10 reasons why the value-stock resurgence has further to run, according to BofA

Spencer Platt/Getty Images

- The rally in value stocks is not yet over, according to a Friday note from Bank of America.

- Value stocks have outperformed growth stocks over the past seven months, reversing a decade-long trend as investors anticipate a full reopening of the US economy.

- Detailed below are the 10 reasons why the rally in value stocks will continue, according to BofA.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

The outperformance in value stocks relative to growth stocks over the past seven months has been attributed to a number of factors, including but not limited to rising interest rates, growing anticipation of the reopening the US economy, and a wide valuation gap.

In recent weeks, a reversal in the value trade has materialized as interest rates fell from their cycle-high peak after Fed Chairman Jerome Powell reiterated his stance that interest rates will stay lower for longer.

But the run in value stocks is not over, according to a Friday note from Bank of America's Savita Subramanian, who recommends investors continue own value oriented pockets of the market like small caps and cyclicals.

These are the 10 signs that would signal the rally in value stocks is over, of which none have been triggered yet, according to BofA.

1. "Growth starts looking cheaper than value."

Even after the seven month underperformance, growth stock remains 1 standard deviation overvalued relative to growth stocks, BofA said.

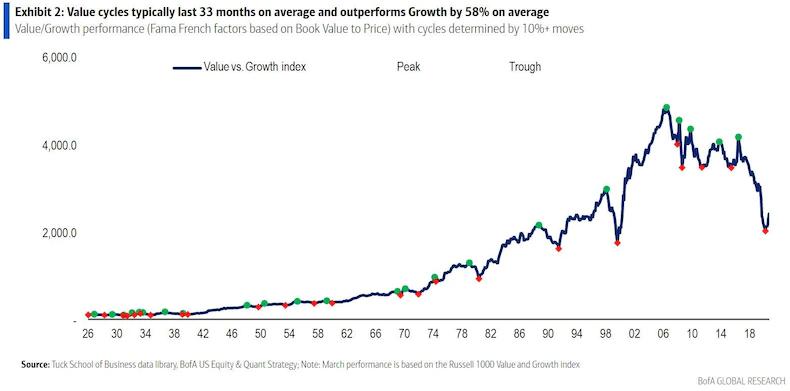

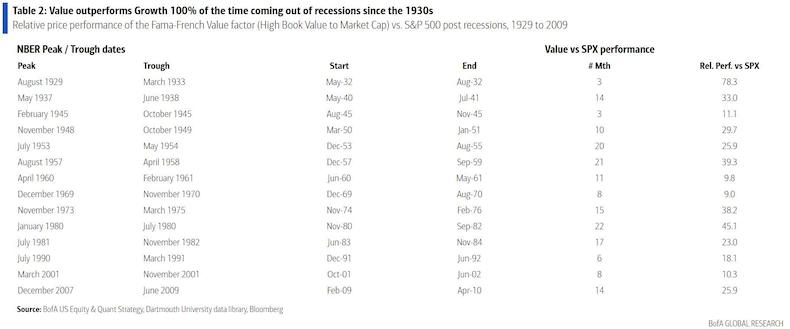

2. "Value has outperformed growth for 33 months on Average."

It's only been seven months of value outperforming growth, well short of the 33 month average, BofA observed.

Bank of America

3. "Value has outperformed growth by ~60% on average."

Value has only outperformed growth by about 20% since the rally began seven months ago, short of its 60% average, BofA said.

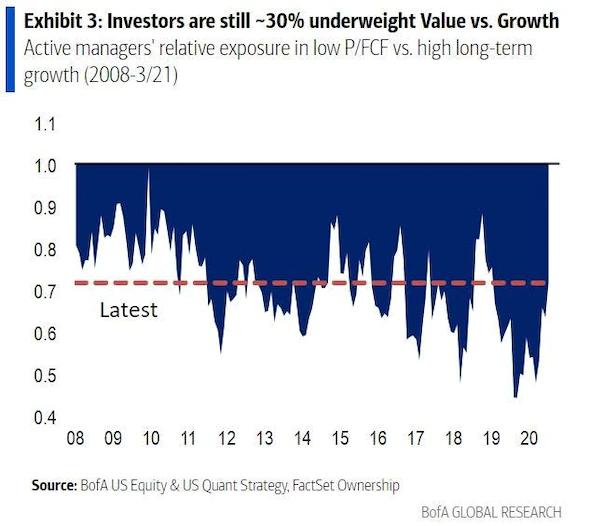

4. "Active funds are overweight value."

Active investment managers are still sticking with growth stocks despite the value rally, and are 30% underweight value, BofA said.

