Therefore, we cannot talk about the significant long-term impact of the US government bond yields on the rand exchange rate.

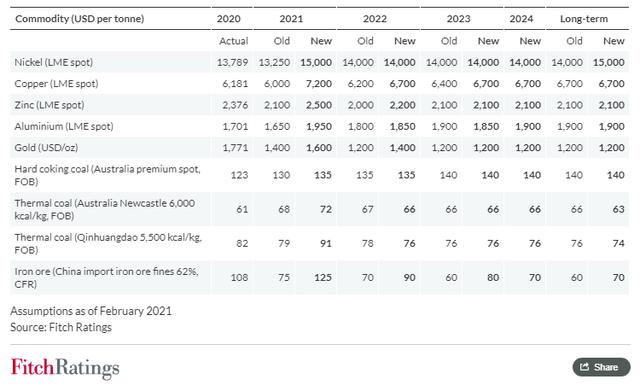

According to forecasts of many market participants and independent agencies, mineral commodities will continue to rise in price this year, exceeding their pre-crisis values. For example, Fitch provides the following price estimates on some minerals in 2021:

Metals and Mining Price Assumptions

Source: Fitch Ratings

Source: Fitch Ratings

More importantly, however, the commodity prices are expected to grow strongly in the first half of the year due to the pent-up demand, continued supply constraints, and an acceleration of growth in the Chinese and US economies.

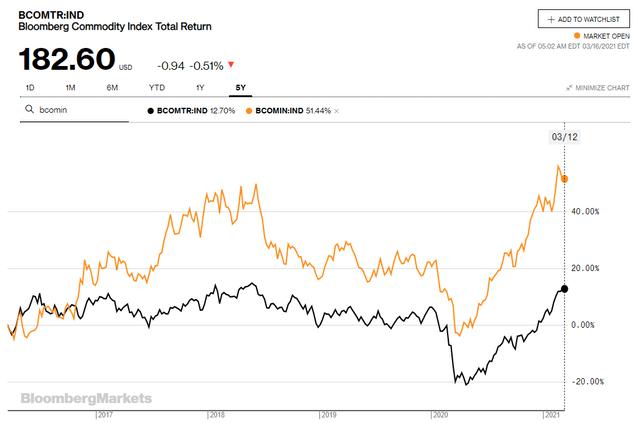

As the Bloomberg indices show, the rate of growth in prices for industrial metals - the main exports of South Africa - is higher than the growth in commodity prices as a whole. With the ongoing recovery in demand amid limited supply, this trend should continue and support the rand.

Bloomberg Commodity Index and Industrial Metals Subindex, as of March 16, 2021

Source: Bloomberg

Source: Bloomberg

Note: BCOMTR stands for Bloomberg Commodity Index, BCOMIN stands for Bloomberg Industrial Metals Subindex.

SA's Macro Conditions: Commodities and Trading Partners Drive Overall Market Sentiment

Finally, the last significant factor is the macroeconomic situation within the country. Many economists rightly point out that the macroeconomic conditions in South Africa are worse than in any other emerging market.

"While South Africa is one of the worst-performing economies in the emerging-market space from a macro standpoint, the market seems to like the rand," said Cristian Maggio, head of emerging-market strategy at TD Securities in London. "Either the hunt for yield is a blinding factor, or the rand is set for some sharp repricing".

- Source: Bloomberg

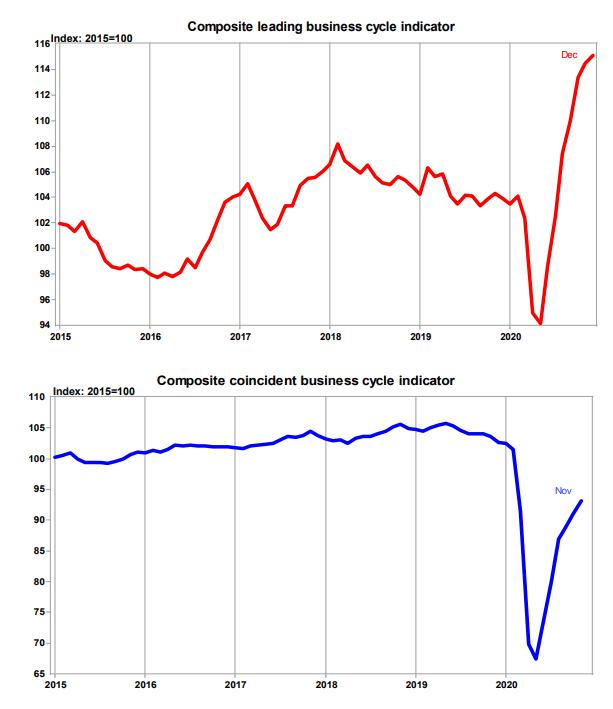

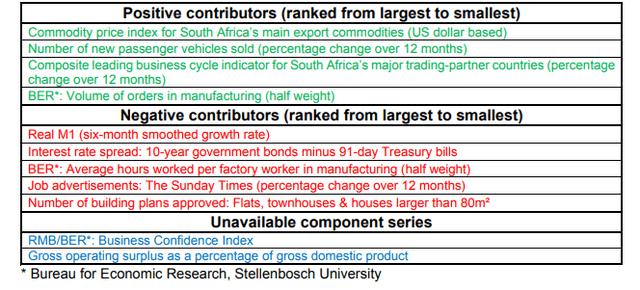

Still, we should take a closer look at one significant leading indicator that might provide insights into the future rand performance. We talk about the composite business cycle indicator for South Africa. Its latest December values are much higher than the figures of a similar coincident indicator calculated for November 2020.

