Tomorrow at 12:30 pm GMT Uncle Sam will print its retail sales numbers for the month of March.

Looking to trade the event?

Here are points you need to know first:

What the heck is a retail sales report?

Every month, the government sends out surveys to retailers to measure spending in department stores, electronic shops, car dealerships, gas stations, and restaurants.

The report features a “core” retail sales figure, which removes volatile items such as automobiles from the mix.

Traders pay attention to the release because consumer spending makes up 70% of the U.S. GDP, one-third of which comes from retail activity.

What happened in the previous release?

- February headline retail sales dropped by 0.3% vs. -0.5% expected

- February core retail trading dipped by 2.7% vs. 0.2% expected

- January headline retail activity revised higher from 5.3% to 7.6%

- January core retail sales revised higher from 5.9% to 8.3%

Both headline and core retail activity missed analysts’ expectations in February thanks to a lapse in government aid and a bit of bad weather.

Traders weren’t too bothered, though, since a lot of Americans already had their eyes on the stimmy checks coming in March. Besides, February 2021’s retail activity still registered higher on an annualized basis AND January’s numbers were also revised higher.

The not-so-concerning retail data, combined with caution ahead of the Fed’s closely watched statement, limited the dollar’s losses across the board.

What are traders expecting this time?

- Headline retail sales could jump by 4.5%

- Core retail activity to gain by 5.2% for the month

Market players see a rebound of headline and core retail activity in March. Most see a 4.5% – 5.0% recovery, but some have penciled in an 11.0% jump. Wowza!

Word around is that increased vaccinations, easing lockdown restrictions, warmer weather, and the $1,400 stimmy checks are expected to have encouraged consumers to go out and make $$$ rain on the retailers in March.

Planning on trading the dollar?

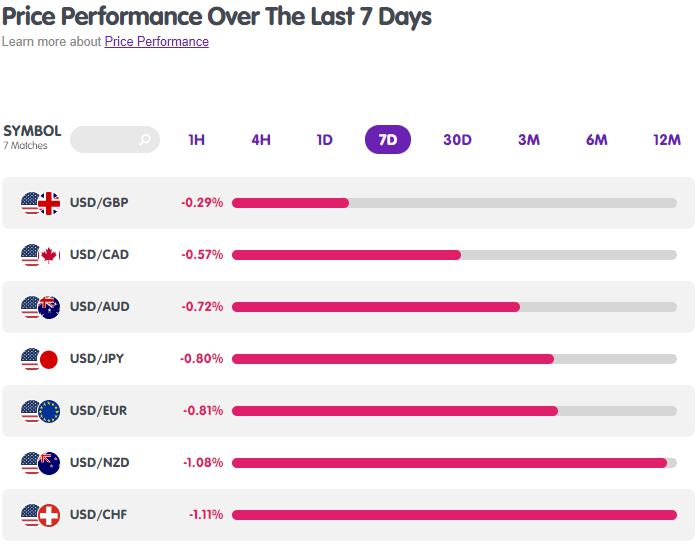

A quick look at MarketMilk tells us that the dollar has been losing pips to its counterparts in the last couple of days.

Much better-than-expected retail data would put an extra shine on the U.S.’ economic recovery prospects and probably lift the dollar higher.

Don’t get too excited though! If yesterday’s CPI release is any clue, other economic catalysts like vaccine updates or Coinbase’s IPO can take center stage and dictate market sentiment.

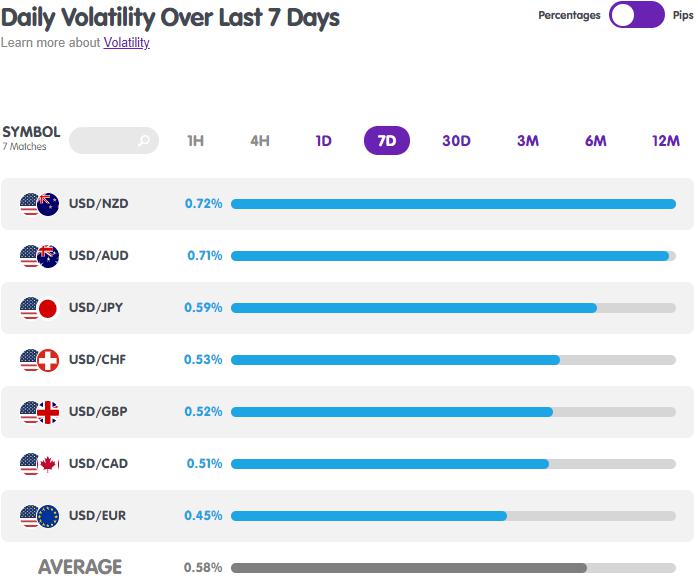

Still, if you’re hoping to catch the biggest moves among the dollar pairs, here’s a look at the average volatility in pips over the past week:

Whichever pair you choose, just don’t forget to practice proper risk management when trading the news. Good luck!

Hot

No comment on record. Start new comment.