Bank of America

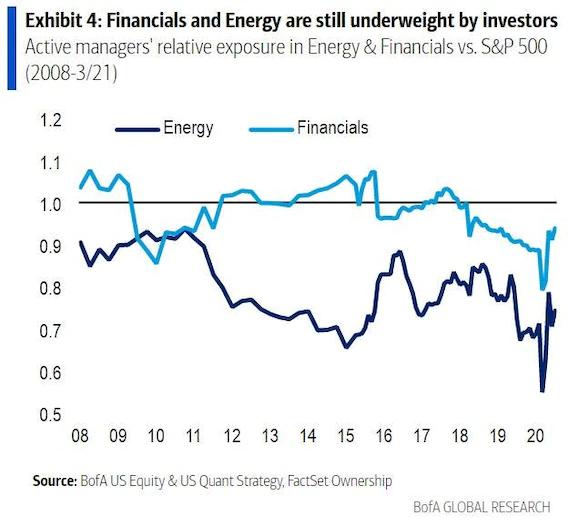

5. "Active funds are equal-weight financials and energy."

Active investment managers continue to shun the financials and energy sectors, holding an underweight position of 6% and 26%, respectively, according to BofA.

Bank of America

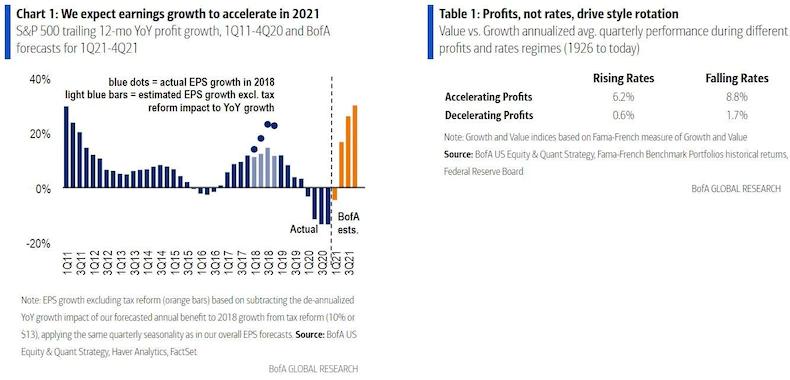

6. "Profits growth peaks."

BofA does not expect a peak in profits growth until the fourth quarter of 2021, according to the note.

Bank of America

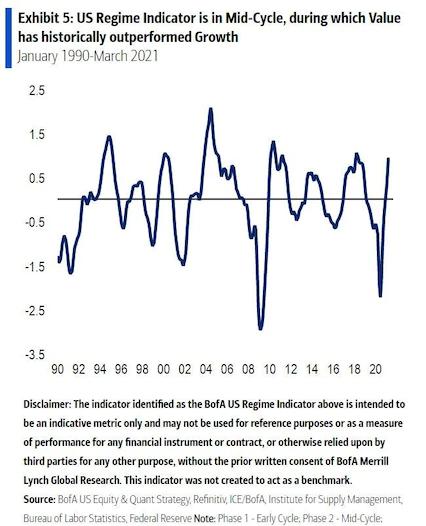

7. "Our regime indicator shift to late cycle."

"US regime indicator is in mid-cycle, during which value has historically outperformed growth," the bank said, adding that prior mid-cycle regimes saw value outperform growth by 2.9 percentage points on average, with a 71% hit rate.

Bank of America

8. "Biden promises that corporate tax rates won't go higher."

President Biden continues to advocate for a 28% corporate income tax rate to help fund his proposed $2.2 trillion infrastructure plan.

According to BofA, a tax hike hurt growth stocks' earnings per share by 3 percentage points more than value stocks.

Bank of America

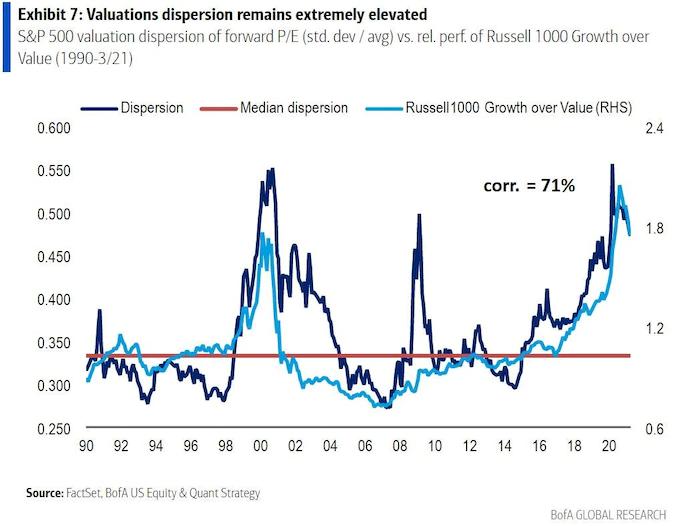

9. "Valuation dispersion hits the long term median."

The difference in valuations between growth and value stocks remains at extreme levels. "We're 42% above [long-term median], just off of record highs," BofA explained.

Bank of America

10. "GDP growth peaks."

BofA expects a pickup in economic growth going forward, with a GDP growth surge of 8% in the second quarter, followed by growth of 11% in the third quarter.

Bank of America

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.