Composite Business Cycle Indicators for South Africa

Source: SARB

Source: SARB

More importantly, commodity prices and leading business cycle indices in South Africa's major trading partners were the main positive contributors to this index, while domestic macroeconomic indicators were the main negative contributors.

Component Time Series of the Composite Leading Business Cycle Indicator and Their Contribution to the December 2020 Data Point

Source: SARB

Source: SARB

Thus, given the rand's reaction to external economic factors and weaker correlation with domestic economic trends, the difference between the coincident and leading indicators may support the thesis about the future strengthening of the South African currency.

The political stability in South Africa also plays a significant role. Just recall the Nenegate case in December 2015, when the resignation of the country's finance minister Nhlanhla Nene caused a 10% drop in the rand exchange rate, the history with the finance minister Pravin Gordhan, who abandoned his office in March 2017, which also caused a 13% decline in the dollar-rand exchange rate. However, at the moment, domestic political factors do not come to the fore. The attention of traders is focused more on the global economic conditions and the risk-on/risk-off trading environment.

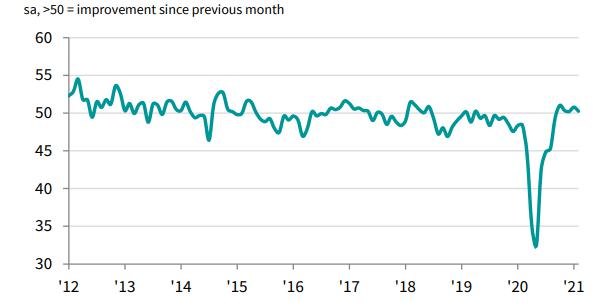

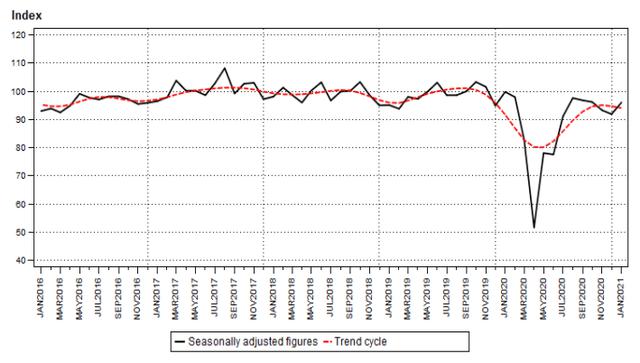

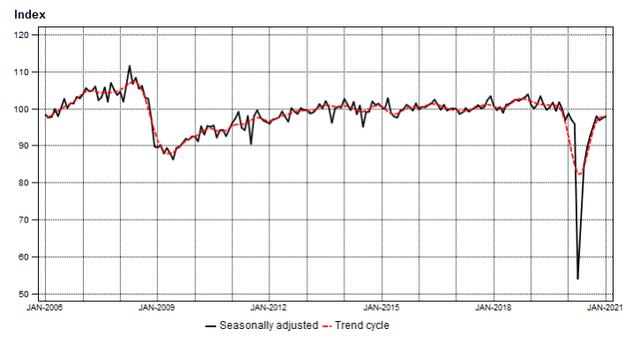

Key economic activity indices in South Africa - PMI, the volume of mining production, manufacturing production - all indicate that the country has returned to pre-crisis levels, which is not so bad in absolute terms. However, compared to other emerging markets, the recovery is longer and slower.

South Africa PMI

Source: IHS Markit

Source: IHS Markit

Volume of Mining Production in South Africa (Base: 2015=100)

Source: Statistics South Africa

Source: Statistics South Africa

Volume of Manufacturing Production (Base: 2015=100)

Source: Statistics South Africa

Source: Statistics South Africa

In terms of technical analysis, we see the prospects for EUR/ZAR to decline to 17.00 over the rest of H1 2021, where the long-term uptrend line passes.

EUR/ZAR 1W, as of March 16, 2021

Source: TradingView.com

Source: TradingView.com

Conclusion

Given the mixed signals from the developed economies for the rand, we suggest focusing our attention on EUR/ZAR for several reasons:

- First, the projected GDP growth rate of the eurozone economy in 2021 is lower than in the United States, which increases the comparative investment attractiveness of South Africa relative to the EU. Nevertheless, the risk of reorientation of investors towards developed countries remains. After the publication of data on the US and Chinese GDP growth for the first quarter of this year in mid-April, we can decide more precisely on the investors' preferences between developed and emerging markets.

- Second, due to the rise in commodity prices, first of all, mineral commodities, the rand should show an upward trend. In a pair with the euro, this trend should be more forceful.

- Third, the macroeconomic situation in South Africa indicates the start of a post-pandemic recovery, which, albeit slower than in other emerging markets, is not putting downward pressure on the rand. Based on technical analysis, we can conclude that the rand should strengthen against the euro during the first half of this year, at least to the 17.00 level.

Reprinted from Seeking Alpha,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.